Are you looking to multiply your money in the stock market without breaking the bank? Look no further than this comprehensive guide on strategic speculation with a budget of just $3,000!

Investing in the stock market can be a daunting task, especially for those with limited funds. However, with the right strategies and a little bit of research, you can make your money work for you and potentially generate significant returns.

This guide will provide you with all the information you need to get started with strategic speculation, including the basics of investing, how to choose the right stocks, and the importance of risk management.

By the end of this guide, you will have the knowledge and confidence to invest your $3,000 wisely and start building your financial future.

Available Properties – Five Point Property Management – Source fivepointpropertymanagement.com

Maximize Your Investment: A Personal Journey

I started investing with a small budget of $3,000, just like you. I was determined to make my money grow, but I didn’t know where to start. I spent countless hours researching different investment strategies and studying the stock market. I made some mistakes along the way, but I also learned a lot.

Over time, I developed a system for strategic speculation that helped me to consistently generate returns. I learned how to identify undervalued stocks, how to manage risk, and how to time the market. I also discovered the importance of patience and discipline.

I am sharing my system with you in this guide. I believe that anyone can be successful in the stock market, regardless of their budget. With the right knowledge and a little bit of effort, you can achieve your financial goals.

Maximize Your Savings with Our Cost Benefit Analysis Template – Get – Source www.bizzlibrary.com

The History and Myth of Strategic Speculation

Strategic speculation has been around for centuries. In the early days, traders used technical analysis to try to predict the future price of stocks. Technical analysis is the study of historical price data to identify patterns and trends.

Over time, technical analysis has become more sophisticated. Today, traders use a variety of technical indicators to help them make investment decisions. However, it is important to remember that technical analysis is not a perfect science. There is no guarantee that a stock will continue to follow a particular pattern or trend.

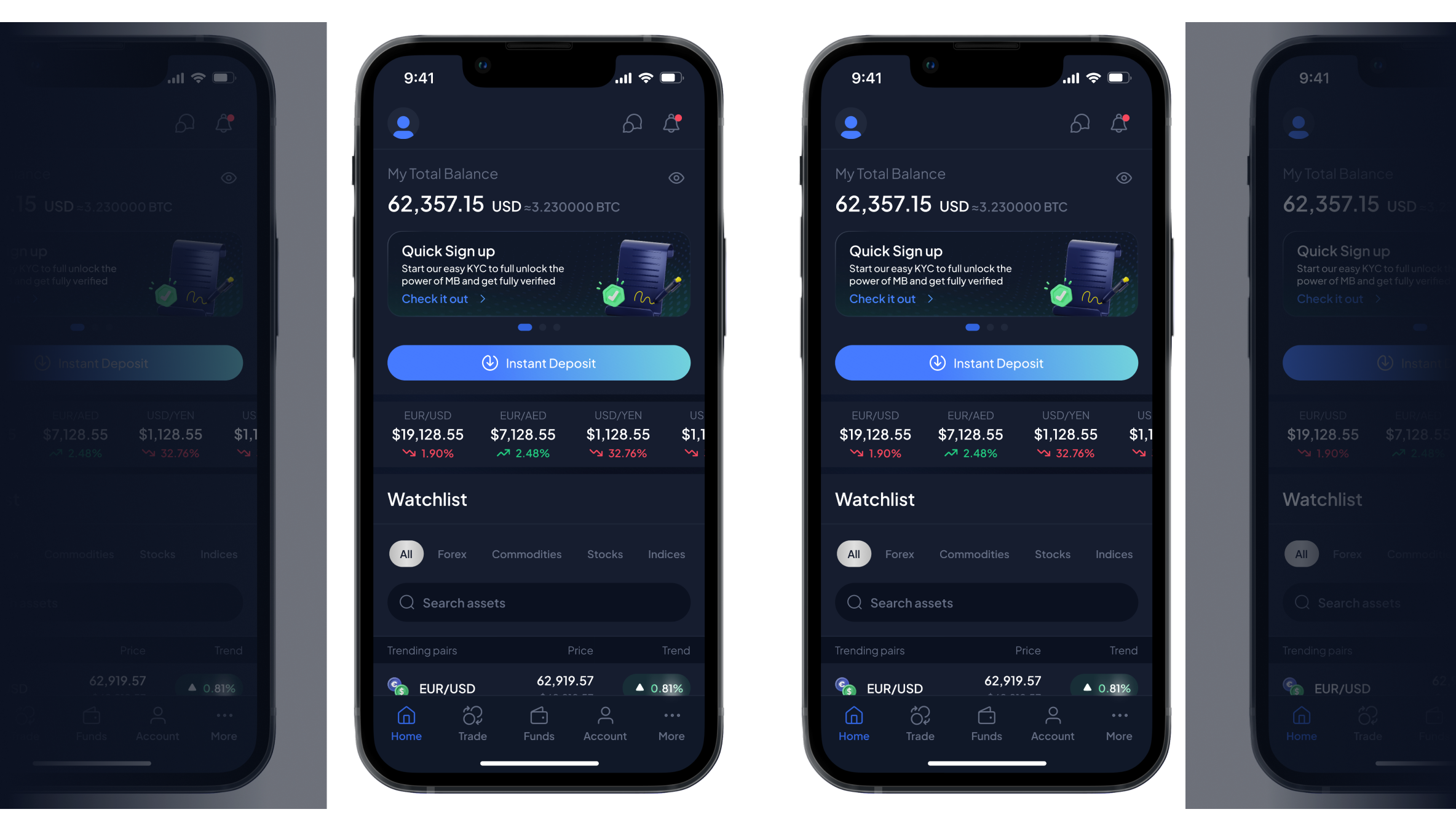

image-1 – Source mbfx-dev.com

The Hidden Secrets of Strategic Speculation

One of the most important secrets of strategic speculation is to focus on the long term. The stock market is volatile, and there will be times when your investments lose value. However, if you focus on the long term, you will have time to ride out the ups and downs and achieve your financial goals.

Another important secret is to diversify your portfolio. This means investing in a variety of different stocks from different sectors. By diversifying your portfolio, you can reduce your risk of losing money if one stock underperforms.

Maximize Your Investment: Choosing the Right CT Solar Installer – Source www.premierimprovementsone.com

Recommendations for Strategic Speculation

If you are new to strategic speculation, I recommend that you start by investing in a few well-known stocks. These stocks are typically less volatile and have a history of consistent growth.

Once you have gained some experience, you can start to invest in more speculative stocks. These stocks have the potential to generate higher returns, but they also come with a higher level of risk.

Unlock Profitable Opportunities With The Sonic Healthcare Investor – Source soniclabs.info

Tips for Strategic Speculation

Here are a few tips to help you get started with strategic speculation:

- Do your research.

- Start small.

- Diversify your portfolio.

- Be patient.

- Don’t be afraid to take risks.

Maximize Your Zoho CRM Potential: Get the Right Training – Source ar-ms.in

Fun Facts about Strategic Speculation

Here are a few fun facts about strategic speculation:

- The first stock market was established in Amsterdam in 1602.

- The first stock market crash occurred in 1720.

- The longest bull market in history lasted from 1990 to 2000.

- The shortest bear market in history lasted from September 23, 2008, to October 9, 2008.

@jewelsbyjadore shows you how to maximize your investment and re – Source www.pinterest.com

How to Maximize Your Investment

To maximize your investment, you need to follow a disciplined approach to strategic speculation. This means setting goals, conducting research, and managing risk.

It is also important to remember that the stock market is a dynamic environment. You need to be able to adapt to changes in the market and make adjustments to your investment strategy as needed.

Maximize Your Investment with Additional Income – Birkdale – Source www.prestigerealty.co.nz

What If Strategic Speculation Doesn’t Work?

Even if you follow a disciplined approach to strategic speculation, there is no guarantee that you will make money. The stock market is unpredictable, and there are always risks involved.

If strategic speculation does not work for you, do not despair. There are other ways to invest your money, such as real estate, bonds, or mutual funds.

For Organizations – HealthFleet – Source www.healthfleet.com

Listicle of Strategic Speculation

Here is a listicle of strategic speculation:

- Identify undervalued stocks.

- Manage risk.

- Time the market.

- Diversify your portfolio.

- Be patient.

Maximize Your Investment with Additional Income – Birkdale – Source www.prestigerealty.co.nz

Question and Answer about Strategic Speculation

Here are four questions and answers about strategic speculation:

A: The best way to get started with strategic speculation is to do your research and learn as much as you can about the stock market. You should also start with a small budget and invest in a few well-known stocks.

A: There are a number of ways to identify undervalued stocks. One way is to look for stocks that are trading below their intrinsic value. Another way is to look for stocks that are trading at a discount to their peers.

A: There are a number of ways to manage risk. One way is to diversify your portfolio. Another way is to use stop-loss orders.

A: Timing the market is difficult, but there are a few things you can do to increase your chances of success. One way is to look for technical indicators that suggest a trend is about to reverse. Another way is to use moving averages.

Conclusion of Maximize Your Investment: A Guide To Strategic Speculation With A $3,000 Budget

Strategic speculation can be a great way to grow your wealth, but it is important to remember that there are risks involved. By following the advice in this guide, you can increase your chances of success and achieve your financial goals.