Seeking a reliable and trusted financial partner in Maxton, North Carolina? Look no further than Lumbee Bank, the community’s trusted choice for all your banking needs.

Are you tired of impersonal banking experiences and high fees that drain your hard-earned money? Lumbee Bank understands your frustrations and offers a refreshing alternative. They prioritize personalized service, competitive rates, and innovative solutions to empower your financial journey.

As your trusted financial partner, Lumbee Bank aims to help you achieve your financial goals, whether it’s saving for the future, growing your business, or safeguarding your family’s well-being. Their team of experienced professionals is dedicated to providing expert guidance and tailored solutions that meet your specific needs.

Lumbee Bank: Your Trusted Financial Partner In Maxton, North Carolina

A Personal Experience with Lumbee Bank

From the moment I walked into Lumbee Bank’s Maxton branch, I was greeted with warmth and professionalism. The staff took the time to understand my financial situation and goals, and they tailored their recommendations accordingly. Their genuine care for my well-being was evident in every interaction.

Lumbee Bank’s online and mobile banking services are equally impressive, offering convenience and security at my fingertips. I can manage my accounts, pay bills, and even deposit checks remotely, saving me valuable time and effort.

Buy and Sell in Laurinburg, North Carolina | Facebook Marketplace – Source www.facebook.com

The History and Mission of Lumbee Bank

Established in 1973, Lumbee Bank has a rich history of serving the Maxton community. Their unwavering commitment to financial inclusion and community development has made them a beloved institution in the region. Lumbee Bank believes that everyone deserves access to affordable and reliable banking services, regardless of their background or financial status.

Their mission is to empower individuals, families, and businesses by providing innovative financial solutions and fostering a culture of financial literacy. Lumbee Bank is dedicated to creating a positive impact on the Maxton community and beyond.

Connect With Us – Magnolia Wealth Advisors of Raymond James – St – Source www.raymondjames.com

The Hidden Secrets of Lumbee Bank

Beyond its exceptional banking services, Lumbee Bank holds a few hidden secrets that make it stand out from the crowd. Their commitment to giving back extends to supporting local charities and non-profit organizations.

Additionally, Lumbee Bank offers a range of unique programs designed to promote financial well-being. These include financial education workshops, homeownership counseling, and small business mentorship. By empowering their customers with knowledge and resources, Lumbee Bank helps them achieve their financial dreams.

CN Financial – Source cnfinancial.org

Recommendations for Lumbee Bank

Based on my personal experience and the positive feedback from the community, I highly recommend Lumbee Bank as your trusted financial partner in Maxton, North Carolina. Their personalized service, competitive rates, and unwavering commitment to customer satisfaction make them an exceptional choice.

Whether you’re looking to open a new account, secure a loan, or grow your investments, Lumbee Bank has the expertise and resources to help you succeed. Visit their website or stop by their Maxton branch today to experience the difference for yourself.

Investor’s Business Daily, MarketWatch Name New York Life Among Top 25 – Source www.newyorklife.com

Lumbee Bank: A Community-Focused Financial Institution

Lumbee Bank is not just a financial institution; it’s an integral part of the Maxton community. Their support for local businesses, schools, and non-profit organizations is a testament to their commitment to the well-being of the region. By choosing Lumbee Bank, you’re not only investing in your financial future, but also in the prosperity of your community.

Financial Literacy & Wealth Advisor| Denver, CO – Source financialwealthsolutions.com

Tips for a Successful Banking Relationship with Lumbee Bank

To make the most of your banking relationship with Lumbee Bank, consider the following tips:

- Establish a rapport with your banker: Get to know the team at your local branch and build a relationship based on trust and open communication.

- Stay informed about Lumbee Bank’s services: Explore their website and attend financial education workshops to learn about their latest offerings and programs.

- Take advantage of their financial planning resources: Lumbee Bank’s financial advisors can help you develop a personalized plan to meet your short- and long-term goals.

- Consider opening multiple accounts: Separate your savings, checking, and investment accounts to better manage your finances and earn higher interest rates.

- Use Lumbee Bank’s mobile banking app: Enjoy the convenience and security of managing your accounts from anywhere, anytime.

Lumbee Bank: Your Partner in Financial Success

By following these tips, you can build a mutually beneficial relationship with Lumbee Bank and achieve your financial aspirations. Their dedication to customer satisfaction and community development makes them an invaluable asset to the Maxton community.

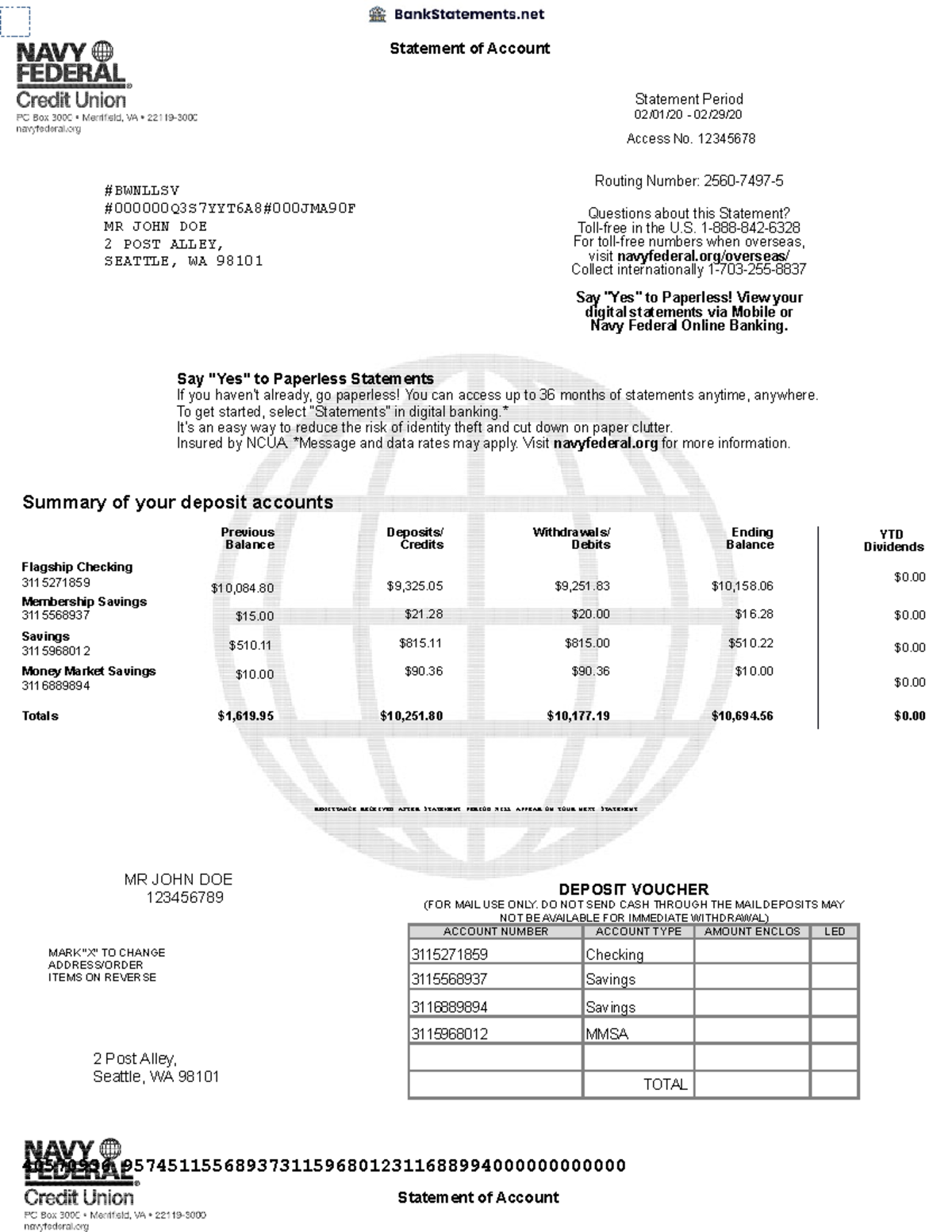

Navy Federal Bank Statement Bank Statements – Statement of Account – Source www.studocu.com

Fun Facts about Lumbee Bank

Did you know that Lumbee Bank is the only Native American-owned and operated bank in the United States? Here are a few more fun facts about this remarkable institution:

- Lumbee Bank is a member of the Federal Deposit Insurance Corporation (FDIC), ensuring the safety of your deposits.

- They offer a wide range of financial products and services, including personal and business banking, loans, investments, and insurance.

- Lumbee Bank has been recognized for its exceptional customer service, earning numerous awards and accolades.

- They are committed to sustainable banking practices and reducing their environmental impact.

How to Become a Lumbee Bank Customer

Becoming a Lumbee Bank customer is easy and convenient. You can visit their website or stop by any of their branches to open an account. Their friendly staff will guide you through the process and answer any questions you may have.

To open an account, you will need to provide the following documents:

- Government-issued identification (e.g., driver’s license, passport)

- Proof of address (e.g., utility bill, lease agreement)

- Initial deposit

What if I’m Not Satisfied with Lumbee Bank?

While Lumbee Bank is committed to providing exceptional customer service, there may be instances where you are not fully satisfied. If you have any concerns or complaints, please contact their customer service department.

Lumbee Bank values customer feedback and will work diligently to resolve any issues you may have. They are dedicated to earning and maintaining your trust.

LL Family Office Services – Source www.llfos.com

Listicle: Reasons to Choose Lumbee Bank

- Personalized service and tailored financial solutions

- Competitive rates and low fees

- Innovative online and mobile banking services

- Commitment to financial inclusion and community development

- Range of financial products and services to meet your needs

- Experienced and knowledgeable staff

- Support for local businesses, schools, and non-profit organizations

- Financial education workshops and resources

- Convenient locations and extended banking hours

- FDIC-insured deposits for peace of mind

Question and Answer

Q: Is Lumbee Bank a member of the FDIC?

A: Yes, Lumbee Bank is a member of the Federal Deposit Insurance Corporation (FDIC), ensuring the safety of your deposits up to applicable limits.

Q: Does Lumbee Bank offer online and mobile banking?

A: Yes, Lumbee Bank provides secure and convenient online and mobile banking services, allowing you to manage your accounts, pay bills, and deposit checks remotely.

Q: Is Lumbee Bank committed to community involvement?

A: Yes, Lumbee Bank is deeply committed to giving back to the Maxton community. They support local businesses, schools, and non-profit organizations, and offer financial education workshops to promote financial literacy.

Q: How do I become a Lumbee Bank customer?

A: You can open an account by visiting the Lumbee Bank website or any of their branches. Bring government-issued identification, proof of address, and an initial deposit.

Conclusion of Lumbee Bank: Your Trusted Financial Partner In Maxton, North Carolina

Lumbee Bank is more than just a financial institution; it’s a trusted partner committed to your financial success and community well-being. Their personalized service, competitive rates, and unwavering dedication make them the ideal choice for all your banking needs. Join the Lumbee Bank family today and experience the difference for yourself.