Many retirement savers feel limited by traditional IRAs, which offer a narrow range of investment options. However, self-directed IRAs empower you with the freedom to diversify your portfolio and pursue unique investment strategies.

Traditional IRAs often confine investors to a limited menu of stocks, bonds, and mutual funds. This can hinder your ability to customize your portfolio based on your specific risk tolerance, investment goals, and market conditions.

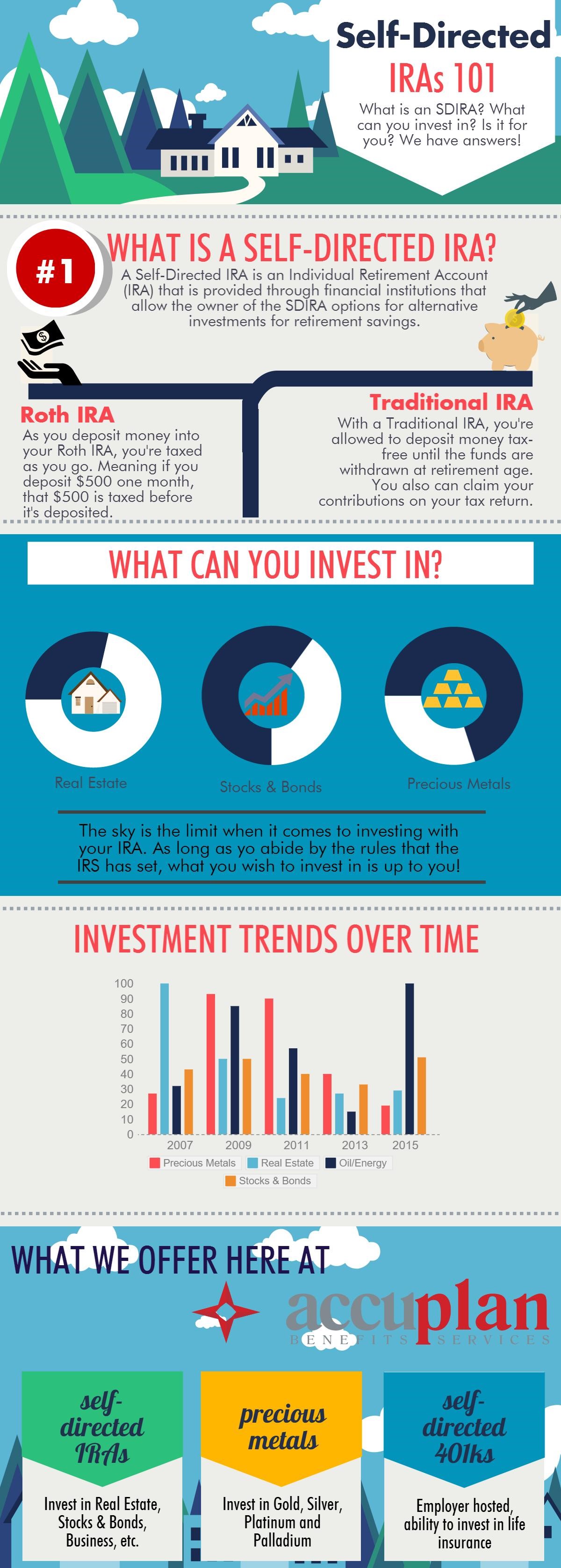

Self-directed IRAs grant you complete control over your investment decisions. You have the authority to invest in alternative assets such as real estate, precious metals, private equity, and even cryptocurrency. This expanded universe of investments can potentially enhance your returns and mitigate risks.

Self-directed IRAs offer unparalleled investment flexibility and control, allowing you to:

7 Essential Things Everyone Must Know Before Starting a Self Directed – Source www.pinterest.com

Self-directed IRAs have been around for several decades. However, misconceptions and myths have persisted over the years.

Adam Bergman, IRA Financial Trust President, To Release Second Book on – Source www.prweb.com

Beyond the well-known benefits of self-directed IRAs, there are hidden gems that can further enhance your retirement savings.

Non-Recourse Loan Lender – Self-Directed IRA Benefits | First Western – Source www.myiralender.com

Choosing the right self-directed IRA provider is crucial. Look for a provider with a proven track record, strong customer support, and a wide range of investment options.

Learn the simple steps to get started with self-directed IRA investing – Source www.pinterest.com

A self-directed IRA custodian holds your assets and ensures that your investments comply with IRS regulations. It is essential to select a reputable custodian with a history of providing excellent service.

Unlocking Financial Freedom: Self-Directed Retirement Savings – uDirect – Source udirectira.com

To maximize your returns, follow these tips for investing in self-directed IRAs:

Is my retirement account a good investment? | My Retirement Plan – Source 401ktime.com

Self-directed IRAs typically have higher fees than traditional IRAs. This is because they require more administrative and custodial services. Before opening an account, compare fees from multiple providers.

Self-Directed IRA: The 5 Best Providers | Investing, Unsecured loans – Source www.pinterest.com

New to Self-Directed IRAs? Here’s a Breakdown {infographic} | Accuplan – Source www.accuplan.net

1. Choose a self-directed IRA custodian.

2. Open an account and fund it with cash or eligible assets.

3. Decide which investments you want to make.

4. Purchase your investments through the custodian.

5. Monitor your investments and make adjustments as needed.

Self-directed IRAs are not for everyone. If you are not comfortable making your own investment decisions or you have a short-time horizon, a traditional IRA or other retirement savings vehicle may be more appropriate.

Consider the Flexibility of a Self-Directed IRA – Hawkins Ash CPAs – Source www.hawkinsash.cpa

Self-directed IRAs offer a powerful tool for retirement savings. By embracing the freedom and control they provide, you can unleash the potential of alternative investments, customize your portfolio to your unique needs, and pursue your financial goals with greater confidence.