Take the Guesswork Out of Withholding Tax: Understanding Part XIII for a Clear Financial Path

Navigating the complexities of withholding tax can be a daunting task.

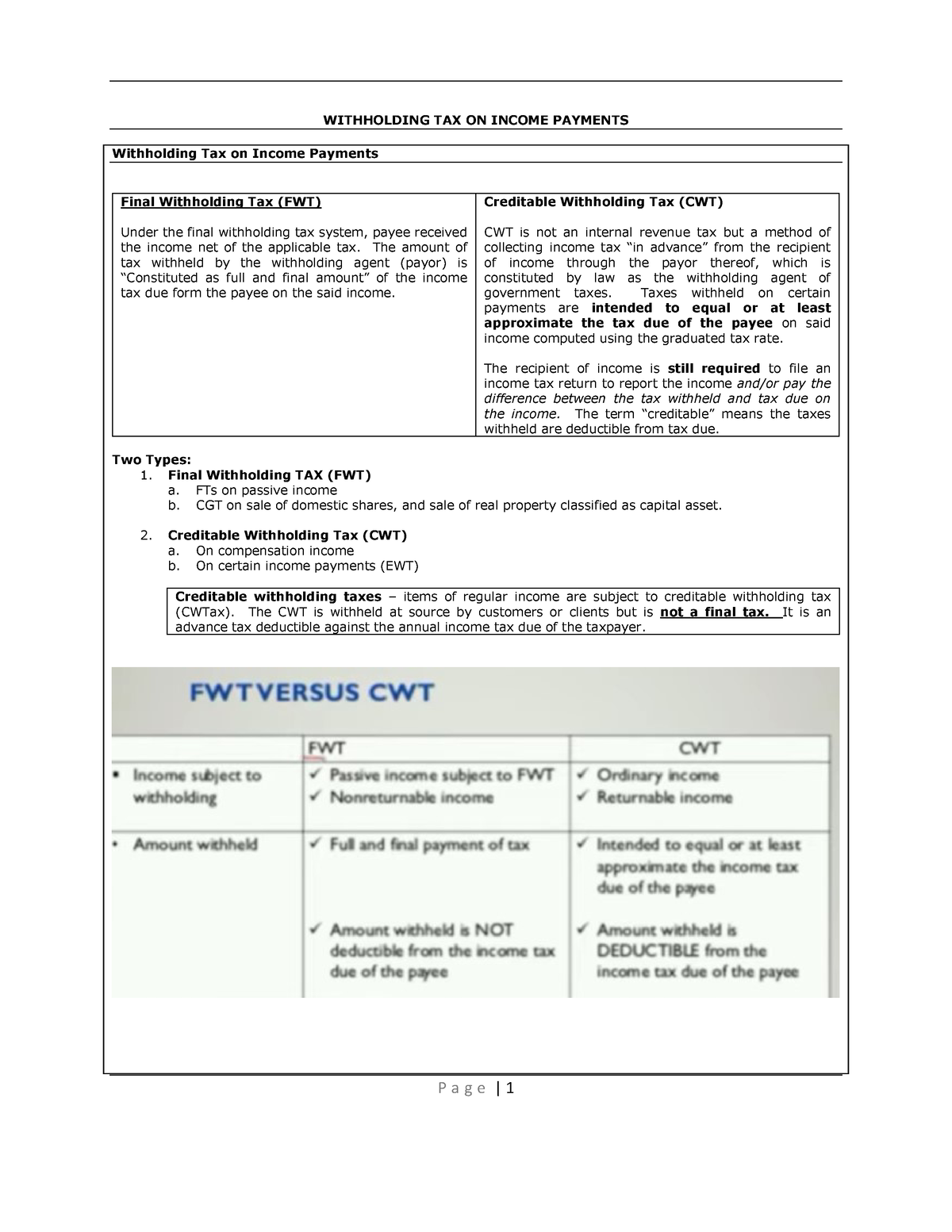

3. Withholding Tax on Income Payments-Integ- Revised 2022 – Copy – Source www.studocu.com

Part XIII of India’s Income Tax Act aims to simplify the process, but it’s crucial to grasp its nuances for effective tax management.

Withholding Tax: Understanding Part XIII And Its Implications

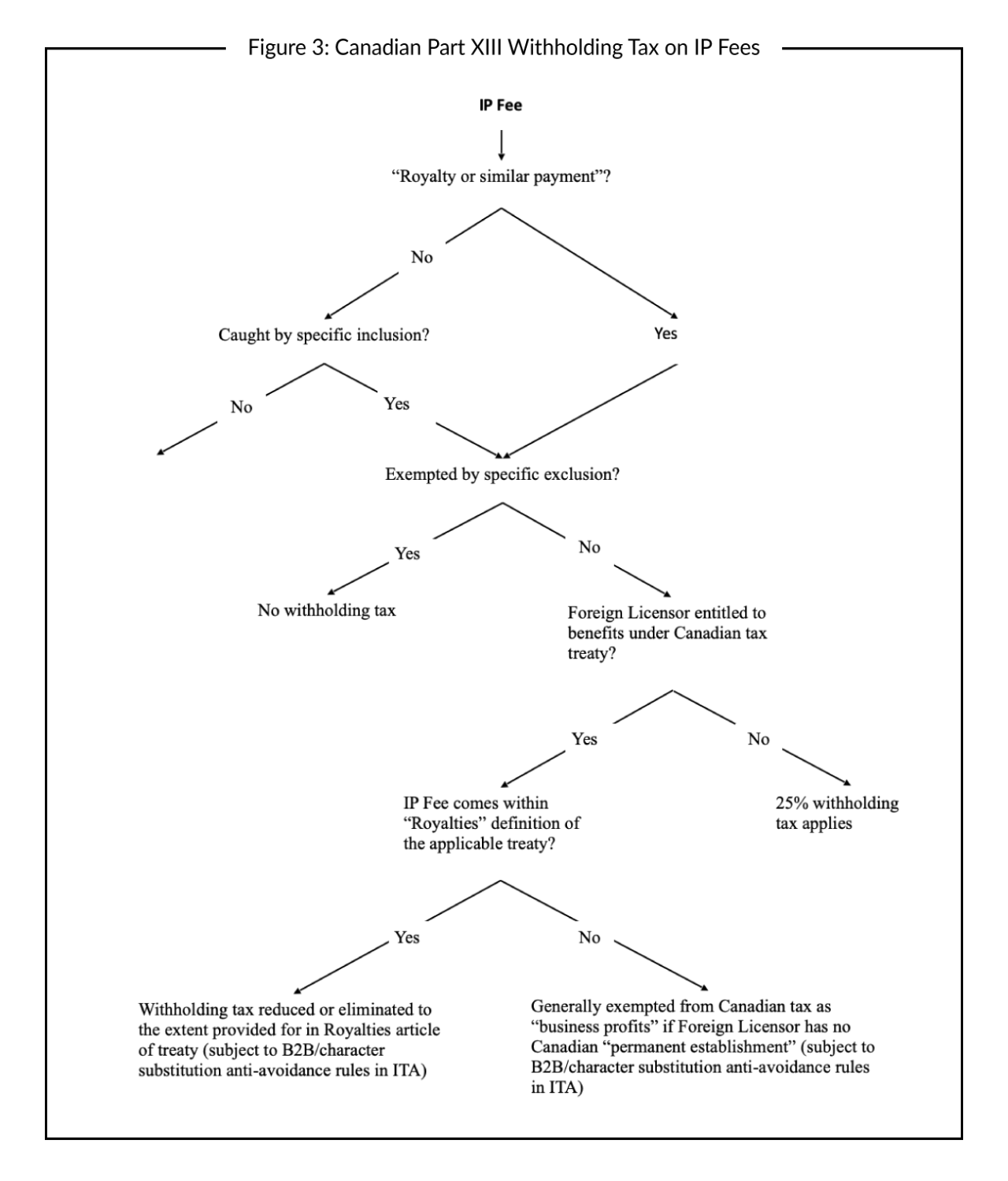

Part XIII of the Income Tax Act introduces a mechanism for collecting tax at source, ensuring that taxes are deducted before payments are made. It applies to specified transactions, such as salary payments, professional fees, and rent.

IRS Form 1116: Foreign Tax Credit With An Example – Source 1040abroad.com

By withholding tax at the source, the government aims to collect revenue on a regular basis and prevent tax evasion.

Decoding the Provisions of Part XIII

Part XIII outlines the responsibilities of the deductor (payer) and the deductee (payee). The deductor is required to deduct tax at the prescribed rate from the payment made to the deductee. The deductee, on the other hand, is entitled to claim credit for the tax withheld against their final tax liability.

Medicare Tax: Understanding Medicare and the Respective Tax Withholding – Source synder.com

Understanding these roles and responsibilities is vital for accurate tax compliance.

Historical Evolution of Withholding Tax

The concept of withholding tax has its roots in the early 20th century. During World War I, the British government introduced a system of deducting tax at source to boost war revenue. Since then, withholding tax has become a widely adopted practice worldwide.

Payments From Canada – Business Tax Canada – Source businesstaxcanada.com

In India, Part XIII was introduced in 1961 and has undergone several revisions to align with changing economic and fiscal policies.

Unveiling the Myths about Withholding Tax

Despite its prominence, withholding tax is shrouded in misconceptions. One common myth is that withholding tax is the final tax payable. However, it’s only an advance tax payment, and the deductee is liable to pay any outstanding tax or claim a refund during tax filing.

Understanding Withholding Tax In China | FDI China – Source fdichina.com

Another misconception is that withholding tax is applicable only to salaried individuals. In reality, it extends to various types of income, including professional fees, rent, and other specified transactions.

Recommendations for Effective Withholding Tax Management

Proper withholding tax management is essential for both businesses and individuals.

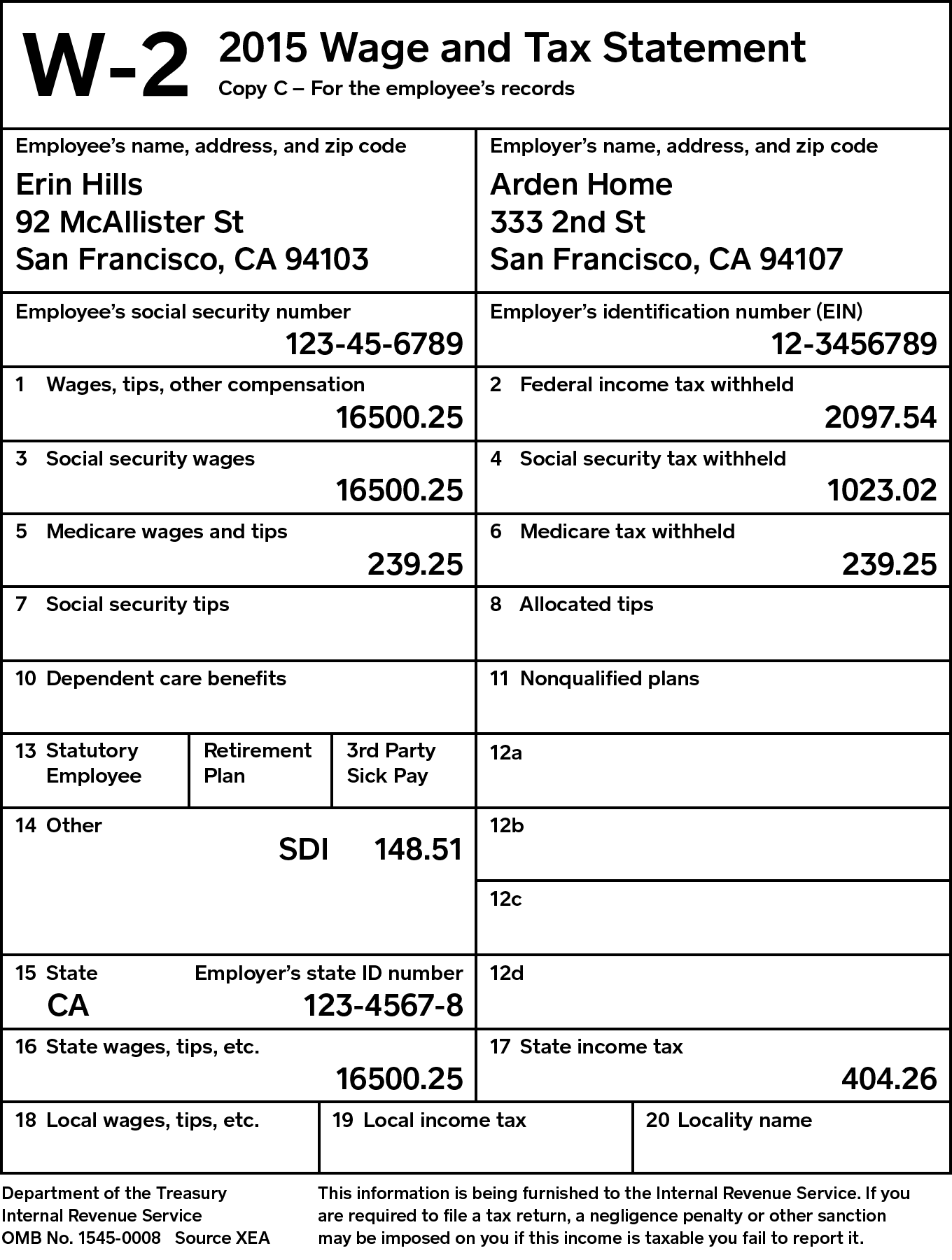

Understanding Form W-2 – Ahola – Source blog.ahola.com

Here are a few recommendations:

– Employers should maintain accurate records of employee salaries and tax deductions.

– Individuals should provide their PAN (Permanent Account Number) to deductors to ensure proper tax withholding.

– Consult a tax professional for guidance on complex withholding tax scenarios.

Tips for Understanding and Complying with Part XIII

To enhance your understanding of Part XIII, consider the following tips:

– Study the relevant provisions of the Income Tax Act and accompanying circulars.

– Utilize online resources and consult with experts for clarity.

Understanding Withholding Tax: A Comprehensive Guide – Source mycpadashboard.com

– Stay updated with changes in tax laws and regulations.

Withholding Tax: Beyond the Basics

Exploring withholding tax beyond the basics can provide deeper insights:

– It plays a crucial role in controlling tax evasion and ensuring revenue collection.

– Non-compliance with withholding tax provisions can lead to penalties and interest charges.

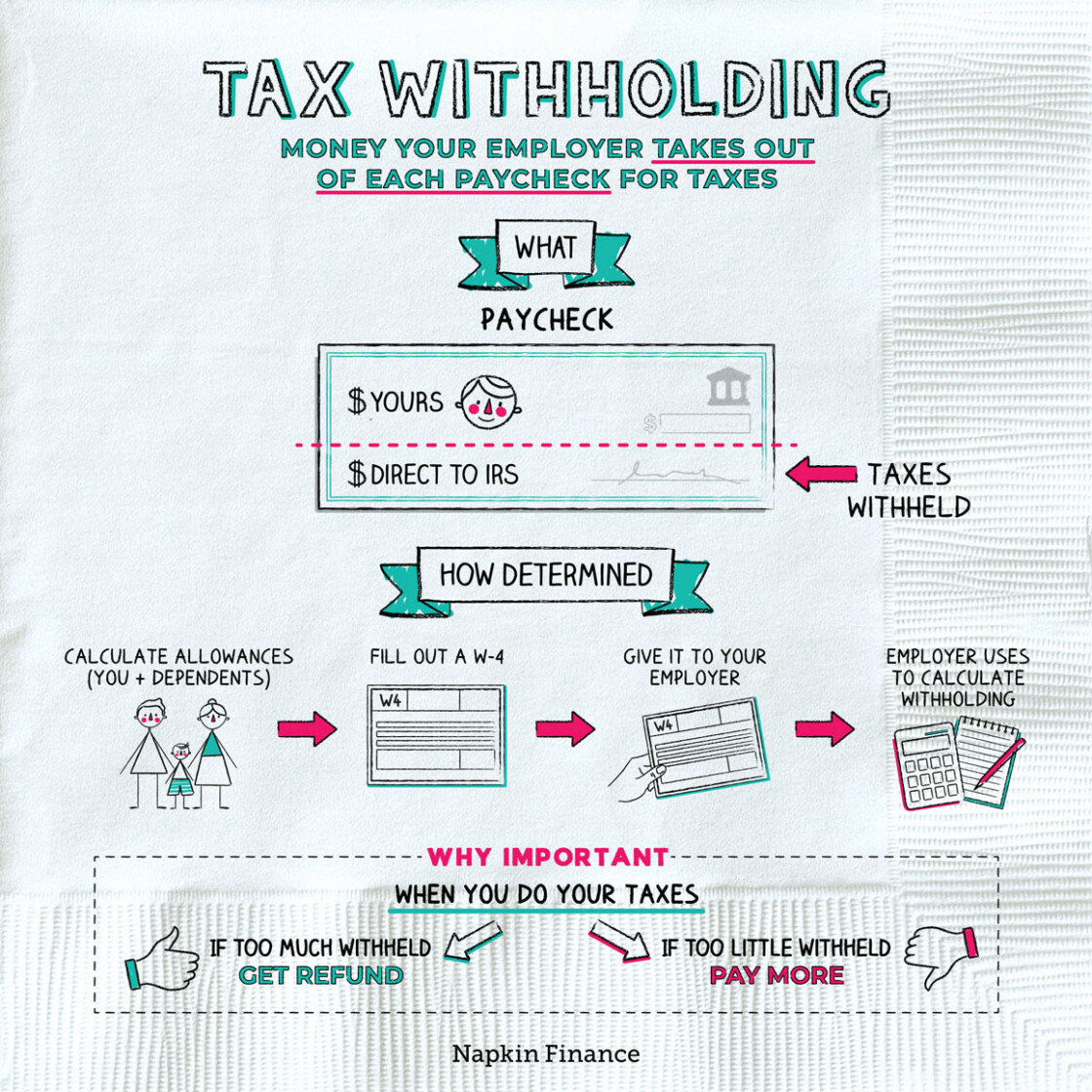

What is Tax Withholding? All Your Questions Answered by Napkin Finance – Source napkinfinance.com

– Withholding tax forms can vary depending on the nature of the transaction and the status of the deductee.

Fun Facts about Withholding Tax

While withholding tax is often perceived as a mundane topic, there are some intriguing facts associated with it:

– The term “withholding” originates from the practice of employers holding back a portion of an employee’s wages for tax payment.

– The highest withholding tax rate in the world is 82%, applicable in certain African countries.

– In some countries, withholding tax is also levied on interest income and dividends.

Tax Withholding for Seasonal and Part-Time Employees – Caras Shulman – Source www.carasshulman.com

– The introduction of electronic filing systems has significantly simplified withholding tax compliance.

Simplify Tax Compliance with Withholding Tax

Understanding the intricacies of withholding tax can empower you to streamline your tax compliance:

– Estimate your tax liability accurately and plan your finances accordingly.

– Avoid the hassle of underpayment penalties and interest charges.

Arkansas State Income Tax Withholding Forms – WithholdingForm.com – Source www.withholdingform.com

– Maintain a clean and transparent financial record for future audits or assessments.

What if You Encounter Issues with Withholding Tax?

If you encounter any issues with withholding tax, seek prompt professional guidance. A tax expert can help you:

– Identify errors or discrepancies in withholding tax calculations.

– File for refunds or pay outstanding taxes as required.

– Negotiate with tax authorities in case of disputes or challenges.

Listicle: Key Points to Remember about Withholding Tax

To summarize the key points discussed:

– Part XIII of the Income Tax Act governs withholding tax in India.

– The deductor is responsible for withholding tax at the source, while the deductee claims credit for the tax withheld.

– Accurate record-keeping and understanding of tax laws are essential for effective withholding tax management.

– Non-compliance with withholding tax provisions can lead to penalties and interest charges.

– Withholding tax plays a crucial role in preventing tax evasion and ensuring revenue collection.

– Consulting a tax expert can provide clarity and guidance on complex withholding tax matters.

Question and Answer: Resolving Your Withholding Tax Queries

A1. Part XIII outlines the provisions for withholding tax at source, ensuring regular tax collection and preventing tax evasion.

A2. The deductor (payer) is responsible for withholding tax, while the deductee (payee) is entitled to claim credit against their final tax liability.

A3. No, it is mandatory to pay withholding tax as prescribed by the Income Tax Act. Non-compliance can lead to penalties and interest charges.

A4. You can claim a refund by filing your income tax return and providing proof of excess withholding tax deducted.

Conclusion of Withholding Tax: Understanding Part XIII And Its Implications

Withholding tax plays a crucial role in the Indian tax system. Understanding Part XIII And Its Implications provides a strong foundation for effective tax management and compliance. By embracing these concepts and seeking professional guidance when needed, individuals and businesses can navigate the complexities of withholding tax with confidence.