Are you losing sleep over the complexities of hedge fund administration? Let this comprehensive guide be your beacon, illuminating the path toward streamlined operations and enhanced investment performance.

Juggling compliance, reporting, and risk management can turn even the most seasoned investment managers into frazzled jugglers. Hedge fund administration services offer a lifeline, freeing up your time and energy to focus on what you do best: generating alpha.

Hedge Fund Administration Services: Your Secret Weapon

Hedge fund administration services are designed to alleviate the administrative burden associated with managing hedge funds. These services encompass a range of tasks, including:

- Fund accounting and reporting

- Compliance and regulatory oversight

- Risk management and portfolio analysis

- Investor relations and communication

Hedge Fund Manager Salary Singapore – Company Salaries 2023 – Source salary.udlvirtual.edu.pe

Hedge Fund Administration Services: A Deeper Dive

Imagine having a team of experts dedicated solely to managing the administrative aspects of your hedge fund. This is what hedge fund administration services provide. They streamline operations, reduce risk, and enhance transparency, allowing you to focus on the core aspects of investing.

The benefits of hedge fund administration services extend beyond efficiency gains. By outsourcing these tasks to a specialized provider, you can access expertise that would be difficult and costly to develop in-house. This expertise helps ensure compliance with complex regulations, mitigate risks, and improve investor reporting.

Hedge Fund Services Cover Letter | Velvet Jobs – Source www.velvetjobs.com

Hedge Fund Administration Services: A Historical Perspective

Hedge fund administration services have evolved over time, fueled by the growing complexity of the hedge fund industry. In the early days, hedge funds often relied on manual processes and spreadsheets to manage their operations. As the industry matured, the need for specialized services became apparent.

Today, hedge fund administration services are a vital part of the investment landscape. They provide a comprehensive suite of solutions tailored to the specific needs of hedge funds, enabling them to operate efficiently and effectively.

:max_bytes(150000):strip_icc()/GettyImages-485205331-af3fb443ce91443192ab756c7167ed58.jpg)

What qualifications do you need to work at a hedge fund? Leia aqui – Source fabalabse.com

Hedge Fund Administration Services: Beyond the Surface

While the core services provided by hedge fund administration firms may seem straightforward, the value they add goes far beyond the basics. These services play a crucial role in:

- Improving operational efficiency

- Reducing compliance risks

- Enhancing investor reporting

- Providing data analysis and insights

By leveraging their expertise and technology, hedge fund administration firms help investment managers make informed decisions and stay ahead of the curve.

11 Tips for Choosing Your Crypto Hedge Fund Services – Source www.truecodecapital.com

Hedge Fund Administration Services: Enhancing Transparency

Transparency is paramount in today’s investment environment. Hedge fund administration services play a vital role in ensuring that investors have access to accurate and timely information about their investments. These services provide:

- Regular fund accounting and reporting

- Independent valuations and audits

- Investor communications and updates

By fostering transparency, hedge fund administration services help build trust between investment managers and their investors.

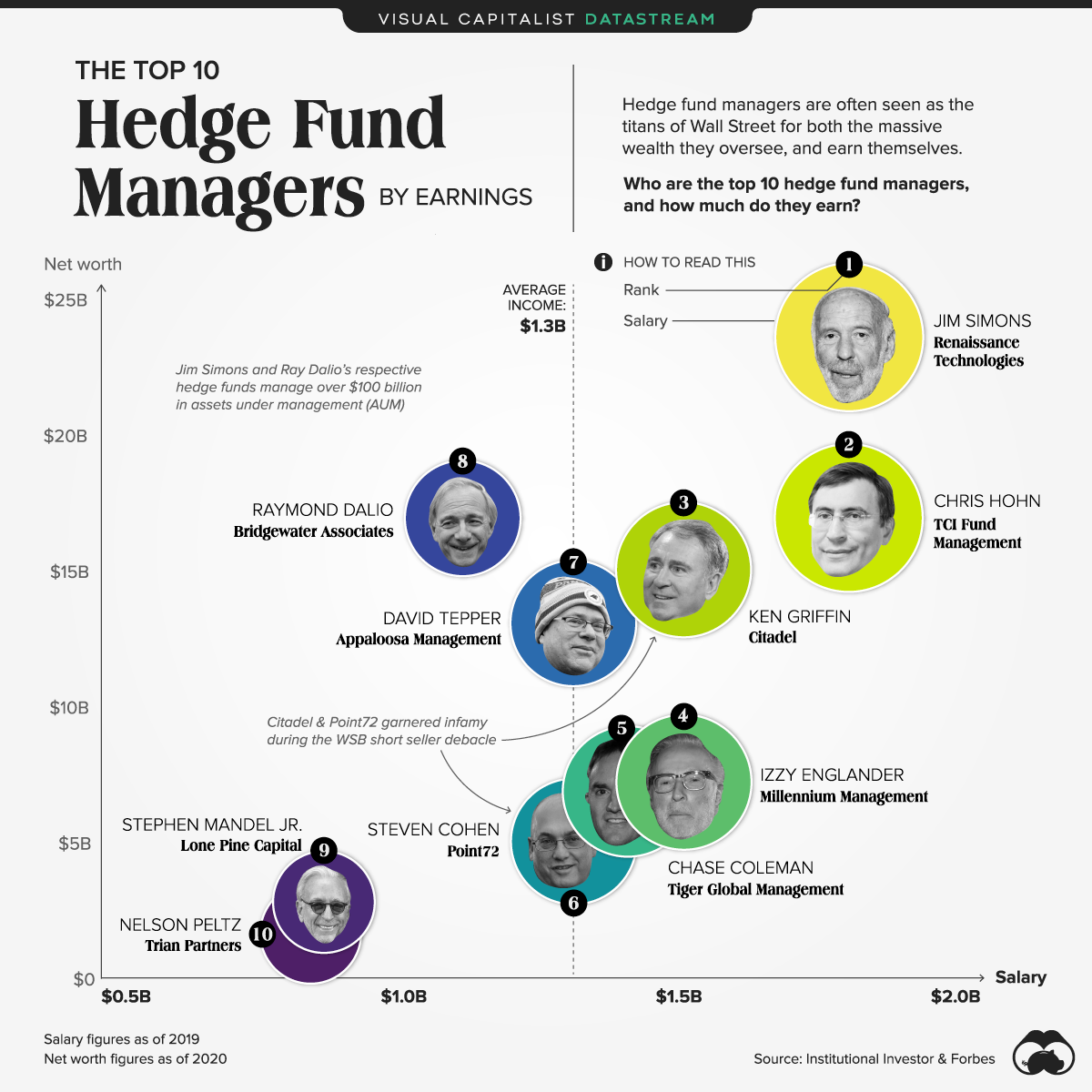

The World’s Top 10 Hedge Fund Managers by Earnings – Investment Watch – Source www.investmentwatchblog.com

Hedge Fund Administration Services: Tips for Success

Choosing the right hedge fund administration service provider is critical to your success. Here are a few tips to help you find the best fit:

- Define your specific needs

- Research potential providers

- Request proposals and references

- Evaluate experience and expertise

By following these tips, you can ensure that you select a provider who can meet your unique requirements and help you achieve your investment goals.

Hedge Fund Manager Salaries: Top 25 Made Combined Billion in 2015 – Source www.ibtimes.com

Hedge Fund Administration Services: A Global Perspective

Hedge fund administration services have become increasingly globalized. Many firms now have offices in multiple countries to serve the needs of their clients. This global presence allows for:

- Access to expertise in different jurisdictions

- Compliance with international regulations

- Improved client communication and support

By choosing a global provider, you can benefit from their experience and expertise in navigating the complexities of investing across borders.

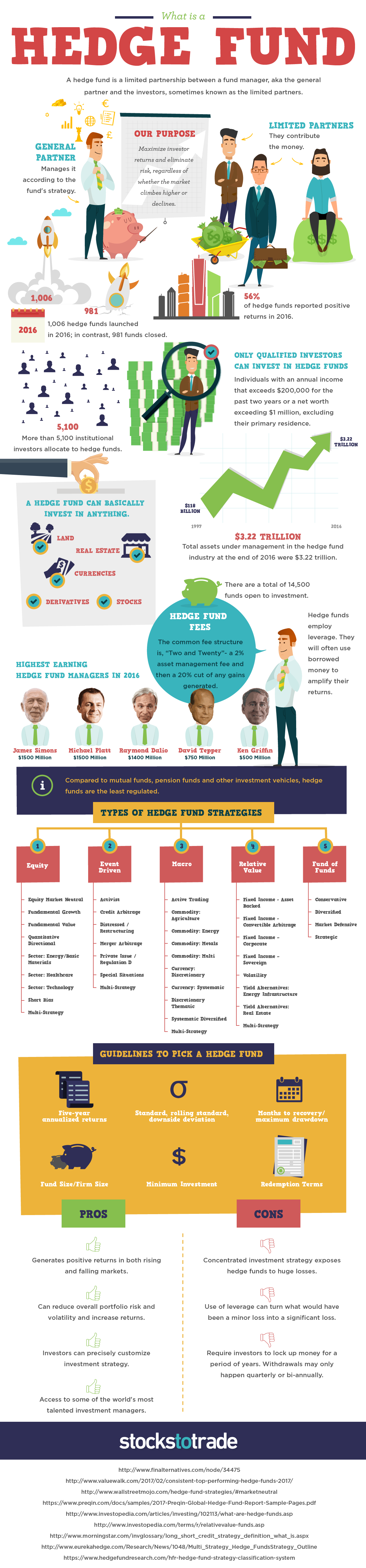

What is a Hedge Fund {INFOGRAPHIC} – StocksToTrade.com – Source stockstotrade.com

Hedge Fund Administration Services: Fun Facts

Did you know that hedge fund administration services:

- Have been around for over 50 years

- Are used by over 90% of hedge funds

- Can help reduce operational costs by up to 30%

These fun facts underscore the importance and widespread adoption of hedge fund administration services in the investment industry.

Introduzir 120+ imagem difference between mutual funds and hedge funds – Source br.thptnganamst.edu.vn

Hedge Fund Administration Services: The Future

The future of hedge fund administration services is bright. As the industry continues to grow and evolve, these services will become even more critical. We can expect to see:

- Increased use of technology

- Expansion into new markets

- Greater focus on data analytics

By embracing these trends, hedge fund administration service providers will continue to play a vital role in the success of the hedge fund industry.

Hedge Funds in Nigeria: Meaning and How They Work | InvestSmall – Source www.investsmall.co

Hedge Fund Administration Services: What if?

Imagine what could happen if you had more time to focus on your core business. What if you could reduce your operational costs and improve your investment performance? Hedge fund administration services can make this a reality.

By outsourcing the administrative burden to a specialized provider, you can free up your time, reduce your risks, and improve your investment outcomes. Don’t let administrative challenges hold you back. Embrace hedge fund administration services and unlock the full potential of your hedge fund.

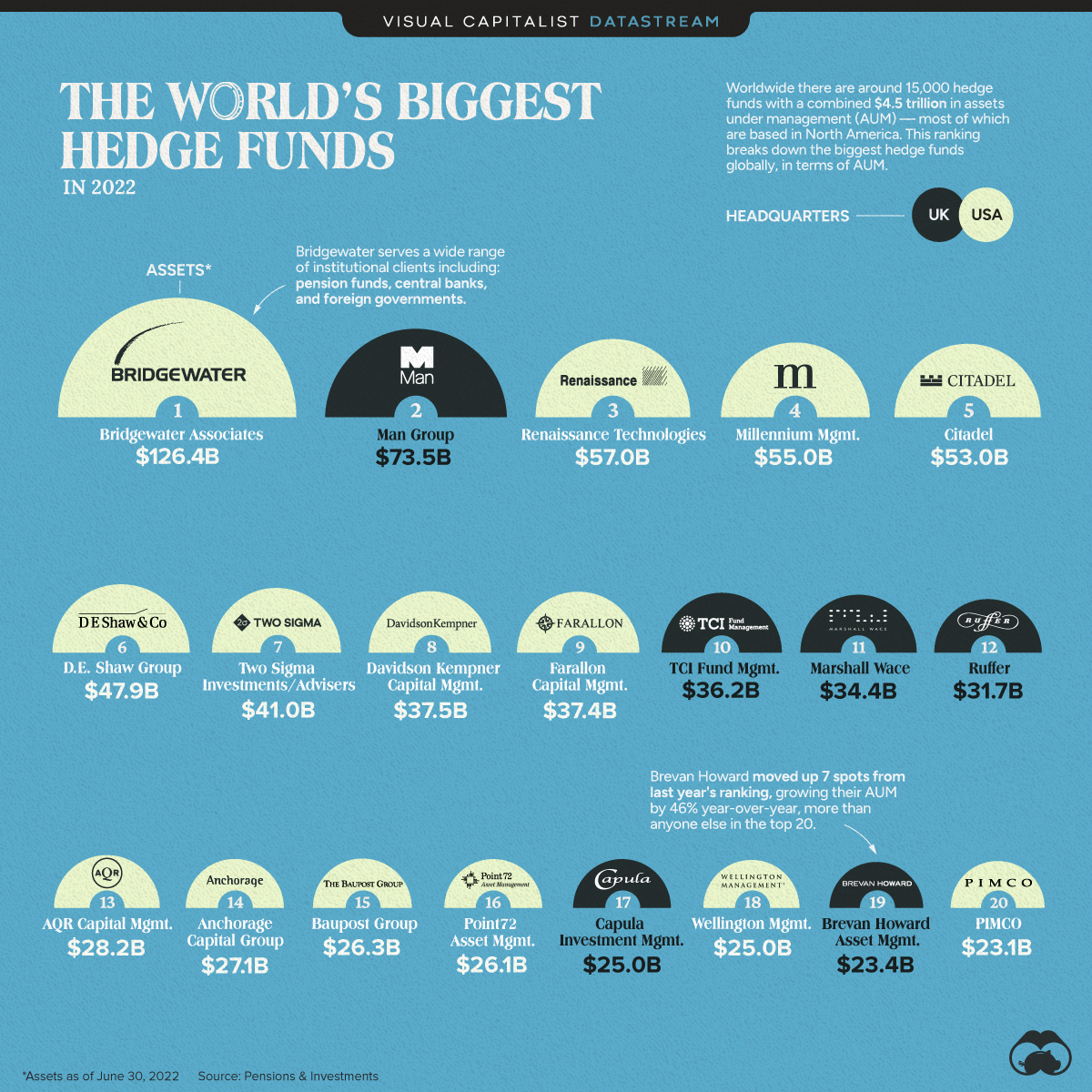

Jeff Desjardins Blog | Ranked: The World’s 20 Biggest Hedge Funds – Source talkmarkets.com

Hedge Fund Administration Services: A Comprehensive List

Here is a comprehensive list of the services that hedge fund administration firms typically offer:

- Fund accounting and reporting

- Compliance and regulatory oversight

- Risk management and portfolio analysis

- Investor relations and communication

- Data analytics and reporting

- Tax preparation and filing

- Legal and regulatory advice

- Due diligence and onboarding

By partnering with a hedge fund administration firm, you can access a team of experts who can handle all of these tasks, allowing you to focus on your core business.

Questions and Answers on Hedge Fund Administration Services

Q: What is the difference between hedge fund administration and fund accounting?

A: Hedge fund administration encompasses a broader range of services than fund accounting. In addition to fund accounting, hedge fund administration services typically include compliance and regulatory oversight, risk management, investor relations, and data analytics.

Q: How much do hedge fund administration services cost?

A: The cost of hedge fund administration services varies depending on the size and complexity of the fund. However, most providers charge a percentage of the fund’s assets under management.

Q: What are the benefits of using hedge fund administration services?

A: Hedge fund administration services can provide a number of benefits, including increased efficiency, reduced risks, improved investor reporting, and access to expertise.

Q: How do I choose a hedge fund administration service provider?

A: When choosing a hedge fund administration service provider, it is important to consider the size and complexity of your fund, your specific needs, and the provider’s experience and expertise.

Conclusion of Hedge Fund Administration Services: A Comprehensive Guide For Investment Managers

Hedge fund administration services are essential for investment managers who want to focus on their core business and achieve optimal investment performance. By outsourcing the administrative burden to a specialized provider, you can free up your time, reduce your risks, and improve your investment outcomes.