Are you worried about losing your income if you can’t work due to an illness or injury? You may consider purchasing Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury.

Short-Term Disability Insurance: A Safety Net During Unexpected Events

Protect Your Income with Short Term Disability Insurance | Guardian – Source eqbits.com

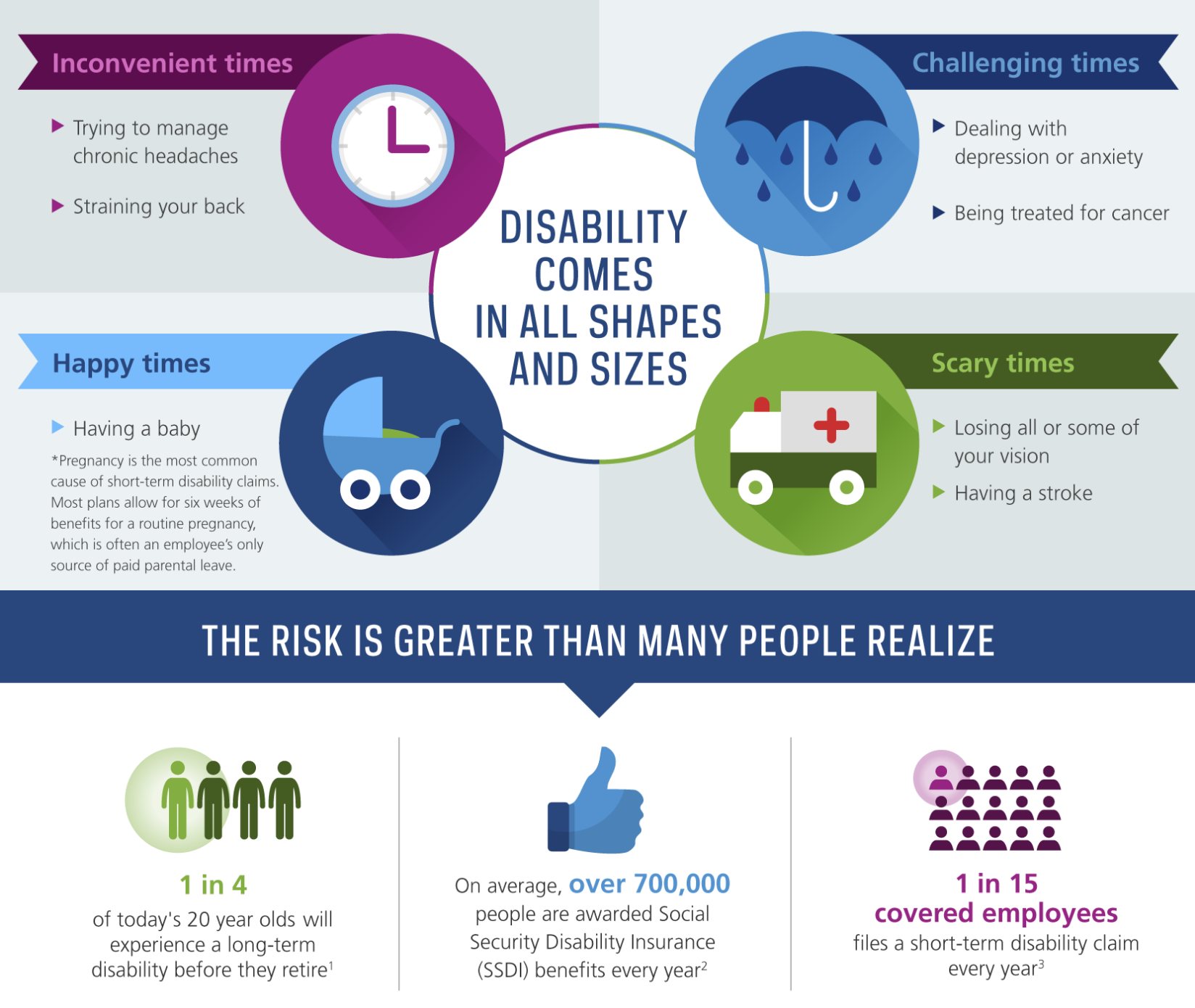

Unexpected illness or injury can disrupt our lives and finances. Without a steady income, meeting our financial obligations can be challenging. Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury provides a safety net, ensuring you receive a portion of your income while you recover and focus on your health.

Peace of Mind and Financial Security

What Do Disability Insurance Policies Usually Cover? | KBI – Source www.kbibenefits.com

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury offers peace of mind and financial security. Knowing that you will have a source of income if you can’t work due to a covered event reduces stress and allows you to focus on recovery.

Main Points About Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

From Injury to Income: Long and Short Term Disability Insurance Claims – Source national-disability-benefits.org

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury covers a wide range of conditions, including injuries, illnesses, and mental health issues. It provides a percentage of your income for a limited period, typically up to 26 weeks. Premiums vary based on factors such as age, health, and the level of coverage you choose.

Personal Experience With Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Short-Term Disability Insurance Requirements for Employers by State – Source mployeradvisor.com

“I never thought I would need Short-Term Disability Insurance until I suffered a severe ankle injury that prevented me from working for several weeks. Thanks to this coverage, I was able to cover my expenses and focus on rehabilitation without worrying about lost wages.” – Emily, a satisfied policyholder

What Is Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury?

Short Term Disability Insurance: How Do You Qualify? | WalletGenius – Source walletgenius.com

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury is an insurance policy that provides income replacement for employees who are unable to work due to a disability. It covers a wide range of conditions, including injuries, illnesses, and mental health issues. Benefits typically begin after a waiting period, and payments continue for a limited period, usually up to 26 weeks.

History and Myths About Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Short Term Disability Insurance – Justworks Help Center – Source help.justworks.com

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury has been around for over a century, but many misconceptions surround it. One common myth is that it is only for people with high-risk jobs. However, anyone can benefit from this coverage, regardless of their occupation. Another myth is that Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury is expensive. While premiums vary, there are affordable options available for most budgets.

Hidden Secrets of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Ewell vetélytárs hegesztés difference between long and short term – Source analiticaderetail.com

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury can be a valuable asset, but there are some hidden secrets you should know. One is that benefits are taxable. Another is that coverage may not extend to all disabilities. Carefully review the policy details before purchasing to understand what is covered and what is not.

Recommendations for Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

How Supplemental Disability Insurance Works for Doctors – Source www.sdtplanning.com

When choosing a Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury policy, there are a few key factors to consider: coverage amount, waiting period, and benefit period. Determine the amount of income you need to replace and choose a policy that provides that coverage. Consider a shorter waiting period if you want benefits to start sooner. Finally, select a benefit period that aligns with your anticipated recovery time.

Types of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Short-Term Disability – How to protect yourself and your employees – Source manshaplan.com

There are two main types of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury: individual and group. Individual policies are purchased directly from an insurance company, while group policies are offered through employers. Group policies are often more affordable, but they may also have lower coverage limits and more restrictions.

Tips for Getting the Most Out of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

What is NYS Short Term Disability – Crowley Insurance Agency – Source www.crowleyinsurance.com

Get the most out of your Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury policy by following these tips:

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury and Your Financial Future

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury is an essential tool for protecting your financial future. It provides peace of mind knowing you will have a source of income if you can’t work due to an unexpected illness or injury.

Fun Facts About Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Did you know?

How to Get Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Getting Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury is easy. You can purchase an individual policy directly from an insurance company or through your employer. If you have group coverage, check with your employer for details on eligibility and enrollment.

What if You Can’t Get Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury?

If you are unable to obtain Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury through your employer or an insurance company, there are other options available to help you protect your income. Consider creating an emergency fund, saving regularly, or investing in a high-yield savings account.

Listicle of Benefits of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

1. Provides income replacement if you can’t work due to a disability.

2. Covers a wide range of conditions, including injuries, illnesses, and mental health issues.

3. Offers peace of mind and financial security.

4. Helps you focus on recovery without worrying about lost wages.

5. Is a valuable asset for anyone, regardless of their occupation or health status.

Question and Answer

Short-term disability insurance provides income replacement for a limited period, typically up to 26 weeks, while long-term disability insurance provides coverage for a longer period, usually up to 5 years or more.

Premiums for short-term disability insurance vary depending on factors such as age, health, and the level of coverage you choose.

Short-term disability insurance covers a wide range of conditions, including injuries, illnesses, and mental health issues.

You should report your disability to your insurance company as soon as possible after you become unable to work and provide detailed medical records and other documentation to support your claim.

Conclusion of Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury

Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury is an essential safety net for anyone who wants to protect their income and financial future. It provides peace of mind, financial security, and allows you to focus on recovery without worrying about lost wages. Consider purchasing Short-Term Disability Insurance In Lincoln: Protect Your Income Against Illness And Injury today to safeguard your income in the event of an unexpected disability.