Are you struggling to understand the intricacies of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024? If so, this comprehensive guide will provide you with the answers you seek.

Unveiling the Challenges of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Understanding the complexities of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 can be a daunting task. Many employers and employees struggle to grasp the details of the program, its benefits and contribution rates. This can lead to confusion, incorrect payments, and potential penalties.

Demystifying Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 are set by the state of Massachusetts and are subject to change each year. For 2024, the contribution rate is 0.75%, which is split evenly between employers and employees.

Essential Points: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

In summary, Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 are 0.75% of wages, shared equally by employers and employees. This program provides income replacement for workers who need to take time off for family or medical reasons. It’s important for employers and employees to understand their responsibilities and benefits under this program.

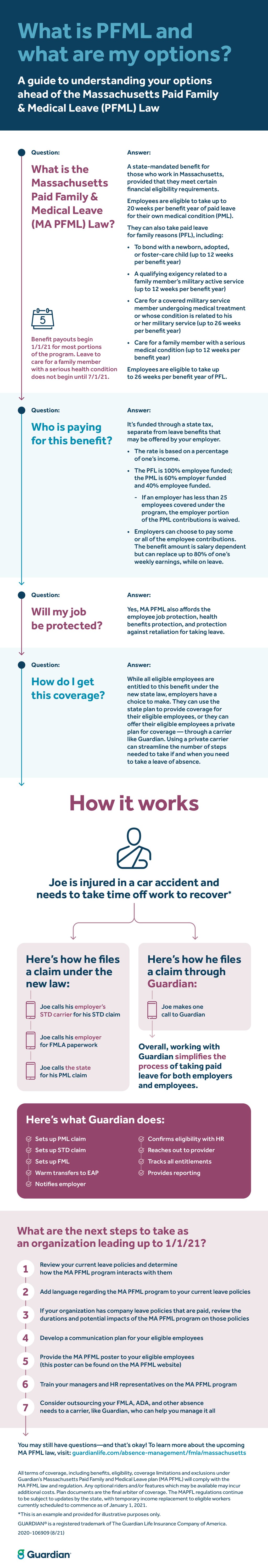

Massachusetts Family and Medical Leave Act Opens Doors for Brokers to – Source insurancewholesaler.net

Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024: A Personal Perspective

As an employee, I appreciate the peace of mind that Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 provides. Knowing that I can take time off to care for a sick family member or welcome a new child without losing my income is invaluable. The program also provides flexibility for employers, allowing them to retain valuable employees during challenging times.

One of the key benefits of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 is its inclusiveness. Regardless of your employment status, income level, or family situation, you are eligible for benefits. This ensures that all workers have access to the support they need during life’s inevitable challenges.

Learn about your options ahead of new MA Paid Family and Medical Leave – Source www.bizjournals.com

History and Evolution: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 have undergone several changes since the program’s inception in 2021. The initial contribution rate was 0.63%, which was later increased to 0.75% for 2023 and 2024. These adjustments reflect the growing demand for paid family and medical leave and the state’s commitment to providing comprehensive support to its workforce.

Over time, Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 are expected to continue evolving in response to economic and societal changes. This flexibility ensures that the program remains relevant and responsive to the needs of Massachusetts workers and families.

MASSACHUSETTS PAID FAMILY & MEDICAL LEAVE PROGRAM UPDATES FOR 2022 – Source www.chameleon-strategies.com

Unveiling the Secrets: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

One of the lesser-known aspects of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 is that they are tax-deductible for both employers and employees. This means that the actual cost of the program is lower than the nominal rate. Additionally, employers may be eligible for federal tax credits for their PFML contributions.

Understanding these hidden benefits can help employers and employees make informed decisions about their participation in the program. By maximizing the tax savings available, businesses can minimize the financial impact of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 while still providing essential support to their workforce.

Massachusetts Paid Family and Medical Leave Benefit Calculations and – Source taylorhrgroup.com

Expert Recommendations: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

To optimize the effectiveness of Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024, experts recommend that employers and employees take the following steps:

- Familiarize themselves with the program’s eligibility requirements and benefits.

- Plan ahead for potential leaves of absence and communicate them to their employer.

- Keep accurate records of wages and contributions.

- Consult with a tax professional to maximize tax savings.

By following these recommendations, individuals and businesses can ensure a smooth and seamless experience with Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024.

Massachusetts Paid Family and Medical Leave | The Standard – Source www.standard.com

Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024: A Deeper Dive

The Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024 are based on a percentage of an employee’s wages. The contribution rate is split evenly between the employer and the employee, with each party contributing 0.375%. The maximum contribution for both the employer and the employee is $1,049.50 per year.

Employers are required to deduct the employee’s portion of the contribution from their wages and remit it to the state along with their own contribution. Employees can claim a deduction for their portion of the contribution on their state income tax return.

MA Legislature announces changes to MA Paid Family Medical Leave – Source www.fmglaw.com

Essential Tips: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Here are a few tips for employers and employees regarding Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024:

- Employers: Set up a system for deducting the employee’s portion of the contribution from their wages and remitting it to the state.

- Employees: Keep track of your wages and contributions so that you can claim the deduction on your state income tax return.

- Both employers and employees: Consult with a tax professional if you have any questions about the contribution rates or the tax implications of the program.

By following these tips, you can ensure that you are meeting your obligations under the Massachusetts Paid Family And Medical Leave (PFML) program.

Massachusetts Department of Paid Family and Medical Leave Releases – Source www.mastaffinglaw.com

Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024: Clarifying Common Misconceptions

There are a few common misconceptions about Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024. Here are a few of the most common:

- Misconception: The contribution rate is the same for all employers.

- Fact: The contribution rate is based on the size of the employer.

- Misconception: Employees are not required to contribute to the program.

- Fact: Employees are required to contribute 0.375% of their wages to the program.

- Misconception: The program is only available to employees who have worked for their employer for a certain amount of time.

- Fact: The program is available to all employees, regardless of their length of service.

By understanding these common misconceptions, you can avoid any confusion or penalties.

Implementing the Massachusetts Paid Family and Medical Leave (PFML – Source www.nutter.com

Fun Facts: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Here are a few fun facts about Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024:

- The contribution rate is the same for all employees, regardless of their income.

- The program is funded by a combination of employer and employee contributions.

- The program is administered by the Massachusetts Department of Family and Medical Leave.

Learning these fun facts can help you better understand the Massachusetts Paid Family And Medical Leave (PFML) program.

Massachusetts Paid Family and Medical Leave Benefits Start January 1 – Source beckreedriden.com

How-to Guide: Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024

Here is a step-by-step guide on how to comply with Massachusetts Paid Family And Medical Leave (PFML) Contribution Rates For 2024:

- Step 1: Determine your employer’s size.

- Step 2: Calculate the contribution rate based on your employer’s size.

- Step 3: Deduct the employee’s portion of the contribution from their wages.

- Step 4: Remit the employee’s and employer’s contributions to the state.

By following these steps, you can ensure that you are meeting your obligations