Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide

Navigating the complexities of short-term disability qualifications can be a daunting task, particularly when dealing with a reputable provider like Lincoln Financial. Understanding the ins and outs of their qualification process is crucial to maximizing your benefits and ensuring a smooth claim experience.

What Are The Responsibilities And Qualifications Required For – Source www.claro.com.au

Many individuals face confusion and uncertainty when applying for short-term disability benefits. The qualification criteria can be stringent, and the application process can be overwhelming. Mastering the qualifications with Lincoln Financial empowers you to confidently navigate this process and access the support you need during times of medical leave.

Conquering Short-Term Disability Qualifications With Lincoln Financial

How Do I Appeal Lincoln Financial Disability? – Top Class Actions – Source topclassactions.com

By understanding Lincoln Financial’s qualifications, you can optimize your application and increase your chances of approval. The following guide provides a comprehensive overview, empowering you to compile a strong case and advocate for your benefits effectively.

Main Points

Understanding the Target

Qualifications and experience needed for… | Disability Support Guide – Source www.disabilitysupportguide.com.au

Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide is designed to assist individuals seeking to qualify for short-term disability benefits from Lincoln Financial. It provides a roadmap to navigate the application process, understand the eligibility criteria, and gather the necessary documentation to support their claim.

Dispelling the Myths

/GettyImages-1058454392-fbc7811aef6640e68f5fc8096d248406.jpg)

Mastering Short-Term Trading – Source www.investopedia.com

Short-term disability qualifications are often shrouded in misconceptions. This guide debunks common myths and provides clear explanations of the actual qualification criteria. By dispelling the myths, individuals can approach the application process with confidence and dispel any lingering doubts or uncertainties.

Unveiling the Hidden Secrets

Mastering Business Financing: A Comprehensive Guide to Qualifications – Source www.cirruscap.com

This guide unlocks the hidden secrets of mastering short-term disability qualifications with Lincoln Financial. It reveals the strategies and insights that can enhance an individual’s chances of approval. By uncovering these secrets, individuals can maximize their benefits and gain a competitive edge in the qualification process.

Expert Recommendations

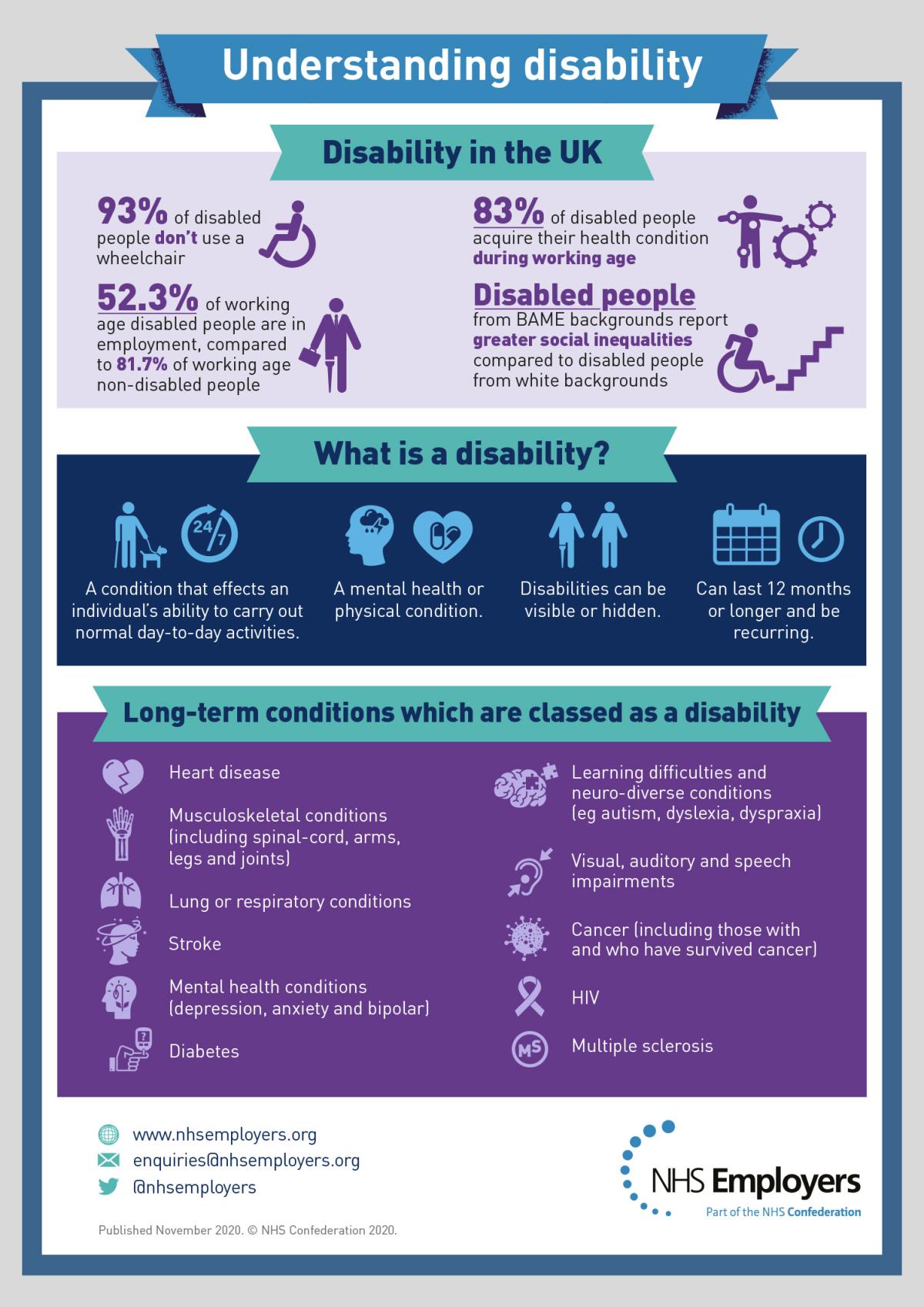

Understanding disability infographic | NHS Employers – Source www.nhsemployers.org

The guide presents recommendations from industry experts and individuals who have successfully navigated the qualification process. These recommendations provide practical tips, cautionary tales, and valuable advice that can help individuals avoid common pitfalls and increase their chances of success.

Qualification Criteria

Understanding Your Short-Term Disability Benefits : The New York City – Source nyccbf.org

Lincoln Financial considers several factors when evaluating an applicant’s eligibility for short-term disability benefits, including:

Tips for Success

A Quick Guide to The Different Types of Disability Insurance – Source www.actionlifemedia.com

Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide includes numerous tips to optimize the application process, such as:

Strategies

Long-Term vs Short-Term Disability Insurance In D.C. – Source donahoekearney.com

This guide outlines various strategies to enhance an individual’s chances of approval, including:

Fun Facts

Responsive navigation with ReactJS and Tailwind. | by Diego Auza | Mar – Source medium.com

Did you know?

How It Works

Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide explains the step-by-step process of applying for and qualifying for short-term disability benefits. It includes:

What If

Addressing common concerns, this guide explores various scenarios and provides guidance on what to do if:

Listicle

For quick reference, the guide provides a listicle of key points:

Question and Answer

Q: Is a doctor’s note sufficient to qualify for short-term disability benefits?

A: While a doctor’s note is essential, it may not be sufficient on its own. Comprehensive medical documentation, including test results and detailed reports, is typically required.

Q: How long does it take to process a short-term disability application?

A: The processing time varies depending on the complexity of the case and the availability of medical documentation. Lincoln Financial aims to provide a decision within a reasonable timeframe.

Q: Can I appeal a denied application?

A: Yes, individuals have the right to appeal a denied application. Lincoln Financial provides an appeals process to review decisions and consider new evidence.

Q: Are short-term disability benefits taxable?

A: In most cases, short-term disability benefits are taxable as income. However, consult with a tax professional or the IRS for specific guidance.

Conclusion of Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide

Mastering Short-Term Disability Qualifications With Lincoln Financial: A Comprehensive Guide empowers individuals with the knowledge and strategies to successfully navigate the qualification process. By understanding the eligibility criteria, gathering necessary documentation, and communicating effectively, you can increase your chances of approval and access the support you need during times of medical leave.