Imagine losing your income due to an unexpected illness or injury. The stress and worry can be overwhelming. That’s where Lincoln Financial Short-Term Disability insurance comes in, providing a safety net to protect your finances during those challenging times.

Facing the Unforeseen: Understanding the Need for Short-Term Disability Insurance

Temporary disability can strike anyone, regardless of age or occupation. Accidents, illnesses, and even mental health issues can leave you unable to work and earn a living. Without a plan in place, the financial consequences can be severe, including lost wages, medical expenses, and household bills piling up.

Lincoln Financial Short-Term Disability: Your Income Lifeline

Lincoln Financial’s Short-Term Disability insurance is designed to provide a sense of security during such challenging times. It replaces a portion of your income when you’re unable to work due to a covered disability. This financial cushion helps you maintain your standard of living and reduces the stress associated with lost income.

Privatize NJ Temporary Disability Insurance: As Easy as 1-2-3 – The DBL – Source insurancewholesaler.net

Lincoln Financial Short-Term Disability: A Personal Story of Support

Sarah was an active and healthy young professional when she was diagnosed with a rare autoimmune disorder. Her illness forced her to take an extended leave from work, leaving her worried about how she would pay her mortgage and other bills. Thankfully, she had Lincoln Financial Short-Term Disability insurance, which provided her with a steady income during her recovery. Sarah’s experience highlights the importance of having short-term disability coverage as a safety net when life throws unexpected curveballs.

Lincoln Financial Short-Term Disability: Protecting Your Income

Lincoln Financial Short-Term Disability insurance is designed to be flexible and customizable to meet your individual needs. You can choose the benefit amount, waiting period, and policy duration that best suits your financial situation. The coverage is available to individuals, families, and businesses, providing a comprehensive solution for income protection.

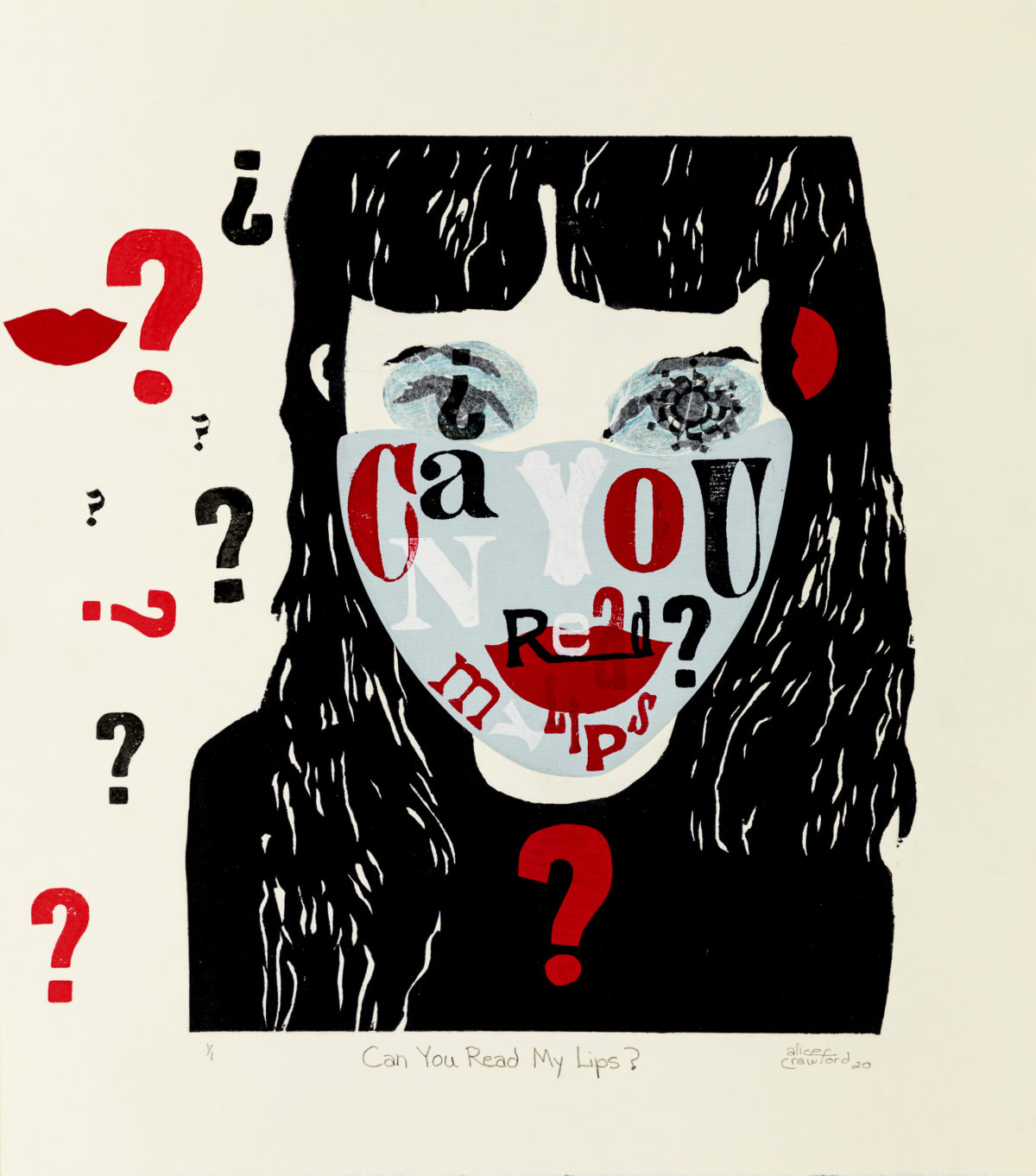

Disability Arts with Erika Lincoln and Jenel Shaw – Mentoring Artists – Source mawa.ca

Lincoln Financial Short-Term Disability: Dispelling Myths and Misconceptions

One common misconception about short-term disability insurance is that it’s only for people with dangerous or physically demanding jobs. However, the reality is that anyone can experience a short-term disability, regardless of their occupation. Even office workers and stay-at-home parents are susceptible to accidents or illnesses that can prevent them from working.

Lincoln Financial Short-Term Disability: The Hidden Secret

The true value of short-term disability insurance often goes unnoticed until you actually need it. It’s not just about replacing lost income; it’s about maintaining your peace of mind knowing that you’re financially protected if the unexpected happens. Having this safety net can help reduce stress and allow you to focus on your recovery without the added burden of financial worries.

Disability Insurance 101: Disability Insurance Companies – Expert – Source highincomeprotection.com

Lincoln Financial Short-Term Disability: Our Recommendation

Investing in Lincoln Financial Short-Term Disability insurance is an essential step towards financial security. It’s a cost-effective way to protect your income and ensure that you can continue to meet your financial obligations, even when faced with a temporary disability.

Lincoln Financial Short-Term Disability: Key Features and Benefits

Lincoln Financial’s Short-Term Disability insurance offers a range of benefits, including:

- Flexible coverage options to meet your needs

- Tax-free benefit payments

- Coverage for pre-existing conditions

- Access to a dedicated claims team

2021 Disability Employment and Inclusion Awards held in Lincoln – Source www.nebraska-advantage.org

Lincoln Financial Short-Term Disability: Tips for Choosing the Right Plan

When selecting a short-term disability plan, it’s important to consider the following factors:

- Your income and expenses

- The waiting period you’re comfortable with

- Your health history and risk factors

- Your current financial situation

Lincoln Financial Short-Term Disability: Compare and Contrast

Lincoln Financial Short-Term Disability insurance is just one of many options available. It’s important to compare different plans and providers to find the one that best meets your needs and budget. Consider the following factors:

- Policy premiums

- Coverage amounts

- Waiting periods

- Customer service reviews

What Is Short-Term Disability? Qualifying Situations – GoodRx – Source www.goodrx.com

Lincoln Financial Short-Term Disability: Fun Facts

Here are some interesting facts about Lincoln Financial Short-Term Disability insurance:

- It’s one of the most popular short-term disability insurance providers in the US.

- Lincoln Financial has been in business for over 100 years.

- Short-term disability insurance is tax-deductible for businesses.

Lincoln Financial Short-Term Disability: How to Apply

Applying for Lincoln Financial Short-Term Disability insurance is simple and straightforward. You can apply online, over the phone, or through an insurance agent. The application process usually takes about 15 minutes, and you’ll typically receive a decision within a few days.

Sixth Circuit Affirms Lincoln Life’s Denial of Long-Term Disability – Source robertsdisability.com

Lincoln Financial Short-Term Disability: What if I’m Denied?

If your application for Lincoln Financial Short-Term Disability insurance is denied, you have the right to appeal the decision. You should contact the insurance company and provide additional information or documentation to support your claim.

Lincoln Financial Short-Term Disability: Listicle of Benefits

Here’s a listicle of the key benefits of Lincoln Financial Short-Term Disability insurance:

- Provides a safety net for your income

- Helps maintain your standard of living

- Reduces financial stress

- Easy to apply for and affordable

Can I Be Fired For Temporary Disability During Coronavirus? – Source findanattorney.net

Questions and Answers

Q: What is the waiting period for Lincoln Financial Short-Term Disability insurance?

A: The waiting period is typically 7 or 14 days, but you can choose a longer waiting period to lower your premiums.

Q: How much does Lincoln Financial Short-Term Disability insurance cost?

A: The cost of premiums will vary depending on your age, health, occupation, and the coverage amount you choose.

Q: Can I apply for Lincoln Financial Short-Term Disability insurance if I have a pre-existing condition?

A: Yes, Lincoln Financial offers coverage for pre-existing conditions, but there may be a waiting period before the coverage takes effect.

Q: How do I file a claim for Lincoln Financial Short-Term Disability insurance?

A: You can file a claim online, over the phone, or by mail. You will need to provide documentation to support your claim, such as a doctor’s note.

Understanding Your Short-Term Disability Benefits : The New York City – Source nyccbf.org

Conclusion of Lincoln Financial Short-Term Disability: Secure Your Income During Temporary Disability

Lincoln Financial Short-Term Disability insurance is a valuable financial safety net that can protect your income and reduce financial stress during a temporary disability. By investing in this coverage, you can ensure that you’ll have the financial resources you need to maintain your standard of living and focus on your recovery.