Unlocking Homeownership: The Dream of Inheriting a Mortgage-Free Property

A Burden Lifted

The weight of a mortgage can be overwhelming, especially for first-time homeowners. The financial strain and ongoing payments can be a constant source of stress.

Caveatable Interests in South Australia – Beger & Co Lawyers Adelaide – Source www.beger.com.au

A Path to Homeownership

Inheriting a mortgage-free property can transform that financial burden into a pathway to homeownership. It eliminates the need for a mortgage, reducing housing expenses and providing a solid foundation for building wealth.

Immigrant homeownership growing in Ohio, 35th in nation – Source www.cincinnati.com

Target Audience

Inheriting a Mortgage-Free Property: A Journey into Homeownership

Inheriting a mortgage-free property is an incredible opportunity for individuals who may have struggled to afford homeownership on their own. It opens doors for first-time buyers, young professionals, and those looking to downsize or relocate without the burden of a mortgage. The prospect of inheriting a mortgage-free property can be a catalyst for financial stability, peace of mind, and the realization of long-held dreams.

Keychain Accessories Pendant Unlocking, Keychain, Unlock, Tool PNG – Source pngtree.com

History and Myths

Unveiling the History and Truths Surrounding Inherited Properties

Inheriting a mortgage-free property has a long history, with its origins in inheritance laws and family traditions. Over time, myths and misconceptions have arisen surrounding inherited properties. Some believe that inherited properties are always valuable, while others assume that they come with hidden costs or legal complications. Understanding the history and dispelling these myths can help individuals navigate the process of inheriting a mortgage-free property with greater confidence and clarity.

Unlocking the Spectrum – Job Opportunities – Source recruiting.paylocity.com

Hidden Secrets

Unlocking the Secrets of Inheriting a Mortgage-Free Property

Inheriting a mortgage-free property is not without its complexities. There are legal considerations, tax implications, and potential expenses that should be carefully examined. By uncovering the hidden secrets associated with inherited properties, individuals can make informed decisions and minimize potential pitfalls. Avoiding probate, understanding capital gains taxes, and navigating insurance and maintenance costs are crucial aspects of ensuring a smooth and successful transition.

Unlocking Quotes | Minimalist Quotes – Source minimalistquotes.com

Recommendations

Expert Advice for Navigating the Inheritance Process

Inheriting a mortgage-free property is a significant financial event that requires careful planning and execution. Seeking guidance from professionals, such as attorneys, financial advisors, and real estate agents, can provide invaluable support throughout the process. These experts can assist with legal matters, tax implications, property valuation, and market analysis, ensuring that the inheritance is handled in a way that maximizes its benefits and minimizes any potential challenges.

Phone Unlocking Hull / Search for technology companies near you, get – Source toppikdept.blogspot.com

Additional Resources:

Inheriting a House: A Step-by-Step Guide

10 Things to Know About Inheriting a House

Tips for Success

Empowering Inheritors with Practical Advice

Inheriting a mortgage-free property presents a unique opportunity for individuals to secure their financial future. By following practical tips, such as conducting thorough property inspections, obtaining insurance, and creating a comprehensive budget, inheritors can maximize the benefits of their inheritance. Understanding the potential expenses associated with homeownership, including property taxes, maintenance costs, and utility bills, is essential for ensuring long-term financial stability.

Unlocking the Potential of Environmental DNA (eDNA) in Tracking and – Source www.world-today-news.com

Additional Tips:

Consider Renting Out the Property

explore Home Equity Loans

Fun Facts

Unveiling Surprising Facts About Inherited Properties

Inheriting a mortgage-free property is often associated with wealth and privilege. However, there are some lesser-known facts that add a unique twist to this topic. Did you know that not all inherited properties are mansions or luxury homes? In fact, many inherited properties are modest homes or even fixer-uppers that require significant renovations. Additionally, inheriting a mortgage-free property does not always guarantee financial freedom, as inheritors may still be responsible for ongoing expenses such as property taxes, maintenance costs, and insurance premiums.

Unlocking the Potential of Synthetix Perps – Source blog.synthetix.io

How-To Guide

A Step-by-Step Approach to Inheriting a Mortgage-Free Property

Inheriting a mortgage-free property involves a series of legal and financial steps. Understanding the process and following a step-by-step guide can help ensure a smooth transition. Key steps include obtaining a death certificate, filing for probate (if necessary), transferring the property title, and updating insurance and tax information. By following these steps diligently, inheritors can secure their rights to the property and prepare for the responsibilities of homeownership.

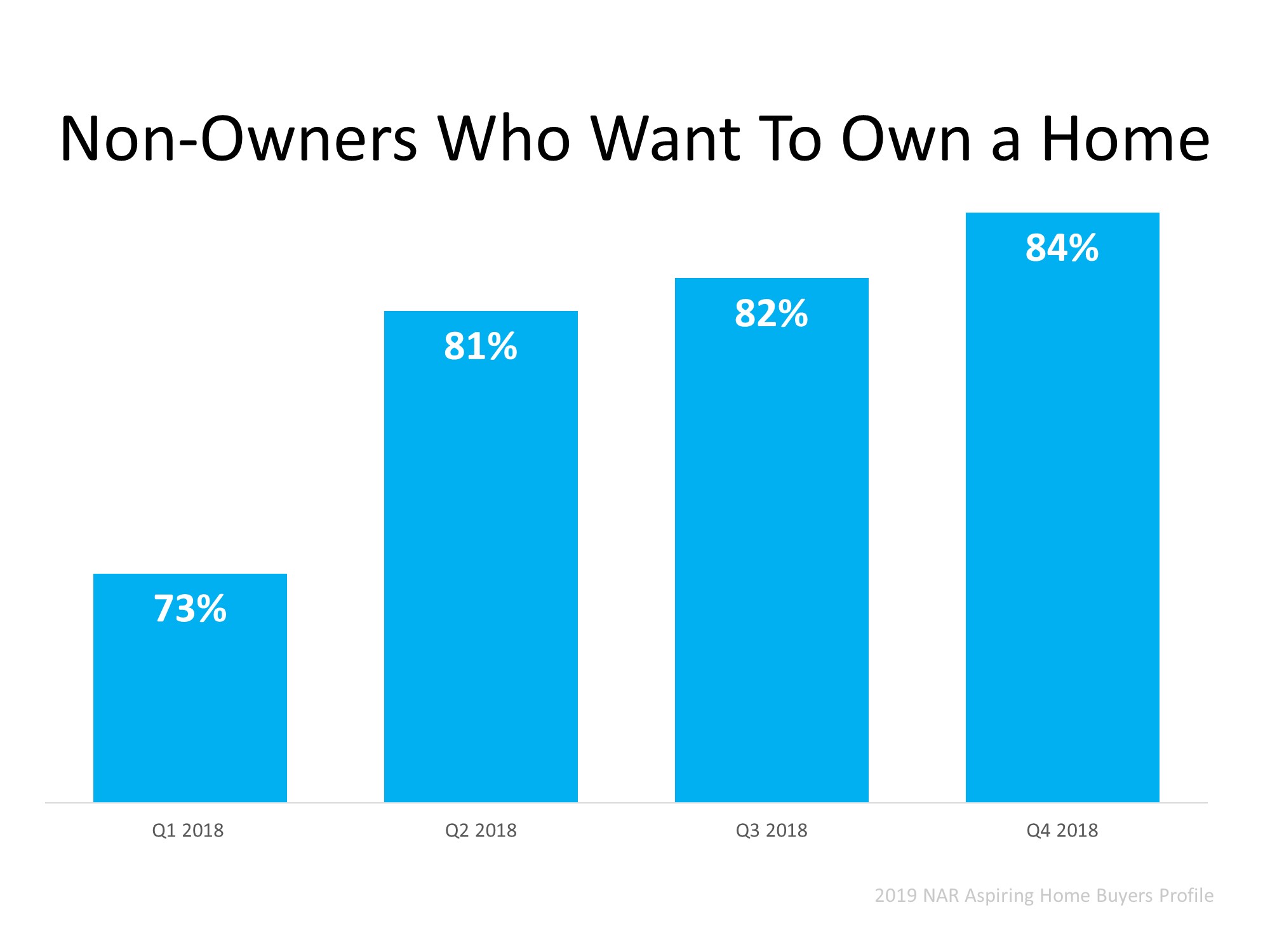

Homeownership Will Always Be a Part of the American Dream – Ursula O – Source ursulaosullivan.com

What-If Scenarios

Exploring Potential Challenges and Solutions

While inheriting a mortgage-free property can be a dream come true, there are potential challenges that inheritors should be aware of. One common concern is dealing with multiple heirs. When a property is inherited by several individuals, it is essential to work together and make decisions that benefit all parties involved. Open communication, compromise, and seeking professional guidance can help navigate these situations effectively. Another challenge is the potential need for repairs or renovations. Inheriting an older property may require significant investments to bring it up to current standards. In such cases, inheritors should carefully assess the costs involved and explore financing options to ensure they can afford the necessary repairs without compromising their financial stability.

Zeitfolgen Trommel Ein Bad nehmen uniqlo sustainability Rechte geben – Source otrabalhosocomecou.macae.rj.gov.br

Listicle:

7 Essential Considerations for Inheriting a Mortgage-Free Property

1. Legal and Administrative Procedures

2. Property Assessment and Condition

3. Financial Implications and Expenses

4. Potential for Multiple Heirs

5. Insurance and Tax Obligations

6. Long-Term Plans and Goals

7. Emotional and Sentimental Value

Question and Answer:

1. What are the legal steps involved in inheriting a mortgage-free property?

2. How can I determine the value of an inherited property?

3. What are the potential tax implications of inheriting a property?

4. How should I handle the distribution of an inherited property among multiple heirs?

Conclusion: Unlocking Homeownership: Inheriting A Mortgage-Free Property

Inheriting a mortgage-free property can be a transformative experience, providing individuals with a path to homeownership and financial security. By navigating the legal, financial, and emotional aspects of inheritance with care and planning, inheritors can unlock the full potential of their inherited property and embark on a journey towards a fulfilling and prosperous future.