Are you looking for a way to simplify the probate process for a small estate in Illinois? If so, you may be able to use a small estate affidavit. In this blog post, we will provide a comprehensive guide to small estate affidavits in Illinois, including what they are, how to use them, and what the benefits are.

Probate is the legal process of administering the estate of a deceased person. This can be a complex and time-consuming process, especially if the estate is large. However, for small estates, there is a simplified probate process available called a small estate affidavit.

Small Estate Affidavit Illinois: A Comprehensive Guide For Probate Simplification

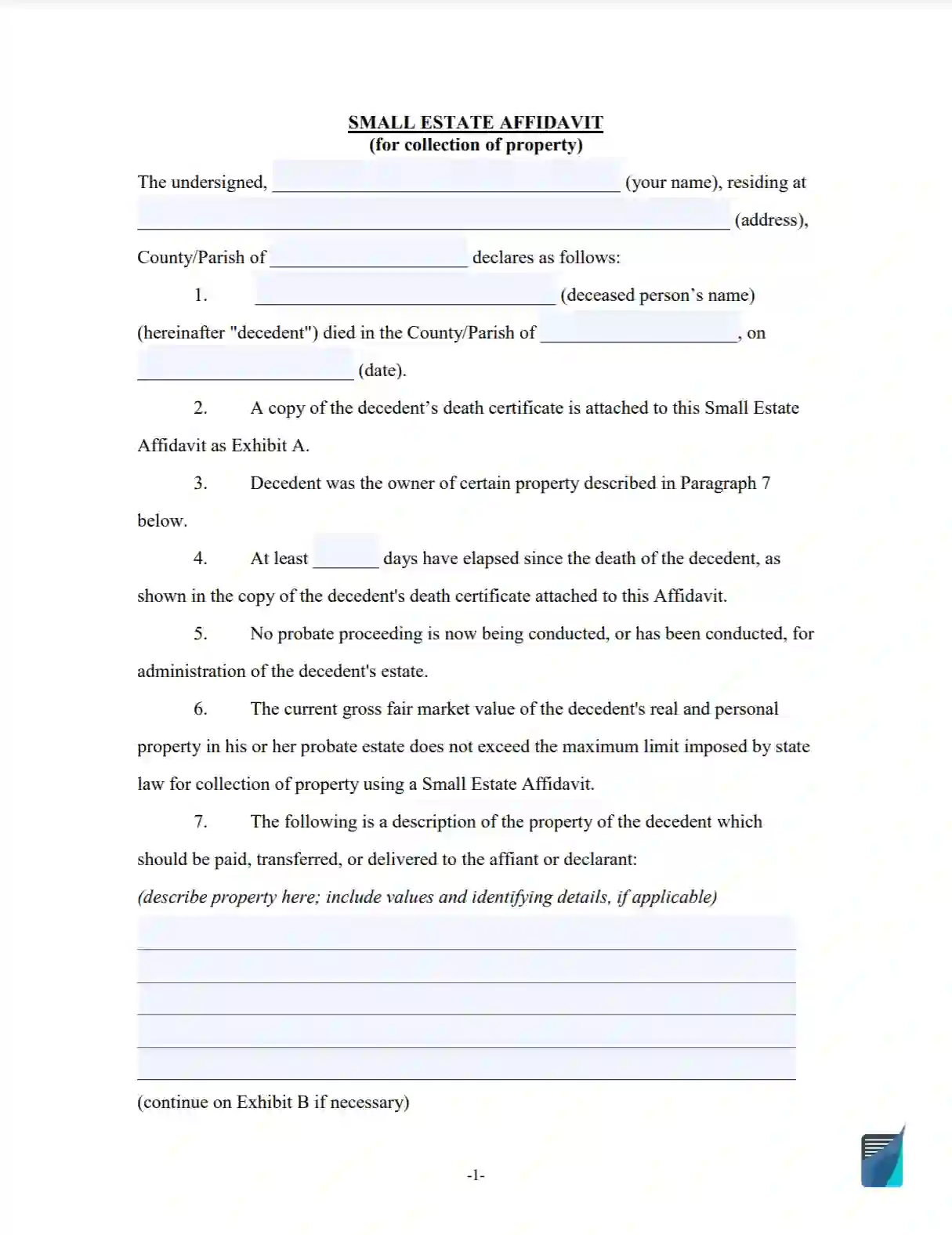

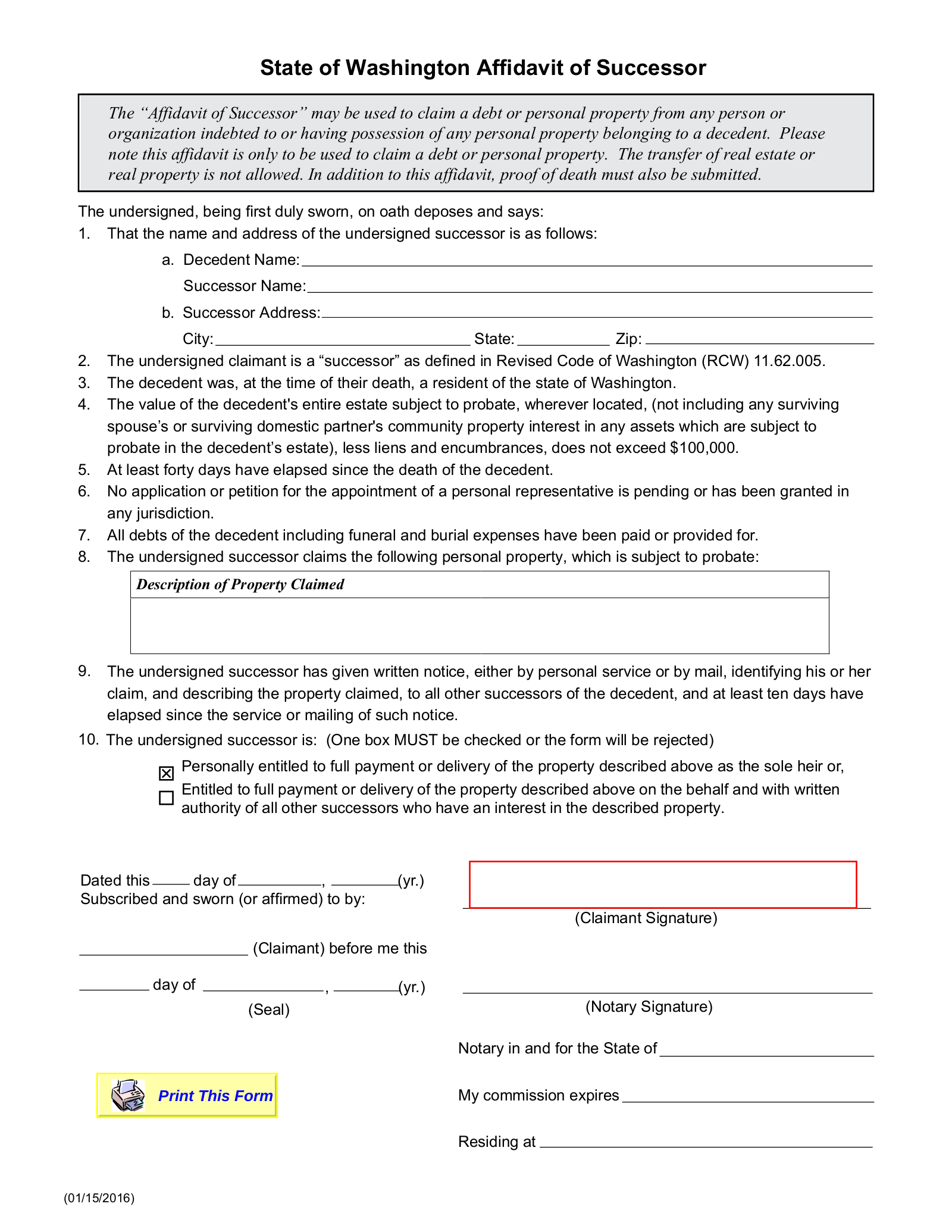

A small estate affidavit is a legal document that allows you to collect and distribute the assets of a deceased person’s estate without having to go through the formal probate process. To be eligible to use a small estate affidavit, the total value of the estate must be less than $100,000. In addition, the estate must not include any real estate.

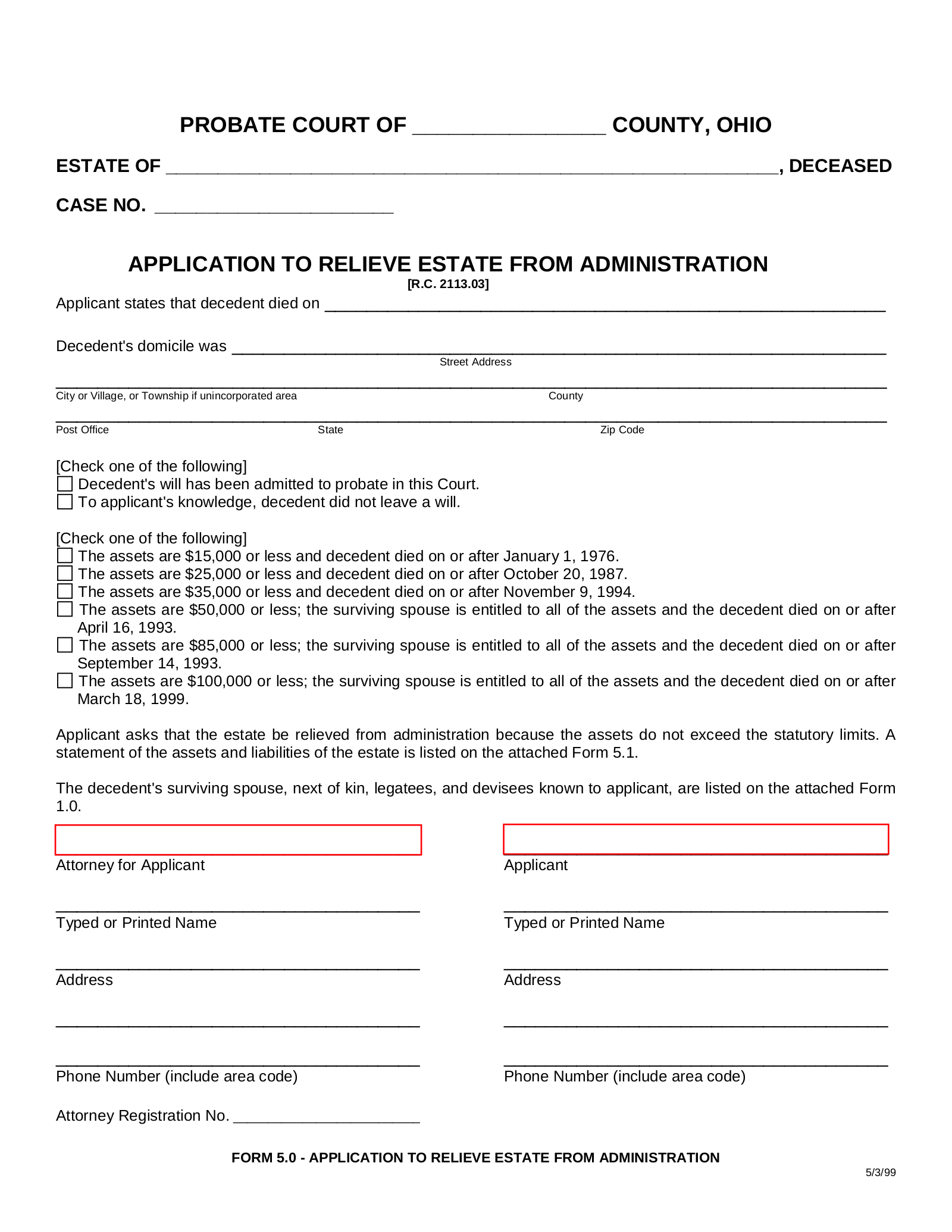

Georgia Small Estate Affidavit 1 – Source cocosign.com

How to Use a Small Estate Affidavit

To use a small estate affidavit, you must first gather all of the necessary information about the deceased person’s estate. This includes the value of all assets, as well as any debts or liabilities. Once you have gathered all of this information, you can complete the small estate affidavit. The affidavit must be signed by two witnesses and notarized.

Once the affidavit is complete, you can file it with the clerk of the circuit court in the county where the deceased person resided. The clerk will then issue you a letter of authority, which will allow you to collect and distribute the assets of the estate.

Ohio Last Will And Testament Template – Source templates.hilarious.edu.np

Benefits of Using a Small Estate Affidavit

There are several benefits to using a small estate affidavit. First, it is a much simpler and less time-consuming process than formal probate. Second, it is less expensive than formal probate. Third, it allows you to avoid having to go through the probate court system, which can be a stressful and public process.

If you are the executor of a small estate in Illinois, you should consider using a small estate affidavit. It is a simple, inexpensive, and efficient way to administer the estate of a deceased person.

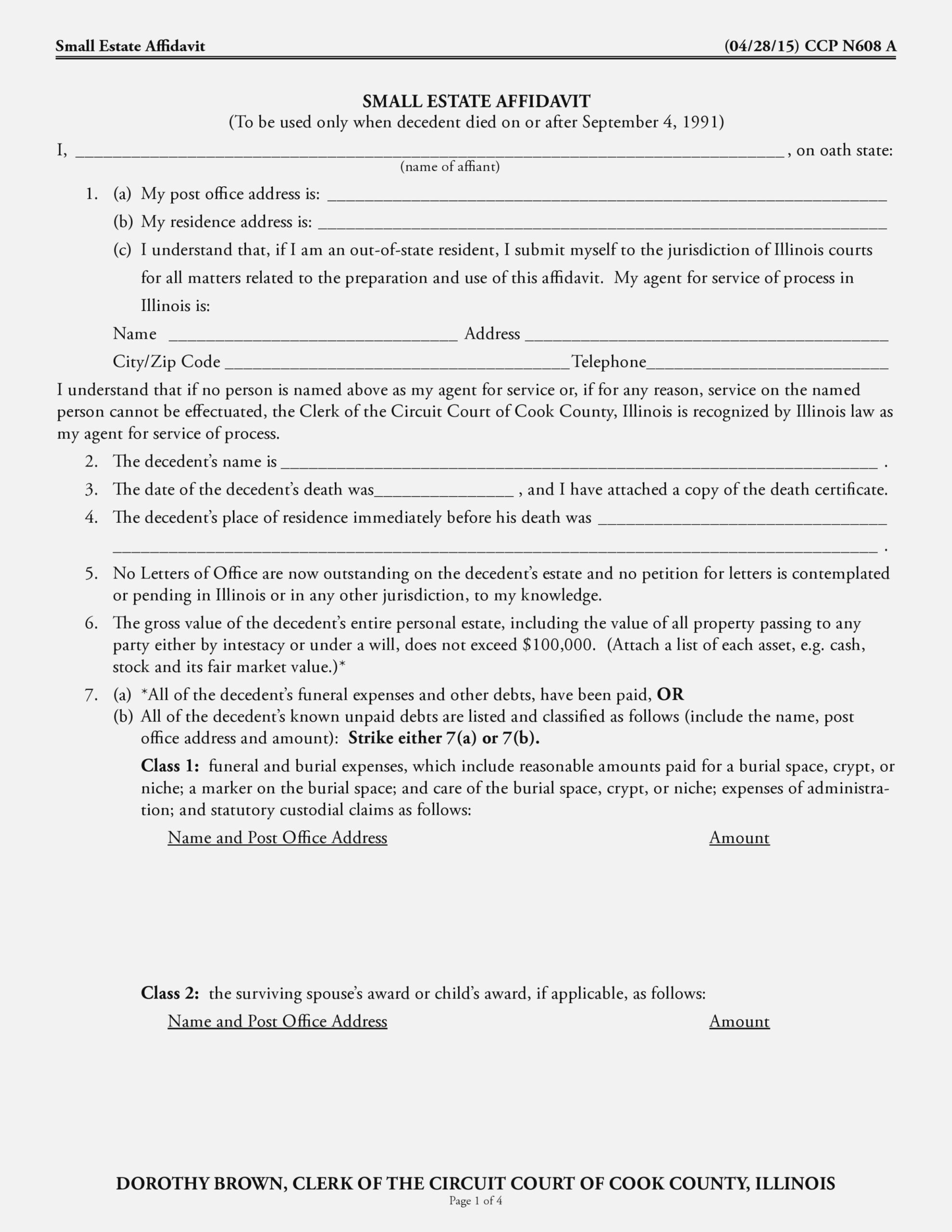

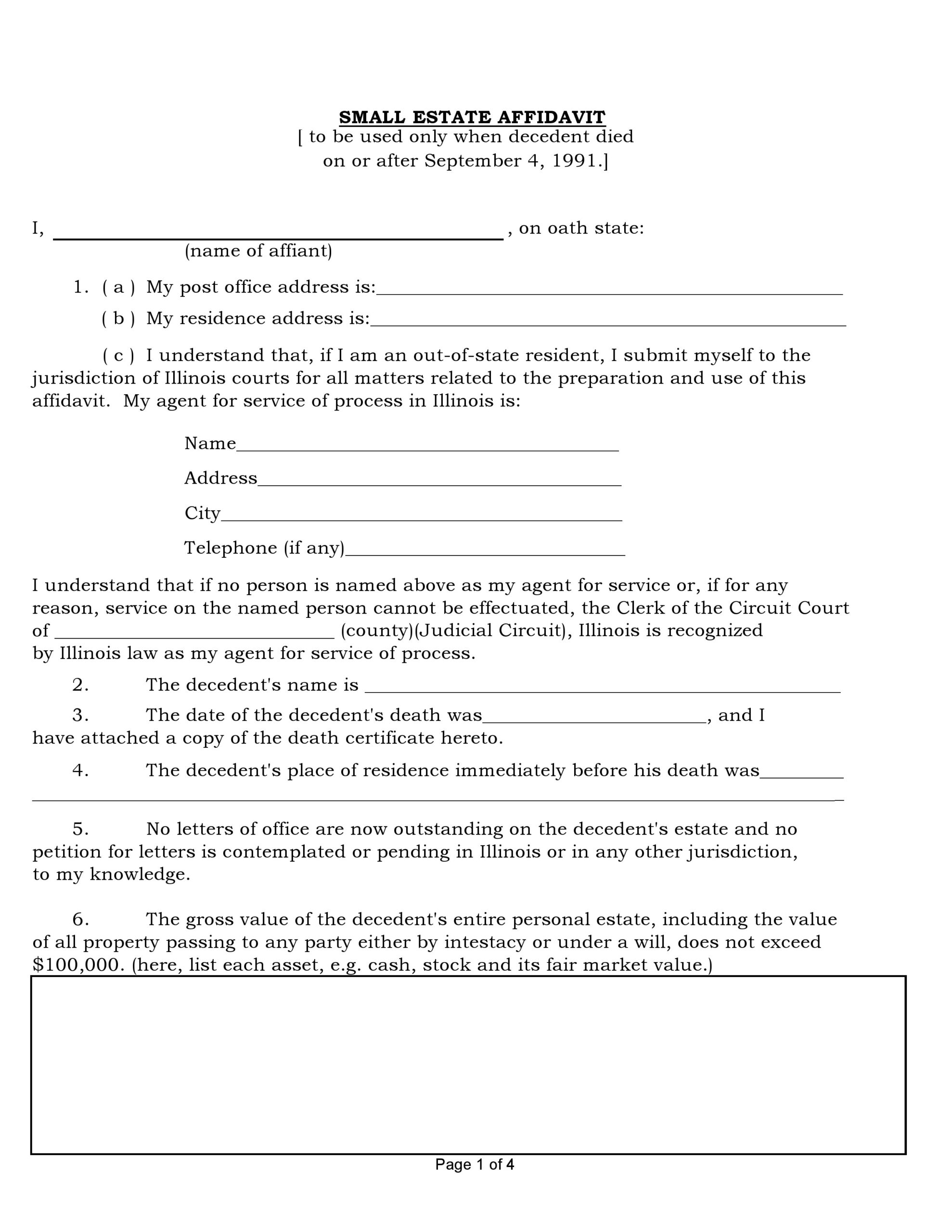

Free Printable Small Estate Affidavit Form Affidavitf – vrogue.co – Source www.vrogue.co

Personal Experience with Small Estate Affidavits

I have personally used small estate affidavits to probate the estates of several family members. In each case, the process was simple and straightforward. I was able to collect and distribute the assets of the estate without having to go through the formal probate process. This saved me a lot of time and money.

I believe that small estate affidavits are a valuable tool for anyone who is responsible for administering the estate of a deceased person. They are a simple, inexpensive, and efficient way to probate a small estate.

Free Illinois Small Estate Affidavit Form | PDF – Source esign.com

History and Myths of Small Estate Affidavits

Small estate affidavits have been around for many years. However, there are still some common myths about them. One myth is that small estate affidavits are only for poor people. This is not true. Small estate affidavits can be used by anyone, regardless of their financial status.

Another myth is that small estate affidavits are only for small estates. This is also not true. Small estate affidavits can be used for estates of any size. However, they are most commonly used for estates that are valued at less than $100,000.

Free Illinois Small Estate Affidavit Form – PDF | Word – eForms – Source eforms.com

Hidden Secrets of Small Estate Affidavits

There are a few hidden secrets about small estate affidavits that you should know. One secret is that you can use a small estate affidavit to collect and distribute assets that are not owned by the deceased person. For example, you can use a small estate affidavit to collect and distribute assets that are held in a joint bank account.

Another secret is that you can use a small estate affidavit to avoid having to pay certain debts and liabilities. For example, you can use a small estate affidavit to avoid having to pay the deceased person’s credit card debts.

Naturalization certificates: Affidavit of support – Source naturalizationcertificates.blogspot.com

Recommendations for Using Small Estate Affidavits

If you are considering using a small estate affidavit, I recommend that you speak with an attorney. An attorney can help you to determine if you are eligible to use a small estate affidavit and can help you to complete the affidavit correctly.

I also recommend that you keep a copy of the small estate affidavit in a safe place. This will help to protect you in the event of any disputes.

Free California Small Estate Affidavit (Affidavit for Collection of – Source eforms.com

Filing a Small Estate Affidavit in Illinois

To file a small estate affidavit in Illinois, you must first gather the following information:

- The deceased person’s name and date of death

- The value of the deceased person’s assets

- The names and addresses of the deceased person’s heirs

Once you have gathered this information, you can complete the small estate affidavit. The affidavit must be signed by two witnesses and notarized.

Small Estate Affidavit Form Cook County Il 2022 – Source www.printableaffidavitform.com

Tips for Using Small Estate Affidavits

Here are a few tips for using small estate affidavits:

- Make sure that you are eligible to use a small estate affidavit. The total value of the estate must be less than $100,000 and the estate must not include any real estate.

- Gather all of the necessary information before you complete the affidavit. This includes the value of all assets, as well as any debts or liabilities.

- Complete the affidavit carefully and accurately. Make sure that all of the information is correct and that the affidavit is signed by two witnesses and notarized.

- File the affidavit with the clerk of the circuit court in the county where the deceased person resided. The clerk will then issue you a letter of authority, which will allow you to collect and distribute the assets of the estate.

Oregon Small Estate Affidavit 1 – Source cocosign.com

When to Use a Small Estate Affidavit

A small estate affidavit can be used when the total value of the estate is less than $100,000 and the estate does not include any real estate. Small estate affidavits are a simple and inexpensive way to probate a small estate.

Livingston County Court Forms Small Claims Affidavit 2023 – Source www.printableaffidavitform.com

Fun Facts About Small Estate Affidavits

Here are a few fun facts about small estate affidavits:

- Small estate affidavits are only available in certain states. Illinois is one of the states that allows the use of small estate affidavits.

- Small estate affidavits are a relatively new legal tool. They were first introduced in the 1970s.

- Small estate affidavits are becoming increasingly popular. This is because they are a simple and inexpensive way to probate a small estate.

How to Avoid Using a Small Estate Affidavit

There are a few ways to avoid using a small estate affidavit. One way is to make sure that the total value of the estate is less than $100,000. Another way is to make sure that the estate includes real estate. If the estate includes real estate, it will need to go through the formal probate process.

What If I Need to Use a Small Estate Affidavit?

If you need to use a small estate affidavit, you should speak with an attorney. An attorney can help you to determine if you are eligible to use a small estate affidavit and can help you to complete the affidavit correctly.

Listicle of Small Estate Affidavits

Here is a listicle of small estate affidavits:

- Small estate affidavits are a legal document that allows you to collect and distribute the assets of a deceased person’s estate without having to go through the formal probate process.

- To be eligible to use a small estate affidavit, the total value of the estate must be less than $100,000 and the estate must not include any