Ultimate Guide: Legitimate Security Deposit Deductions For Landlords

Landlords, are you tired of dealing with tenant disputes over security deposit deductions? It’s time to empower yourself with the knowledge of legitimate deductions to protect your property and investments.

When tenants move out, their security deposits are often a bone of contention. Landlords may want to deduct money for damages or unpaid rent, while tenants may dispute these claims. Understanding the legal guidelines for security deposit deductions is crucial for landlords to avoid disputes and ensure fair treatment.

This comprehensive guide will provide you with a clear understanding of legitimate security deposit deductions, helping you navigate the complexities of landlord-tenant relationships and protect your financial interests.

Legitimate Security Deposit Deductions For Landlords: A Guide To Protecting Your Property

As a landlord, it’s essential to understand your rights and responsibilities when it comes to security deposits. Security deposits are intended to cover potential damages or unpaid rent, and landlords are legally allowed to deduct these expenses from the deposit. However, deductions must be reasonable and supported by evidence.

According to the law, legitimate security deposit deductions include:

- Unpaid rent

- Damages to the property beyond normal wear and tear

- Unpaid utilities

- Cleaning costs if the property is left excessively dirty

It’s important to note that deductions must be documented and justified. Landlords should provide tenants with an itemized statement of deductions and supporting evidence, such as receipts or photos of damages.

The History And Myth Of Security Deposit Deductions

The concept of security deposits has been around for centuries. In the past, landlords often required large security deposits to protect their properties. However, as tenant rights evolved, so did the regulations surrounding security deposits.

Today, security deposits are typically limited to one month’s rent in most jurisdictions. This is intended to prevent landlords from using security deposits as a form of additional rent or to cover general maintenance costs.

The Landlord’s Itemized List of Common Security Deposit Deductions – Source www.martinhomemanagement.com

The Hidden Secrets Of Security Deposit Deductions

While the law provides guidance on legitimate security deposit deductions, there are often grey areas. Landlords should be aware of common tenant disputes and how to address them fairly.

For example, tenants may argue that damage was caused by normal wear and tear. Landlords should have clear criteria for determining what constitutes normal wear and tear and be able to provide evidence of excessive damage.

Recommendations For Legitimate Security Deposit Deductions

To avoid disputes and protect your financial interests, it’s crucial to follow these recommendations:

- Create a detailed lease agreement that outlines the terms of the security deposit.

- Conduct a thorough move-in inspection with the tenant and document any existing damages.

- Regularly inspect the property during the tenancy to identify any potential problems.

- Provide tenants with a detailed move-out checklist and instructions.

- Document all deductions with receipts or photos.

Not Returning Security Deposit Letter – Tasbih.armstrongdavis.com – Source tasbih.armstrongdavis.com

Consequences Of Improper Security Deposit Deductions

Landlords who improperly deduct from security deposits may face legal consequences. Tenants can file complaints with consumer protection agencies or take legal action to recover their funds.

In addition, landlords who make false or misleading claims about security deposits may damage their reputation and credibility with potential tenants.

Tips For Navigating Security Deposit Deductions

To navigate the complexities of security deposit deductions, consider the following tips:

- Stay informed about the latest laws and regulations governing security deposits.

- Communicate clearly with tenants about the terms of the security deposit.

- Be fair and reasonable in your deductions.

- Document everything thoroughly.

- Be prepared to negotiate with tenants if necessary.

Professional Advice For Security Deposit Deductions

If you encounter complex or challenging situations involving security deposit deductions, it’s advisable to consult with an attorney or property manager. They can provide legal guidance and help you resolve disputes fairly.

Disputes On Deposit Deductions | CIA Landlords – Source www.cia-landlords.co.uk

Fun Facts About Security Deposit Deductions

Did you know?

- The average security deposit in the United States is one month’s rent.

- Some states have laws that limit the amount of security deposit landlords can collect.

- Landlords are not required to pay interest on security deposits.

- Tenants are entitled to a written statement of deductions within a specified time frame.

How To Handle Security Deposit Disputes

If a tenant disputes your security deposit deductions, follow these steps:

- Review your documentation and ensure you have valid reasons for the deductions.

- Communicate with the tenant and explain your deductions in detail.

- Be willing to negotiate a fair settlement.

- If an agreement cannot be reached, consider mediation or legal action.

Listicle Of Security Deposit Deductions

For quick reference, here is a listicle of legitimate security deposit deductions:

- Unpaid rent

- Damages beyond normal wear and tear

- Unpaid utilities

- Cleaning costs if the property is left excessively dirty

- Carpet cleaning

- Repairs to appliances

- Replacement of damaged fixtures

- Painting if the walls are damaged

- Landscaping costs if the yard is damaged

- Pest control if the property is infested

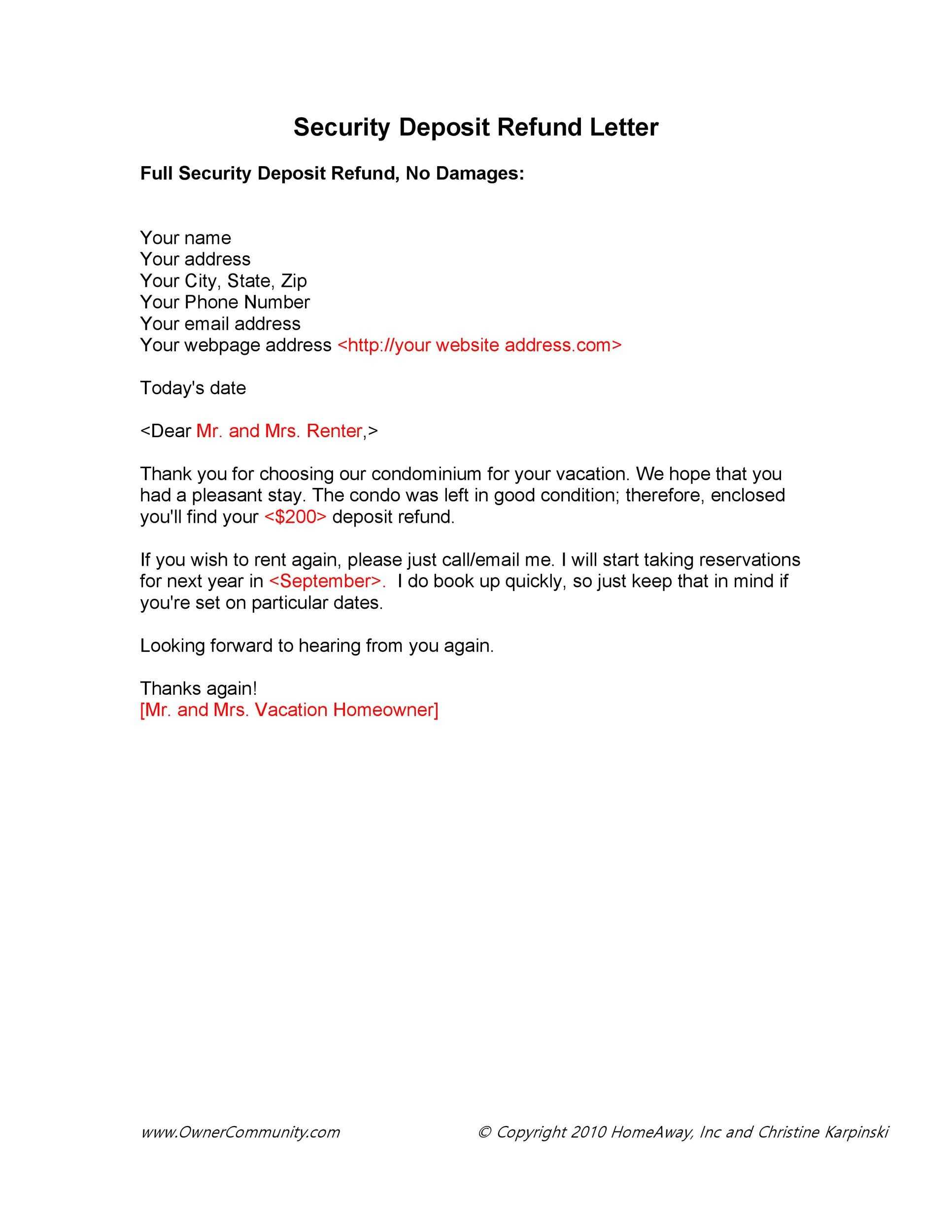

![50 Effective Security Deposit Return Letters [MS Word] ᐅ TemplateLab 50 Effective Security Deposit Return Letters [MS Word] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/03/security-deposit-return-letter-15.jpg)

50 Effective Security Deposit Return Letters [MS Word] ᐅ TemplateLab – Source templatelab.com

Question And Answer

Q: What is the difference between normal wear and tear and damage?

A: Normal wear and tear refers to minor imperfections that occur over time due to everyday use. Damage, on the other hand, is significant and requires repairs or replacement.

Q: Can landlords deduct for cleaning if the property is left dirty?

A: Yes, landlords can deduct for cleaning costs if the property is left excessively dirty or beyond normal cleaning standards.

Q: What is the time frame for landlords to return security deposits?

A: The time frame for returning security deposits varies by state. Landlords should consult their local laws for specific requirements.

Q: What if a tenant refuses to pay for legitimate security deposit deductions?

A: Landlords can file a lawsuit to recover the funds. However, it’s important to document all deductions and provide the tenant with a detailed statement.

Conclusion Of Ultimate Guide: Legitimate Security Deposit Deductions For Landlords

Understanding legitimate security deposit deductions is essential for landlords to protect their property investments. By following the guidelines outlined in this comprehensive guide, landlords can avoid disputes, maintain fair landlord-tenant relationships, and ensure the proper use of security deposits.