Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

Probate can be a time-consuming and expensive process. With a transfer upon death deed (TODD), you can avoid probate and pass your assets to your loved ones quickly and easily. A TODD is a legal document that allows you to transfer ownership of your property to a beneficiary upon your death. This can be a great way to simplify probate and protect your assets.

One of the biggest benefits of a TODD is that it can help you avoid probate. Probate is the legal process of distributing your assets after your death. It can be a long and expensive process, and it can also be public record. A TODD can help you avoid probate by transferring ownership of your property to your beneficiary immediately upon your death.

TODDs are also a great way to protect your assets. If you have a TODD, your assets will not be subject to probate. This means that your creditors will not be able to claim your assets, and your assets will not be distributed according to the laws of intestacy.

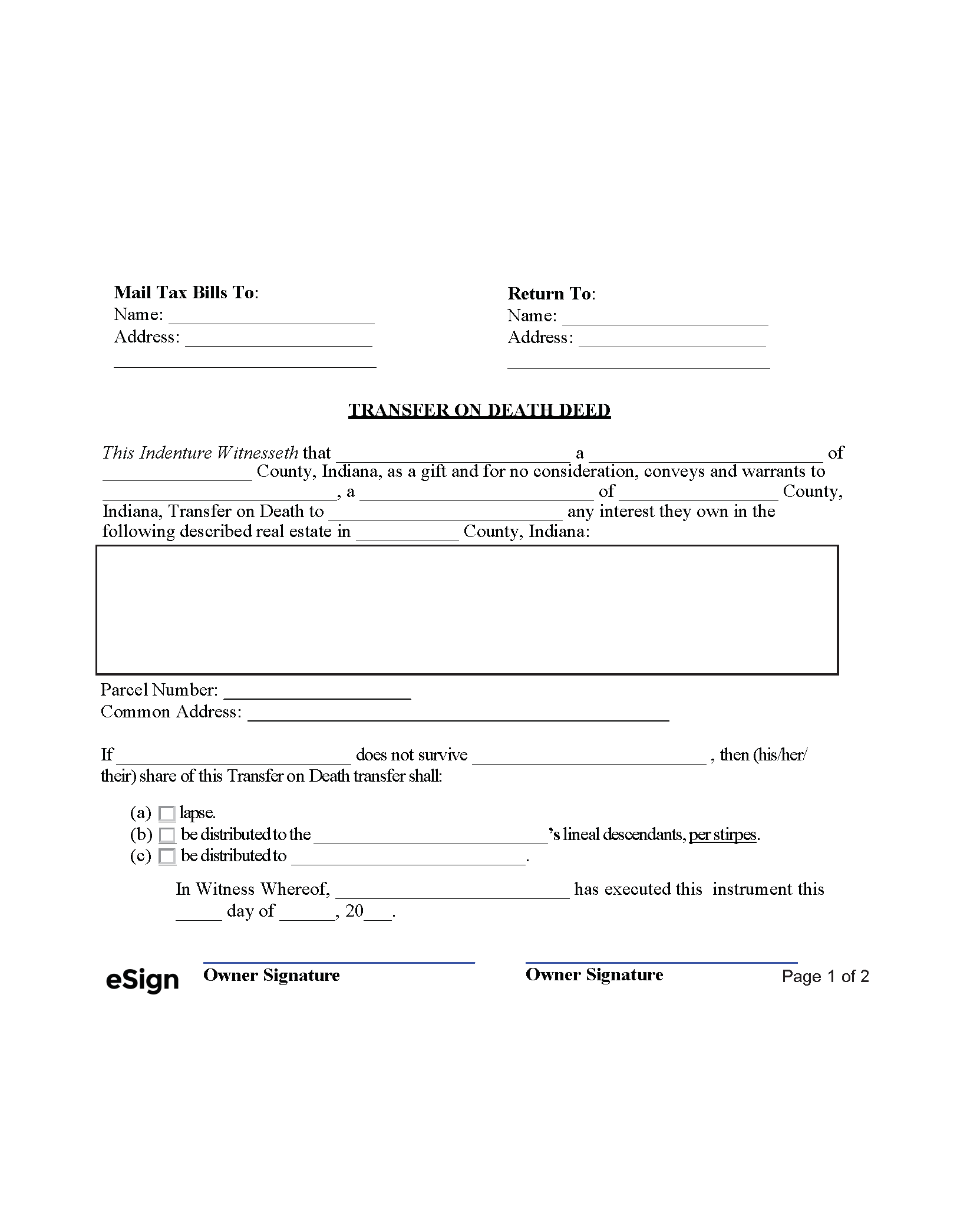

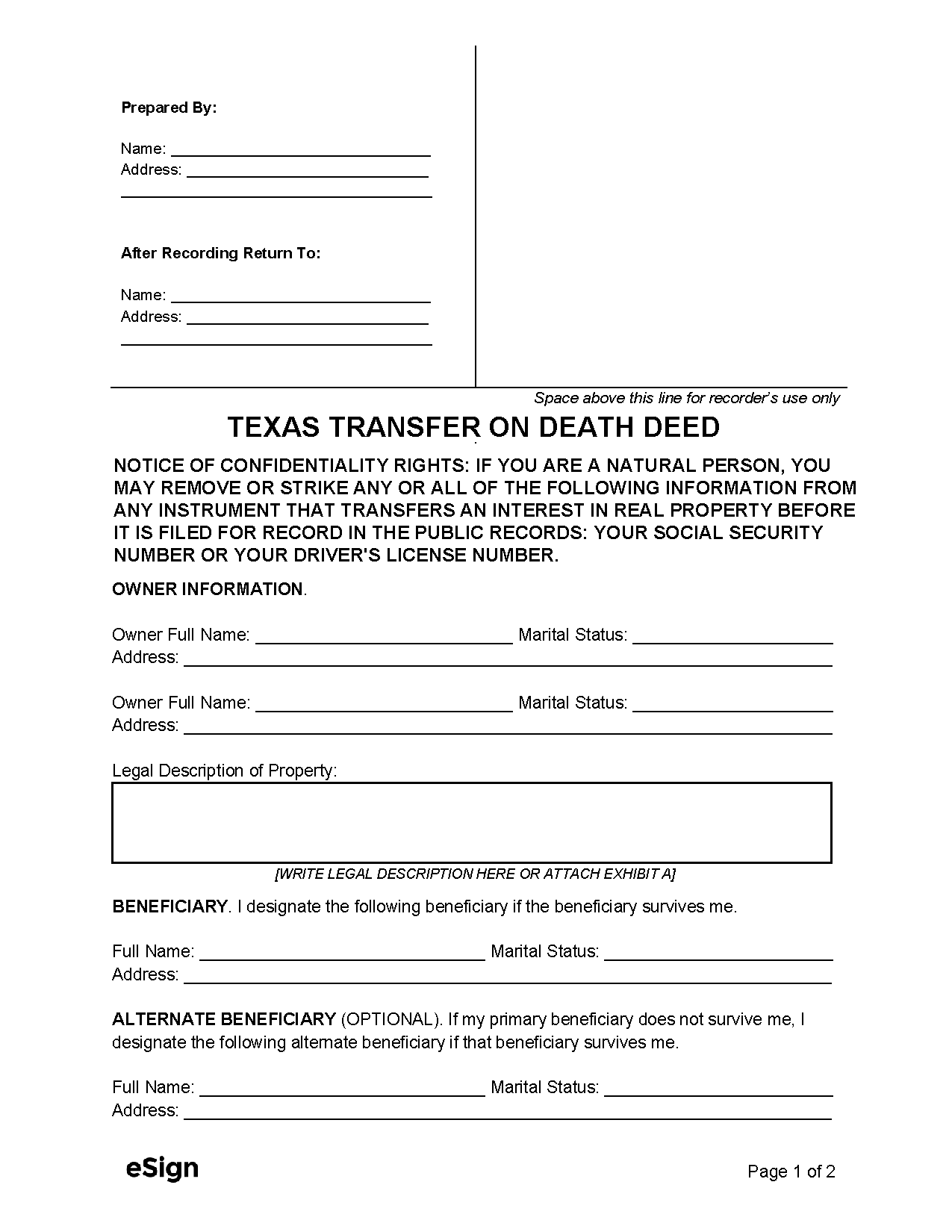

Free Texas Transfer On Death Deed Form Pdf Word – vrogue.co – Source www.vrogue.co

My Journey with Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

I first learned about TODDs when my father passed away. He had a TODD in place, and it made the probate process much easier for my family. We were able to avoid probate and distribute his assets quickly and easily.

After my father’s death, I decided to create a TODD for myself. I wanted to make sure that my assets would be distributed according to my wishes, and I wanted to avoid probate. I spoke to an attorney, and he helped me create a TODD that met my needs.

I am so glad that I created a TODD. It has given me peace of mind knowing that my assets will be distributed according to my wishes, and it has helped me avoid probate. If you are not familiar with TODDs, I encourage you to learn more about them. They can be a great way to simplify probate and protect your assets.

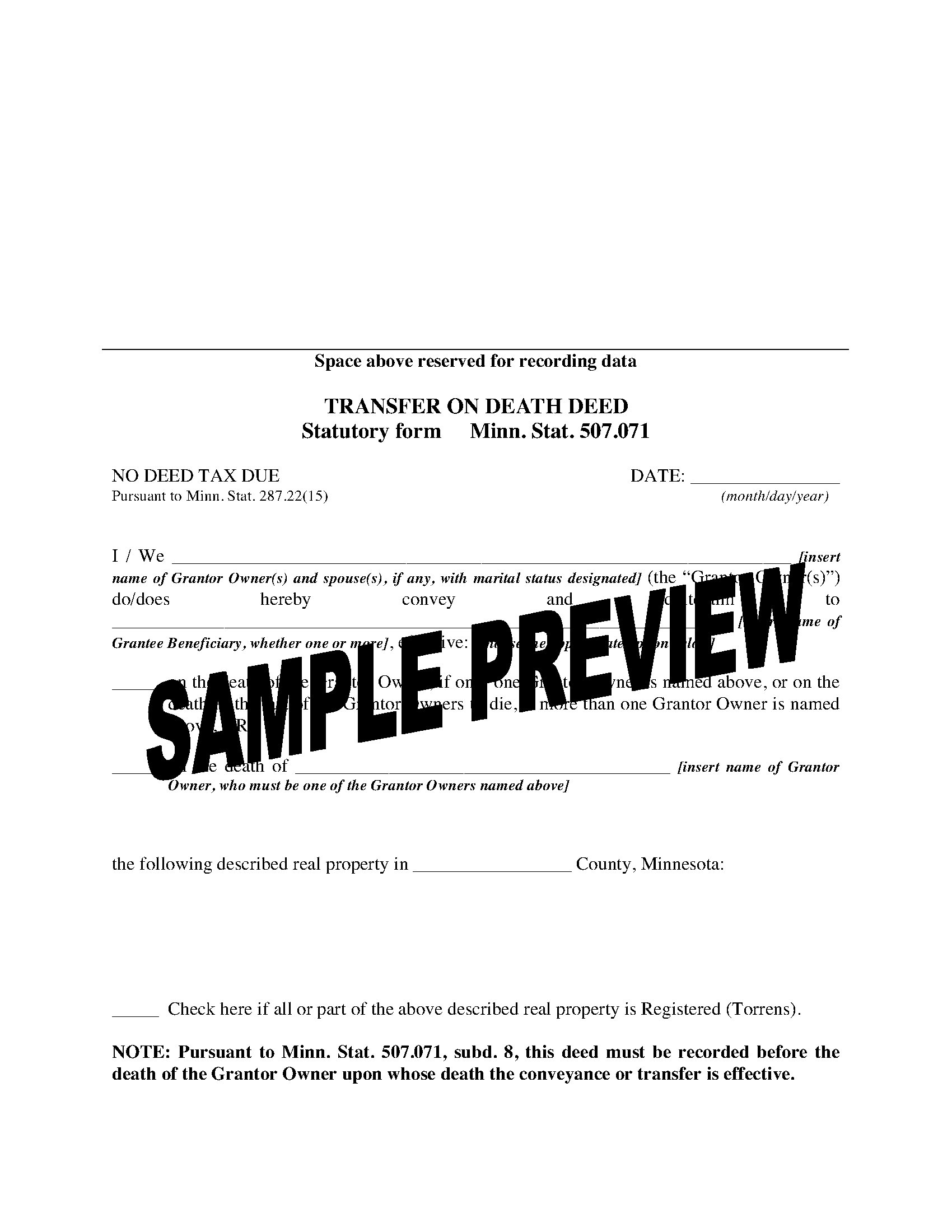

Minnesota Transfer on Death Deed Forms | Legal Forms and Business – Source www.megadox.com

Background of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

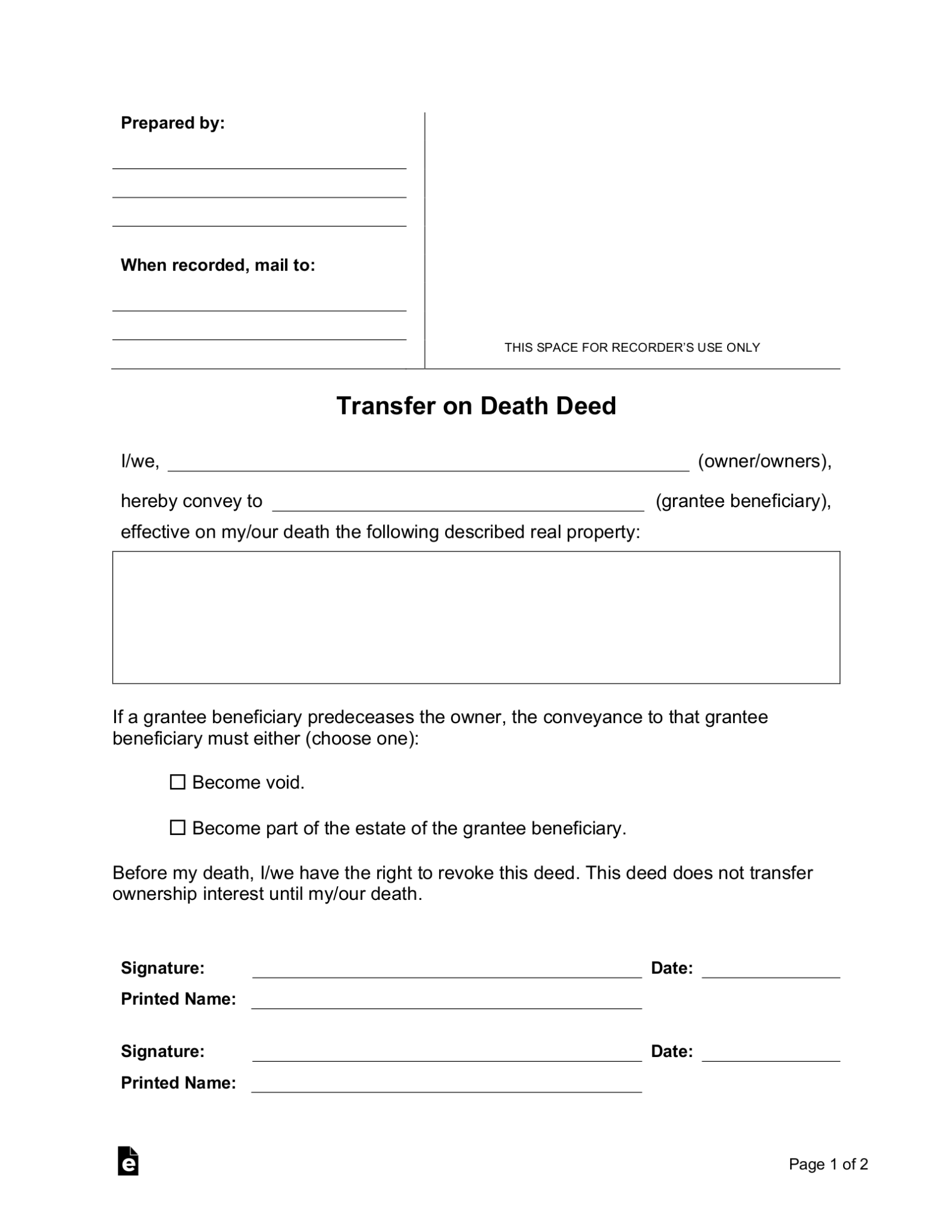

TODDs have been around for many years. They were first created in the early 1900s, and they have since become a popular way to avoid probate. TODDs are legal in all 50 states, and they are governed by state law.

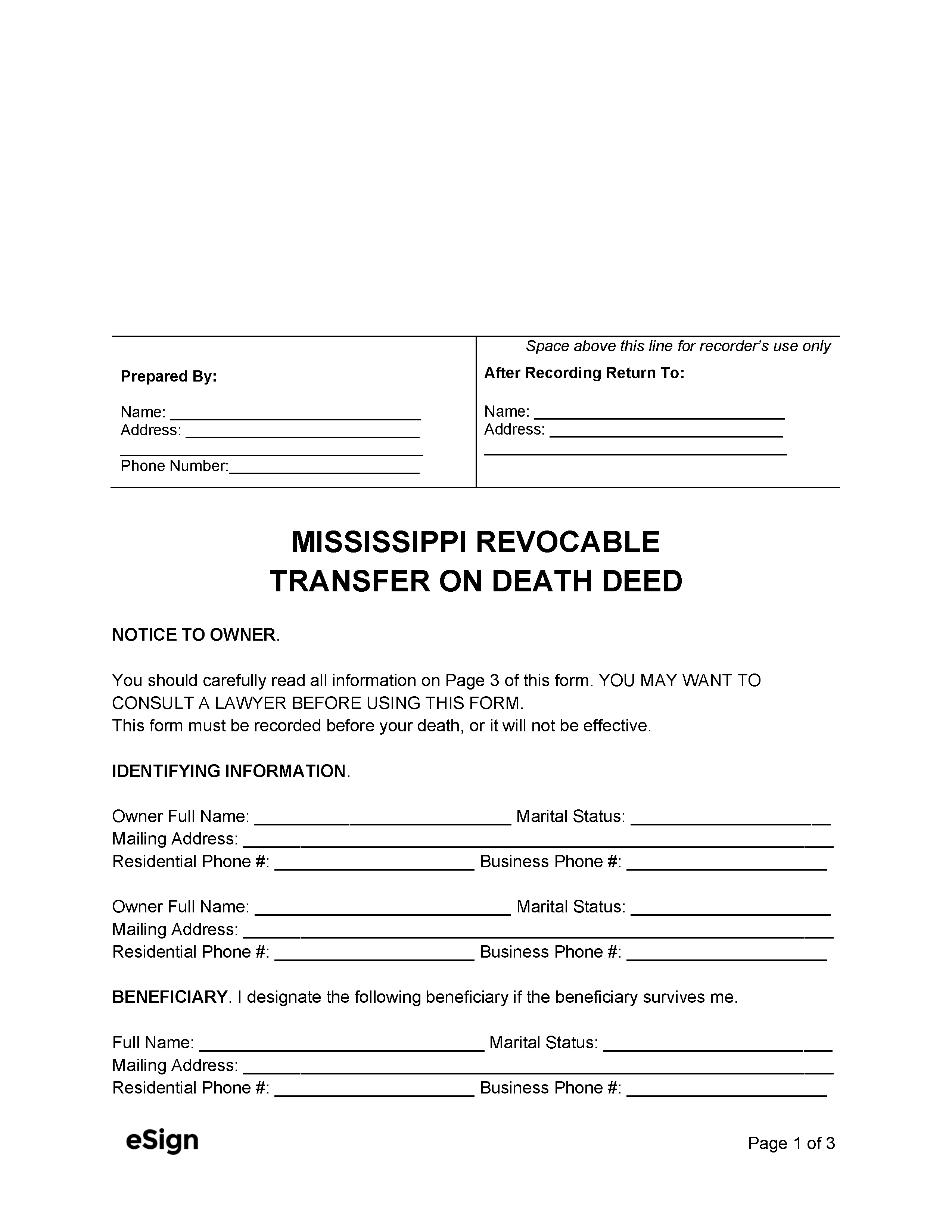

In Illinois, TODDs are governed by the Illinois TODD Act. The TODD Act was enacted in 1991, and it has been amended several times since then. The TODD Act allows you to create a TODD for any type of property, including real estate, personal property, and financial assets.

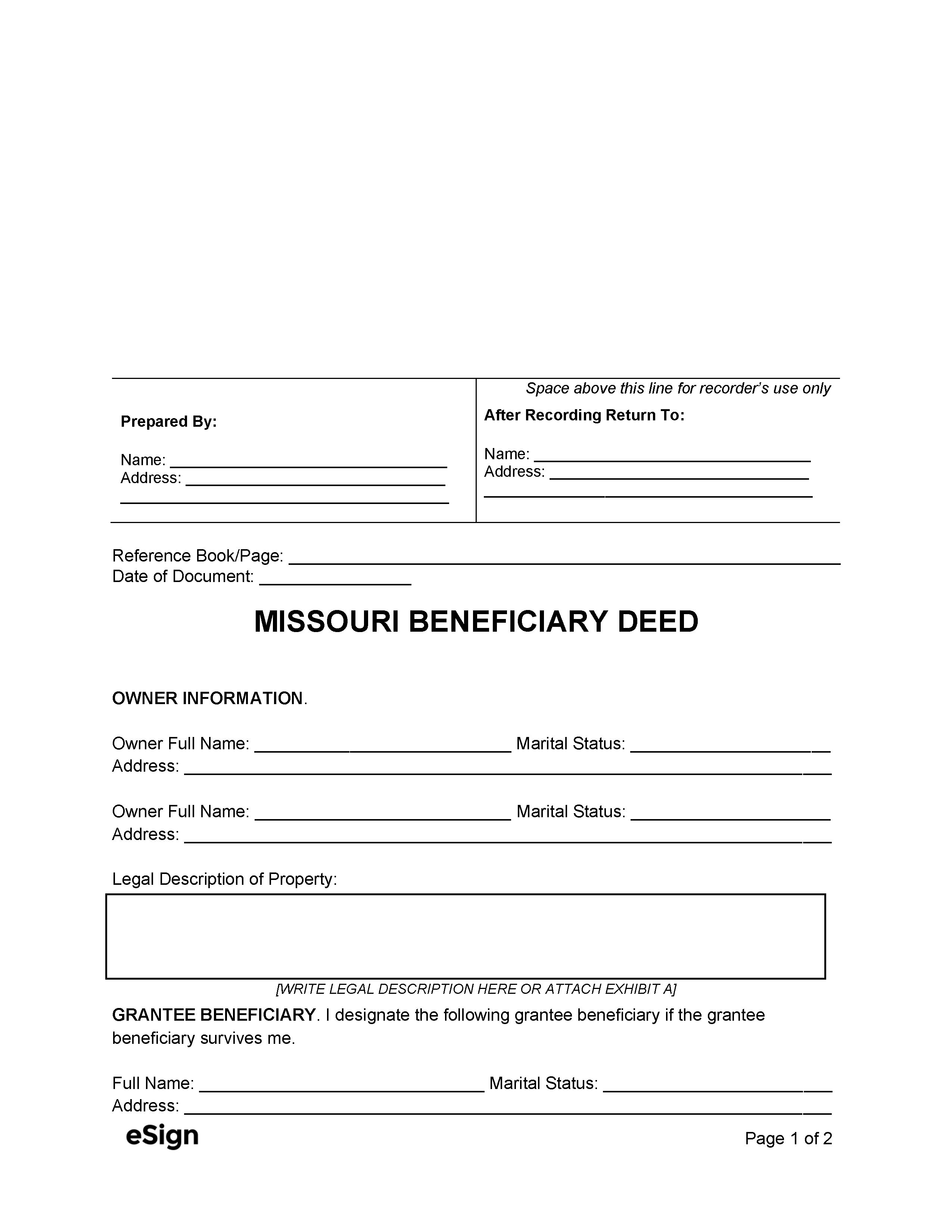

Free Printable Beneficiary Deed Missouri – Source admin.cashier.mijndomein.nl

The Hidden Truth of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

TODDs are a great way to simplify probate and protect your assets. However, there are some things you should keep in mind before you create a TODD.

First, you should make sure that you understand the TODD Act. The TODD Act is complex, and it is important to make sure that you understand all of the requirements before you create a TODD. If you do not understand the TODD Act, you should speak to an attorney.

Your Guide to What Happens During the Will Probate Process – Source www.welchlawfirm.com

Recommendation of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

If you are considering creating a TODD, I recommend that you speak to an attorney. An attorney can help you create a TODD that meets your needs, and they can also answer any questions you have about the TODD Act.

Here are some of the benefits of working with an attorney:

- An attorney can help you understand the TODD Act.

- An attorney can help you create a TODD that meets your needs.

- An attorney can answer any questions you have about the TODD Act.

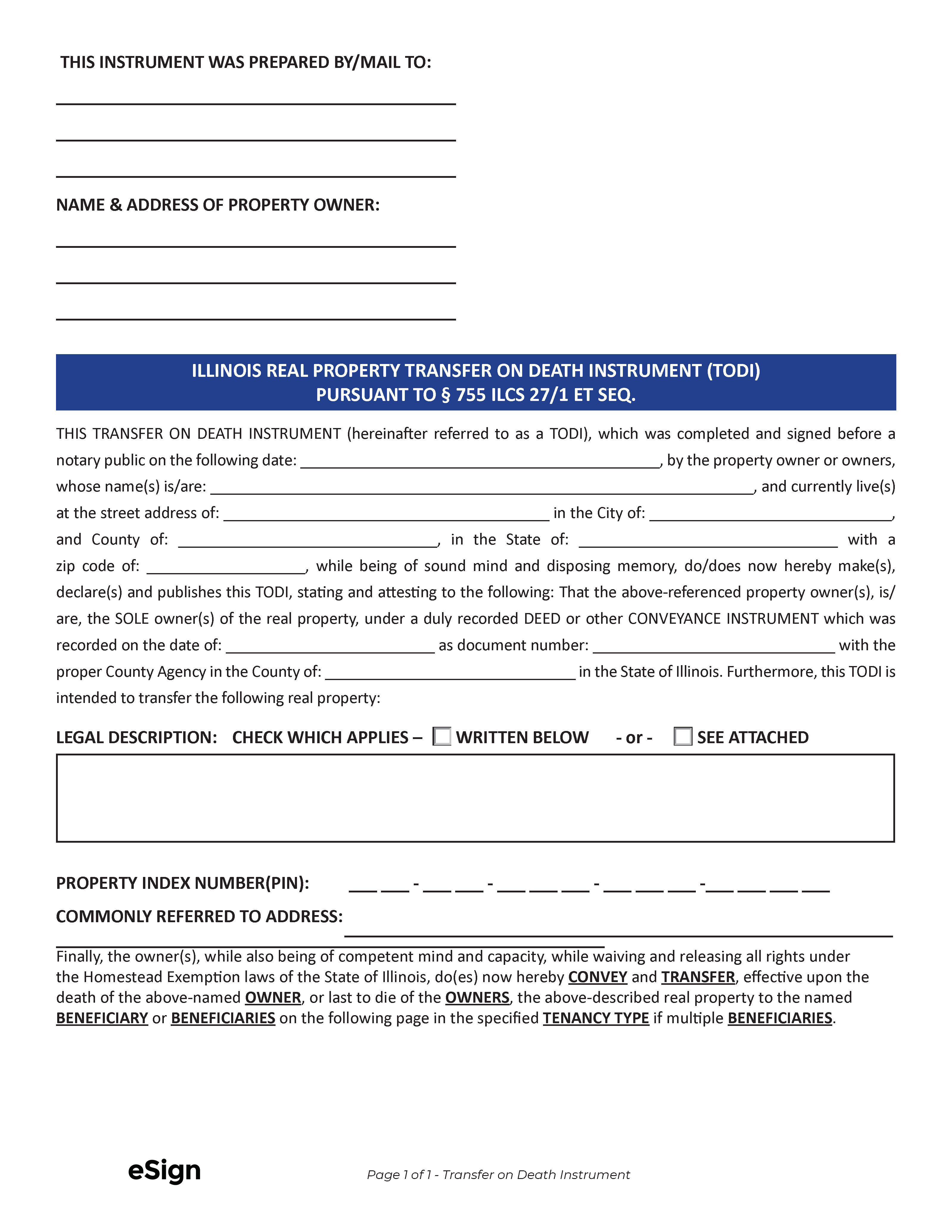

Cook County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

Advantages of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

There are many advantages to using a TODD. Some of the advantages include:

- TODDs are simple to create.

- TODDs are inexpensive to create.

- TODDs can avoid probate.

- TODDs can protect your assets.

:max_bytes(150000):strip_icc()/Enhanced-Life-Estate-Deed-56aa10bb3df78cf772ac382f.jpg)

How to Use a Transfer-on-Death Deed to Avoid Probate – Source www.thebalancemoney.com

Tips on Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

Here are some tips for creating a TODD:

- Make sure you understand the TODD Act.

- Speak to an attorney if you have any questions about the TODD Act.

- Create a TODD that meets your needs.

- Keep your TODD in a safe place.

- Review your TODD regularly.

Texas Transfer On Death Deed Form 2023 – Printable Forms Free Online – Source printableformsfree.com

Disadvantages of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

There are some disadvantages to using a TODD. Some of the disadvantages include:

- TODDs can be difficult to change.

- TODDs can be contested by your heirs.

Transfer Death Tod Doc Template Pdffiller – vrogue.co – Source www.vrogue.co

Fun Facts About Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

Here are some fun facts about TODDs:

- TODDs are a relatively new type of legal document.

- TODDs are becoming increasingly popular.

- TODDs can be used to transfer any type of property.

Free Transfer on Death Deed – PDF | Word – eForms – Source eforms.com

How To Apply for Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

To apply for a TODD, you will need to complete a TODD form. The TODD form is available from the Illinois Secretary of State’s office. Once you have completed the TODD form, you will need to file it with the county recorder’s office in the county where the property is located.

The filing fee for a TODD is $15.00. Once the TODD is filed, it will be recorded in the county recorder’s office. The TODD will be effective immediately upon your death.

Free Printable Transfer On Death Deed Form Missouri – Free Printable – Source printables.it.com

What Happens if Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

If you create a TODD, your property will be transferred to your beneficiary immediately upon your death. The TODD will override any other provisions in your will or trust.

If you do not create a TODD, your property will be distributed according to the laws of intestacy. The laws of intestacy vary from state to state. In Illinois, the laws of intestacy provide that your property will be distributed to your spouse, children, and other relatives.

Lists of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

Here is a list of the benefits of using a TODD:

- TODDs are simple to create.

- TODDs are inexpensive to create.

- TODDs can avoid probate.

- TODDs can protect your assets.

- TODDs can be used to transfer any type of property.

Questions and Answers about Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

- Q: What is a TODD?

- A: A TODD is a legal document that allows you to transfer ownership of your property to a beneficiary upon your death.

- Q: How do I create a TODD?

- A: To create a TODD, you will need to complete a TODD form and file it with the county recorder’s office in the county where the property is located.

- Q: What are the benefits of using a TODD?

- A: TODDs can simplify probate, protect your assets, and avoid will contests.

- Q: What are the disadvantages of using a TODD?

- A: TODDs can be difficult to change and can be contested by your heirs.

Conclusion of Transfer Upon Death Deed In Illinois: Simplify Probate And Protect Your Assets

TODDs are a great way to simplify probate and protect your assets. If you are considering creating a TODD, I encourage you to speak to an attorney. An attorney can help you create a TODD that meets your needs and can answer any questions you have about the TODD Act.