Definitive Stock Transfer Agreement: Outlining Rights And Obligations For Stock Transaction

When it comes to stock transactions, having a clear understanding of the rights and obligations involved is crucial. A well-drafted Definitive Stock Transfer Agreement (DSTA) is essential to ensure a smooth transfer process and protect the interests of all parties involved.

The absence of a clear DSTA can lead to disputes, delays, and potential legal complications. It’s important to address these details to minimize risks and ensure a successful stock transaction.

A DSTA outlines the specific terms and conditions governing the transfer of ownership from one party to another. It specifies the number of shares being transferred, the consideration being paid, and the date of transfer. The agreement also addresses any warranties, representations, and indemnifications provided by the parties involved. By clearly defining these aspects, the DSTA helps minimize misunderstandings and potential legal disputes.

In addition to outlining the rights and obligations of the parties, the DSTA also provides a framework for resolving any disputes that may arise during the transfer process. This can include provisions for mediation, arbitration, or litigation, depending on the specific agreement. By providing a clear dispute resolution mechanism, the DSTA helps ensure that any issues can be addressed promptly and efficiently.

Data Sharing Agreement Template – Source ar.inspiredpencil.com

The Importance of a Definitive Stock Transfer Agreement

A well-crafted DSTA is essential for protecting the interests of both the buyer and seller in a stock transaction. For the buyer, it provides assurance that they are acquiring the shares they are purchasing and that they will have clear ownership of those shares. For the seller, it provides assurance that they will receive the consideration agreed upon and that they will be released from any obligations related to the shares being sold.

In addition to protecting the interests of the parties involved, a DSTA can also facilitate the smooth and timely transfer of shares. By clearly outlining the terms of the transaction, the DSTA helps to avoid delays and disputes that can arise during the transfer process. This can save both time and money for all parties involved.

Overall, a well-drafted DSTA is an essential tool for any stock transaction. It helps to protect the interests of the parties involved, facilitate the smooth and timely transfer of shares, and provide a framework for resolving any disputes that may arise.

Pin on Rental Templates – Source www.pinterest.co.kr

The History and Evolution of Definitive Stock Transfer Agreements

The DSTA has a long history, dating back to the early days of stock trading. The first known DSTA was drafted in the 1800s, and it has since evolved to become a complex and sophisticated legal document.

One of the most significant changes to the DSTA over time has been the development of standardized terms and conditions. In the early days of stock trading, each DSTA was unique and tailored to the specific transaction. However, as the stock market became more globalized, the need for standardized terms and conditions became apparent.

Today, there are a number of standard form DSTAs that are used in stock transactions. These standard forms are drafted by industry experts and are designed to be fair and equitable to both buyers and sellers. The use of standard form DSTAs has helped to streamline the stock transfer process and reduce the risk of disputes.

Rsu Agreement Template – Source old.sermitsiaq.ag

Tips for Negotiating a Definitive Stock Transfer Agreement

Negotiating a DSTA can be a complex process. Here are a few tips to help you get the best possible deal:

- Start early. The earlier you start negotiating the DSTA, the more time you will have to get the best possible deal.

- Do your research. Before you start negotiating, make sure you understand the key terms of the DSTA and the implications of those terms.

- Be prepared to compromise. Negotiation is a give-and-take process. You may not be able to get everything you want, but you should be able to reach a compromise that is fair to both parties.

- Get legal advice. If you are not comfortable negotiating the DSTA on your own, you should consider getting legal advice from an experienced attorney.

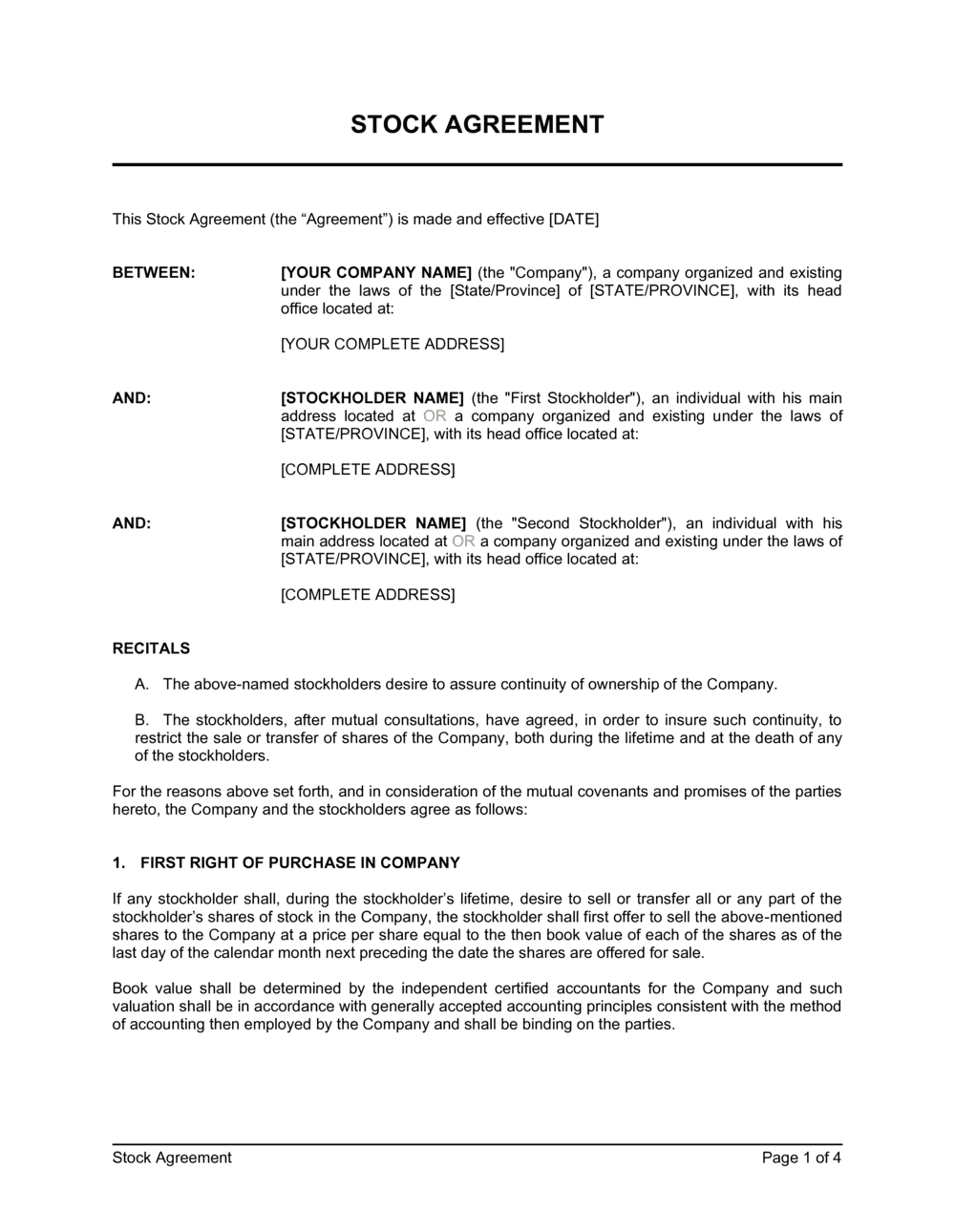

Stock Transfer Agreement Template – Source ar.inspiredpencil.com

Conclusion of Definitive Stock Transfer Agreement: Outlining Rights And Obligations For Stock Transaction

The DSTA is a vital document in any stock transaction. It outlines the rights and obligations of the buyer and seller, and it helps to ensure that the transfer of shares is smooth and efficient. By understanding the DSTA and negotiating it carefully, you can protect your interests and ensure a successful transaction.