Investing For Accredited Individuals In Canada: A Comprehensive Guide

Investing in Canada as an accredited individual can open doors to a wider range of investment opportunities. But understanding the nuances and requirements is crucial to navigate this landscape successfully. This comprehensive guide will provide you with everything you need to know about investing as an accredited investor in Canada.

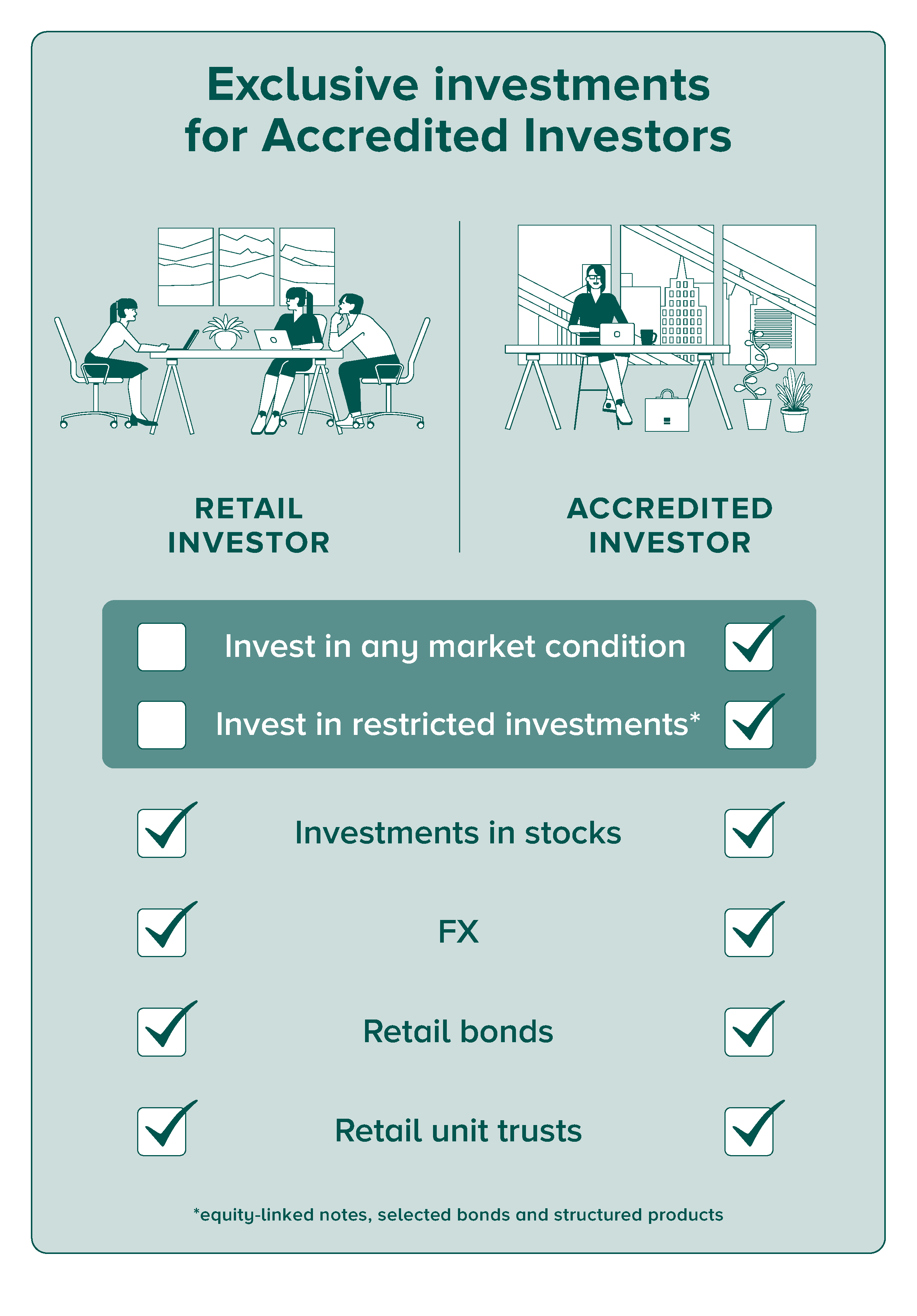

What it means to be an Accredited Investor | DBS Treasures – Source www.dbs.com.sg

To qualify as an accredited investor in Canada, you must meet certain income or net worth criteria. Individuals with an annual income of $200,000 or more for the past two years or a net worth of $1 million or more are generally considered accredited investors. You must also be able to demonstrate a sophisticated understanding of investments and investment strategies.

As an accredited investor, you gain access to private placements, venture capital funds, hedge funds, and other alternative investments that are typically not available to retail investors. These investments often offer the potential for higher returns but also carry higher risks. Accredited investors are also exempt from certain prospectus and registration requirements, providing greater flexibility in their investment decisions.

💌 Inclusive practice promotes equality and supports diversity. How – Source webapi.bu.edu

The range of investments available to accredited investors in Canada is vast. Some popular options include:

While accredited investor status offers access to a wider range of investment opportunities, it also comes with increased risks. Accredited investors should be aware of the following risks:

Investing in your employees is a sure success for future rewards. It – Source www.pinterest.com

Investing as an accredited individual in Canada can be a rewarding experience, but it is important to proceed with caution. By understanding the requirements, benefits, risks, and types of investments available, you can make informed decisions that align with your investment goals and risk tolerance.

Personal Experience with Accredited Investing

As an accredited investor, I have had the opportunity to invest in a diverse range of alternative investments, including private placements and venture capital funds. While some of these investments have generated significant returns, others have not performed as well. It is important to diversify your portfolio and invest in a mix of assets to mitigate your risks.

Accredited investing has allowed me to access investments that would not have been available to me as a retail investor. However, it is crucial to do your research and carefully evaluate each investment opportunity before making a commitment.

History and Myth of Accredited Investing

The concept of accredited investing originated in the United States in the 1930s. The Securities and Exchange Commission (SEC) established regulations to protect retail investors from risky investments. Accredited investors were exempted from these regulations because they were deemed to have the knowledge and experience to make their own investment decisions.

How to automate your personal finances in minutes – the complete guide – Source www.pinterest.com

Over time, the myth has emerged that accredited investors are wealthy individuals who can afford to take risks. However, the reality is that there are many accredited investors who are not wealthy but simply have a high net worth or annual income. Accredited investing is not just for the super-rich; it is an opportunity for individuals to access a wider range of investment options.

Hidden Secrets of Accredited Investing

One of the hidden secrets of accredited investing is that it can provide access to exclusive investment opportunities. For example, many private equity funds are only open to accredited investors. These funds invest in non-publicly traded companies that have the potential for high growth.

Accredited investors can also access hedge funds, which use sophisticated investment strategies to generate returns. Hedge funds can be complex and come with high fees, but they can also offer the potential for high returns.

Recommendations for Accredited Investors

If you are considering accredited investing, it is important to do your research and carefully evaluate each investment opportunity before making a commitment. Here are a few recommendations:

Real Estate Investing Non Accredited – InvestmentProGuide.com – Source www.investmentproguide.com

Investing for Accredited Individuals in Canada: A Comprehensive Guide

As an accredited investor in Canada, you have access to a wider range of investment opportunities than retail investors. However, it is important to understand the requirements, benefits, risks, and types of investments available before making any decisions.

This guide will provide you with everything you need to know about investing as an accredited individual in Canada. It will cover the following topics:

By the end of this guide, you will have a comprehensive understanding of accredited investing and be able to make informed decisions about whether it is right for you.

Tips for Accredited Investors

Here are a few tips for accredited investors:

Accredited Investor Canada: A Comprehensive Guide – Amur Capital – Source amurcapital.ca

Investing for Accredited Individuals in Canada: A Comprehensive Guide

As an accredited investor in Canada, you have access to a wider range of investment opportunities than retail investors. However, it is important to understand the requirements, benefits, risks, and types of investments available before making any decisions.

This guide will provide you with everything you need to know about investing as an accredited individual in Canada. It will cover the following topics:

By the end of this guide, you will have a comprehensive understanding of accredited investing and be able to make informed decisions about whether it is right for you.

Fun Facts about Accredited Investing

Here are some fun facts about accredited investing:

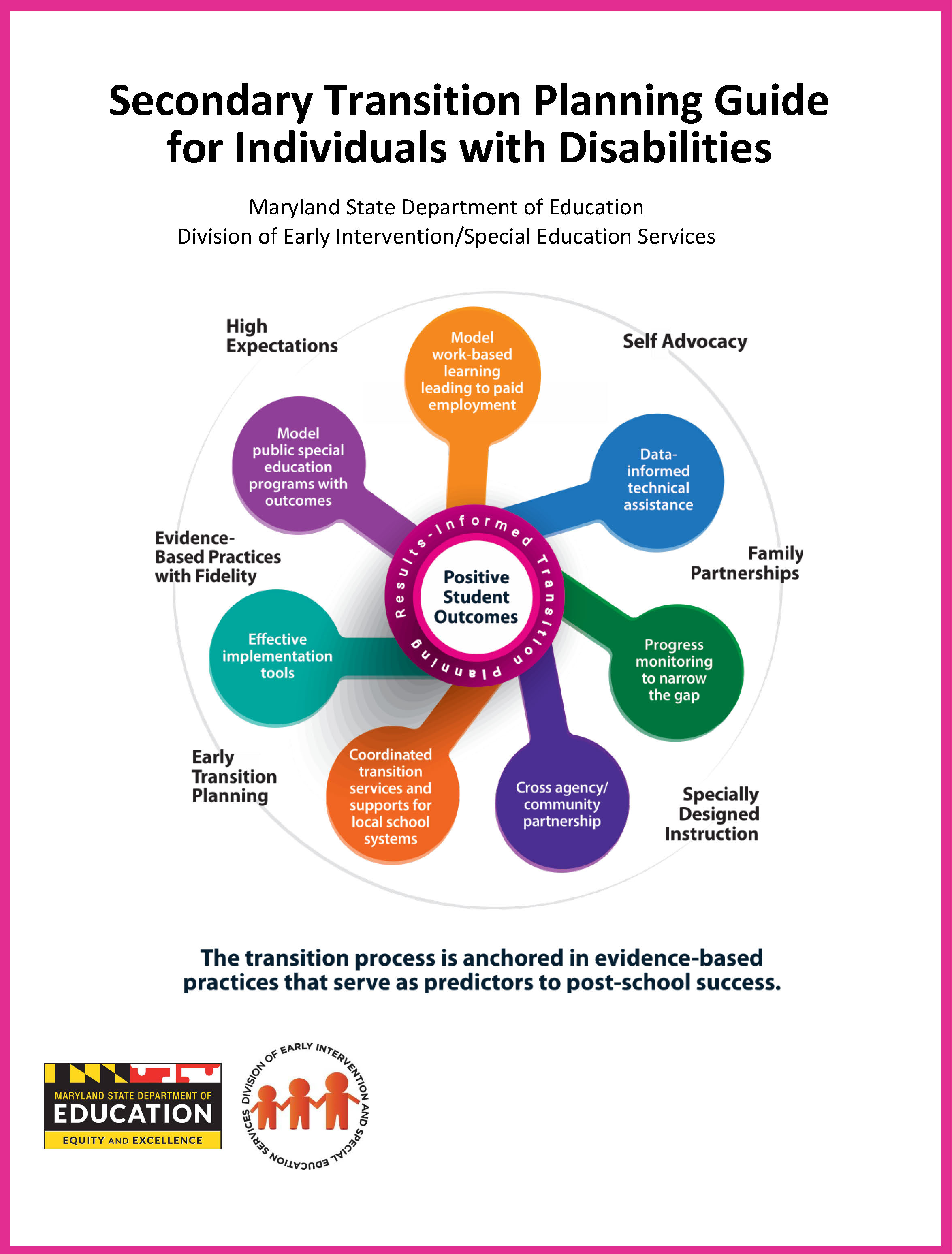

Specially Designed Instruction & Transition Planning – Source marylandpublicschools.org

How to Invest as an Accredited Individual in Canada

To invest as an accredited individual in Canada, you must meet certain requirements. These requirements vary depending on the type of investment you are interested in.

For example, to invest in a private placement, you must have an annual income of at least $200,000 or a net worth of at least $1 million. To invest in a venture capital fund, you must have an annual income of at least $250,000 or a net worth of at least $2 million.

Once you have met the requirements, you can start investing by contacting a financial advisor or investment firm. They will be able to help you identify suitable investment opportunities and guide you through the investment process.

What if I’m Not an Accredited Investor?

If you do not meet the requirements to be an accredited investor, you can still invest in alternative assets. However, you will have to do so through a registered investment dealer or a prospectus-exempt offering.

Registered investment dealers are regulated by the provincial securities commissions and must meet certain requirements. Prospectus-exempt offerings are not subject to the same prospectus requirements as other securities offerings.

If you are not an accredited investor, it is important to do your research and understand the risks involved before investing in alternative assets.

EquityMultiple – Real Estate Investing for Accredited Individuals: Your – Source milled.com

Listicle of Accredited Investing

Here is a listicle of accredited investing: