Unlocking the Secrets of Trust Companies: A Comprehensive Guide to Wealth Management and Succession Planning in Canada

Manage Your Wealth with Ease

Navigating the intricacies of wealth management and succession planning can be daunting. Trust companies in Canada provide a valuable solution, offering expert guidance and tailored services to help you safeguard your financial future and protect your loved ones.

Unlocking the benefits of a tailored upstream operating model | McKinsey – Source www.mckinsey.com

Empowering You with Trusted Solutions

Trust companies serve as trusted fiduciaries, managing assets and administering trusts on behalf of individuals and families. They provide personalized wealth management strategies, ensuring the preservation and growth of your wealth while minimizing tax implications and legal complexities.

What is succession planning? – Source www.tofler.in

Unlocking the Power of Trust Companies

Trust companies offer a comprehensive suite of services designed to meet your unique financial needs:

- Wealth management and investment services

- Estate and succession planning

- Trust administration and management

- Philanthropic advisory services

- Tax planning and compliance

By leveraging the expertise of trust companies, you gain access to a wealth of knowledge and experience, empowering you to make informed decisions and secure your financial legacy.

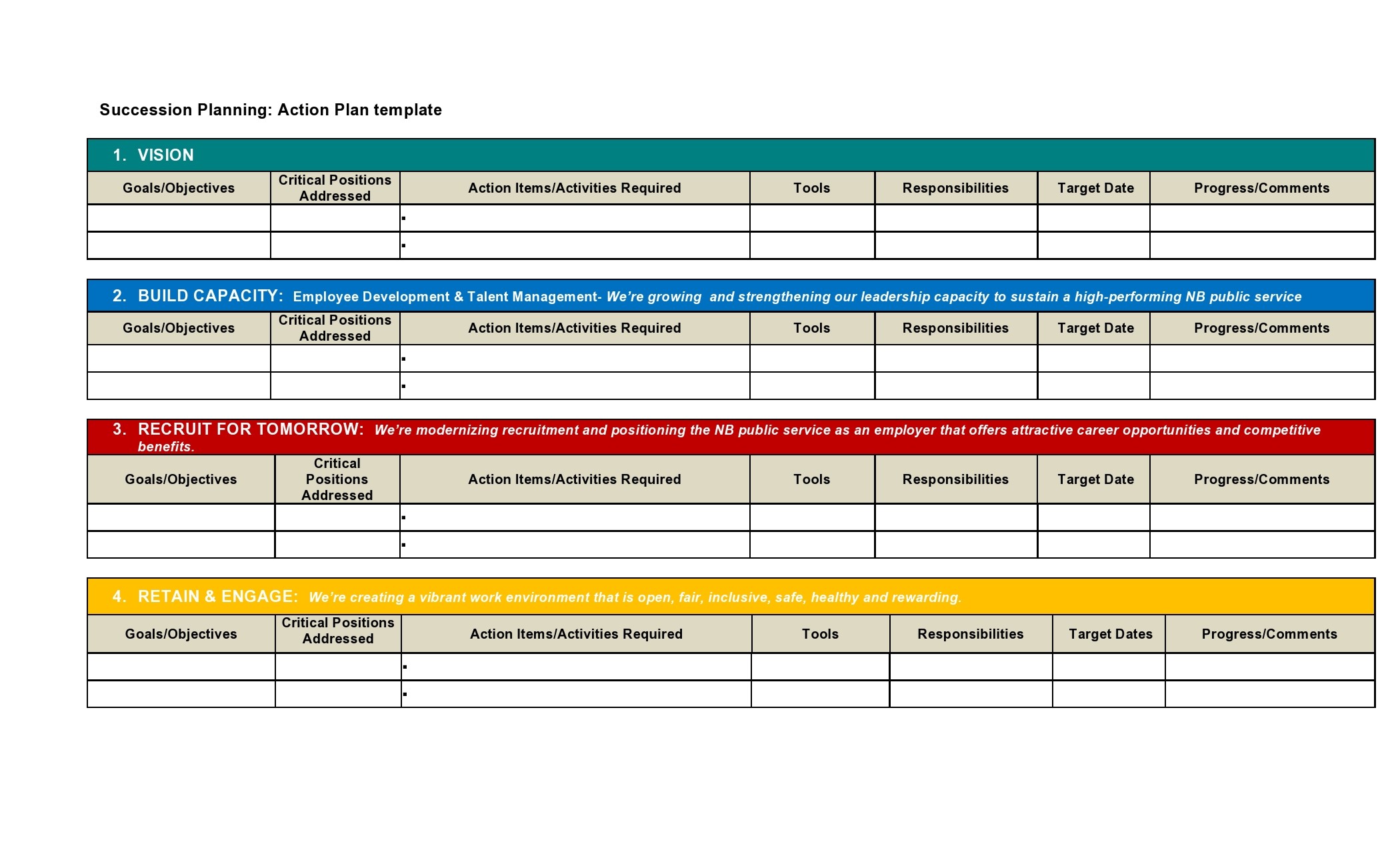

A Guide to Creating a Succession Planning Template – HSI – Source hsi.com

A Deeper Dive into Trust Companies

Trust companies have a long-standing history in Canada, dating back to the late 19th century. Their role has evolved over time, but their commitment to protecting wealth and fulfilling the wishes of their clients remains unwavering.

Succession Planning Template Xls – Source template.mapadapalavra.ba.gov.br

Unveiling the Hidden Secrets

Beyond their traditional services, trust companies offer a wealth of hidden secrets that can further enhance your wealth management and succession planning:

- Access to global investment opportunities

- Estate litigation support

- Real estate investment and management

- Art and collectibles advisory services

- Advanced tax planning strategies

By unlocking these hidden secrets, you can maximize the benefits of working with a trust company and achieve your financial goals with greater confidence.

10 Succession Planning Metrics You Should Know – AIHR – Source www.aihr.com

Our Recommendation: Trust Companies for Peace of Mind

We highly recommend partnering with a reputable trust company in Canada to secure your financial future. They provide personalized guidance tailored to your specific needs, ensuring the preservation and growth of your wealth while minimizing the burden on your loved ones during the estate administration process.

Trust companies offer a comprehensive range of services, from wealth management to estate planning, allowing you to focus on what truly matters without the added stress of managing complex financial matters.

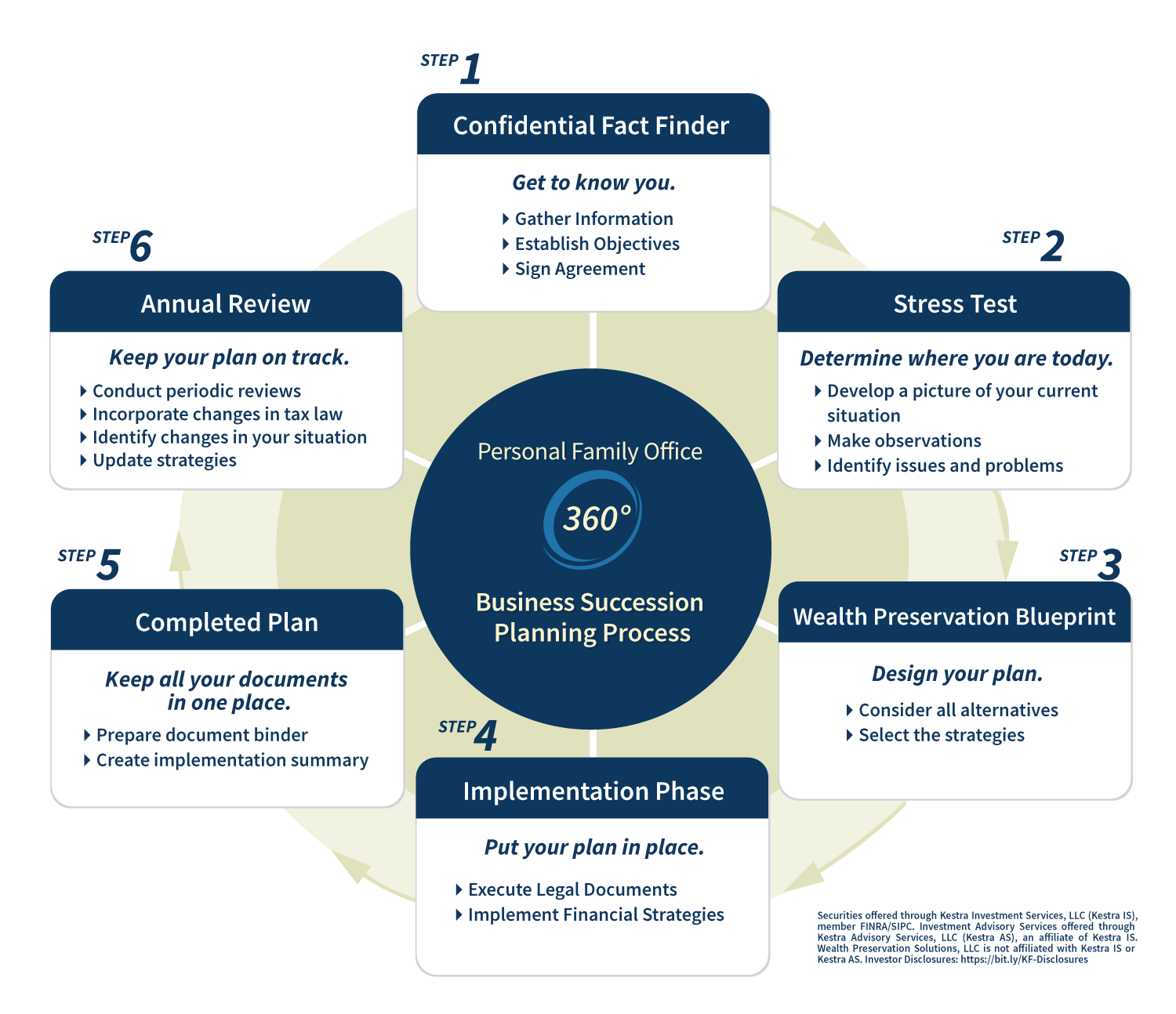

Business Succession Planning – Wealth Preservation Solutions – Source wealthpreservationsolutions.com

The Benefits of Trust Companies: In-Depth Exploration

The benefits of working with a trust company extend far beyond their core services:

- Protection and preservation of your wealth

- Reduced tax burden and increased tax efficiency

- Peace of mind knowing your wishes will be fulfilled

- Confidential and secure management of your assets

- Access to professional and experienced investment managers

Trust companies empower you to achieve your financial goals with confidence and tranquility.

Cynthia Macturk: 2022 Virginia Small Business CFO of the Yea – Source fahrenheitadvisors.com

Tips for Choosing the Right Trust Company

To ensure you make the best choice for your unique needs, consider the following tips when selecting a trust company:

- Research their reputation and experience

- Schedule consultations to discuss their services

- Review their investment philosophy and strategies

- Inquire about their fees and service levels

- Seek referrals from trusted sources

By carefully considering these factors, you can find a trust company that aligns with your financial goals and provides the highest level of service.

Preparing a future-ready workforce through individual focus – Talent – Source www.talentmgt.com

Unlocking the True Potential of Trust Companies

Trust companies are not merely financial institutions; they serve as trusted advisors who can help you navigate the complexities of wealth management and succession planning. They provide tailored guidance and support throughout your life journey, ensuring your financial legacy is preserved and protected.

Unlocking the full potential of trust companies empowers you to:

- Secure your financial future with confidence

- Protect your loved ones from unnecessary stress

- Minimize tax burdens and optimize tax efficiency

- Achieve your financial goals with greater peace of mind

- Leave a lasting legacy for generations to come

The .5 trillion dollar skills gap: How learning leaders must address – Source www.talentmgt.com

Fun Facts About Trust Companies

Here are some fascinating fun facts about trust companies:

- The first trust company in Canada was established in Montreal in 1881.

- Trust companies play a significant role in the Canadian economy, managing over $2 trillion in assets.

- Trust companies are regulated by provincial and federal governments, ensuring the highest standards of governance and accountability.

These fun facts highlight the importance and impact of trust companies in the financial landscape of Canada.

Tips To Find A Wealth Manager – Wealth Management Canada – Source wealthmanagementcanada.com

How to Get Started with a Trust Company

To get started with a trust company, follow these simple steps:

- Contact a reputable trust company and schedule a consultation.

- Provide them with your financial information and goals.

- Review their recommendations and discuss any questions you may have.

- Sign a trust agreement outlining the terms and conditions of the trust.

By completing these steps, you can establish a trust that will protect and manage your wealth for years to come.

What if I Don’t Use a Trust Company?

If you choose not to use a trust company, you will be responsible for managing your wealth and succession planning on your own. This can be a daunting task, especially if you lack financial expertise or have complex financial needs.

By working with a trust company, you can benefit from their professional guidance, expertise, and personalized services, ensuring your financial affairs are handled with the utmost care and efficiency.

Listicle: Benefits of Trust Companies

Here’s a listicle summarizing the key benefits of working with a trust company:

- Personalized wealth management and investment services

- Comprehensive estate and succession planning

- Professional trust administration and management

- Tax planning and compliance support

- Access to a wide range of financial products and services

Trust companies provide a comprehensive and tailored approach to wealth management and succession planning, empowering you to achieve your financial goals with greater confidence and peace of mind.

Frequently Asked Questions

-

What is the role of a trust company?

Trust companies serve as trusted fiduciaries, managing assets and administering trusts on behalf of individuals and families.

-

What services do trust companies offer?

Trust companies provide a comprehensive range of services, including wealth management, estate and succession planning, trust administration, philanthropic advisory services, and tax planning.

-

How do I choose the right trust company?

Consider their reputation, experience, investment philosophy, fees, and service levels to find the best match for your needs.

-

What are the benefits of using a trust company?

Trust companies offer personalized guidance, expert management, tax efficiency, peace of mind, and a comprehensive approach to wealth management and succession planning.

Conclusion of Unlocking The Benefits Of Trust Companies In Canada: A Guide To Wealth Management And Succession Planning

Trust companies play a vital role in safeguarding the financial future of individuals and families in Canada. By partnering with a reputable trust company, you gain access to expert guidance, tailored wealth management strategies, and comprehensive succession planning services. Trust companies empower you to protect your legacy, minimize tax burdens, and achieve your financial goals with confidence and peace of mind.