Are you interested in learning more about Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation? If so, then you will want to read this post because it will provide you with all the information that you need to know about this topic.

Many employees are unaware of the full range of compensation options available to them. This can lead to them missing out on valuable benefits that could help them achieve their financial goals. One such option is advisory shares. Advisory shares are a type of equity compensation that gives employees the right to receive shares of company stock in the future. They are often used to incentivize employees and align their interests with those of the company.

Advisory shares can be a valuable part of an employee’s compensation package. They can provide employees with the opportunity to share in the success of the company and build long-term wealth. However, it is important to understand how advisory shares work before you decide if they are right for you.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation is a comprehensive guide to advisory shares. It covers everything you need to know about this type of equity compensation, from how they work to how they are taxed. This guide will help you understand the benefits and risks of advisory shares so that you can make informed decisions about your financial future.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Advisory shares are a type of equity compensation that gives employees the right to receive shares of company stock in the future. They are often used to incentivize employees and align their interests with those of the company. Advisory shares can be a valuable part of an employee’s compensation package, but it is important to understand how they work before you decide if they are right for you.

Advisory Shares: Step-by-step guide for startups – Source waveup.com

Advisory shares are typically granted to employees who are expected to make a significant contribution to the company’s success. They are often used to attract and retain key employees, such as executives, sales representatives, and engineers. Advisory shares can also be used to reward employees for their past performance or to recognize their potential.

There are a number of different ways that advisory shares can be structured. The most common type of advisory share is a stock option. Stock options give employees the right to buy shares of company stock at a set price, known as the exercise price. The exercise price is typically set at a discount to the current market price of the stock.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Advisory shares can be a valuable part of an employee’s compensation package. They can provide employees with the opportunity to share in the success of the company and build long-term wealth. However, it is important to understand how advisory shares work before you decide if they are right for you.

Understanding Advisory Shares: A Beginner’s Guide – Foundercrate – Source www.foundercrate.com

One of the most important things to consider when evaluating advisory shares is the vesting period. The vesting period is the period of time that you must hold the advisory shares before you can exercise them. Vesting periods can range from one year to five years or more. If you leave the company before the vesting period is over, you will forfeit your advisory shares.

Another important factor to consider is the tax treatment of advisory shares. Advisory shares are taxed as ordinary income when they are exercised. This means that you will have to pay income tax on the difference between the exercise price and the fair market value of the stock at the time of exercise.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

The history of advisory shares dates back to the early days of the stock market. In the early 1900s, companies began to issue advisory shares to employees as a way to attract and retain key talent. Advisory shares were also used to reward employees for their contributions to the company’s success.

What Are Startup Advisory Shares? A Complete Guide – Source www.pitchdeckcreators.com

Over the years, advisory shares have become increasingly popular as a form of employee compensation. Today, many companies offer advisory shares to their employees. Advisory shares can be a valuable part of an employee’s compensation package, but it is important to understand how they work before you decide if they are right for you.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

There are a number of hidden secrets about advisory shares that many employees are unaware of. One of the most important secrets is that advisory shares are not always a good investment. The value of advisory shares can fluctuate significantly, and you could lose money if the company’s stock price declines.

What is a compensation strategy? – Source www.peoplekeep.com

Another hidden secret about advisory shares is that they can be taxed at a very high rate. When you exercise advisory shares, you will have to pay income tax on the difference between the exercise price and the fair market value of the stock at the time of exercise. This can result in a large tax bill, so it is important to be aware of the tax implications before you exercise your advisory shares.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

If you are considering accepting advisory shares as part of your compensation package, it is important to do your research and understand the risks involved. Advisory shares can be a valuable part of your compensation package, but they are not right for everyone. You should carefully consider your financial goals and risk tolerance before you decide if advisory shares are right for you.

Compensation Letter Template – Source old.sermitsiaq.ag

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Advisory shares are a type of equity compensation that gives employees the right to receive shares of company stock in the future. They are often used to incentivize employees and align their interests with those of the company. Advisory shares can be a valuable part of an employee’s compensation package, but it is important to understand how they work before you decide if they are right for you.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Tips for investing in advisory shares:

What are Advisory Shares? | AngelList – Source learn.angellist.com

- Do your research. Before you invest in advisory shares, it is important to do your research and understand the company and its stock. You should also understand the terms of the advisory shares, including the vesting period and the tax implications.

- Diversify your investments. Don’t put all of your eggs in one basket. Diversify your investments by investing in a variety of assets, including stocks, bonds, and real estate.

- Be patient. Investing in advisory shares is a long-term game. Don’t expect to get rich quick. Be patient and let your investments grow over time.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Advisory shares can be a valuable part of an employee’s compensation package, but it is important to understand how they work before you decide if they are right for you. By following these tips, you can increase your chances of success when investing in advisory shares.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Fun facts about advisory shares:

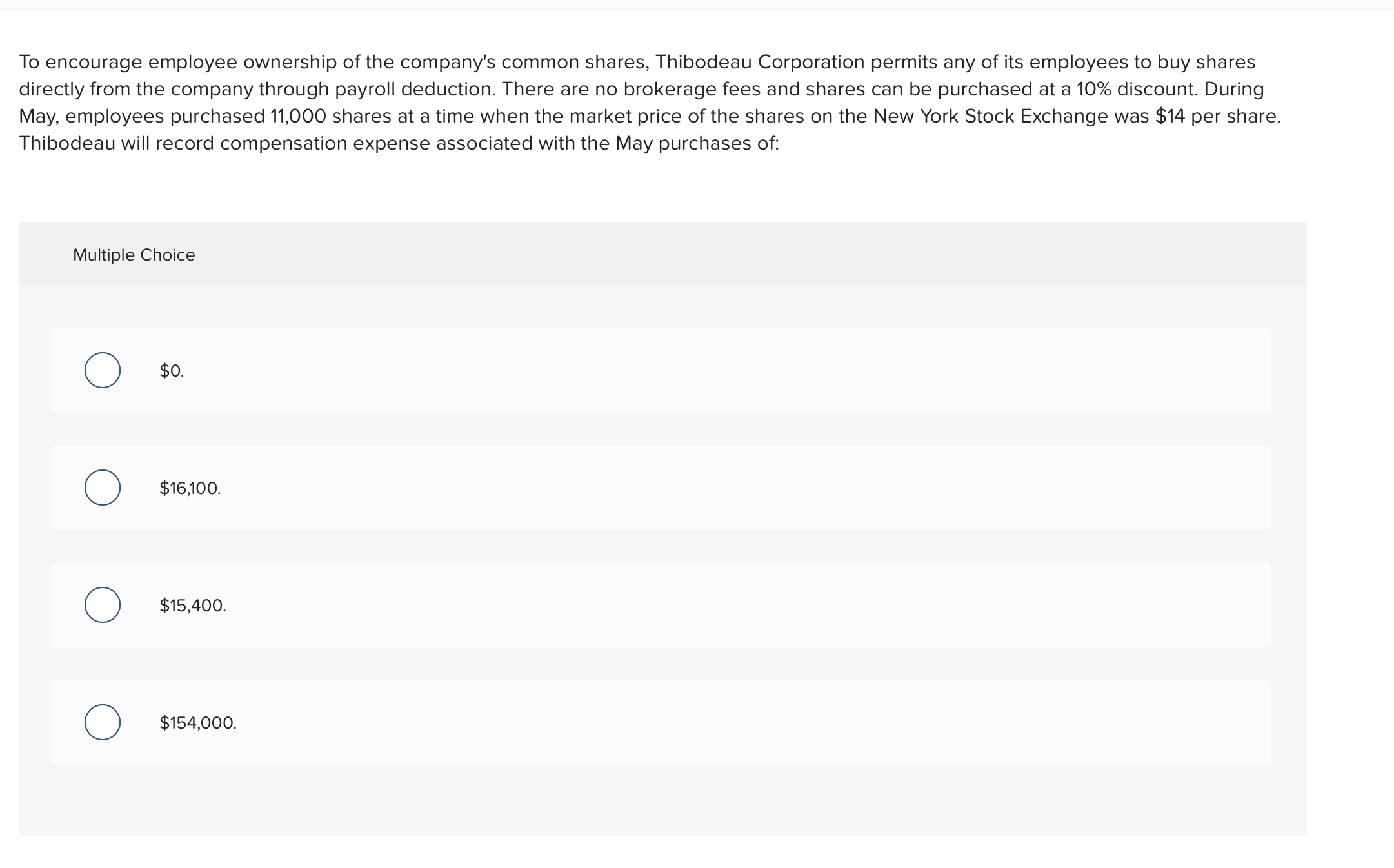

Solved To encourage employee ownership of the company’s | Chegg.com – Source www.chegg.com

- Advisory shares are not always a good investment. The value of advisory shares can fluctuate significantly, and you could lose money if the company’s stock price declines.

- Advisory shares can be taxed at a very high rate. When you exercise advisory shares, you will have to pay income tax on the difference between the exercise price and the fair market value of the stock at the time of exercise.

- Advisory shares are not the same as stock options. Stock options give employees the right to buy shares of company stock at a set price, while advisory shares give employees the right to receive shares of company stock in the future.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

How to get started with advisory shares:

Benefits by Design Insurance Services Employee benefits Archives – Source benefitsbydesignca.com

- Talk to your employer. If you are interested in receiving advisory shares as part of your compensation package, talk to your employer. Your employer can provide you with more information about the company’s advisory share program and help you decide if it is right for you.

- Read the prospectus. Before you invest in advisory shares, it is important to read the prospectus. The prospectus will provide you with detailed information about the company and its advisory share program.

- Make a decision. After you have done your research and read the prospectus, you can make a decision about whether or not to invest in advisory shares.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

What if you don’t want advisory shares?

Employee Discretionary Benefit Ideas to Attract the Best Talent – Source blogs.oregonstate.edu

If you are not interested in receiving advisory shares as part of your compensation package, you can negotiate with your employer to receive other forms of compensation, such as cash or stock options.

Unveiling Advisory Shares: A Comprehensive Guide To Employee Compensation

Listicle of advisory shares:

Salary Schedule A Comprehensive Guide To Understanding And Managing – Source slidesdocs.com

- Advisory shares are a type of equity compensation that gives employees the right to receive shares of company stock in the future.

- Advisory shares are often used to incentivize employees and