In the ever-evolving digital landscape, crafting a strategic stock portfolio is key to unlocking financial success. Unveiling the secrets of renowned investor Ryan Cohen’s portfolio provides a valuable blueprint for navigating the complexities of the contemporary market.

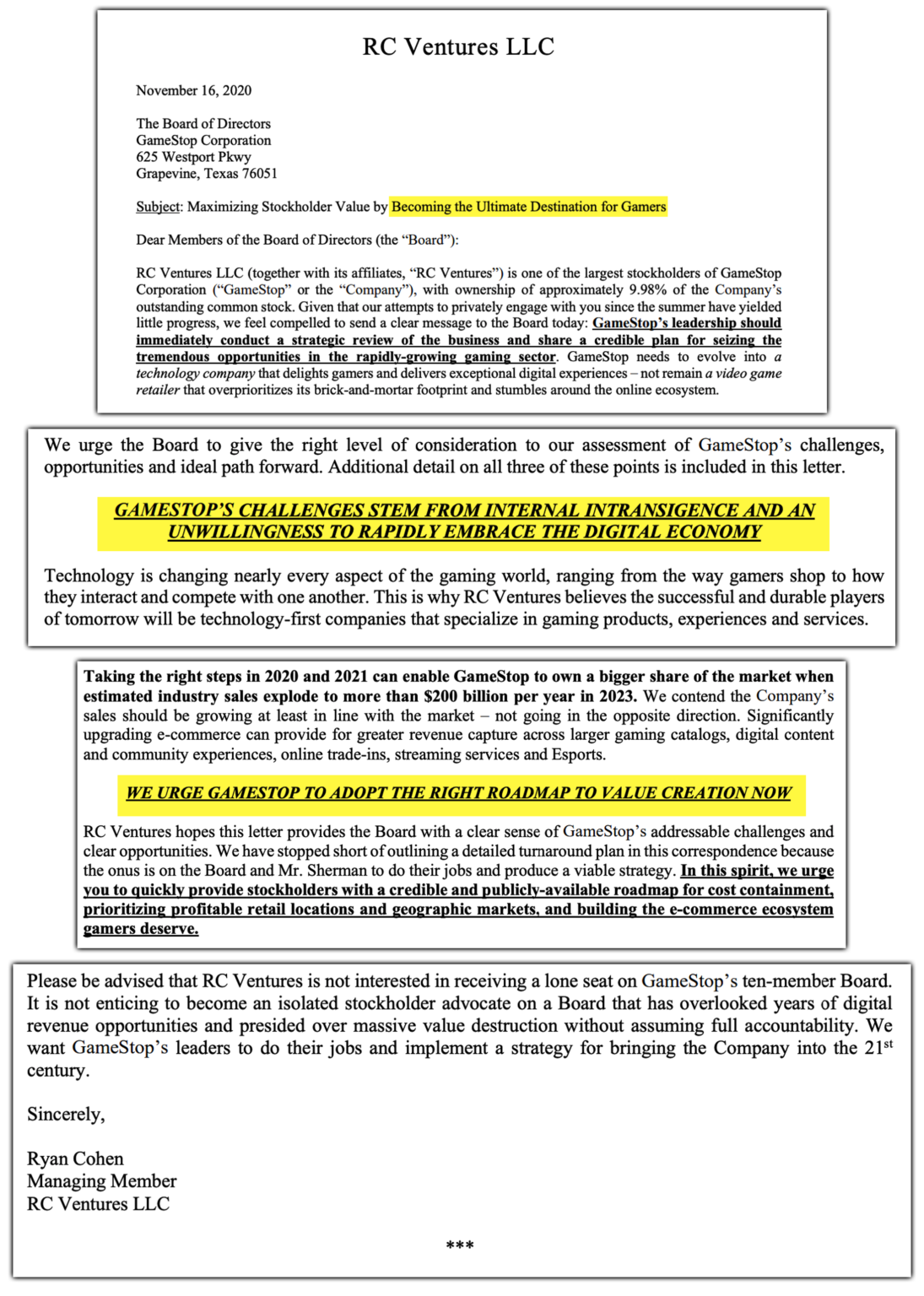

Ryan Cohen Urges Strategic Review in Letter to Board | GameStop Due – Source www.gmedd.com

Embracing Innovation And Shaping The Future

The digital age is characterized by rapid technological advancements and the rise of disruptive technologies. Ryan Cohen’s portfolio reflects this dynamic environment, with a focus on companies poised to benefit from the transformative power of innovation. By investing in ventures at the forefront of e-commerce, social media, and artificial intelligence, his strategy seeks to capture the exponential growth potential of these emerging sectors.

Blueprint Strategic Planning Service – Source www.nyscoss.org

Investing In Disruptors And Industry Leaders

Cohen’s portfolio also places significant emphasis on identifying and investing in companies positioned as disruptive forces within their respective industries. These firms often possess a unique competitive advantage, enabling them to challenge legacy incumbents and drive transformative changes in the marketplace. By backing innovators with strong leadership teams and innovative business models, Cohen aims to capitalize on the potential for outsized returns in high-growth sectors.

Residential Architectural Portfolio | Blueprint Architectural Design – Source blueprintdesign.org.uk

Harnessing The Power Of Long-Term Vision

Ryan Cohen’s investment strategy is characterized by a long-term perspective. He understands that building lasting wealth requires patience and a deep understanding of the companies he invests in. His portfolio demonstrates a commitment to supporting companies with strong fundamentals, sustainable business practices, and the potential to generate consistent returns over extended periods.

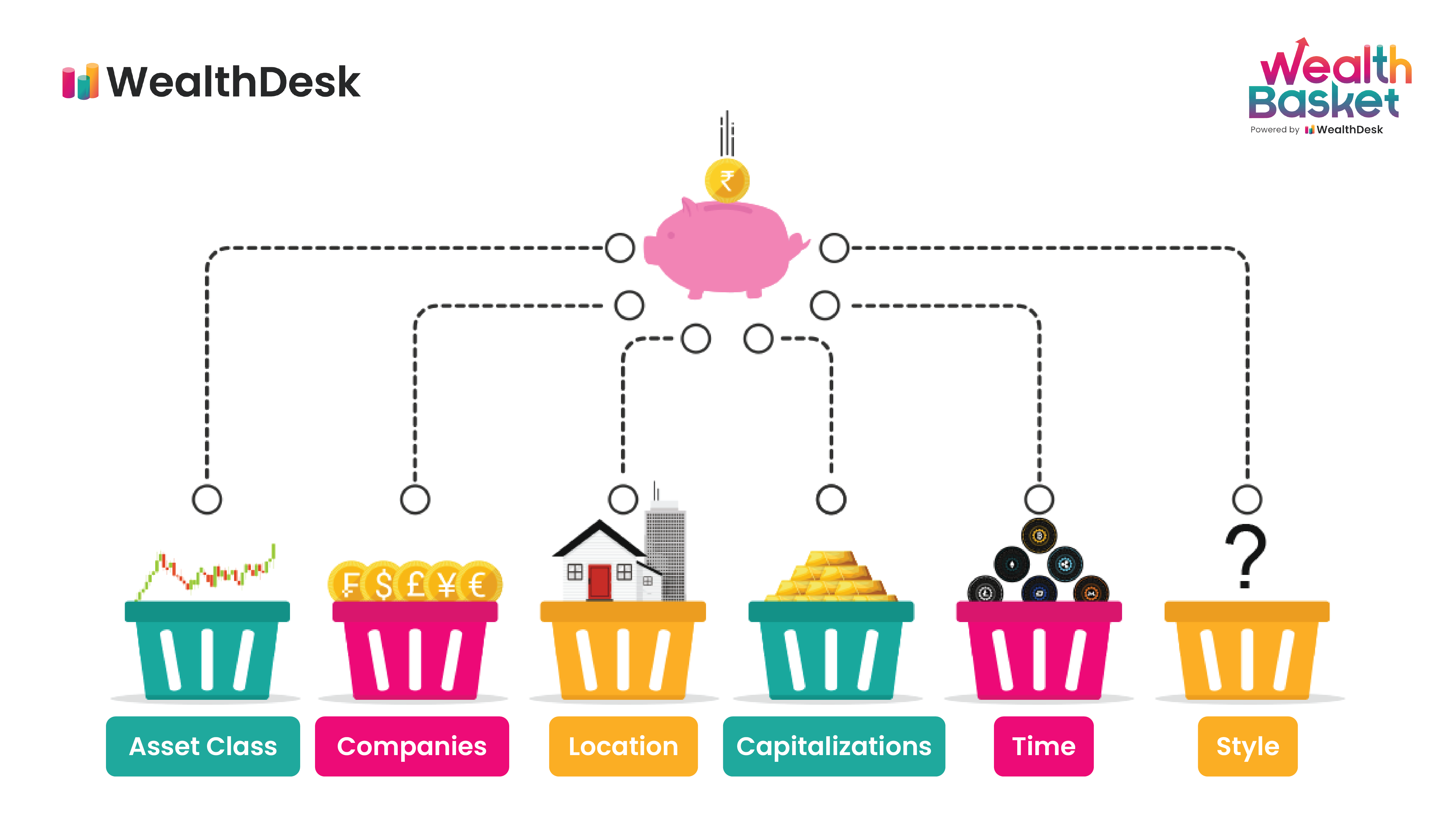

6 Tips to Diversify Your Portfolio | WealthDesk – Source wealthdesk.in

Unveiling Ryan Cohen’s Strategic Stock Portfolio: A Blueprint For Success In The Digital Age

Ryan Cohen’s strategic stock portfolio serves as a testament to his investment prowess and adaptability in the rapidly evolving digital landscape. His ability to identify and invest in disruptive companies, while embracing a long-term vision, has positioned his portfolio as a benchmark for success in the digital age.

Customer Success Blueprint As Your Business Scales – CXChronicles – Source cxchronicles.com

Deconstructing Cohen’s Investment Strategy: A Personal Perspective

As a financial enthusiast, I have been closely following Ryan Cohen’s investment strategies for years, and his approach has profoundly influenced my own investment decisions. His emphasis on innovation and disruption aligns with my belief that the digital age presents unparalleled opportunities for those who embrace change. Through Cohen’s portfolio, I have discovered promising companies that are shaping the future of industries, such as e-commerce, technology, and renewable energy.

Ryan Cohen, renowned investor and Chairman of GameStop, has made a name for himself with his strategic stock portfolio.

His portfolio is a masterclass in identifying and investing in companies that are poised to benefit from the transformative power of innovation. By backing innovators with strong leadership teams and innovative business models, Cohen aims to capitalize on the potential for outsized returns in high-growth sectors.

LEAN Frog – Source theleanleap.com

Historical Context And Evolution Of Cohen’s Portfolio

Ryan Cohen’s investment strategy has evolved over time, reflecting his deep understanding of market trends and his willingness to adapt to changing circumstances. In his early days, he focused on identifying undervalued companies with strong fundamentals. However, as the digital age matured, he recognized the importance of investing in companies that were driving disruptive innovation. This shift in strategy has paid off handsomely, as Cohen’s portfolio has outperformed the broader market in recent years.

Cohen’s portfolio is a reflection of his deep understanding of market trends and his willingness to adapt to changing circumstances.

Throughout his investment journey, Cohen has maintained a strong belief in the power of long-term investing. He understands that building lasting wealth requires patience and a deep understanding of the companies he invests in. This approach has allowed him to weather market fluctuations and generate consistent returns over extended periods.

Six Principles of Strategic Portfolio Management – Value Creation Focus – Source smartorg.com

Unveiling The Secret Ingredients Of Cohen’s Success

Ryan Cohen’s investment success can be attributed to several key factors. First and foremost is his ability to identify and invest in disruptive companies at an early stage. He has a knack for spotting companies that have the potential to transform their respective industries and generate exponential returns for investors. Additionally, Cohen is a patient investor who is willing to hold onto his investments for the long term. He believes that the best way to build wealth is to invest in companies with strong fundamentals and a clear path to growth.

Cohen’s investment success can be attributed to several key factors, including his ability to identify and invest in disruptive companies at an early stage.

Finally, Cohen is a highly disciplined investor who follows a rigorous investment process. He conducts thorough research before making any investment decision. He also has a clear understanding of his risk tolerance and investment goals. This discipline has helped him to avoid costly mistakes and make sound investment decisions.

Residential Architectural Portfolio | Blueprint Architectural Design – Source blueprintdesign.org.uk

Recommendations For Emulating Cohen’s Investment Approach

If you are looking to emulate Ryan Cohen’s investment approach, there are several things you can do. First, focus on identifying companies that are poised to benefit from the transformative power of innovation. These companies may be operating in emerging industries or developing new technologies. Second, be patient and willing to hold onto your investments for the long term. The best investments often take time to mature. Finally, follow a disciplined investment process and do your research before making any investment decision.

If you are looking to emulate Ryan Cohen’s investment approach, there are several things you can do, including focusing on identifying companies that are poised to benefit from the transformative power of innovation.

By following these simple tips, you can increase your chances of investment success and build a portfolio that will generate wealth for years to come.

Digital Transformation: A blueprint for business success – Source www.way2smile.uk

Unveiling The Nuances Of Ryan Cohen’s Portfolio: A Deep Dive

Ryan Cohen’s investment portfolio is a complex and multifaceted entity, reflecting his deep understanding of the financial markets and his ability to identify undervalued opportunities. To fully comprehend the intricacies of his approach, it is essential to delve into the specific sectors and companies that have garnered his attention.

Cohen’s portfolio is a reflection of his deep understanding of the financial markets and his ability to identify undervalued opportunities.

Cohen’s portfolio has a strong focus on companies operating in the technology sector, recognizing the exponential growth potential of this industry. He has invested heavily in e-commerce platforms, social media giants, and cutting-edge technology companies. By backing these innovators, Cohen positions his portfolio to capitalize on the digital transformation shaping various aspects of our lives.

Ryan Cohen Memes – Imgflip – Source imgflip.com

Tips For Success In The Digital Age: Lessons From Cohen’s Portfolio

Ryan Cohen’s investment strategy offers valuable lessons for investors seeking success in the digital age. Here are a few key tips to consider:

- Embrace innovation and disruption: Invest in companies that are pushing the boundaries of technology and driving transformative change in their respective industries.

- Focus on long-term growth: Avoid chasing short-term gains and instead prioritize companies with strong fundamentals and a clear path to sustained growth.

- Conduct thorough research: Before making any investment decision, take the time to thoroughly research the company, its industry, and its competitive landscape.

- Be patient: The best investments often take time to mature, so be patient and resist the urge to sell your shares prematurely.

- Diversify your portfolio: Spread your investments across a range of industries and companies to reduce risk and enhance your chances of long-term success.

By following these tips, you can position your portfolio to thrive in the ever-evolving digital landscape.

Unveiling The Secrets Of Ryan Cohen’s Portfolio: A Deeper Exploration

To fully comprehend the intricacies of Ryan Cohen’s investment portfolio, it is essential to explore the specific strategies and techniques that have contributed to his success. One key aspect of his approach is his emphasis on identifying companies with strong leadership teams. Cohen believes that a talented and experienced management team is crucial for driving innovation and executing a clear growth strategy.

Cohen believes that a talented and experienced management team is crucial for driving innovation and executing a clear growth strategy.

Another important element of Cohen’s investment philosophy is his focus on companies with a clear competitive advantage. He seeks out companies that possess unique products or technologies that differentiate them from their competitors. This competitive advantage can be a powerful driver of long-term