Need a simplified estate administration solution? Our Waiver of Probate and Indemnity Agreement could streamline the process.

Dealing with the complexities of estate administration can be daunting. Our Waiver of Probate and Indemnity Agreement aims to minimize legal hassles and delays.

The Waiver of Probate and Indemnity Agreement enables you to avoid probate, which is the court-supervised process of settling an estate. It also provides indemnity to the personal representative, reducing their liability.

Benefits of Waiver of Probate and Indemnity Agreement for Simplified Estate Administration:

– Avoid probate court and its associated costs

– Expedite estate settlement

– Protect the personal representative from personal liability

– Provide clarity and peace of mind to beneficiaries

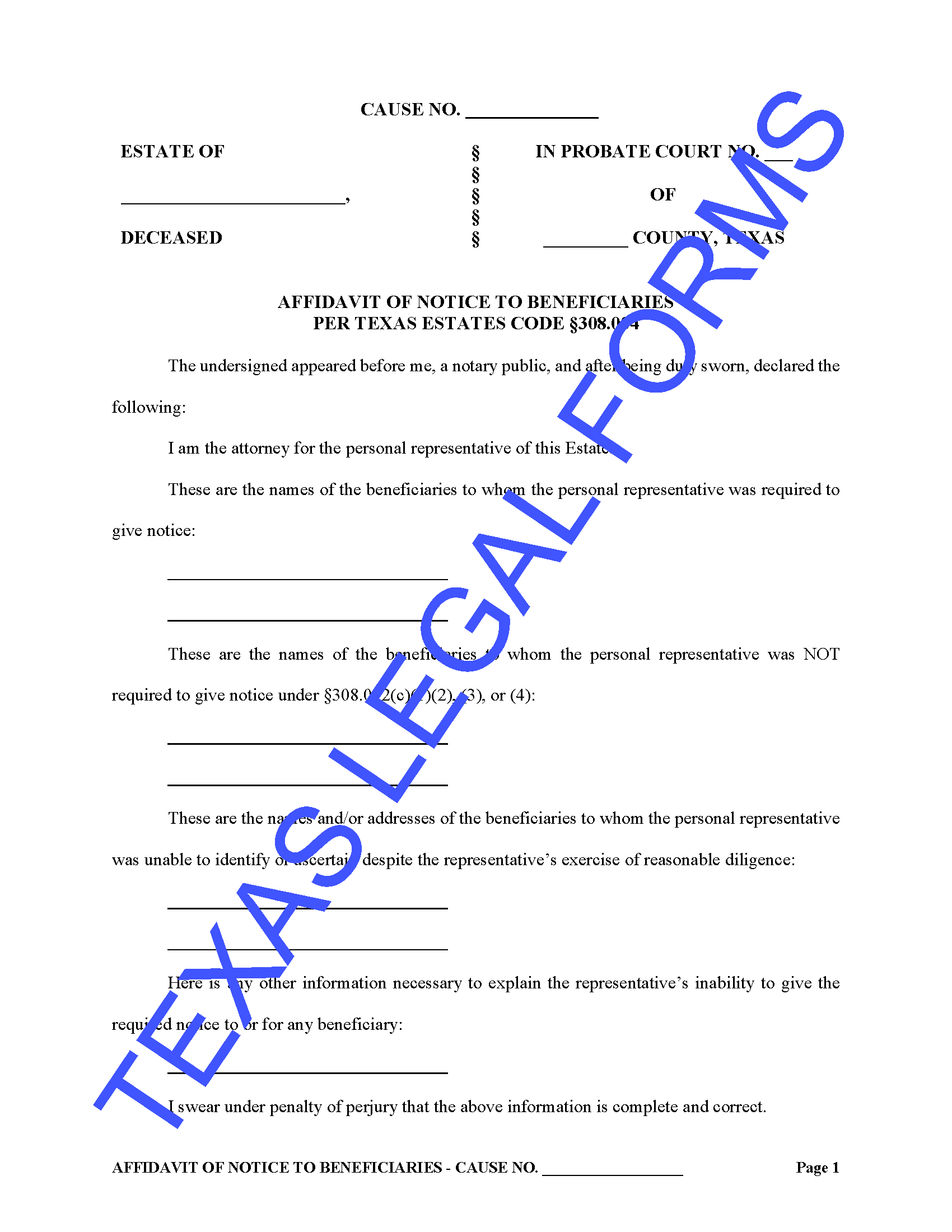

Texas Affidavit Of Notice To Beneficiaries Form – Buy Probate Legal – Source www.texaslegalforms.com

Waiver of Probate and Indemnity Agreement: A Closer Look

Our Waiver of Probate and Indemnity Agreement empowers you to appoint a personal representative to manage your estate according to your wishes. The agreement includes provisions that waive the need for probate and indemnify the personal representative against potential claims.

Our agreement is carefully drafted to ensure its validity and enforceability. It includes language that safeguards the interests of all parties involved.

History and Myths of Waiver of Probate and Indemnity Agreements

The concept of waiver of probate has evolved over time. It was initially introduced as a means to avoid the lengthy and costly probate process. However, myths and misconceptions have often surrounded these agreements.

One common myth is that the waiver of probate eliminates all taxes. While it is true that probate administration fees are avoided, it is crucial to remember that estate taxes may still be applicable. Our agreement clearly outlines these considerations.

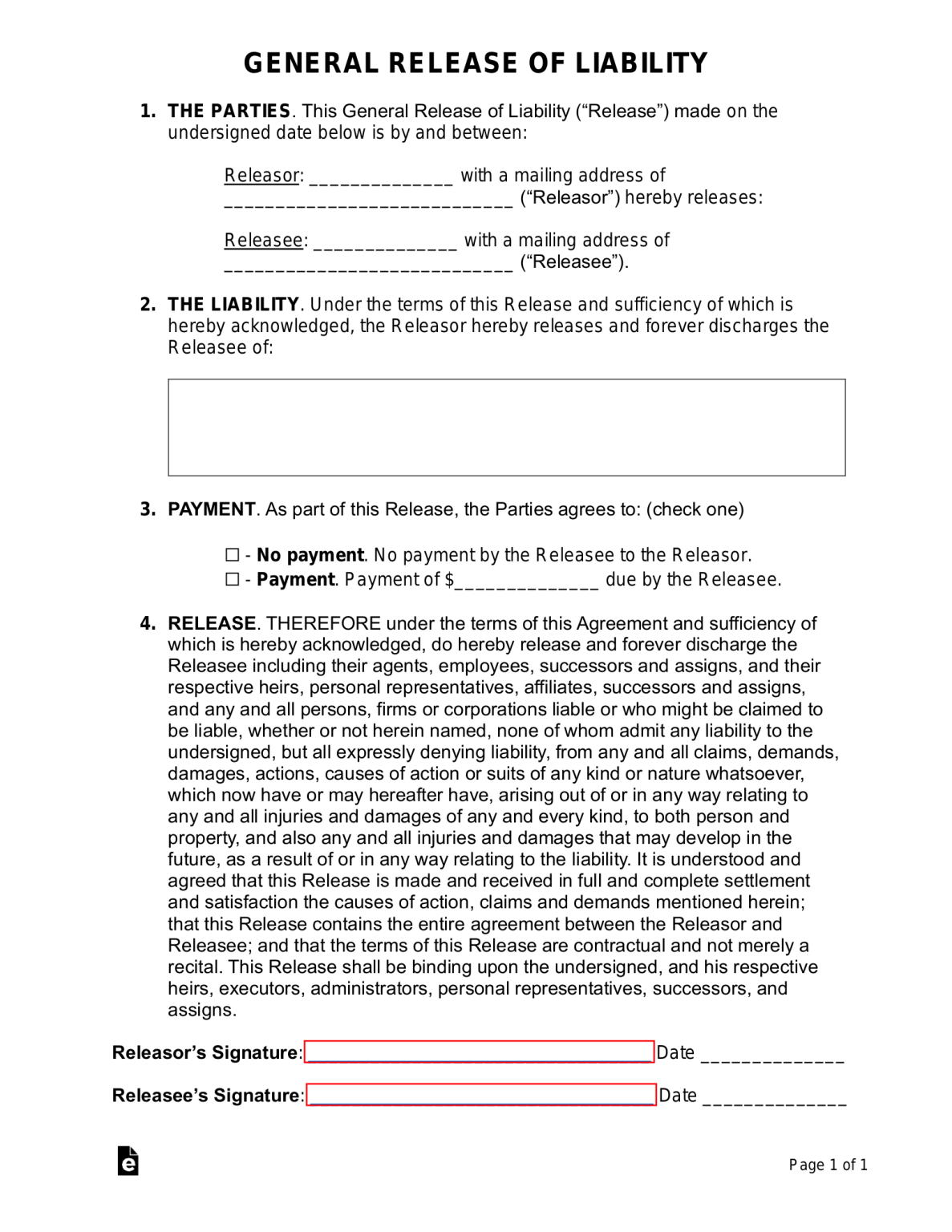

Vehicle Release Of Reliability Form Printable – Printable Forms Free Online – Source printableformsfree.com

Unveiling the Hidden Secret of Waiver of Probate and Indemnity Agreements

A hidden secret of waiver of probate and indemnity agreements lies in their versatility. They can be tailored to meet the specific needs of your estate plan.

For instance, you can include provisions for specific distributions of assets without the need for further court involvement. This flexibility ensures that your wishes are honored in a timely and efficient manner.

Recommendations for Waiver of Probate and Indemnity Agreements

We highly recommend considering a Waiver of Probate and Indemnity Agreement if you are concerned about minimizing probate costs, expediting estate distribution, and protecting your personal representative.

Our agreement provides a comprehensive solution that simplifies estate administration, reduces uncertainties, and provides peace of mind.

Indemnity Form – Free Printable Documents | Letter templates, Lettering – Source www.pinterest.com.au

Waiver of Probate and Indemnity Agreement: A Smart Choice for Estate Planning

A Waiver of Probate and Indemnity Agreement offers a strategic solution for individuals who seek a streamlined and cost-effective estate administration process.

By avoiding probate, you can save time, money, and potential conflicts within the family. Our agreement protects the personal representative from unnecessary liability, empowering them to carry out your wishes with confidence.

Tips for Drafting a Waiver of Probate and Indemnity Agreement

Drafting a valid and enforceable Waiver of Probate and Indemnity Agreement requires careful attention to detail. Here are some practical tips:

– Clearly outline the terms of the waiver, including the avoidance of probate and the appointment of the personal representative.

– Ensure that all parties understand their roles and responsibilities under the agreement.

– Include provisions for the distribution of assets and handling of potential claims.

– Seek legal counsel to ensure the agreement is customized to your specific estate planning needs.

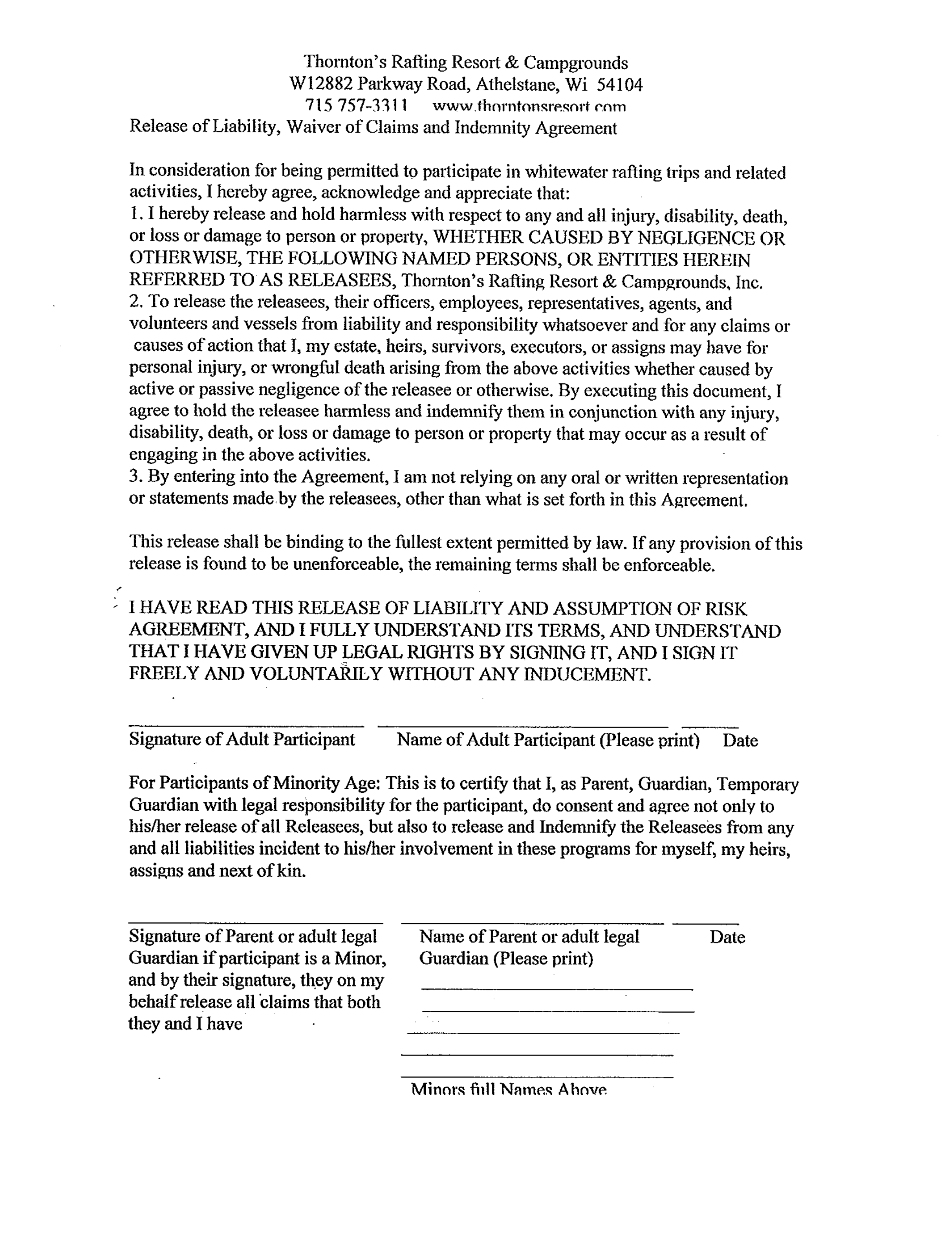

Release of Liability, Waiver of Claims and Indemnity Agreement – Edit – Source handypdf.com

Waiver of Probate and Indemnity Agreement: Essential Considerations

Consider the following factors when implementing a Waiver of Probate and Indemnity Agreement:

– The size and complexity of your estate

– The potential for estate taxes

– The number of beneficiaries and their potential disputes

– The availability of a qualified personal representative

Fun Facts about Waiver of Probate and Indemnity Agreements

Here are some intriguing facts about Waiver of Probate and Indemnity Agreements:

– They have been recognized in various jurisdictions, including common law and civil law countries.

– Some states have adopted specific statutory provisions governing waiver of probate agreements.

– The enforceability of these agreements depends on the clarity of their drafting and compliance with applicable laws.

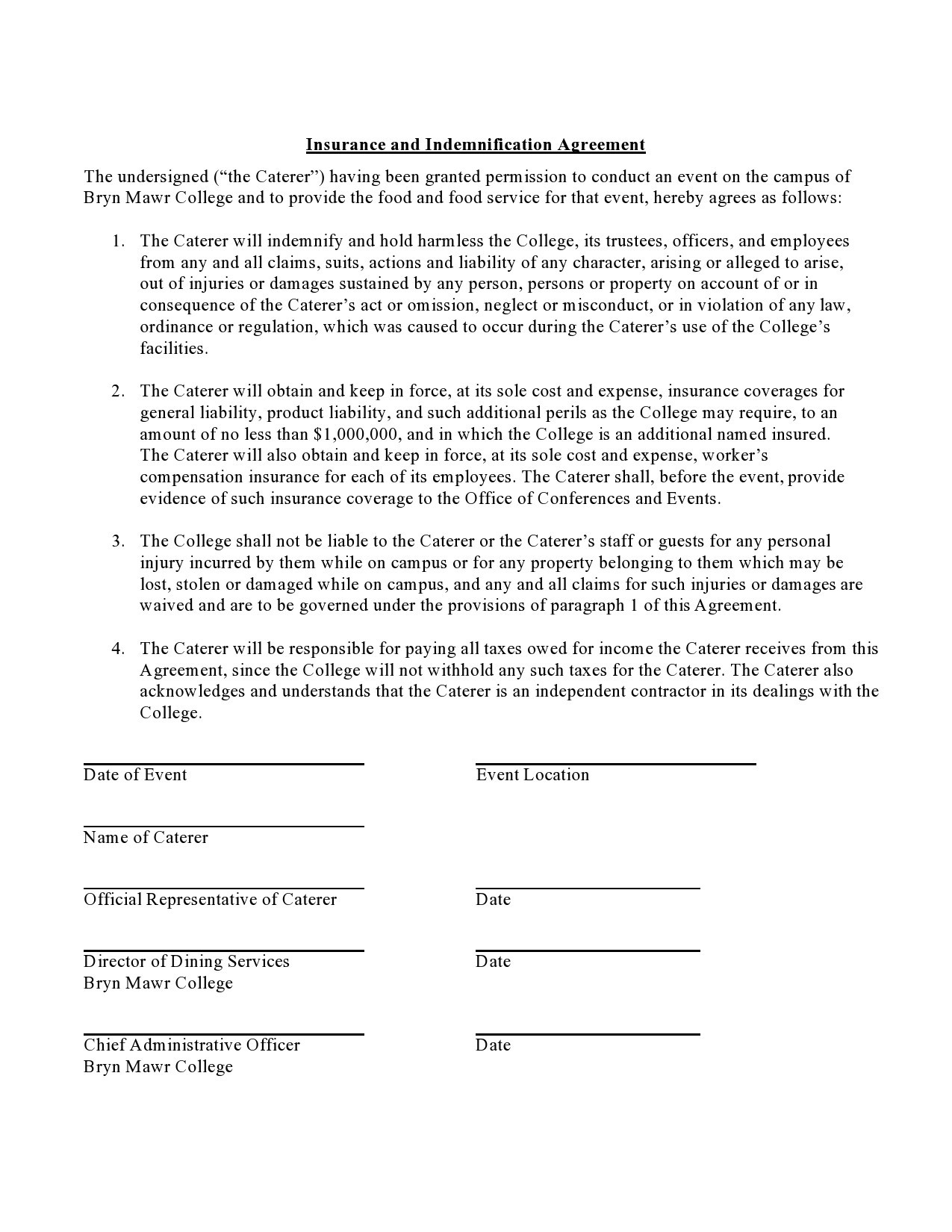

Indemnification Agreement Template – Source combos2016.diariodolitoral.com.br

How to Implement a Waiver of Probate and Indemnity Agreement

To implement a Waiver of Probate and Indemnity Agreement, follow these steps:

– Consult with an estate planning attorney to draft the agreement.

– Execute the agreement in the presence of witnesses.

– File the agreement with the appropriate authorities, if required by law.

– Inform your beneficiaries and personal representative about the agreement.

What if the Waiver of Probate and Indemnity Agreement is Challenged?

While Waiver of Probate and Indemnity Agreements are generally upheld by courts, there is still a possibility of challenges.

Potential grounds for challenging an agreement could include undue influence, fraud, coercion, or lack of capacity. It is crucial to ensure the agreement is executed voluntarily and in full compliance with applicable laws.

MONTH-TO-MONTH Rental Agreement/ Editable Rental Agreement/ | Etsy in – Source www.pinterest.com

Listicle of Essential Points for Waiver of Probate and Indemnity Agreements

Here is a listicle of crucial points to consider:

- Benefits include avoiding probate, expediting settlement, and protecting the personal representative.

- It empowers you to appoint a personal representative to manage your estate according to your wishes.

- It is important to have the agreement drafted by an estate planning attorney to ensure its validity.

- The agreement should be executed in the presence of witnesses and filed with the appropriate authorities, if required by law.

- There is still a possibility of challenges to the agreement, such as undue influence or fraud, so it is important to ensure it is executed voluntarily and in compliance with laws.

Question and Answer

Q: What are the advantages of a Waiver of Probate and Indemnity Agreement?

A: It avoids probate court and its costs, expedites estate settlement, protects the personal representative from personal liability, and provides clarity to beneficiaries.

Q: Can a Waiver of Probate and Indemnity Agreement be challenged?

A: Yes, it is possible, but courts generally uphold these agreements if they are executed voluntarily and comply with applicable laws.

Q: Is a Waiver of Probate and Indemnity Agreement right for me?

A: It depends on the size and complexity of your estate, the potential for estate taxes, and the availability of a qualified personal representative.

Q: How do I implement a Waiver of Probate and Indemnity Agreement?

A: Consult an estate planning attorney to draft the agreement, execute it in the presence of witnesses, file it with the appropriate authorities, if required by law, and inform beneficiaries and the personal representative.

Conclusion of Waiver of Probate and Indemnity Agreement for Simplified Estate Administration

A Waiver of Probate and Indemnity Agreement is a valuable tool that can simplify estate administration, reduce legal hassles, and provide peace of mind. By avoiding probate and protecting the personal representative from liability, it ensures a smooth transition of your legacy while honoring your wishes.