Filing taxes can be a confusing and overwhelming process, especially when it comes to understanding the standard deduction. In this comprehensive guide, we break down everything you need to know about the 2023 standard deduction rates for federal taxes, empowering you to optimize your tax savings and navigate tax season with confidence.

Ati Teas Practice Test Printable – vrogue.co – Source www.vrogue.co

Standard Deduction: A Painless Route

The standard deduction is a specific amount that you can subtract from your taxable income before calculating your taxes. It provides a basic level of tax relief to taxpayers, allowing them to reduce their tax liability. Understanding the standard deduction rates is crucial as they determine the amount of your earnings exempt from taxation.

Microsoft Reveals Everything You Need To Know About W – vrogue.co – Source www.vrogue.co

2023 Standard Deduction Rates Unveiled

The standard deduction rates for 2023 have been adjusted to account for inflation. The new rates are as follows:

- Single: $13,850

- Married filing jointly: $27,700

- Married filing separately: $13,850

- Head of household: $20,800

These increased rates translate into higher tax savings for taxpayers in all filing statuses.

What Are Tax Deductions and Credits? 20 Ways To Save – Comfy Package – Source comfypakage.com

Key Points to Grasp

The 2023 standard deduction rates provide a substantial reduction in taxable income, offering tax savings for individuals and families. If your itemized deductions are less than the standard deduction amount, it is generally more beneficial to claim the standard deduction.

Anything (from Anywhere ) Customize Everything And Find Imgur Hack You – Source www.vrogue.co

2023 Standard Deduction Rates: A Personal Narrative

Understanding the standard deduction rates empowered me to make informed tax-saving decisions. During the 2022 tax season, I was able to reduce my taxable income by claiming the standard deduction, saving a significant amount on my taxes. It provided peace of mind knowing that I was optimizing my tax savings within the legal framework.

2024 Tax Brackets And Standard Deduction – Tracy Harriett – Source nicolettewlanna.pages.dev

Standard Deduction: Unveiling Its Essence

The standard deduction serves as a foundational element of the US tax code, offering a simplified method for taxpayers to reduce their taxable income. It eliminates the need for itemizing deductions, which involve meticulously tracking and totaling various expenses. By streamlining the tax filing process, the standard deduction makes tax compliance more accessible for individuals and families.

What is Generative AI? – Everything you need know incl. Meaning, Models – Source morethandigital.info

History and Myths Surrounding the Standard Deduction

The standard deduction has a rich history, with its roots dating back to the early 1900s. Initially implemented to simplify tax filing, it has undergone several revisions over the decades. One common myth is that the standard deduction is only beneficial for low-income earners. However, the revised rates for 2023 demonstrate that it can provide significant tax savings for individuals and families across all income levels.

Microsoft Office Visio 2019 Download Logo Icon Png Sv – vrogue.co – Source www.vrogue.co

Unveiling the Hidden Secrets of the Standard Deduction

Beyond its basic function, the standard deduction offers hidden secrets that can further enhance tax savings. For instance, taxpayers age 65 and older receive an additional standard deduction amount. Additionally, individuals who are blind or have certain disabilities may qualify for further deductions. Understanding these nuances can maximize your tax savings and ensure you are claiming all eligible deductions.

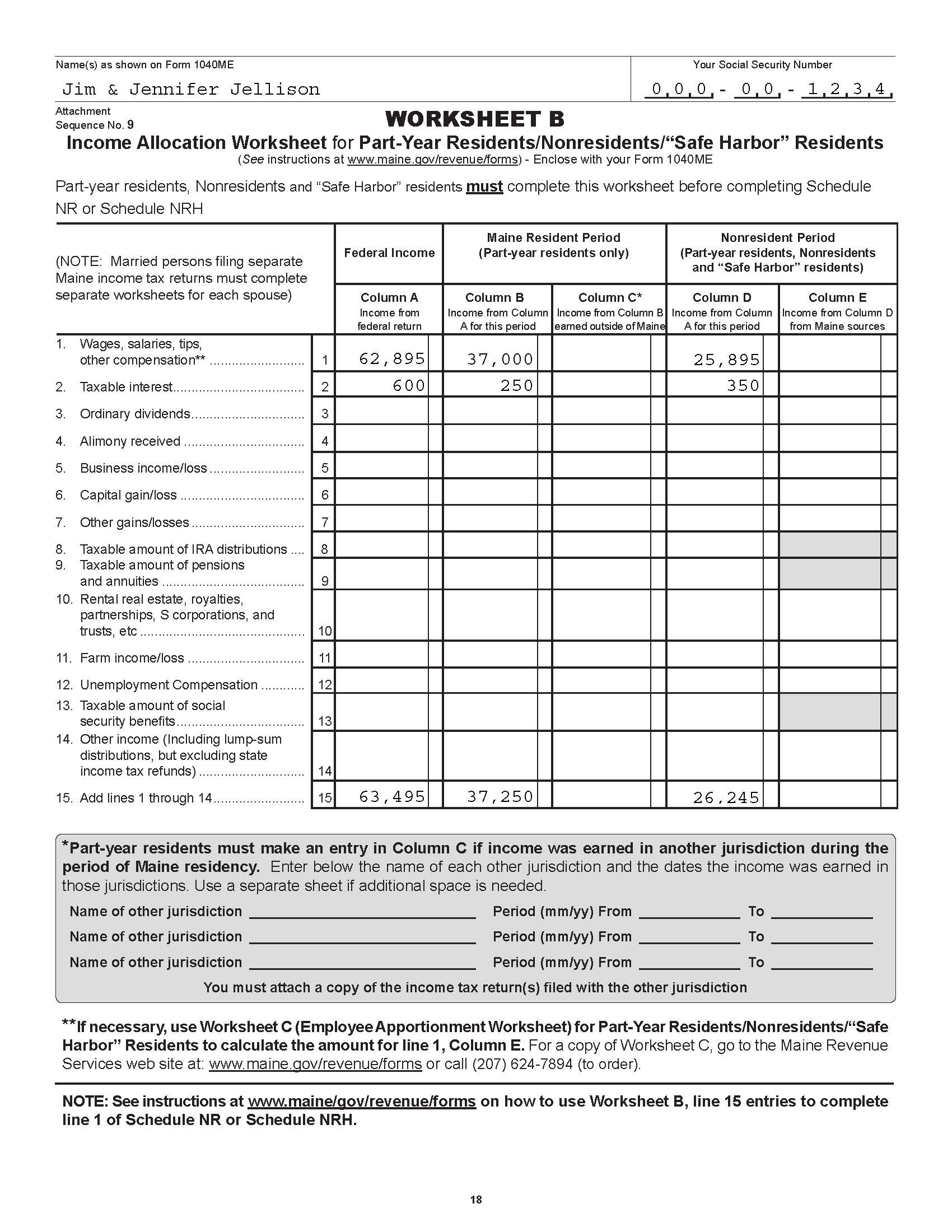

Tax And Deduction Worksheet – Source learningcampusschulz.z1.web.core.windows.net

Expert Recommendations for Maximizing Standard Deduction Benefits

To fully leverage the benefits of the standard deduction, consider these expert recommendations:

- Estimate your standard deduction: Determine if the standard deduction or itemizing deductions would provide greater tax savings based on your estimated expenses.

- Plan significant expenses strategically: If you anticipate substantial expenses in a given year, consider bunching them together to exceed the standard deduction threshold and itemize deductions in that year.

- Consider your filing status: The standard deduction varies based on your filing status. Choose the filing status that optimizes your tax savings.

By implementing these strategies, you can maximize the tax savings associated with the standard deduction.

.jpg?width=3333&name=tax graphic_2020 (1).jpg)

What to Expect When Filing Your Taxes This Year – Source blog.churchillmortgage.com

Standard Deduction: A Detailed Exploration

Understanding the intricate details of the standard deduction is crucial for optimizing tax savings. Factors such as age, marital status, and dependency status can influence the applicable standard deduction amount. Consulting a tax professional or utilizing tax software can provide personalized guidance based on your specific circumstances.

Nyu State And Local Tax Institute 2024 – Tiff Shandra – Source torriewkevyn.pages.dev

Tips for Navigating the Standard Deduction Labyrinth

To simplify the process of claiming the standard deduction, here are some practical tips:

- Keep accurate records: Maintain receipts and documentation of any expenses you may itemize in the future.

- Utilize tax software or consult a professional: These resources can assist in calculating your standard deduction and determining if itemizing deductions is more advantageous.

- Stay informed about tax law changes: The standard deduction rates and rules are subject to periodic adjustments. Stay updated on any changes to ensure you are claiming the most up-to-date deduction amounts.

By following these tips, you can confidently navigate the complexities of the standard deduction and maximize your tax savings.

Standard Deduction: A Deeper Dive

The standard deduction is a fundamental concept in the US tax system, impacting the tax liability of millions of individuals and families. By understanding the intricacies of the standard deduction, taxpayers can make informed decisions about their tax filing strategies and optimize their tax savings.

Fun Facts about the Standard Deduction

Did you know?

- The standard deduction was introduced in 1913 as part of the first federal income tax law.

- The standard deduction has undergone numerous adjustments over the years to account for inflation and changes in the tax code.

- The standard deduction is not available to non-resident aliens or individuals who file using Form 1040-NR.

These fun facts add depth to our understanding of the standard deduction and its significance in the US tax system.

How to Leverage the Standard Deduction Wisely

By employing strategic tax planning techniques, you can harness the power of the standard deduction to reduce your tax liability. Here’s how:

- Maximize your contributions to retirement accounts: Contributions to 401(k), 403(b), and IRA accounts can reduce your taxable income, potentially increasing your standard deduction.

- Utilize tax credits: Tax credits directly reduce your tax liability, dollar for dollar. Explore eligible tax credits to further minimize your tax burden.

- Consider tax-advantaged investments: Investments in municipal bonds or qualified dividend-paying stocks can provide tax-free or reduced-tax income, enhancing your overall tax savings strategy.

By implementing these tactics, you can effectively leverage the standard deduction and minimize your tax liability.

What If the Standard Deduction Doesn’t Cut It?

In certain situations, itemizing deductions may be more beneficial than claiming the standard deduction. Here are some instances:

- High medical expenses: If your medical expenses exceed 7.5% of your adjusted gross income (AGI), itemizing deductions may provide greater tax savings.

- Significant charitable contributions: Generous charitable donations can push you over the standard deduction threshold, making itemizing deductions more advantageous.

- Homeownership with mortgage interest and property taxes: Homeowners with substantial mortgage interest and property tax payments may benefit from itemizing deductions.

If you meet any of these criteria, carefully compare the standard deduction with itemized deductions to determine the best strategy for your tax situation.

Standard Deduction: A Comprehensive List

To provide a comprehensive overview of the standard deduction, here’s a listicle summarizing key points:

- The standard deduction is a specific amount you can subtract from your taxable income before calculating taxes.

- The standard deduction rates vary based on your filing status (single, married filing jointly, etc.).

- The standard deduction is typically more beneficial than itemizing deductions, especially if your itemized deductions are less than the standard deduction amount.

- Factors such as age, marital status, and dependency status can affect your standard deduction amount.

- Strategic tax planning techniques can help you optimize your standard deduction and minimize your tax liability.

This listicle serves as a concise reference guide for understanding the standard deduction and its implications.

Questions and Answers

Q: What is the standard deduction for married couples filing jointly in 2023?

A: The standard deduction for married couples filing jointly in 2023 is $27