It’s that time of year again: the 2024 Parking And Transit FSA Limits: Essential Guide For Employers And Employees is here. If you’re an employer or employee who uses a parking or transit FSA, it’s important to be aware of the changes for 2024. In this blog post, we’ll provide an overview of the new limits, explain what they mean for you, and offer some tips on how to make the most of your FSA.

2024 Parking And Transit FSA Limits: Essential Guide For Employers And Employees

The 2024 Parking And Transit FSA Limits: Essential Guide For Employers And Employees are designed to help you save money on your commuting costs. With a parking FSA, you can set aside pre-tax dollars to pay for parking expenses, such as monthly parking passes or daily parking fees. With a transit FSA, you can set aside pre-tax dollars to pay for public transportation expenses, such as bus passes or train tickets.

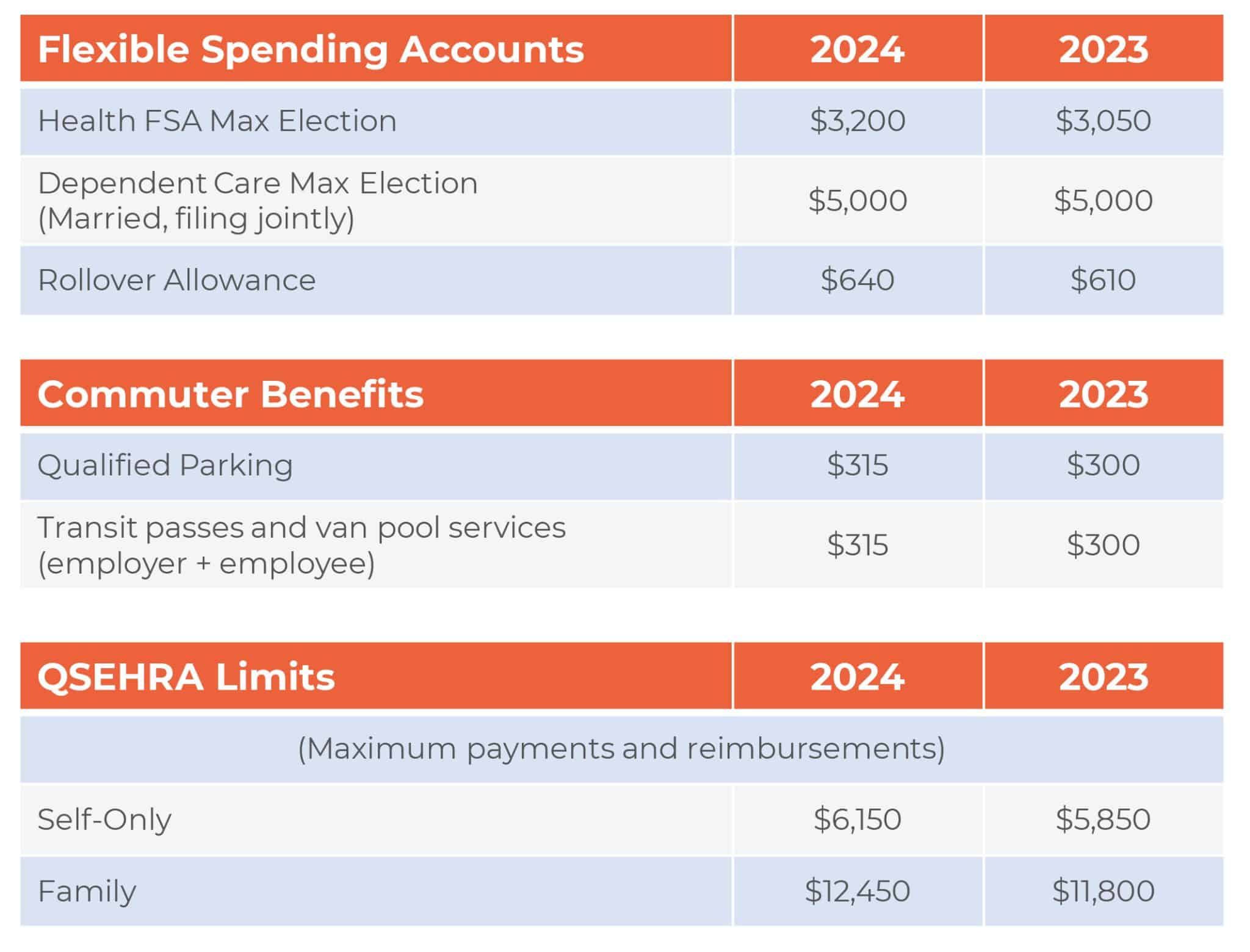

The 2024 Parking And Transit FSA Limits: Essential Guide For Employers And Employees are as follows:

- Parking FSA: $300 per month

- Transit FSA: $300 per month

Irs Parking Limit 2024 – Bert Marina – Source michelinewzara.pages.dev

If you use both a parking FSA and a transit FSA, the total amount you can contribute to both accounts is $300 per month.

What Do The New Limits Mean For You?

The new limits mean that you can save more money on your commuting costs. If you contribute the maximum amount to both a parking FSA and a transit FSA, you can save up to $7,200 per year. This can add up to big savings over time.

Just In: 2024 Benefit Limits – HRPro – Source www.hrpro.com

If you’re not currently using a parking or transit FSA, now is a great time to start. With the new limits, you can save even more money on your commuting costs.

How To Make The Most Of Your FSA

Here are a few tips on how to make the most of your FSA:

- Contribute the maximum amount that you can afford. The more you contribute, the more you’ll save.

- Use your FSA funds for eligible expenses only. Parking and transit expenses are the only eligible expenses for parking and transit FSAs.

- Keep track of your expenses. You’ll need to keep track of your eligible expenses in order to reimburse yourself from your FSA.

Irs Dependent Care Fsa Limits 2024 – Nissa Leland – Source kelleywdeonne.pages.dev

By following these tips, you can make the most of your FSA and save money on your commuting costs.

Conclusion

The 2024 Parking And Transit FSA Limits: Essential Guide For Employers And Employees are a great way to save money on your commuting costs. If you’re not currently using a parking or transit FSA, now is a great time to start. With the new limits, you can save even more money on your commuting costs.