BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

Navigating healthcare costs can be a daunting task. Understanding BCBSIL PPO plan coverage details and 2023 cost comparisons can empower you to make informed decisions about your healthcare. This guide will explore the ins and outs of BCBSIL PPO plans, helping you gain clarity and confidence in your healthcare choices.

The rising cost of healthcare is a significant concern for many, making it imperative to carefully consider insurance coverage options. Understanding the details of BCBSIL PPO plans, including coverage, benefits, and costs, is crucial for making informed choices that align with your healthcare needs and financial situation.

This guide will provide a comprehensive overview of BCBSIL PPO plan coverage details and 2023 cost comparisons, empowering you to make informed decisions. By delving into the specifics of PPO plans, including covered services, premiums, deductibles, and out-of-pocket expenses, you can gain a clear understanding of your coverage and make choices that align with your healthcare goals.

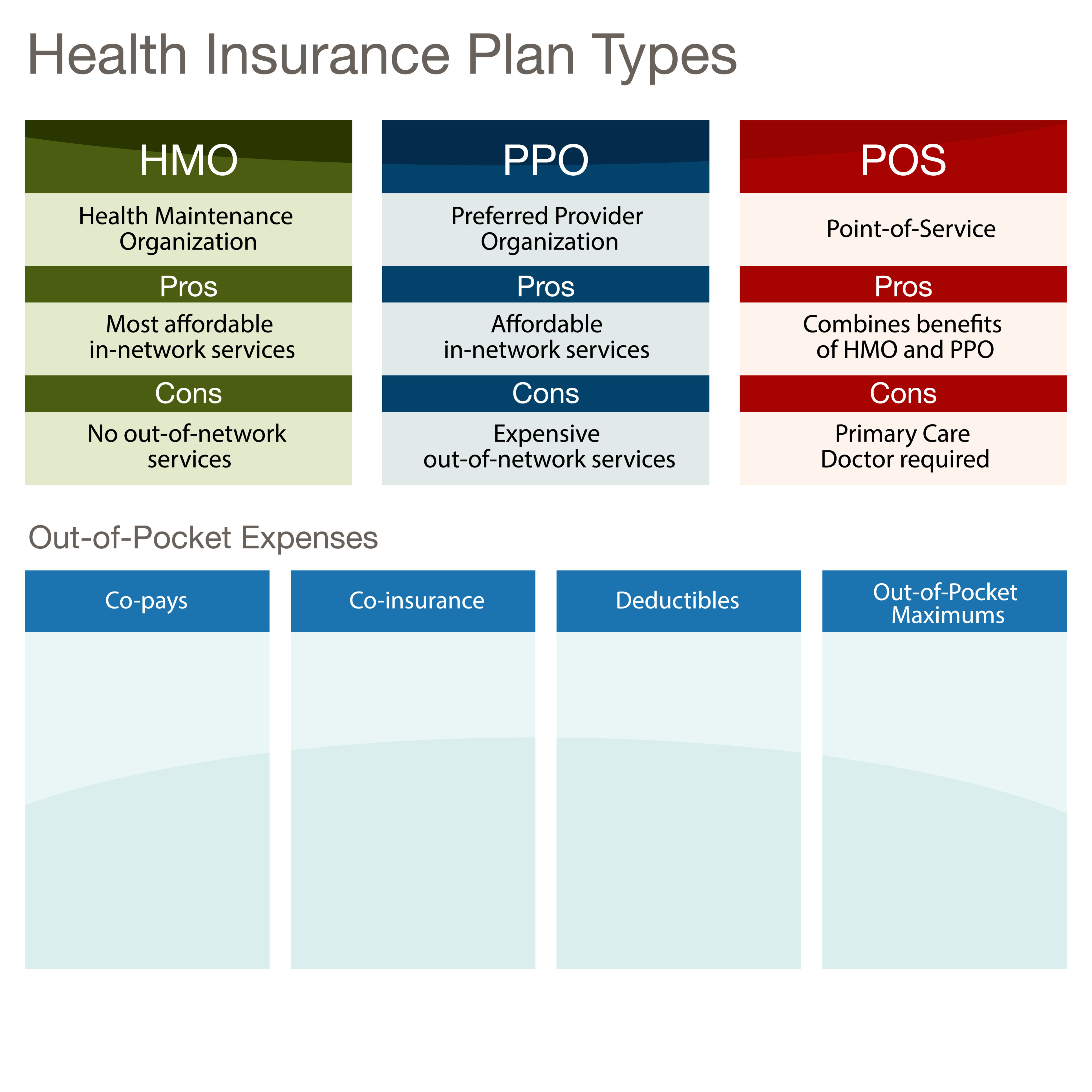

Whats a pos – inkgasw – Source inkgasw.weebly.com

BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

BCBSIL PPO (Preferred Provider Organization) plans offer members access to a network of preferred providers, including doctors, hospitals, and other healthcare professionals. These plans provide flexibility and choice, allowing members to seek care from both in-network and out-of-network providers while offering varying levels of coverage and cost-sharing.

When enrolling in a BCBSIL PPO plan, it’s essential to carefully review the plan details to understand the coverage, benefits, and costs associated with your chosen plan. Each plan may have different deductibles, copayments, and coinsurance rates, which can impact your out-of-pocket expenses.

To make informed decisions about your healthcare coverage, it’s advisable to compare different BCBSIL PPO plans and consider factors such as monthly premiums, deductibles, and out-of-pocket maximums. This comparison can help you select the plan that best meets your healthcare needs and financial situation.

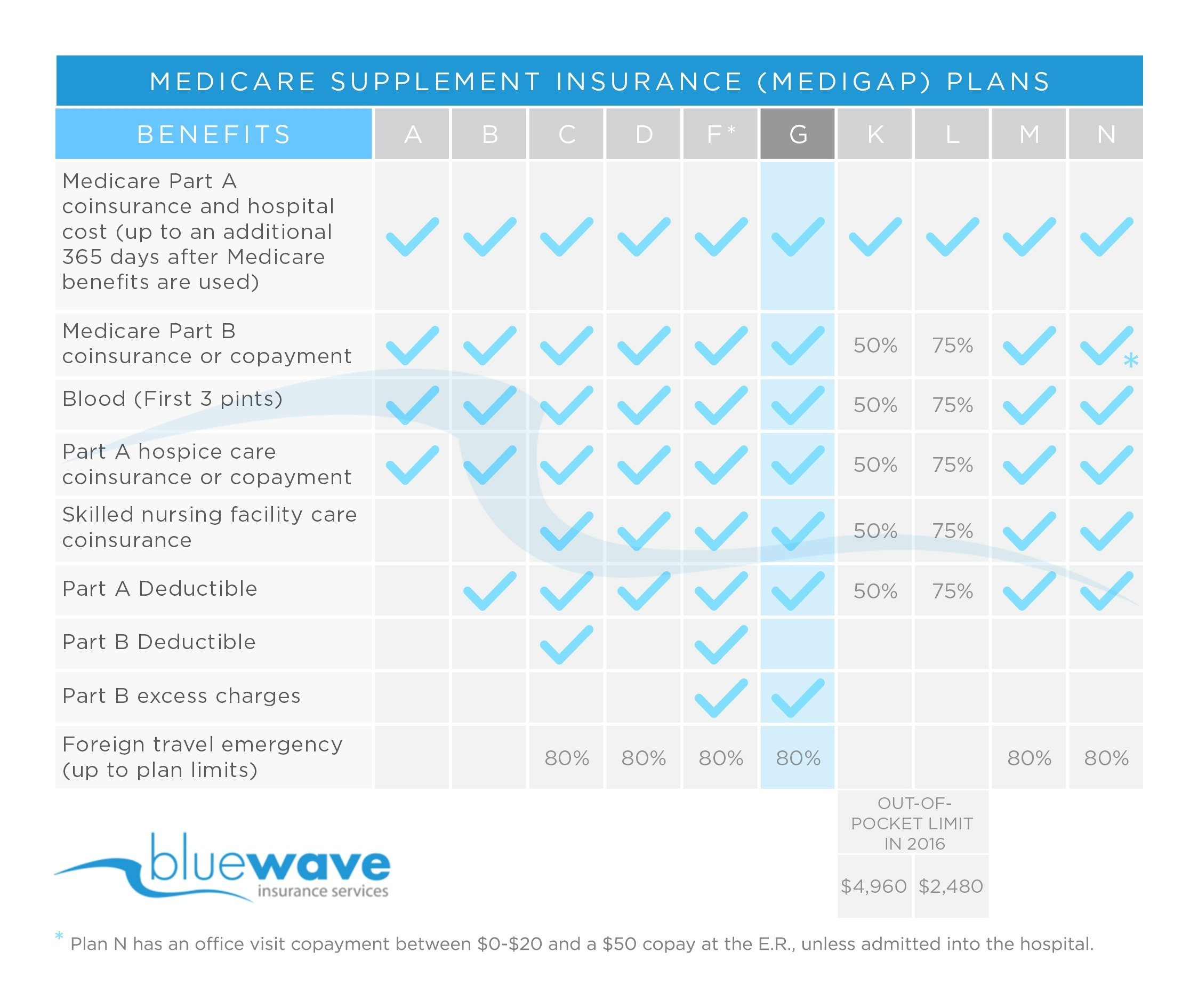

Does Plan N Cover Medicare Deductible – MedicareTalk.net – Source www.medicaretalk.net

History and Myths of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

BCBSIL PPO plans have a rich history, dating back to the early days of managed care. Over the years, these plans have evolved to meet the changing needs of healthcare consumers.

One common myth surrounding BCBSIL PPO plans is that they are more expensive than other types of health insurance plans. However, this is not always the case. While PPO plans may have higher premiums than HMOs, they often offer greater flexibility and choice, which can result in lower out-of-pocket costs in the long run.

Another myth is that PPO plans only cover care from in-network providers. While it is true that in-network providers offer the most comprehensive coverage, PPO plans also provide coverage for out-of-network care, albeit at a higher cost-sharing rate.

What is a PPO Plan? Health Insurance Explained – Zencare Blog – Source blog.zencare.co

Hidden Secrets of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

BCBSIL PPO plans offer a range of benefits and coverage options that may not be readily apparent. These hidden secrets can provide significant value and savings to members.

One hidden secret is that many BCBSIL PPO plans offer preventive care benefits, such as annual physicals, screenings, and immunizations, at no additional cost. These benefits can help members maintain good health and avoid costly medical expenses in the future.

Another hidden secret is that PPO plans often provide discounts on prescription drugs and medical equipment. Members can access these discounts through the plan’s pharmacy benefit manager or by using a preferred provider network.

HMO vs. PPO: Differences, Similarities, and How to Choose – GoodRx – Source www.goodrx.com

Recommendation of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

When choosing a BCBSIL PPO plan, it’s essential to consider several factors, including your healthcare needs, financial situation, and lifestyle.

If you anticipate frequent visits to healthcare providers, a plan with a lower deductible may be a good option. However, if you are generally healthy and do not expect to incur significant medical expenses, a plan with a higher deductible and lower monthly premium may be more cost-effective.

It’s also important to consider your preferred providers and whether they are in-network with the plan you are considering. If you have a specific doctor or specialist you prefer to see, you may want to choose a plan that includes them in its network.

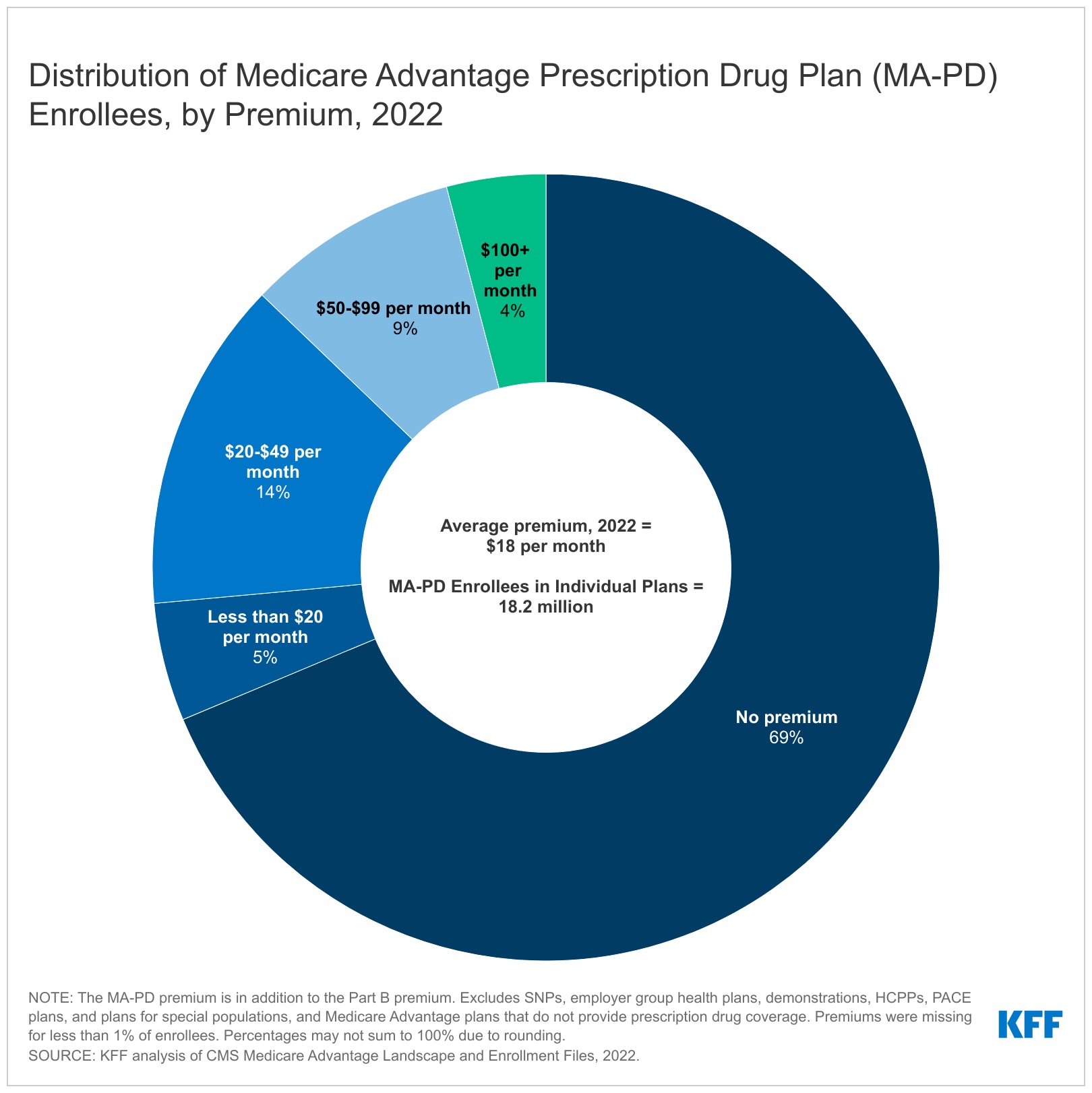

Medicare Advantage in 2022: Premiums, Out-of-Pocket Limits, Cost – Source www.kff.org

BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

BCBSIL PPO plans offer a wide range of coverage options, including:

- Inpatient and outpatient hospital care

- Doctor visits

- Prescription drugs

- Mental health and substance abuse treatment

- Preventative care

The specific coverage details will vary depending on the plan you choose. It’s important to carefully review the plan documents to understand what is and is not covered.

Why Choose a PPO Plan? – Easy Affordable Health Insurance – Source www.ezaffordablehealthinsurance.com

Tips of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

Here are a few tips to help you get the most out of your BCBSIL PPO plan:

- Use in-network providers whenever possible. This will save you money on your out-of-pocket costs.

- Take advantage of preventive care benefits. These benefits can help you stay healthy and avoid costly medical expenses in the future.

- Ask your doctor about generic drugs. Generic drugs are often just as effective as brand-name drugs, but they cost less.

- Consider using a Health Savings Account (HSA). HSAs allow you to save money for qualified medical expenses on a pre-tax basis.

Anthem Silver Ppo Plan – sportcarima – Source sportcarima.blogspot.com

BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

The cost of BCBSIL PPO plans varies depending on several factors, including:

- Your age

- Your location

- Your health status

- The plan you choose

You can get an estimate of your monthly premium by using BCBSIL’s online quoting tool. You can also call BCBSIL’s customer service number to speak with a representative.

Medicare Medigap Plans Comparison Chart – Senior HealthCare Solutions – Source seniorhealthcaresolutions.com

Fun Facts of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

Here are a few fun facts about BCBSIL PPO plans:

- BCBSIL is the largest health insurer in Illinois.

- BCBSIL has been in business for over 80 years.

- BCBSIL offers a variety of PPO plans to choose from.

- BCBSIL PPO plans are accepted by a wide range of healthcare providers.

- BCBSIL PPO plans offer a variety of benefits, including preventive care, prescription drug coverage, and mental health coverage.

How to Choose an Insurance Plan For Your Company – What Your Boss Thinks – Source www.whatyourbossthinks.com

How to BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

If you are considering enrolling in a BCBSIL PPO plan, there are a few things you can do to get started:

- Compare plans and costs. Use BCBSIL’s online quoting tool to get an estimate of your monthly premium for different plans.

- Talk to your doctor. Ask your doctor if they are in-network with BCBSIL PPO plans.

- Enroll in a plan. You can enroll in a BCBSIL PPO plan online, by phone, or through a broker.

How to Choose a Health Insurance Plan from an Employer – JobSage – Source www.jobsage.com

What If BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

If you are not satisfied with your BCBSIL PPO plan, you may have the option to switch plans or disenroll from your coverage.

To switch plans, you will need to contact BCBSIL and request a change of plan. You may be able to switch plans during the open enrollment period or if you have a qualifying life event, such as getting married or having a baby.

To disenroll from your coverage, you will need to submit a written request to BCBSIL. You can disenroll from your coverage at any time, but you may be subject to a termination fee.

Listicle of BCBSIL PPO Plan Coverage Details And 2023 Cost Comparison

Here is a listicle of the key points to remember about BCBSIL PPO plans:

- BCBSIL PPO plans offer a wide range of coverage options