Navigating the complex world of Form 144 can be daunting. Let’s break down the intricacies and provide a comprehensive guide to help you sail through the filing requirements.

What’s Form 144 All About?

When it comes to selling securities acquired through certain transactions, such as stock options or employee stock purchase plans, Form 144 is your key to ensuring compliance with SEC regulations. It helps safeguard against violating insider trading rules and protect your financial interests.

Hybrid and Derivative Securities – Review the types of leases, leasing – Source www.studocu.com

Form 144: A Closer Look

Form 144 is a crucial document that enables you to sell restricted or control securities publicly. By filing Form 144, you’re essentially informing the SEC of your intention to sell these securities and providing detailed information about the transaction. This transparency helps maintain market integrity and prevents potential conflicts of interest.

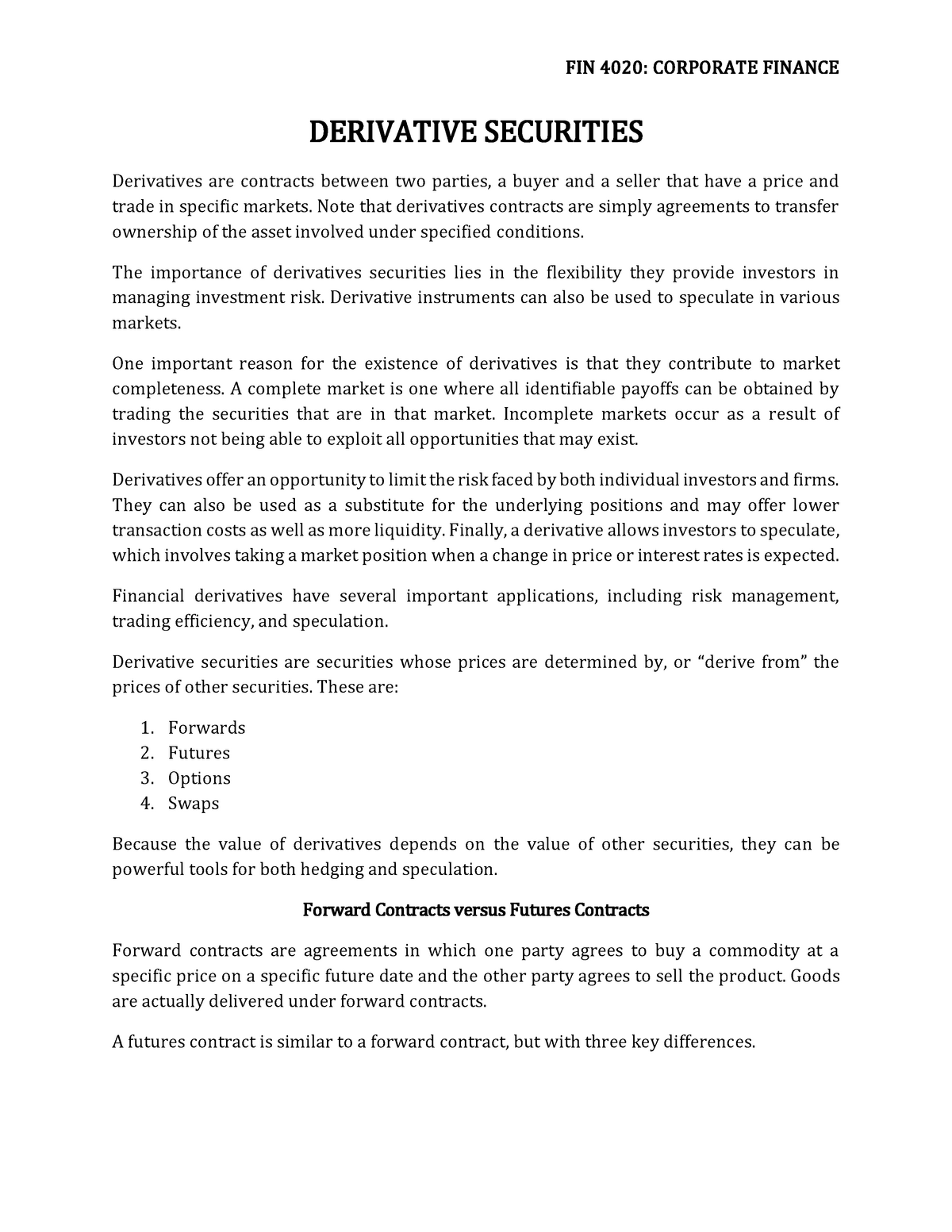

Derivative Securities Subject Guide – FNCE Derivative Securities – Source www.studocu.com

History and Myths

Form 144 has a rich history, dating back to the aftermath of insider trading scandals in the 1960s. It was designed to address concerns about selective disclosure of material information and ensure fair market practices. Over time, several myths have emerged around Form 144, such as the belief that it’s only for large institutions or that it’s an overly complex process. However, these myths are far from the truth. Form 144 is accessible and manageable for individuals and small businesses alike.

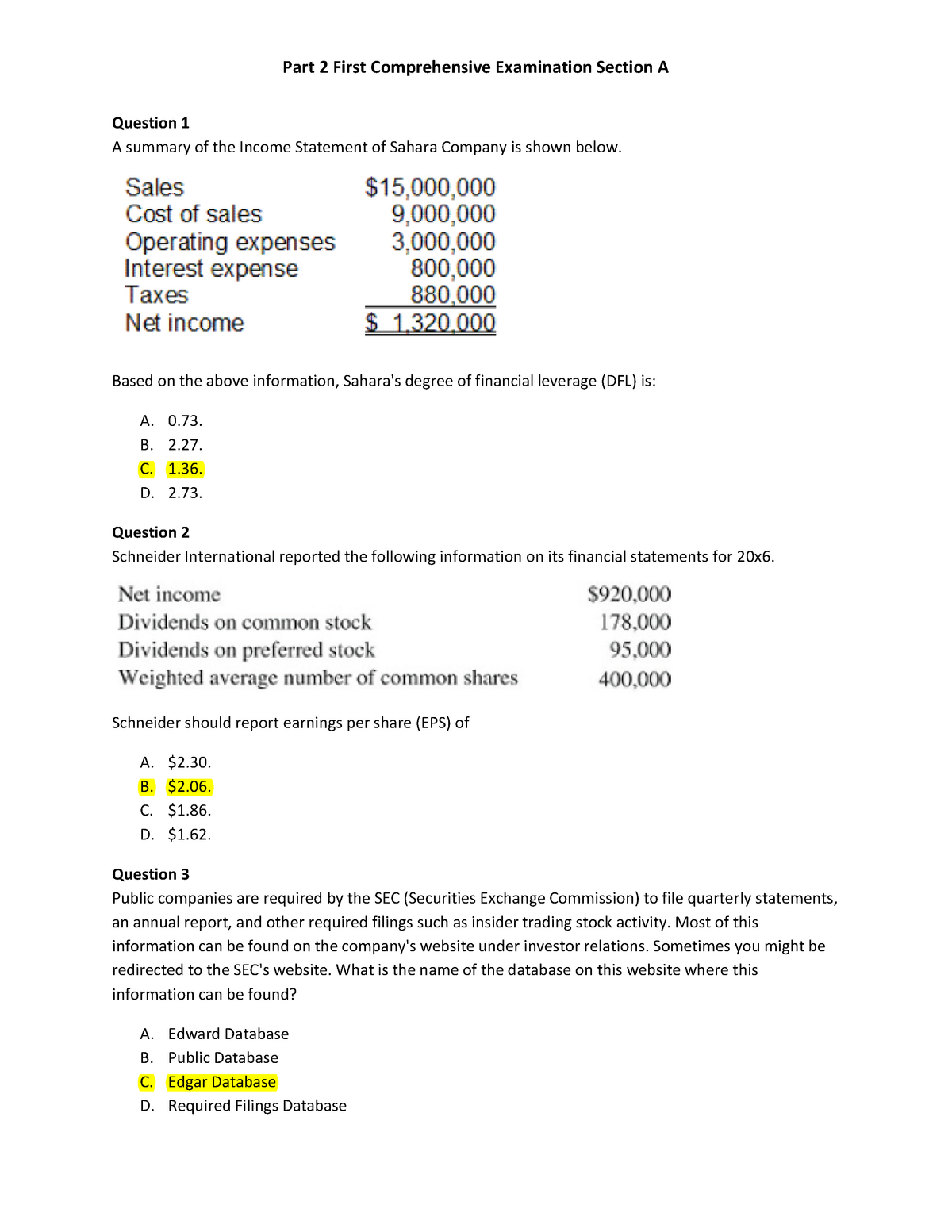

Part 2 First Comprehensive Examination Section A Qs 25 Sept 2021 with – Source www.studocu.com

Hidden Secrets Unveiled

Behind the seemingly complex facade of Form 144 lies a treasure trove of hidden secrets. One such secret is the ability to use it to sell not only common stock but also convertible debt, warrants, and other types of equity-linked securities. Understanding these nuances can significantly enhance your flexibility in managing your investment portfolio.

SEC Filing | Hertz Global Holdings, Inc. – Source ir.hertz.com

Expert Recommendations

Navigating Form 144 can be a breeze with the right guidance. Here are some expert recommendations:

- Seek professional advice from an experienced securities attorney to ensure compliance and avoid potential pitfalls.

- File Form 144 promptly to avoid delays in selling your securities.

- Stay informed about any changes or updates to Form 144 requirements to maintain compliance.

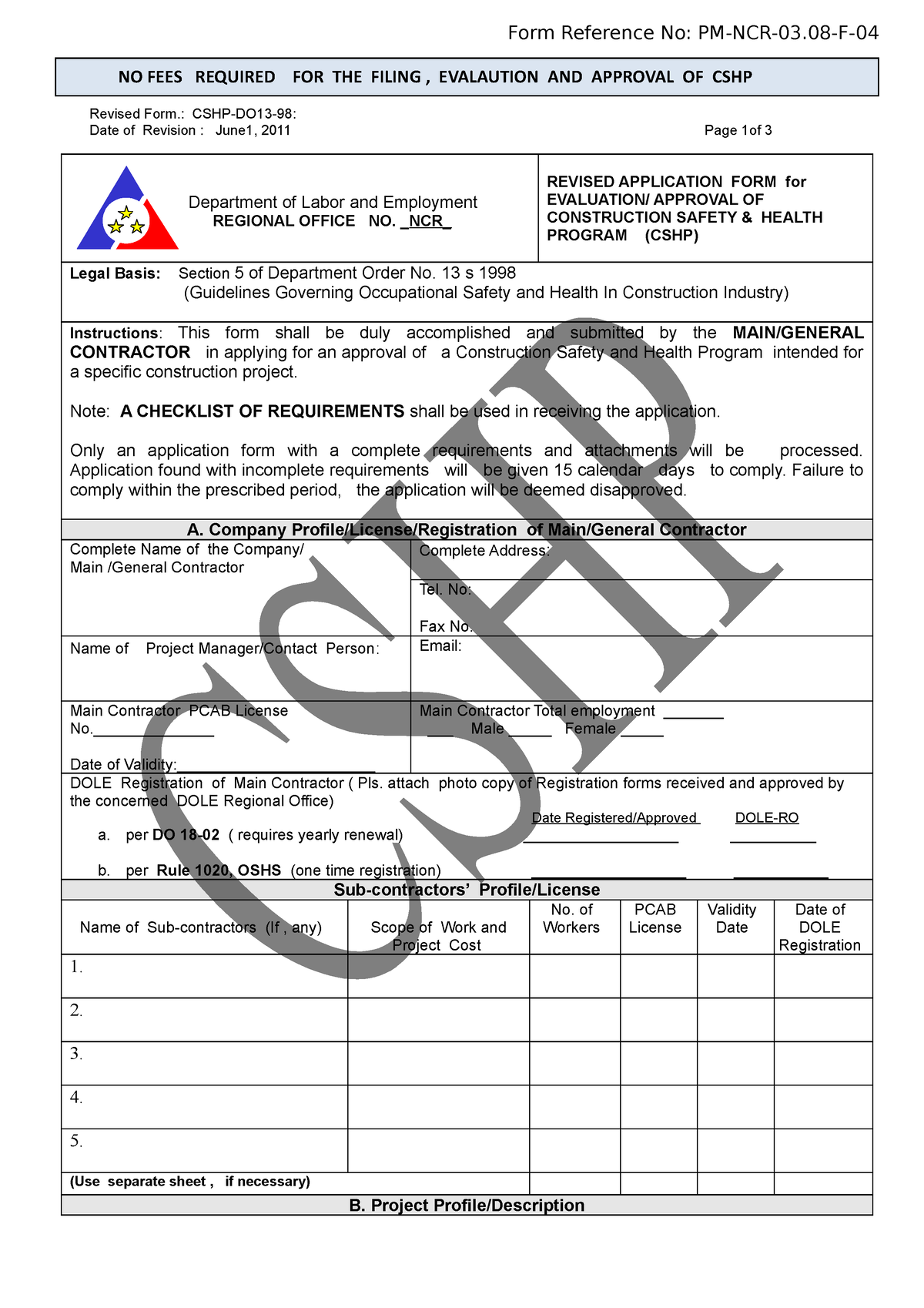

Comprehensive CSHP Application Form – Form Reference No: PM-NCR-03-F – Source www.studocu.com

Filing Form 144: A Step-by-Step Guide

Filing Form 144 doesn’t have to be an enigma. Follow these simple steps:

1. Gather the necessary information and documents.

2. Determine the type of Form 144 you need to file (Form 144 or Form 144A).

3. Complete the form accurately and thoroughly.

4. File the form with the SEC through EDGAR (Electronic Data Gathering, Analysis, and Retrieval system).

Form 144 Sec Form 1147 Fill Out Sign Online And Downl – vrogue.co – Source www.vrogue.co

Tips and Tricks for Success

Mastering Form 144 requires a few insider tips:

1. Use the SEC’s EDGAR Filer Manual as your go-to resource for guidance.

2. Familiarize yourself with the different types of Form 144 available.

3. Don’t hesitate to consult with an expert if you have any uncertainties.

What does it mean to think liad ajhdh lalajd ad – 1 October 2012 What – Source www.studocu.com

Form 144: A Comprehensive Guide for Non-Experts

Understanding Form 144 can be simplified by breaking it down into key concepts:

1. It’s a legal document that allows you to sell restricted or control securities publicly.

2. It provides transparency to the SEC about your intention to sell these securities.

3. It’s not as complex as it may seem, especially with the right guidance.

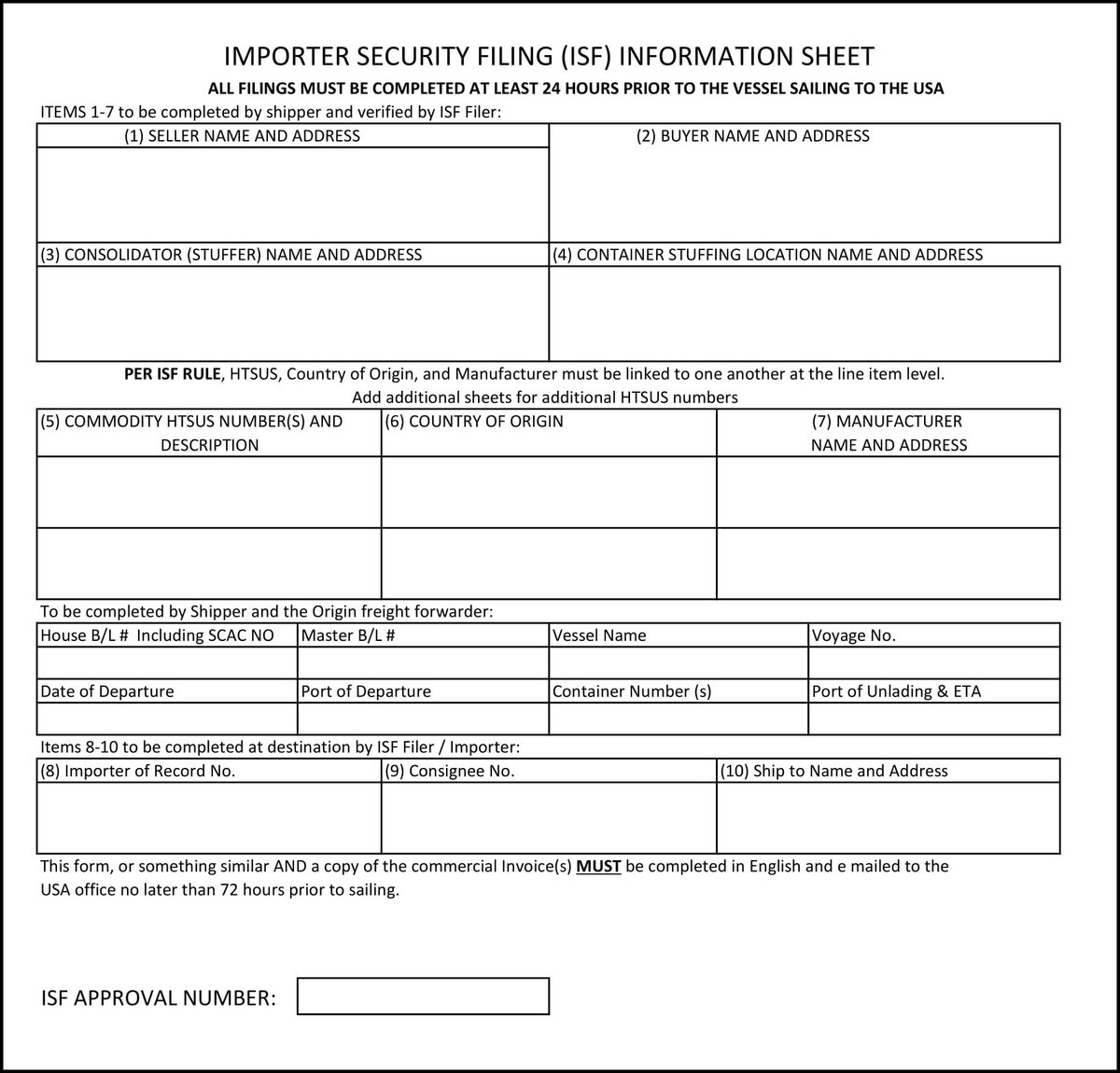

10 2 Isf Form Template – Source templates.rjuuc.edu.np

Fun Facts of Form 144

Did you know?

1. Form 144 was originally created in 1972 as part of Rule 144 under the Securities Act of 1933.

2. It has undergone several revisions and updates over the years to enhance its effectiveness.

3. Filing Form 144 can help you avoid hefty fines and other penalties for non-compliance.

FIN 4020 WK 11 Derivatives Securities – DERIVATIVE SECURITIES – Source www.studocu.com

How to Ace Form 144

Here’s a winning strategy for mastering Form 144:

1. Educate yourself about the rules and regulations surrounding Form 144.

2. Prepare all the necessary documents and information well in advance.

3. Don’t be afraid to ask for professional assistance if needed.

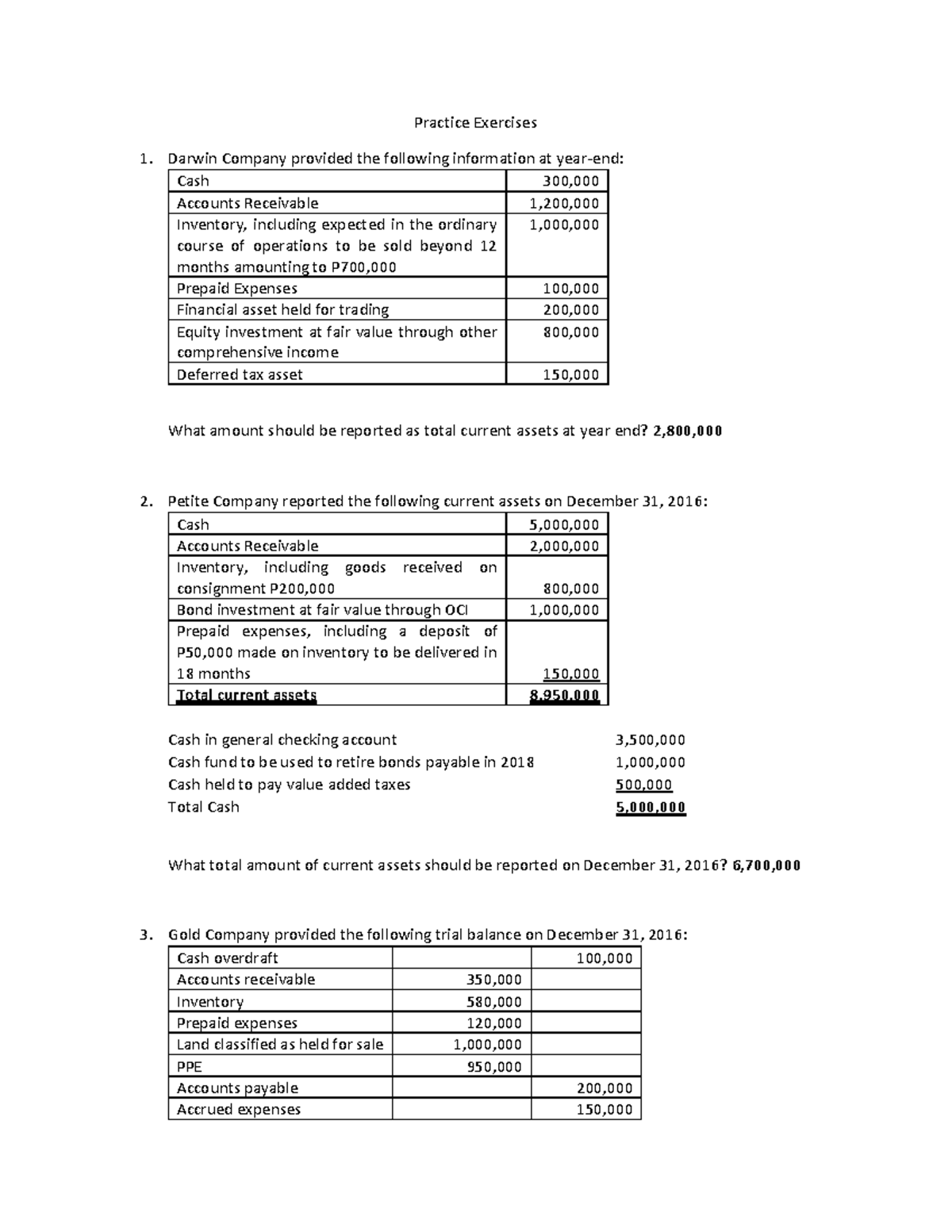

Practice Exercises – Financial Position and Financial Performance – Source www.studocu.com

What If? Scenarios

Navigating Form 144 can bring forth various “what if” scenarios. Here are a few to consider:

1. What if I make a mistake on Form 144?

2. What if I don’t file Form 144 on time?

3. What if I sell more securities than I disclosed on Form 144?

Listicle of Form 144

To help you conquer Form 144, here’s a concise listicle:

1. Form 144 is a crucial document for selling restricted securities publicly.

2. Filing Form 144 ensures compliance with SEC regulations and protects your financial interests.

3. Seek professional guidance, file promptly, and stay updated on Form 144 requirements.

4. Utilize the SEC’s EDGAR Filer Manual as a valuable resource.

5. Remember that Form 144 is not as complex as it may seem.

Question and Answer

Conclusion of Form 144: A Comprehensive Guide To Filing Requirements For Derivative Securities

Navigating the intricacies of Form 144 can be daunting at first, but with the right approach, it becomes manageable. By understanding the purpose, requirements, and nuances of Form 144, you can confidently safeguard your financial interests while adhering to SEC regulations. Remember that seeking professional advice, staying informed, and maintaining meticulous attention to detail will empower you to master Form 144 and unlock its full potential.