Are you worried about losing your income if you become disabled? Long-term disability insurance can help protect you financially if you’re unable to work due to a covered disability.

What is Long-Term Disability Insurance?

What You Need To Know About Long Term Disability (LTD) Claims – Source www.hshlawyers.com

Long-term disability insurance is a type of insurance that provides income protection if you’re unable to work due to a covered disability. This can include a physical or mental impairment that prevents you from performing your job duties.

How Does Long-Term Disability Insurance Work?

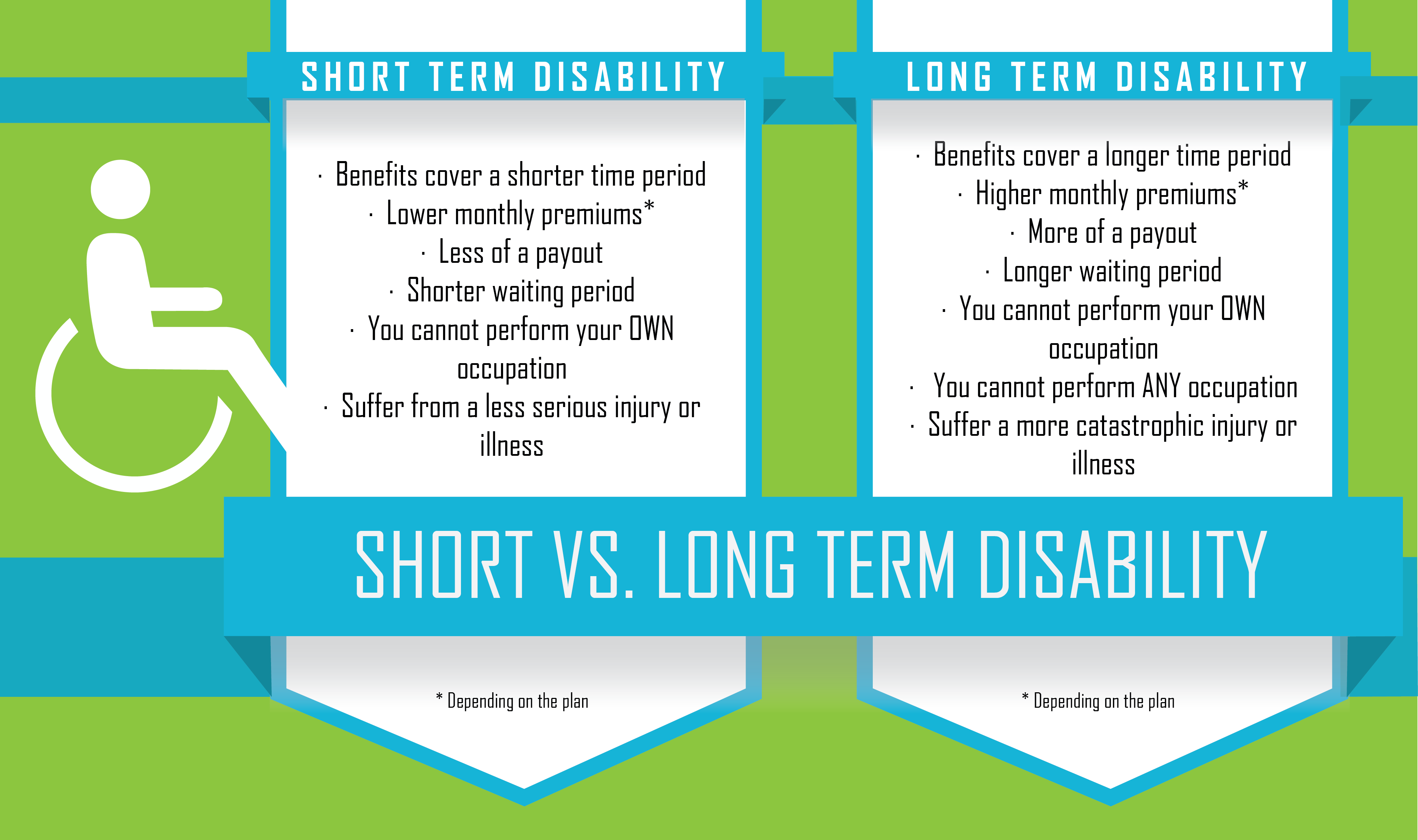

A Quick Guide to The Different Types of Disability Insurance – Source www.actionlifemedia.com

Long-term disability insurance policies typically have a waiting period before benefits start. This waiting period can range from 30 days to 180 days. Once the waiting period is over, you’ll receive a monthly benefit that is a percentage of your income. The benefit amount and duration of benefits vary depending on the policy you purchase.

Why You Need Long-Term Disability Insurance

What Do Disability Insurance Policies Usually Cover? | KBI – Source www.kbibenefits.com

Long-term disability insurance can provide financial protection if you become disabled and unable to work. This can help you pay for living expenses, such as rent or mortgage payments, car payments, and food. It can also help you cover medical expenses that aren’t covered by your health insurance.

## Personal Experience with Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

Short Term Disability Insurance Louisiana – Life Insurance Quotes – Source davida.davivienda.com

I was in a car accident a few years ago and was unable to work for several months. I was grateful that I had long-term disability insurance, which provided me with a monthly income while I was recovering. Without this insurance, I would have had a difficult time paying my bills and supporting my family.

Long-term disability insurance is a valuable safety net that can help you protect your income if you become disabled. I encourage everyone to consider purchasing this type of insurance.

## What is Covered by Long-Term Disability Insurance: Protect Your Income With Liberty Mutual?

Voluntary Benefits – Benefits – Northville Public Schools – Source www.northvilleschools.org

Long-term disability insurance typically covers disabilities that prevent you from performing your job duties. This can include physical impairments, such as back injuries, cancer, or heart disease. It can also include mental impairments, such as depression, anxiety, or bipolar disorder.

The specific coverage provided by your policy will vary depending on the policy you purchase. Be sure to read your policy carefully to understand what is covered and what is not.

## History and Myth of Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

The Importance of Long Term Disability Insurance – Mann Lawyers – Source www.mannlawyers.com

Long-term disability insurance has been around for over 100 years. The first policy was issued in 1850 by the Travelers Insurance Company. In the early days, long-term disability insurance was only available to white-collar workers. However, over time, it has become more widely available to all workers.

There are a number of myths about long-term disability insurance. One myth is that it is only for people who have high-paying jobs. This is not true. Long-term disability insurance is available to people of all income levels.

Another myth is that long-term disability insurance is too expensive. This is also not true. There are a number of affordable long-term disability insurance policies available.

## Hidden Secret of Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

Long-Term Disability Insurance: What Is It, and Is It Worth it? | CCK Law – Source cck-law.com

One of the best-kept secrets about long-term disability insurance is that it can be used to supplement your Social Security benefits. If you become disabled and unable to work, you may be eligible for Social Security disability benefits. However, these benefits are often not enough to cover all of your expenses.

Long-term disability insurance can help you bridge the gap between your Social Security benefits and your expenses. This can help you maintain your financial stability while you’re recovering from your disability.

## Recommendation of Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

Disability Insurance During a Pandemic – Small Business Health – Source abbotbenefits.com

I highly recommend that everyone consider purchasing long-term disability insurance. This type of insurance can provide you with financial protection if you become disabled and unable to work. It can help you pay for living expenses, medical expenses, and other costs.

There are a number of different long-term disability insurance policies available. Be sure to shop around and compare policies before you purchase one. Make sure you understand the coverage provided by the policy and the cost of the policy.

### Long-Term Disability Insurance: Protect Your Income With Liberty Mutual: A Smart Investment

A Guide to LongTerm Disability Insurance – RequestLegalHelp.com – Source requestlegalhelp.com

Long-term disability insurance is a smart investment in your financial future. It can help you protect your income and your family’s financial security if you become disabled.

Don’t wait until it’s too late. Purchase long-term disability insurance today.

## Tips for Choosing the Right Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

Long-Term vs Short-Term Disability Insurance In D.C. – Source donahoekearney.com

Here are a few tips for choosing the right long-term disability insurance policy:

- Consider your income and expenses. Make sure you purchase a policy that will provide you with enough income to cover your living expenses and other costs.

- Read the policy carefully. Make sure you understand the coverage provided by the policy and the cost of the policy.

- Shop around. Compare policies from different insurance companies before you purchase one.

- Consider your health history and occupation. Some policies may not cover certain disabilities or occupations.

#### How to File a Claim for Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

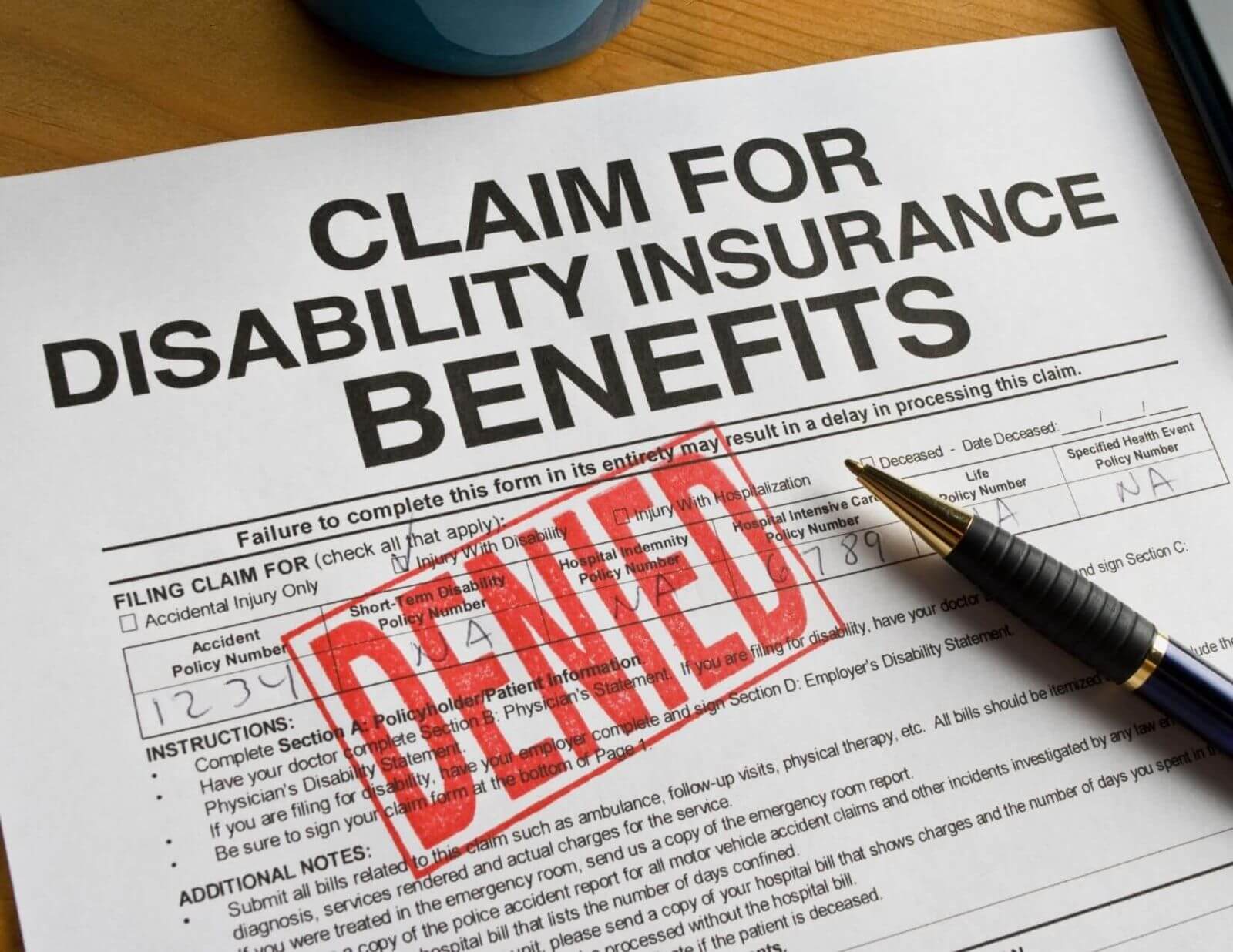

If you become disabled and unable to work, you will need to file a claim for long-term disability benefits. Here are a few tips for filing a claim:

- Contact your insurance company as soon as possible. You will need to provide them with information about your disability and your inability to work.

- Be prepared to provide medical documentation to support your claim. This may include a doctor’s note, medical records, or other documentation.

- Keep track of your expenses. You may be able to recover these expenses from your insurance company.

## Fun Facts of Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

- Long-term disability insurance is the most common type of disability insurance.

- About one in four workers will become disabled for at least three months during their working life.

- The average long-term disability claim lasts for more than two years.

## How to Qualify for Long-Term Disability Insurance: Protect Your Income With Liberty Mutual

To qualify for long-term disability insurance, you must be able to answer yes to the following questions:

- Are you employed?