Maximize Savings and Convenience with Optum Bank’s Commuter Benefits Program

Navigating daily commutes can be a significant financial and logistical challenge for many individuals. Transportation costs can add up quickly, and the inconvenience of traffic can impact productivity and well-being. Fortunately, Optum Bank offers a comprehensive Commuter Benefits Program designed to alleviate these concerns while offering substantial savings and conveniences.

Target Audience

Optum Bank’s Commuter Benefits Program is tailored to organizations and their employees who seek to optimize transportation expenses and streamline commutes. It provides a flexible solution for companies to offer tax-efficient commuter subsidies to their workforce.

Overview of Optum Bank’s Commuter Benefits Program

Optum Bank’s Commuter Benefits Program allows employees to set aside pre-tax income towards eligible expenses related to commuting to and from work. These expenses typically include mass transit, vanpools, and parking. By utilizing pre-tax dollars, participants can significantly reduce their taxable income, leading to potential savings on federal, state, and local taxes.

Optum Logo and symbol, meaning, history, PNG – Source 1000logos.net

Historical Perspective

The concept of commuter benefits programs originated in the 1970s as a way to encourage energy conservation and reduce traffic congestion. Optum Bank has been a pioneer in this field, consistently innovating to offer cutting-edge solutions that meet the evolving needs of commuters.

The Hidden Secret of Optum Bank’s Commuter Benefits Program

The true power of Optum Bank’s Commuter Benefits Program lies in its flexibility and customization options. Employers can tailor the program to suit their specific needs, including setting contribution limits and selecting eligible expenses. This flexibility ensures that the program aligns with the diverse commuting patterns and financial situations of their employees.

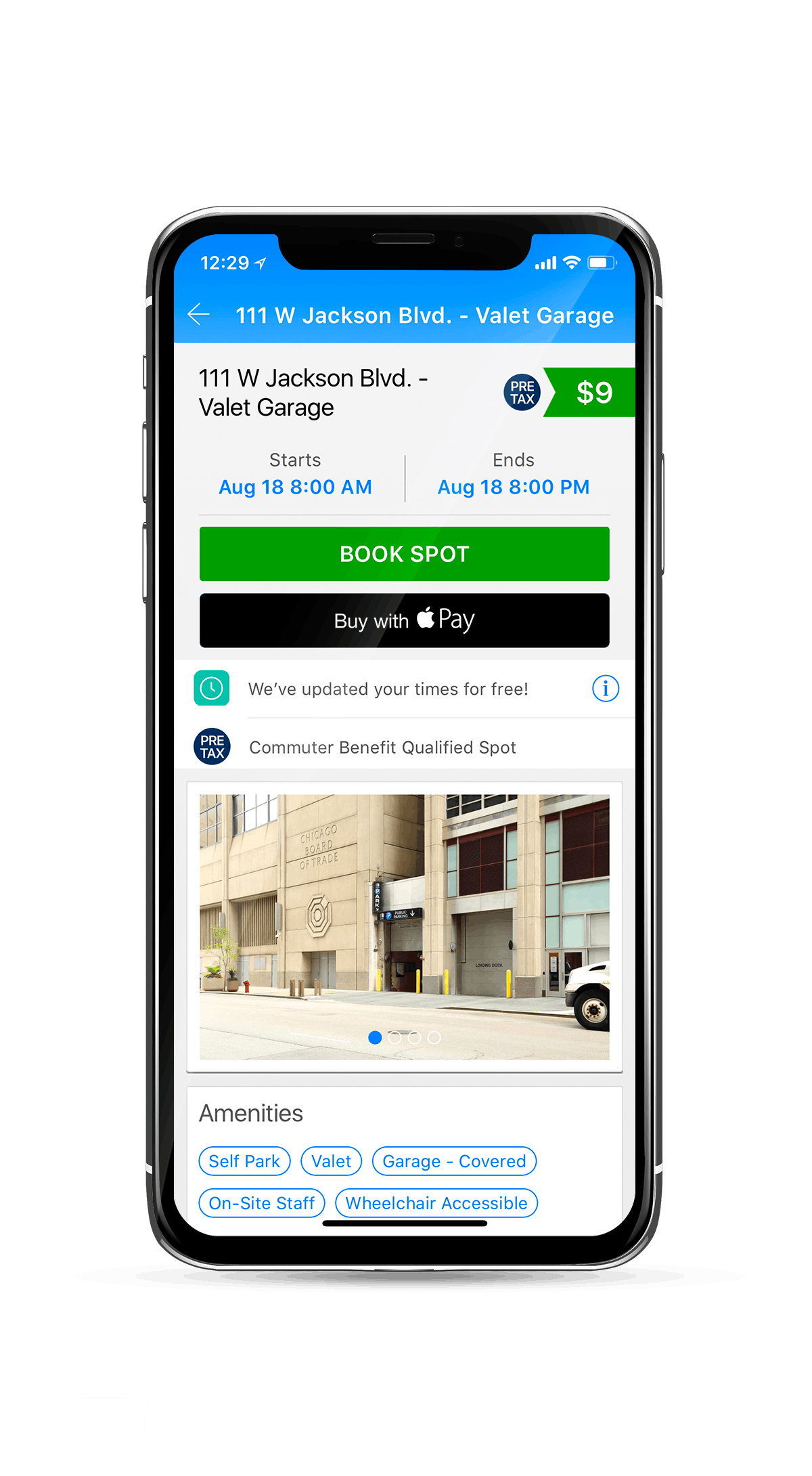

Commuter Benefits | SpotHero – Source spothero.com

Recommendation for Implementation

Organizations considering implementing Optum Bank’s Commuter Benefits Program should carefully review their employee commuting patterns and consult with the Optum Bank team. A thorough analysis will help determine the optimal program design and ensure maximum savings and convenience for all participants.

Explanation of the Program’s Features

Optum Bank’s Commuter Benefits Program operates through a user-friendly online platform. Employees can easily manage their accounts, track expenses, and access valuable resources. The program includes robust reporting tools that provide employers with insights into program utilization and savings achieved.

Tips for Maximizing Savings

To make the most of Optum Bank’s Commuter Benefits Program, participants should fully utilize the pre-tax savings opportunities. It is also advisable to consider exploring alternative commuting options, such as carpooling or using public transportation, which can further reduce expenses.

Maximize your potential – Optum Network – Source partner.optum.com

Benefits for Employees and Employers

The benefits of Optum Bank’s Commuter Benefits Program extend beyond financial savings. Employees gain convenience, flexibility, and peace of mind knowing their commuting needs are supported. For employers, the program enhances employee morale, reduces absenteeism, and contributes to a more sustainable and eco-friendly workplace.

Fun Facts and Trivia

Did you know that Optum Bank’s Commuter Benefits Program has been recognized for its excellence by industry organizations? It has received multiple awards for innovation and customer satisfaction.

How to Join the Commuter Benefits Program

Interested organizations and employees can visit Optum Bank’s website or contact the dedicated Commuter Benefits team to learn more and enroll in the program.

What if My Commute Changes?

Optum Bank’s Commuter Benefits Program allows for flexibility in managing commuting expenses. Employees can easily adjust their contributions and expense claims based on changes in their commute patterns.

What Are Commuter Benefits – Source www.sharemobility.com

Top Ways to Save with the Commuter Benefits Program

1. Take advantage of pre-tax savings to reduce taxable income.

2. Explore alternative commuting options with lower expenses.

3. Consider carpooling or sharing transportation costs with colleagues.

4. Utilize the program’s online platform for convenient account management.

Questions and Answers

A: Savings vary depending on individual commuting expenses and tax brackets.

A: Yes, eligible parking expenses can be reimbursed through the program.

A: Yes, part-time employees may be eligible to participate in the program.

A: Expense claims can be submitted monthly or as often as desired.

What Are Commuter Benefits? | KBI Benefits – Source www.kbibenefits.com

Conclusion of Maximize Savings and Convenience With Optum Bank’s Commuter Benefits Program

Optum Bank’s Commuter Benefits Program offers a comprehensive and cost-effective solution for organizations and their employees. It provides substantial savings, enhances commuting convenience, and promotes a more sustainable and employee-centric workplace. By embracing Optum Bank’s Commuter Benefits Program, employers and employees can unlock a world of financial advantages and improved commuting experiences.