Are you worried about your financial security if you become unable to work due to a disability? Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage can help you protect your income and provide peace of mind.

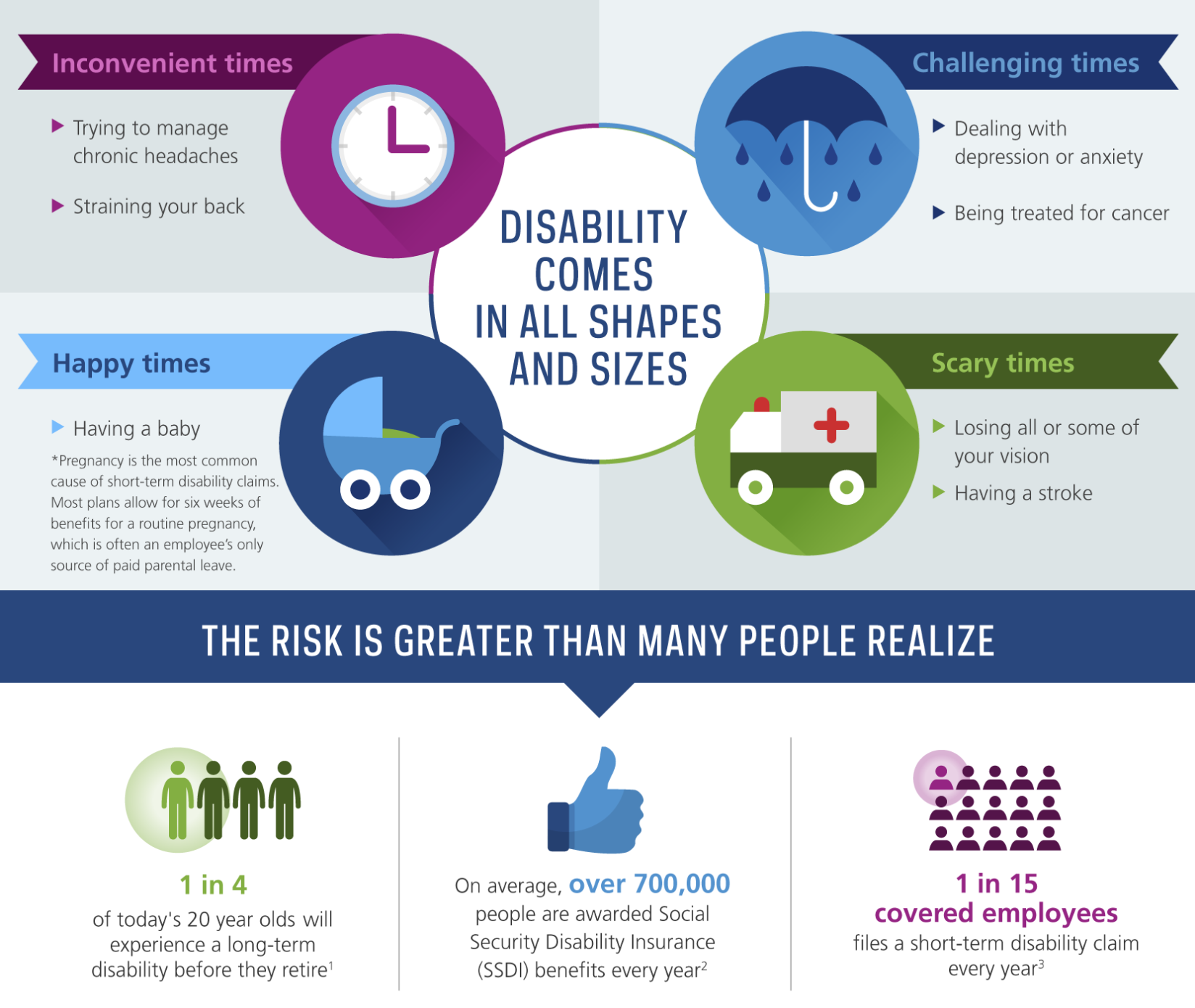

Every year, millions of Americans are unable to work due to a disability. If you’re one of them, you could face a significant loss of income. Long-term disability insurance can help protect you from this financial risk.

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage provides a monthly income if you’re unable to work due to a covered disability. The coverage can help you pay for living expenses, such as your mortgage or rent, car payment, and groceries.

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security. If you’re not sure whether you need long-term disability insurance, talk to your financial advisor.

Accenture, Verizon, Lincoln Financial Group, And ServiceNow Launch A – Source www.forbes.com

Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

In the event of an unexpected disability, Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage offers a safety net to safeguard your financial well-being.

I vividly recall the day I suffered a debilitating injury that rendered me incapable of performing my job. The realization that my income had abruptly ceased sent shivers down my spine. Like many others, I had overlooked the significance of long-term disability insurance, a decision that could have had dire consequences.

Fortunately, I had enrolled in Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage just a few months prior. Little did I know that this seemingly insignificant step would become my lifeline during one of the most challenging times of my life.

The Importance of Long Term Disability Insurance – Mann Lawyers – Source www.mannlawyers.com

What is Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage?

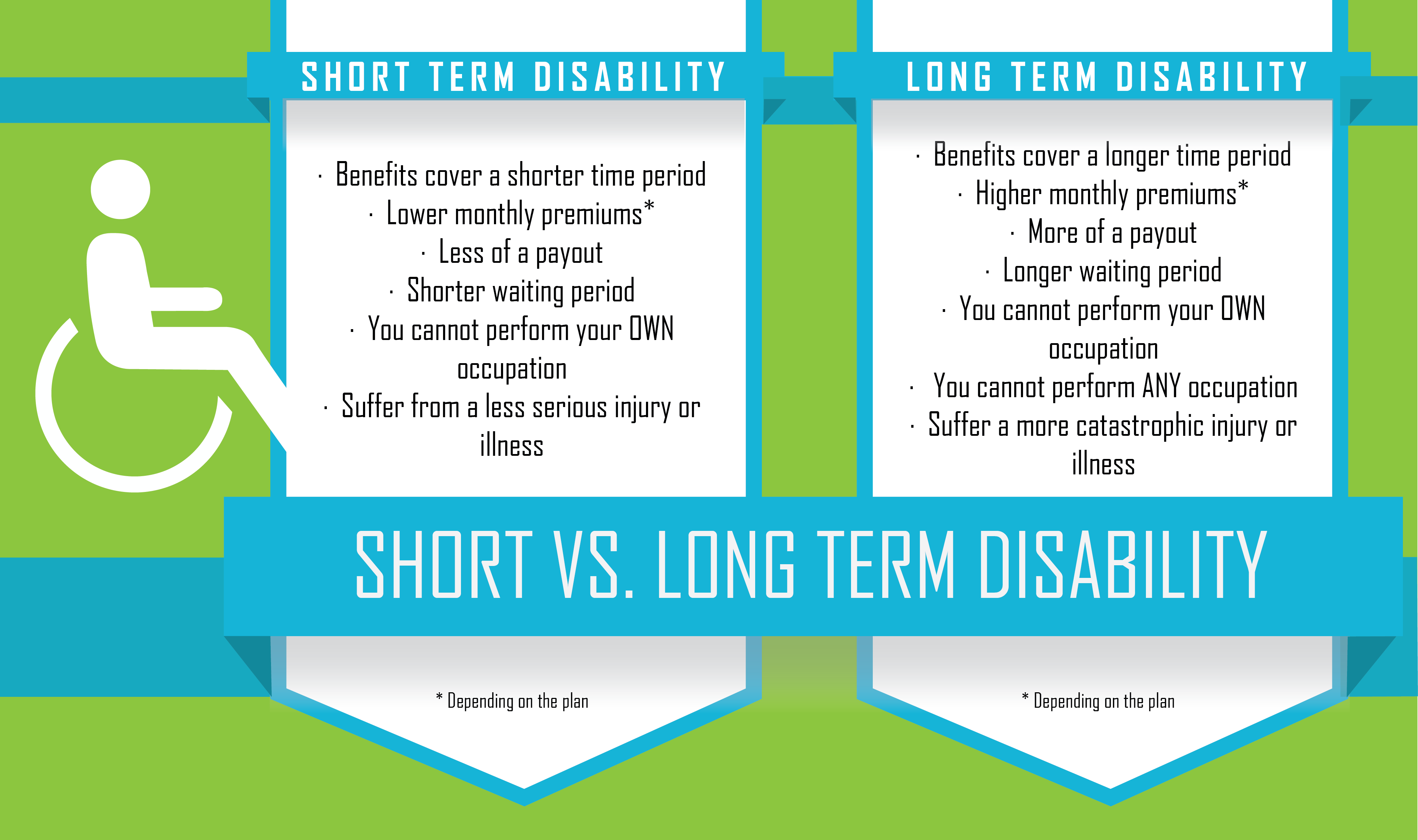

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is an insurance policy that provides income replacement if you become disabled and unable to work.

The coverage is designed to protect your income if you’re unable to work due to a covered disability, such as an illness, injury, or mental health condition.

The benefits of Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage include:

- Monthly income payments if you’re unable to work due to a covered disability

- Coverage for up to 60% of your pre-disability income

- Benefits that can continue until you reach retirement age or return to work

3 Simple Steps for Building a Healthy Financial Safety Net | Financial – Source www.pinterest.com

History and Myth of Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Long-term disability insurance has its roots in the late 19th century, when insurance companies began offering policies to protect workers against the loss of income due to disability.

Over the years, long-term disability insurance has become an increasingly popular benefit, as more and more people recognize the importance of protecting their income in the event of a disability.

However, there are still some myths and misconceptions about long-term disability insurance.

One common myth is that long-term disability insurance is only for people who work in high-risk occupations.

The truth is, anyone can become disabled, regardless of their occupation.

Another common myth is that long-term disability insurance is too expensive.

While it’s true that long-term disability insurance premiums can vary, there are a number of affordable options available.

How Supplemental Disability Insurance Works for Doctors – Source www.sdtplanning.com

Hidden Secret of Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

One of the best-kept secrets about long-term disability insurance is that it can also be used to supplement your retirement income.

If you become disabled and unable to work before you reach retirement age, long-term disability benefits can help you bridge the gap between your disability income and your retirement savings.

Long-term disability insurance can also help you protect your family’s financial security in the event of your death.

If you die while you’re receiving long-term disability benefits, your beneficiaries may be eligible to receive a death benefit.

2021 Recordkeeping Survey | PLANSPONSOR – Source www.plansponsor.com

Recommendation of Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

If you’re not sure whether you need long-term disability insurance, talk to your financial advisor.

They can help you assess your risk of disability and determine if long-term disability insurance is right for you.

If you decide to purchase long-term disability insurance, be sure to choose a policy that meets your needs and budget.

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security.

Disability Insurance 101: Disability Insurance Companies – Expert – Source highincomeprotection.com

Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security.

Here are some tips for getting the most out of your long-term disability coverage:

- Make sure you understand the terms of your policy.

- File your claim as soon as possible after you become disabled.

- Keep your insurance company informed of your condition and any changes in your situation.

- Be patient. It can take time for your claim to be processed.

Learn about 175+ imagen lincoln financial field seat map – In – Source in.thptnganamst.edu.vn

Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security.

Here are some additional tips for maximizing your long-term disability coverage:

- Consider purchasing a policy that offers a guaranteed income stream.

- Choose a policy that provides coverage for a long period of time.

- Make sure your policy includes a cost-of-living adjustment.

Long Term Disability Insurance – Bonnici Law Group – Source bonnicilawgroup.com

Fun Facts of Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Here are some fun facts about long-term disability insurance:

- The first long-term disability insurance policy was issued in 1891.

- The average long-term disability claim lasts for 2.5 years.

- About 1 in 4 people will experience a disability that lasts for at least 3 months.

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security.

ERISA Procedures For Disability Provider Plans Went Into Effect April 1 – Source www.bc2co.com

How to Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Here are some tips on how to maximize your financial security with Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage:

- Make sure you have enough coverage to meet your needs.

- Consider purchasing a policy that offers additional benefits, such as a waiver of premium.

- Review your policy regularly and make sure it still meets your needs.

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage is a valuable benefit that can help you protect your financial security.

What is NYS Short Term Disability – Crowley Insurance Agency – Source www.crowleyinsurance.com

What if Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage?

What if you become disabled and unable to work? Will you be able to pay your bills? Will you be able to support your family?

Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage can help you protect your financial security if you become disabled.

The coverage can provide you with a monthly income if you’re unable to work due to a covered disability.

The benefits of Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage can help you:

- Pay your bills

- Support your family

- Maintain your standard of living

Listicle of Maximize Your Financial Security: Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage

Here is a listicle of the benefits of Lincoln Financial Group’s Comprehensive Long-Term Disability Coverage:

1. Monthly income payments if you’re unable to work due to a covered disability

2. Coverage for up to 60% of your pre-disability income

3. Benefits that can continue until you reach retirement age or return to work

4. Guaranteed income stream

5. Long coverage period

6. Cost