In an increasingly globalized economy, maximizing value through intercompany transactions has become paramount for multinational corporations. Price Transfer Inc. emerges as a leading provider of specialized services to optimize intercompany pricing, ensuring that organizations leverage the full potential of their transactions.

Understand the Challenges of Intercompany Transactions

Multinational corporations often face challenges in managing intercompany transactions due to:

Intercompany Solution | be one solutions – Source www.beonesolutions.com

Price Transfer Inc.: Maximizing Value Through Intercompany Transactions

Price Transfer Inc. offers a comprehensive suite of services tailored to help multinational corporations navigate the complexities of intercompany transactions. Their experts assist in setting optimal transfer prices, ensuring compliance with tax regulations, and optimizing profit allocation among different entities.

Maximizing Value Through Intercompany Transactions

Price Transfer Inc.’s services enable multinational corporations to:

[Solved] On October 1, 2021, the Allegheny Corporation purchased – Source www.coursehero.com

Price Transfer Inc.: A Personal Experience

In my role as a financial manager for a global manufacturing company, I have firsthand experience with the transformative impact of Price Transfer Inc.’s services. They helped us optimize our intercompany pricing, resulting in significant tax savings and improved cash flow.

Through their in-depth understanding of transfer pricing regulations and global tax laws, Price Transfer Inc. guided us in developing a robust transfer pricing policy that aligned with our business objectives while minimizing tax exposure.

Unveiling the Myth of Transfer Pricing

Contrary to misconceptions, transfer pricing is not solely about tax avoidance. Rather, it is a strategic tool that enables multinational corporations to allocate profits and resources efficiently, optimize their global supply chain, and respond to changing market conditions.

Price Transfer Inc.’s expertise demystifies the complexities of transfer pricing, empowering corporations to harness its full potential for value maximization.

Revealing the Hidden Secrets of Price Transfer

Price Transfer Inc. provides invaluable insights into the intricacies of intercompany transactions, including:

Strategies For Maximizing Value In Lower Middle Market Transactions For – Source www.startupguys.net

Recommendations from Price Transfer Inc.

Price Transfer Inc. recommends:

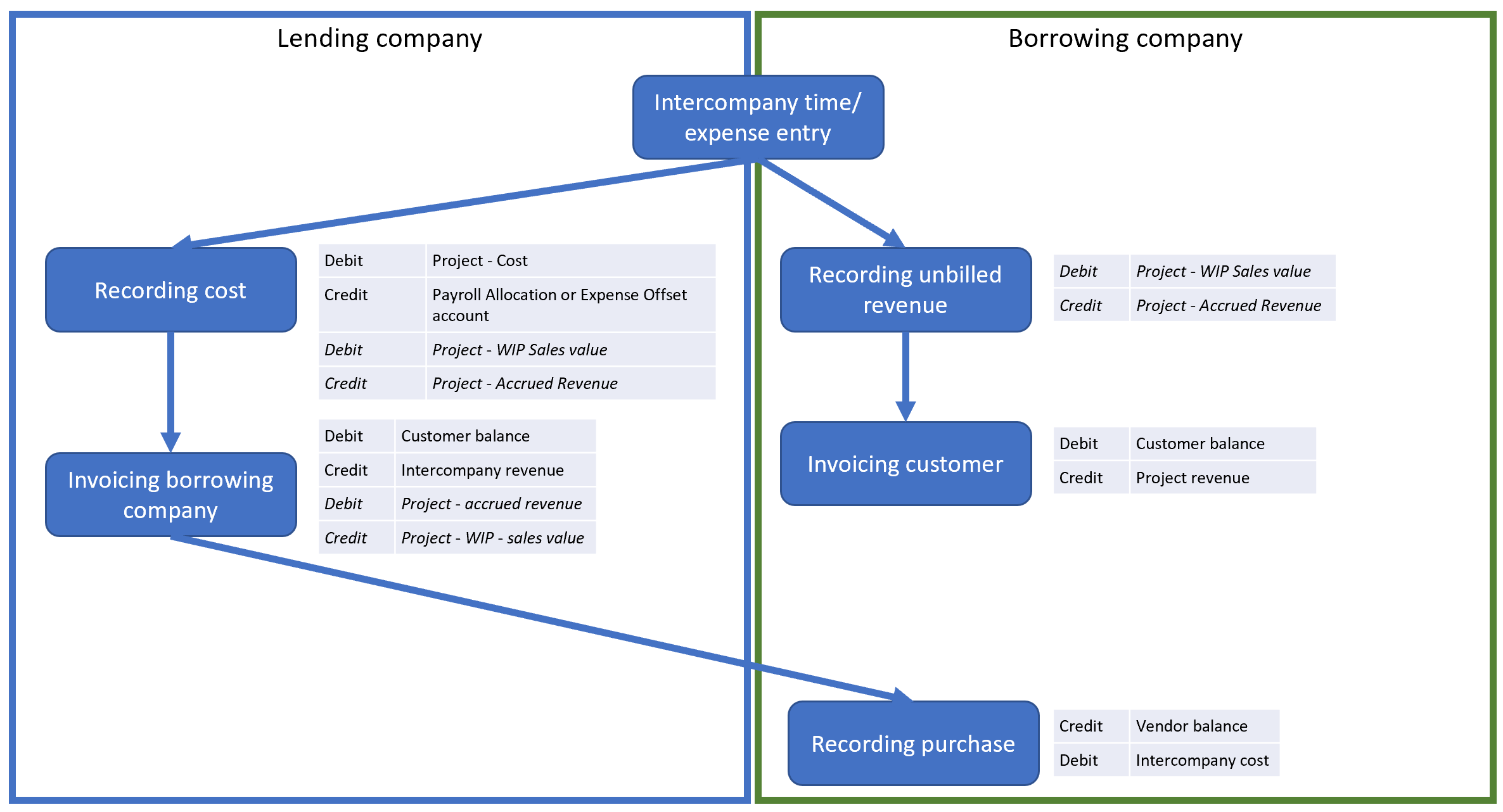

Intercompany-Rechnungsstellung – Übersicht | Microsoft Learn – Source learn.microsoft.com

Price Transfer Inc.: Exploring the Intricacies

Price Transfer Inc.’s services encompass:

The Regulation of Transfer Pricing in Thailand – MPG – Source mahanakornpartners.com

Tips for Effective Price Transfer Implementation

To effectively implement price transfer strategies, consider:

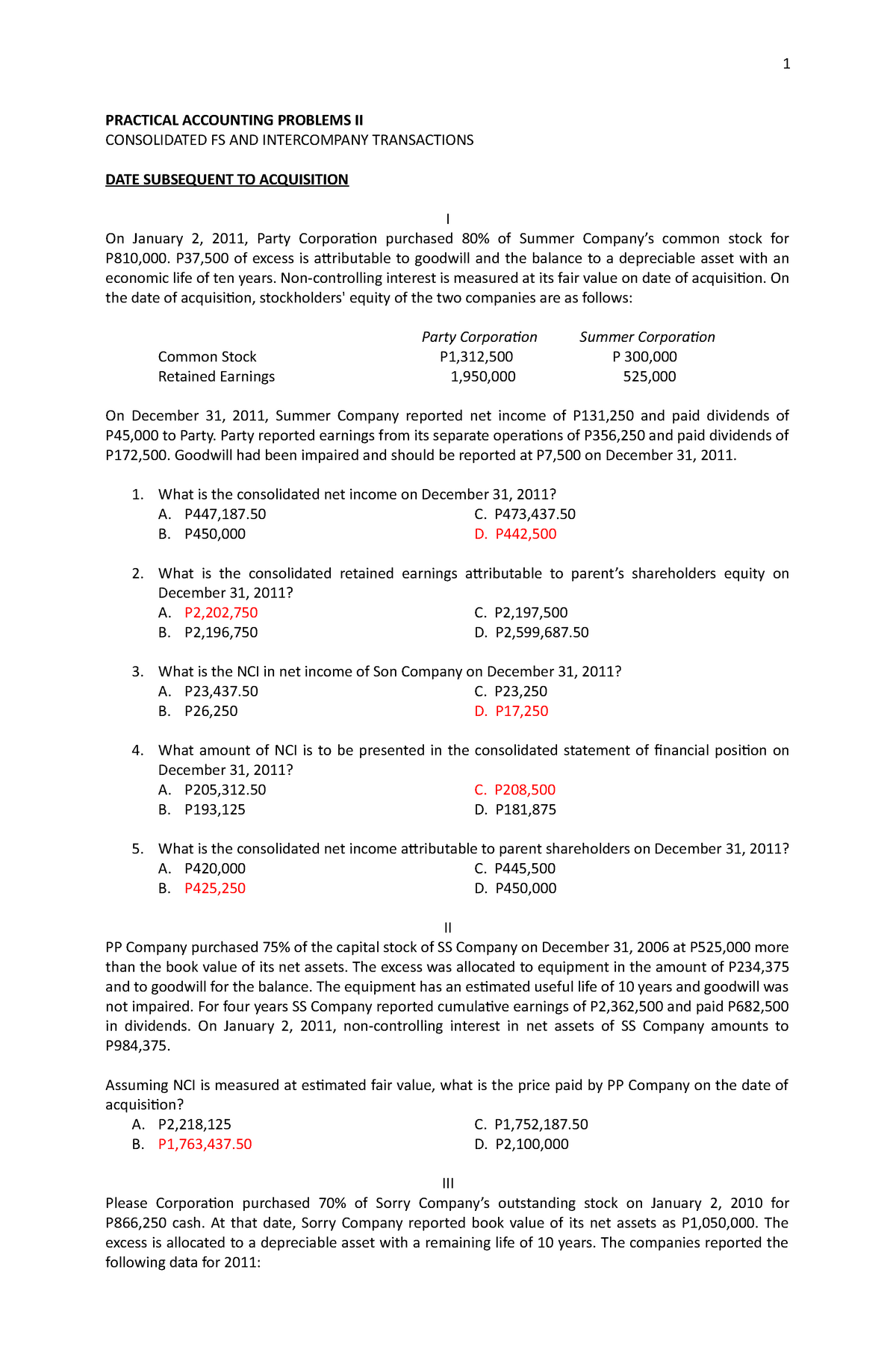

Consolidated FS & intercompany transactions – PRACTICAL ACCOUNTING – Source www.studocu.com

Understanding the Concept of Arm’s Length Pricing

Intercompany transactions should be conducted at arm’s length, meaning prices should be comparable to those between unrelated parties in similar circumstances.

Fun Facts About Price Transfer Inc.

Price Transfer Inc.:

About Us | Forex Transfer – Source forextransferinc.com

How to Use Price Transfer Inc.’s Services

To utilize Price Transfer Inc.’s services:

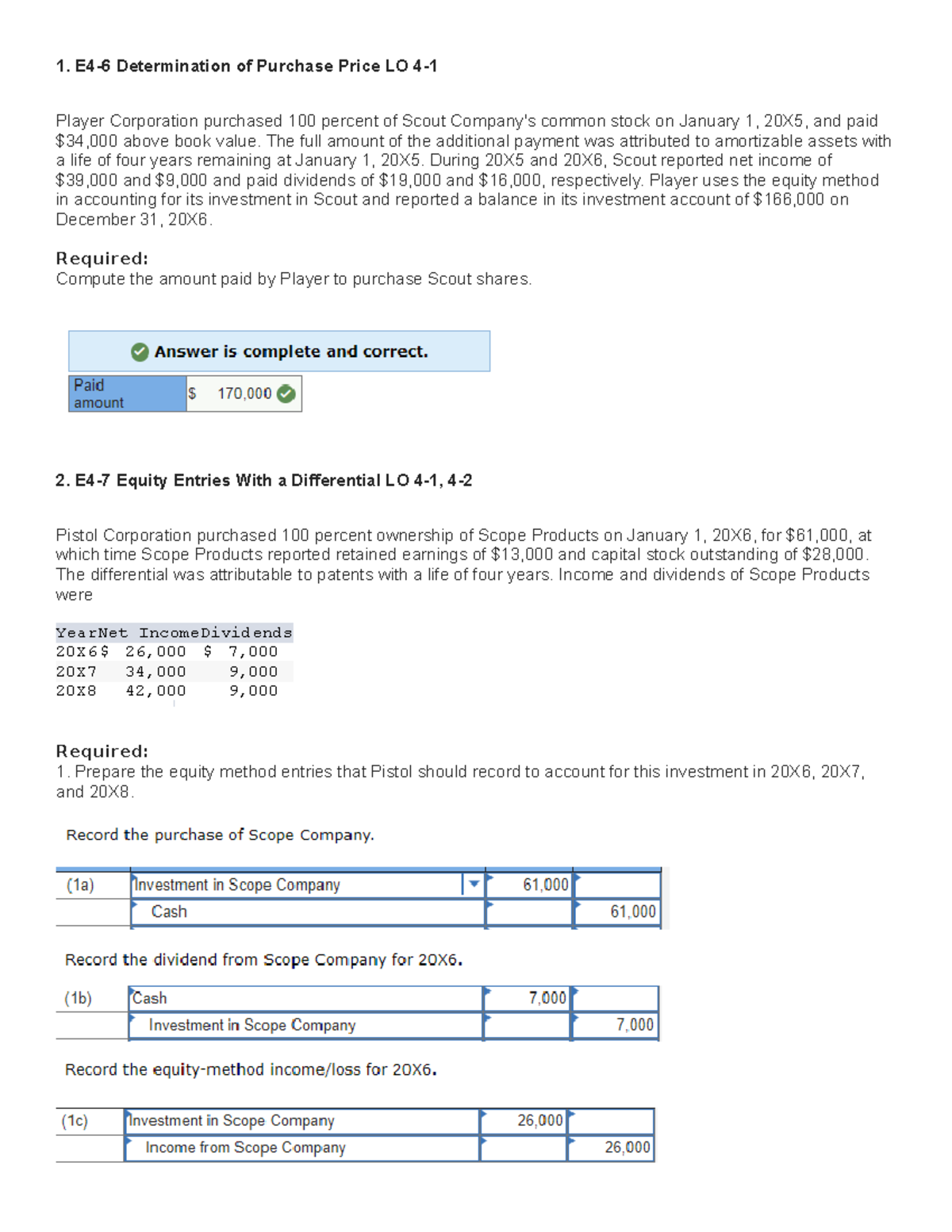

Ch 4 HW2 – Ch. 4 Intercompany transactions – 1. E4-6 Determination of – Source www.studocu.com

What If You Ignore Price Transfer Inc.’s Recommendations?

Ignoring Price Transfer Inc.’s recommendations could lead to:

Royalties in intercompany transactions | RoyaltyRange – Source www.royaltyrange.com

Price Transfer Inc.’s Proven Track Record

Price Transfer Inc. boasts a proven track record of helping multinational corporations:

Price Transfer, FCL Logistics Will Pay Nearly 1,000 Employees for Wage – Source topclassactions.com

Question and Answer on Price Transfer Inc.

Q: What is the primary benefit of Price Transfer Inc.’s services?

A: Maximizing value through optimized intercompany pricing and tax savings.

Q: How does Price Transfer Inc. ensure compliance with tax regulations?

A: Through in-depth understanding of transfer pricing laws and guidance in developing robust transfer pricing policies.

Q: Is transfer pricing primarily about tax avoidance?

A: No, transfer pricing is a strategic tool for efficient profit allocation, supply chain optimization, and market response.

Q: What value does Price Transfer Inc. provide beyond tax optimization?

A: Insights into intercompany transaction complexities, support in developing transfer pricing policies, and assistance in implementing effective transfer pricing strategies.

Conclusion of Price Transfer Inc.: Maximizing Value Through Intercompany Transactions

Price Transfer Inc. empowers multinational corporations to unlock the full potential of their intercompany transactions. Their specialized services, combined with a deep understanding of transfer pricing regulations and global tax laws, enable organizations to achieve tax efficiency, optimize resource allocation, and maximize overall value.