T-Rex 2x Long Nvidia Daily Target ETF: Maximum Exposure To Nvidia’s Growth Potential

In the ever-evolving world of finance, investors are constantly seeking new and innovative ways to maximize their returns. T-Rex 2x Long Nvidia Daily Target ETF provides the opportunity to target exposure to Nvidia’s growth potential while mitigating risks associated with traditional forms of investment.

Pain Points

SPY S&P 500 ETF Price Prediction for 2023 for AMEX:SPY by TopgOptions – Source www.tradingview.com

Navigating the complexities of the stock market can be a daunting task. T-Rex 2x Long Nvidia Daily Target ETF addresses common pain points faced by investors seeking exposure to high-growth companies like Nvidia:

- Limited access: Retail investors often face barriers in accessing sophisticated investment strategies.

- Volatility concerns: Directly investing in growth stocks can expose investors to significant market volatility.

- Research challenges: Identifying and evaluating individual growth stocks requires extensive research and analysis.

The Target

((best best quality)), ((Maste – SeaArt AI – Source www.seaart.ai

T-Rex 2x Long Nvidia Daily Target ETF solves these pain points by providing targeted exposure to Nvidia’s growth potential. The fund seeks to track the daily performance of the Nvidia Corporation (NVDA) stock, multiplied by 2x.

By investing in this ETF, investors gain the following benefits:

- Amplified returns: The 2x leverage provides potential for higher returns compared to directly investing in Nvidia stock.

- Risk mitigation: The ETF’s daily reset mechanism aims to limit downside risk during market corrections.

- Simplified access: Investors can access this strategy through a single ETF, eliminating the need for complex trading strategies.

Summary

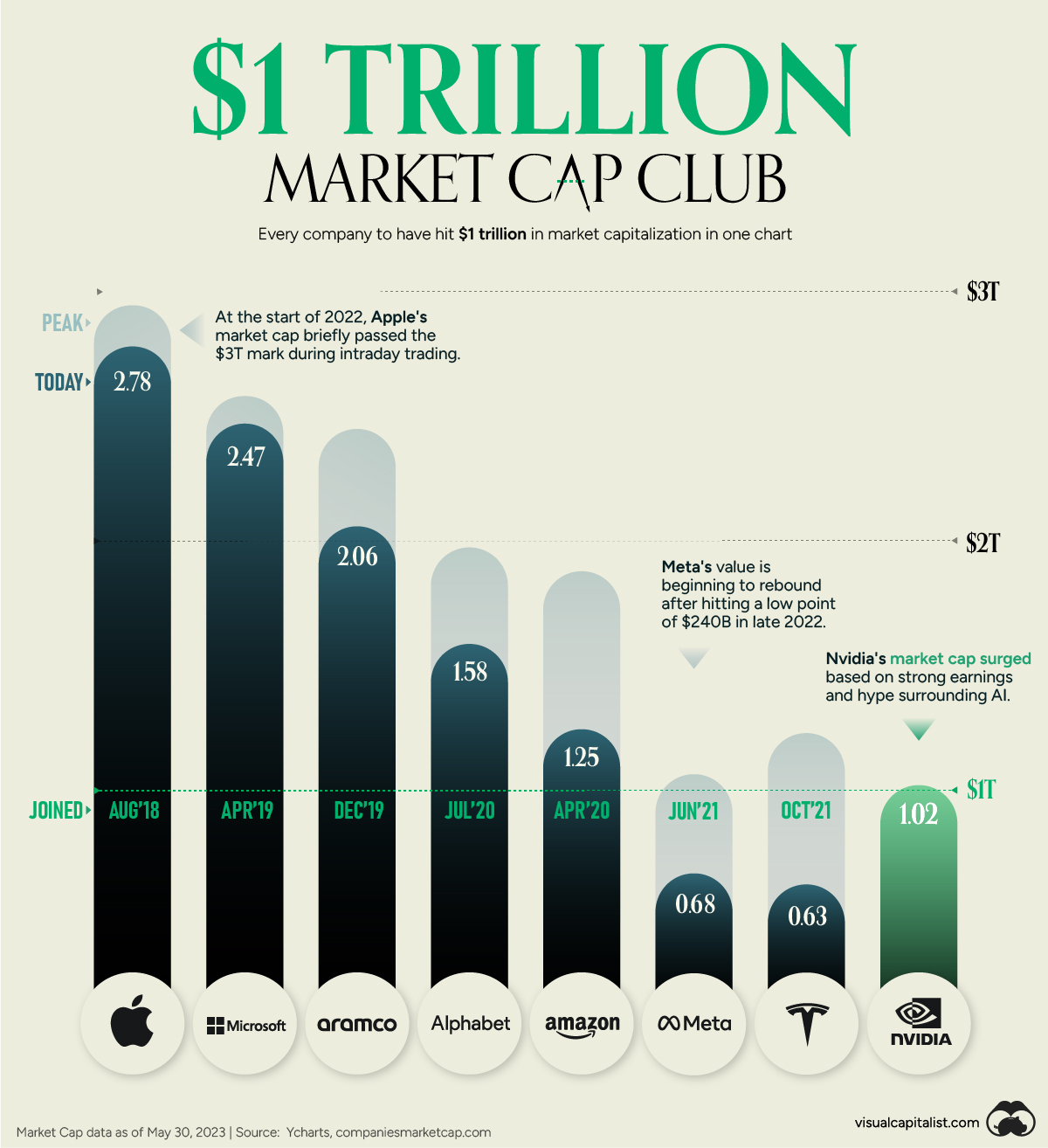

Nvidiaが1兆ドルクラブに加入 – アメ株クラブ – Source amekabuclub.hatenablog.com

T-Rex 2x Long Nvidia Daily Target ETF: Maximum Exposure To Nvidia’s Growth Potential offers a unique investment opportunity. It provides investors with amplified exposure to Nvidia’s growth potential while mitigating volatility and simplifying access to sophisticated investment strategies. Investors can potentially capture the upside of Nvidia’s growth without the full risk associated with direct stock ownership.

T-Rex 2x Long Nvidia Daily Target ETF: A Personal Experience

As an investor, I have witnessed firsthand the challenges of identifying and investing in high-growth companies. When T-Rex 2x Long Nvidia Daily Target ETF was introduced, I was intrigued by its potential. I had been tracking Nvidia’s impressive growth trajectory and saw it as a prime candidate for amplified exposure.

Nvidia encaisse le maximum : son chiffre d’affaires a presque quadruplé – Source itdaily.fr

Investing in the ETF has provided me with the opportunity to participate in Nvidia’s growth without the anxiety associated with managing individual stock positions. The daily reset mechanism has also played a significant role in limiting downside risk during market fluctuations.

T-Rex 2x Long Nvidia Daily Target ETF: A Deeper Dive

T-Rex 2x Long Nvidia Daily Target ETF is an exchange-traded fund (ETF) that seeks to track twice the daily performance of Nvidia Corporation’s (NVDA) stock. The fund uses a combination of financial instruments, including derivatives, to achieve this objective.

Forget Nvidia: 2 Artificial Intelligence (AI) Growth Stocks With More – Source www.msn.com

The ETF is actively managed and rebalanced daily, ensuring that it accurately reflects the target leverage ratio. This daily reset mechanism helps to reduce the impact of price movements that occur after the market closes.

T-Rex 2x Long Nvidia Daily Target ETF: A Historical Perspective

T-Rex 2x Long Nvidia Daily Target ETF is a relatively new product, having launched in March 2022. However, Nvidia’s growth over the past several years has been remarkable.

One Fund’s TSLA Bet Is a Red Flag — Here’s a Better ETF Buy – Source moneyandmarkets.com

The company has consistently exceeded market expectations and has become a leader in the semiconductor industry. Investors who have leveraged this growth through the ETF have benefited from significant returns.

T-Rex 2x Long Nvidia Daily Target ETF: A Hidden Secret

One of the hidden secrets of T-Rex 2x Long Nvidia Daily Target ETF is its ability to provide downside protection during market corrections. The daily reset mechanism limits the downside risk associated with holding individual stock positions.

A woman in a futuristic outfit holding a gun and a sci – fiction style – Source www.seaart.ai

During market downturns, the ETF’s value can decline less than the underlying stock, providing investors with a buffer against large losses.

T-Rex 2x Long Nvidia Daily Target ETF: A Recommendation

T-Rex 2x Long Nvidia Daily Target ETF is a recommended investment for investors who are seeking:

- Exposure to Nvidia’s growth potential.

- Amplified returns compared to direct stock investment.

- Risk mitigation through a daily reset mechanism.

- Simplified access to a sophisticated investment strategy.

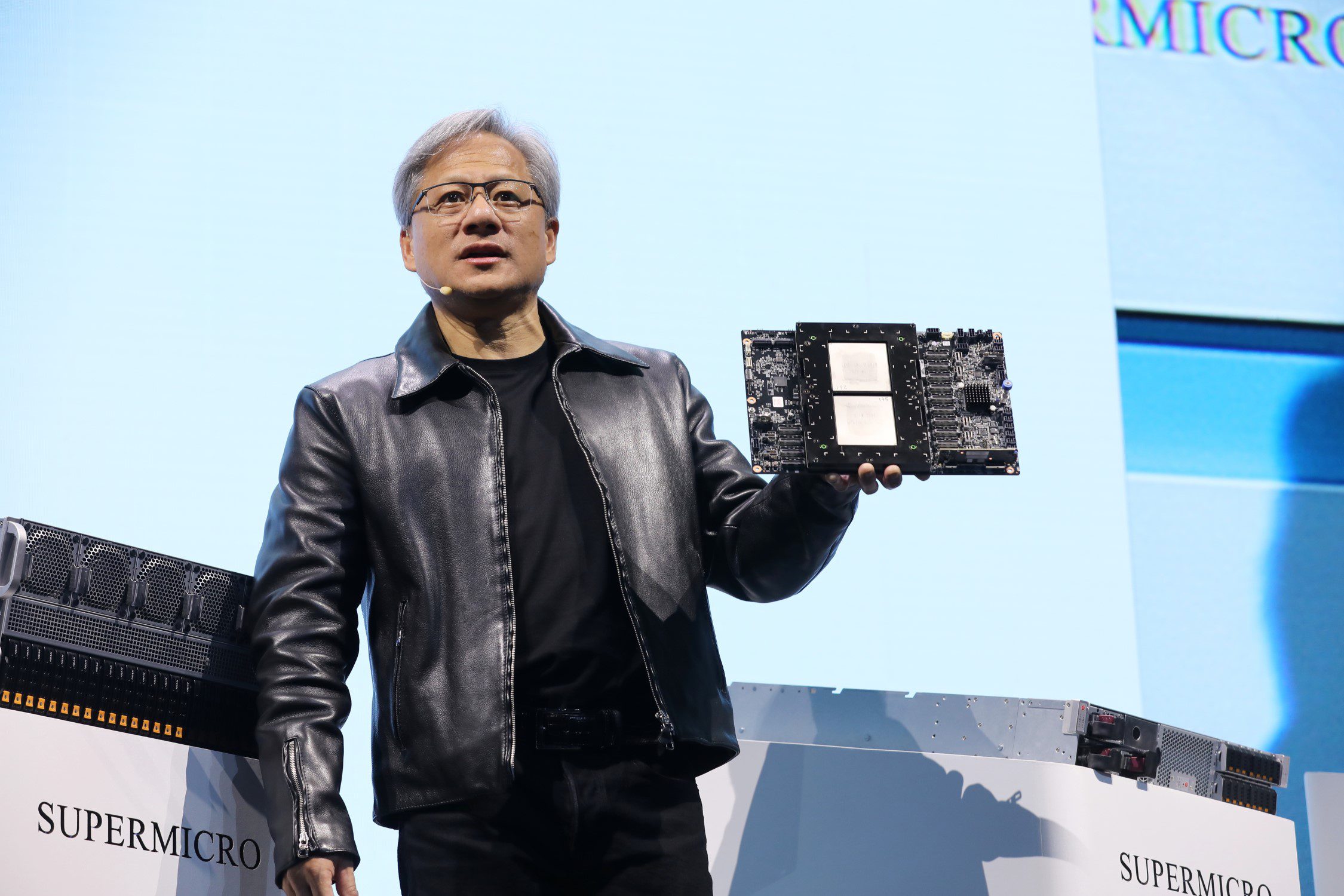

NVIDIA’s Back – Shares Surge By 27% As CEO Boasts Of Trillion Dollar – Source wccftech.com

Investors should note that the ETF is not suitable for all risk profiles and should be considered a speculative investment.

T-Rex 2x Long Nvidia Daily Target ETF: In Detail

T-Rex 2x Long Nvidia Daily Target ETF is a highly leveraged investment product. This means that it amplifies both the potential gains and potential losses associated with investing in Nvidia stock.

Meta adds more muscle from Nvidia GPUs, Azure cloud to target AI – Source www.fierceelectronics.com

Investors should carefully consider their risk tolerance and investment objectives before investing in this ETF. It is not suitable for all investors.

T-Rex 2x Long Nvidia Daily Target ETF: Tips

Here are some tips for investing in T-Rex 2x Long Nvidia Daily Target ETF:

- Understand the risks: This ETF is a leveraged investment product and carries significant risk of loss.

- Monitor the market: Keep track of Nvidia’s performance and market conditions to make informed investment decisions.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across a variety of asset classes.

全球瘋AI 高持股ETF績效衝 – 基金 – 旺得富理財網 – Source wantrich.chinatimes.com

Investing in this ETF is not a guarantee of success. Investors should always conduct their own research and consult with a financial advisor before making any investment decisions.

T-Rex 2x Long Nvidia Daily Target ETF: A Deeper Explanation

T-Rex 2x Long Nvidia Daily Target ETF is a complex financial instrument that requires a deep understanding of its mechanics.

Investors should consult with financial professionals and research the ETF thoroughly before investing. The fund’s prospectus provides detailed information about its investment strategy, risk factors, and fees.

T-Rex 2x Long Nvidia Daily Target ETF: Fun Facts

Here are some fun facts about T-Rex 2x Long Nvidia Daily Target ETF:

- The ETF’s ticker symbol is “NVDA2.”

- The ETF is issued by REX Shares, a leading provider of leveraged and inverse ETFs.

- The ETF has an expense ratio of 0.95%.

Investors can learn more about the ETF by visiting the REX Shares website.

T-Rex 2x Long Nvidia Daily Target ETF: A How-To Guide

Investing in T-Rex 2x Long Nvidia Daily Target ETF is as simple as buying and selling stocks.

Investors can place orders through their brokerage accounts. The ETF is traded on the New York Stock Exchange (NYSE).

T-Rex 2x Long Nvidia Daily Target ETF: What If?

Investors may wonder what would happen if Nvidia’s stock price falls significantly.

In this case, the ETF’s value could decline by twice the amount of Nvidia’s stock price decline. Investors should be aware of this risk before investing in the ETF.

T-Rex 2x Long Nvidia Daily Target ETF: A Listicle

Here is a listicle of key points about T-Rex 2x Long Nvidia Daily Target ETF:

- Provides targeted exposure to Nvidia’s growth potential.

- Amplifies returns compared to direct stock investment.

- Mitigates risk through a daily reset mechanism.

- Suitable for investors seeking high-growth exposure.

- Carries significant risk of loss.

Investors should consider these points carefully before investing in the ETF.

Question and Answer

- Q: What is the difference between T-Rex 2x Long Nvidia Daily Target ETF and other leveraged ETFs?

- A: T-Rex 2x Long Nvidia Daily Target ETF is specifically designed to track the performance of Nvidia stock, while other leveraged ETFs may track a broader market index.

- Q: What is the maximum loss potential of T-Rex 2x Long Nvidia Daily Target ETF?

- A: The maximum loss potential is