Are you considering transferring investments from Schwab to Fidelity? Whether you’re looking for better fees, more investment options, or a better user experience, Fidelity offers a wide range of accounts and services to meet your financial needs. In this guide, we’ll walk you through the step-by-step process of transferring your investments from Schwab to Fidelity.

Understanding Your Investment Transfer

Before you initiate a transfer, it’s important to understand the potential implications and timelines involved. Transfers can take several days or weeks to complete, and during that time your investments may be inaccessible. You should also be aware of any potential fees associated with the transfer, such as brokerage fees or account closure fees.

20 Second Advisor: Your Accounts & TD’s transition to the Schwab – Source verisail.com

Benefits of Transferring to Fidelity

Fidelity offers a range of benefits to investors, including:

- Low trading commissions

- Access to a wide range of investment options

- Powerful research and planning tools

- Excellent customer support

Transfer Your Investments Seamlessly: Schwab To Fidelity Migration Guide

To transfer your investments from Schwab to Fidelity, follow these steps:

- Open a Fidelity account

- Gather your account information from Schwab

- Initiate the transfer through Fidelity’s website or mobile app

- Review and confirm the transfer details

- Wait for the transfer to complete

Risk Transfer Considerations | Russell Investments – Source russellinvestments.com

Simplify Your Investments with Fidelity

Fidelity’s intuitive platform and comprehensive investment offerings make it easy for investors of all levels to manage their finances. Whether you’re a seasoned trader or just starting out, Fidelity has the tools and support you need to reach your financial goals.

The History and Myth of Transferring Investments

The practice of transferring investments between brokerages has been around for decades. In the past, transfers were often time-consuming and expensive. However, thanks to advances in technology, transfers are now much faster and easier than ever before.

Fidelity Investments Logo Vector – (.Ai .PNG .SVG .EPS Free Download) – Source vectorseek.com

Unveiling the Hidden Secrets of Investment Transfers

While transferring investments is generally straightforward, there are a few things you should keep in mind to ensure a smooth transition. Be sure to research different brokerages and compare their fees, services, and investment options. It’s also important to understand the tax implications of transferring investments.

Our Recommendation for Transferring Investments

If you’re looking for a reputable and reliable brokerage to transfer your investments to, Fidelity is a great option. With low fees, a wide range of investment options, and excellent customer support, Fidelity has everything you need to manage your finances effectively.

Wall Street titans Fidelity, Charles Schwab and Citadel Securities – Source stockhead.com.au

Transferring Investments Seamlessly: A Step-by-Step Guide

Follow these steps to transfer your investments from Schwab to Fidelity:

- Gather your account information from Schwab

- Open a Fidelity account

- Initiate the transfer through Fidelity’s website or mobile app

- Review and confirm the transfer details

- Wait for the transfer to complete

Tips for Transferring Investments Seamlessly

Here are a few tips to make the transfer process as smooth as possible:

- Start the transfer process early

- Provide clear and accurate account information

- Review the transfer details carefully

- Contact customer support if you have any questions

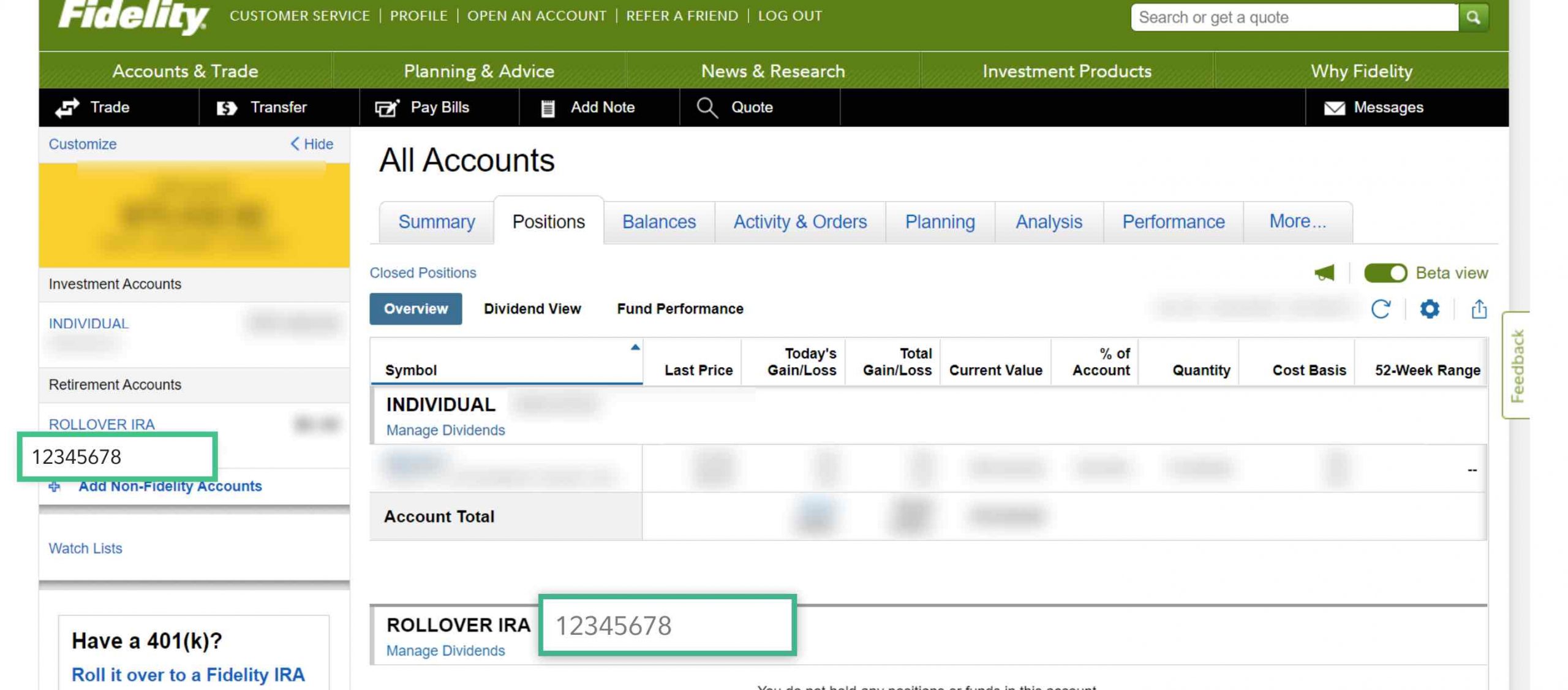

4 Ways to Find Your Fidelity Account Number | Capitalize – Source www.hicapitalize.com

FAQs About Transferring Investments

- How long does it take to transfer investments?

- Are there any fees associated with transferring investments?

- What are the tax implications of transferring investments?

- How do I choose the right brokerage to transfer my investments to?

Conclusion of Transfer Your Investments Seamlessly: Schwab To Fidelity Migration Guide

Transferring investments from Schwab to Fidelity is a relatively simple process. By following the steps outlined in this guide, you can ensure a smooth and efficient transfer of your assets.