Illinois Inheritance Law and Community Property

The topic of Illinois Inheritance Law and Community Property can be a bit complicated, but it’s important to understand if you want to ensure that your assets are distributed according to your wishes after you pass away.

In Illinois, there is no such thing as community property. This means that all property acquired during a marriage is considered to be the separate property of each spouse. However, there are some exceptions to this rule.

How to Change Joint Tenancy to Community Property in a California – Source www.wikihow.com

One exception is property that is acquired through joint tenancy. Joint tenancy is a type of ownership in which two or more people hold title to property together. When one joint tenant dies, the surviving joint tenant automatically inherits the deceased joint tenant’s share of the property. Another exception is property that is acquired through tenancy by the entirety. Tenancy by the entirety is a type of ownership in which a husband and wife hold title to property jointly. When one spouse dies, the surviving spouse automatically inherits the deceased spouse’s share of the property.

What is the Target of Illinois Inheritance Law and Community Property?

The target of Illinois Inheritance Law and Community Property is to ensure that the assets of a deceased person are distributed according to their wishes. This can be done through a will or a trust. A will is a legal document that outlines how a person wants their assets to be distributed after they die. A trust is a legal entity that holds assets for the benefit of another person.

What To Do About Lawyer Work Permit Before It’s Too Late – Rugusat – Source rugusat.com

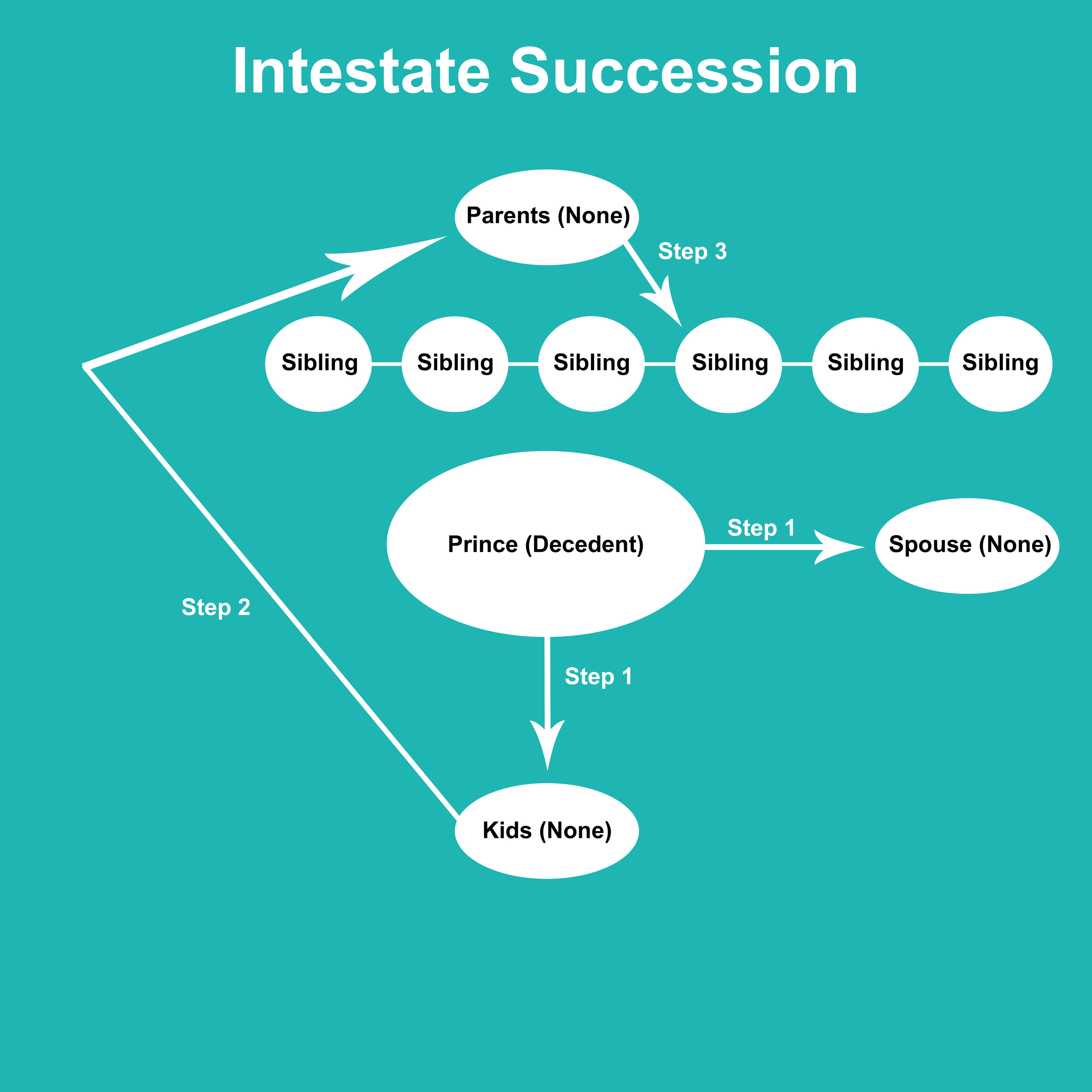

If a person dies without a will, their assets will be distributed according to the laws of intestacy. The laws of intestacy vary from state to state, but they generally provide that the assets of a deceased person will be distributed to their spouse, children, and other family members.

History and Myth of Illinois Inheritance Law and Community Property

The history of Illinois Inheritance Law and Community Property is long and complex. The first laws governing the distribution of property after death were enacted in the early 19th century. These laws were based on the common law of England, which did not recognize the concept of community property.

Alabama Intestate Succession Chart – Source abbiekerr.z21.web.core.windows.net

Over time, the laws governing the distribution of property after death in Illinois have evolved. In 1973, the Illinois legislature passed the Illinois Probate Act, which codified the laws governing the distribution of property after death in Illinois. The Illinois Probate Act established the concept of community property in Illinois. Community property is property that is acquired during a marriage and is owned by both spouses equally.

Hidden Secret of Illinois Inheritance Law and Community Property

There are a number of hidden secrets of Illinois Inheritance Law and Community Property. One of the most important secrets is that community property is not automatically distributed to the surviving spouse after the death of one spouse. In order to inherit community property, the surviving spouse must file a petition with the probate court.

DISQUALIFICATIONS FROM INHERITANCE (SECTION 25-28 OF THE HSA, 1956 – Source thelawgist.org

Another hidden secret of Illinois Inheritance Law and Community Property is that community property can be used to satisfy the debts of the deceased spouse. This means that if the deceased spouse had any debts, the surviving spouse may be responsible for paying those debts out of the community property.

Recommendation of Illinois Inheritance Law and Community Property

If you are considering getting married in Illinois, it is important to understand the laws governing inheritance and community property. By understanding these laws, you can ensure that your assets are distributed according to your wishes after you die.

Elva Ósk Wiium – Lagastoð – Source lagastod.is

One of the best ways to ensure that your assets are distributed according to your wishes is to create a will. A will is a legal document that outlines how you want your assets to be distributed after you die. You can use a will to create a trust, which is a legal entity that holds assets for the benefit of another person.

Tips of Illinois Inheritance Law and Community Property

Here are a few tips for understanding Illinois Inheritance Law and Community Property:

Fun Facts of Illinois Inheritance Law and Community Property

Here are a few fun facts about Illinois Inheritance Law and Community Property:

How to Illinois Inheritance Law and Community Property

If you want to learn more about Illinois Inheritance Law and Community Property, there are a few things you can do.

What if Illinois Inheritance Law and Community Property

What if you don’t understand Illinois Inheritance Law and Community Property? If you don’t understand Illinois Inheritance Law and Community Property, you should talk to an attorney. An attorney can help you understand the law and can help you create a will or trust to ensure that your assets are distributed according to your wishes.

Listicle of Illinois Inheritance Law and Community Property

Here is a listicle of Illinois Inheritance Law and Community Property:

Conclusion of Illinois Inheritance Law and Community Property

Illinois Inheritance Law and Community Property can be a complex topic, but it’s important to understand if you want to ensure that your assets are distributed according to your wishes after you pass away. By understanding these laws, you can create a plan that will protect your assets and ensure that your loved ones are taken care of.