Are you an executor or heir responsible for closing an estate in Illinois? The process can be complex and overwhelming, but this comprehensive guide will provide you with everything you need to know. From understanding your duties to navigating the legal procedures, we’ll cover all the essential steps involved.

Navigating the Challenges of Probate Court

Probate court can be a daunting experience. Dealing with legal paperwork, managing the estate’s assets, and resolving disputes can be stressful. Our guide will simplify the process, helping you understand the court system and avoid common pitfalls.

Executors and Heirs: Your Rights and Responsibilities

As an executor, you have a fiduciary duty to act in the best interests of the estate. This includes managing assets, paying debts, and distributing property according to the will. Heirs, on the other hand, have the right to receive their inheritance and be informed of the estate’s administration.

Estate Closing Letter in Word, Google Docs, Pages – Download | Template.net – Source www.template.net

Key Steps in Closing an Estate in Illinois

The estate closing process can be lengthy, but by following these key steps, you can ensure a smooth and timely resolution:

- Obtain Letters Testamentary or Letters of Administration

- Inventory and Appraise Assets

- Pay Debts and Expenses

- Distribute Assets to Beneficiaries

A Personal Journey Through Estate Administration

Closing an estate can be an emotional and challenging experience. Our guide includes personal accounts from executors and heirs who have navigated the process. These stories provide valuable insights and practical advice, helping you understand what to expect and how to cope with the challenges.

Executors in Will Administration: A Comprehensive Guide – Source sovereignplanning.co.uk

Understanding Probate Law in Illinois

Probate law governs the administration of estates. Our guide provides a comprehensive overview of Illinois probate law, explaining the legal framework and procedures involved in closing an estate. Understanding the law will empower you to make informed decisions and protect your rights.

Demystifying the Myths and Misconceptions

There are many myths and misconceptions surrounding estate administration. Our guide debunks these myths and provides accurate information about the probate process. By dispelling common fallacies, we empower you to approach estate closing with confidence.

![Montana Last Will and Testament Templates (Free) [Word, PDF, ODT] Montana Last Will and Testament Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2022/02/Montana-Last-Will-and-Testament-Templates.Legal_.jpg)

Montana Last Will and Testament Templates (Free) [Word, PDF, ODT] – Source templates.legal

Hidden Secrets of Estate Planning and Execution

Effective estate planning and execution can make a significant difference in the administration of an estate. Our guide reveals hidden secrets and strategies to minimize taxes, protect assets, and ensure the smooth transfer of property. Discover how to optimize the estate closing process.

Recommendations and Tips for Success

Our guide offers practical recommendations and tips to help you navigate the estate closing process successfully. By following our advice, you can avoid costly mistakes, save time, and minimize stress. Learn from the experiences of others and ensure a positive outcome for all parties involved.

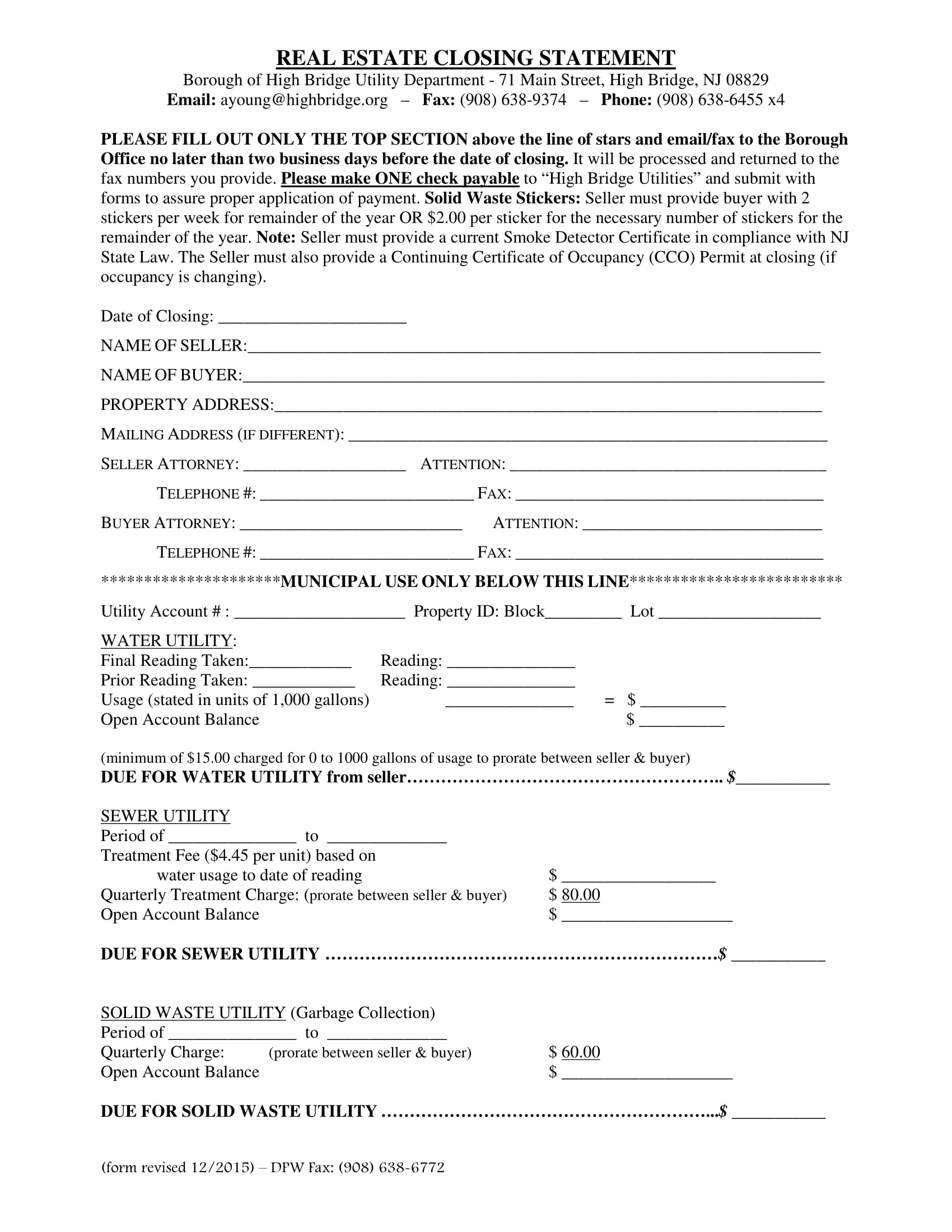

FREE 14+ Closing Statement Forms in PDF | MS Word – Source www.sampleforms.com

Common Challenges in Estate Administration

Estate administration often involves challenges such as contesting wills, contesting heirs, and tax disputes. Our guide provides insights into these common challenges and offers strategies for resolving them. By understanding the potential obstacles, you can be prepared to handle them effectively.

Essential Tips for Closing an Estate in Illinois

In addition to our comprehensive guide, we offer these essential tips for closing an estate in Illinois:

- Hire an experienced attorney to guide you through the process

- Stay organized and keep accurate records

- Communicate regularly with heirs and beneficiaries

- Be patient and persistent

Understanding the Probate Court Process

Probate court is where the estate administration process takes place. Our guide provides an in-depth explanation of the probate court process, including filing petitions, attending hearings, and obtaining necessary approvals. By understanding the court procedures, you can effectively navigate the legal system.

Prince heirs sue Illinois hospital over care during overdose – Source www.hurriyetdailynews.com

Fun Facts About Estate Planning and Administration

While estate planning and administration can be serious matters, there are some interesting and surprising facts to know. Our guide reveals fun facts about the history of probate law, unusual wills, and unique estate planning strategies.

How to Avoid Probate in Illinois

In some cases, it may be possible to avoid probate in Illinois. Our guide explores the different methods of avoiding probate, such as creating trusts, using joint ownership, and making gifts during life. By understanding these strategies, you can reduce the complexity and costs associated with estate administration.

Free Illinois Residential Purchase and Sale Agreement – PDF | Word – eForms – Source eforms.com

What Happens if an Estate is Not Properly Administered?

Failing to properly administer an estate can have serious consequences. Our guide outlines the potential risks and liabilities associated with improper estate administration, such as legal challenges, financial penalties, and damage to the estate’s value. By adhering to the guidelines and seeking professional guidance, you can ensure the proper administration of the estate.

Listicle: 10 Crucial Steps for Closing an Estate in Illinois

For a quick and easy reference, our guide provides a listicle outlining the 10 crucial steps for closing an estate in Illinois:

- Obtain Letters Testamentary or Letters of Administration

- Inventory and Appraise Assets

- Pay Debts and Expenses

- Distribute Assets to Beneficiaries

- File Tax Returns

- Close Estate Accounts

- Distribute Remaining Assets

- File Final Report with the Court

- Close the Estate

- Hire an Attorney

Question and Answer: Estate Administration in Illinois

Q: How long does it take to close an estate in Illinois?

A: The time it takes to close an estate varies depending on its complexity. In general, it can take several months to a year or more.

Q: What are the costs of closing an estate in Illinois?

A: The costs of closing an estate include probate fees, attorney fees, executor fees, and other expenses. The specific costs will vary depending on the size and complexity of the estate.

Q: What are the tax implications of closing an estate in Illinois?

A: There are both federal and state taxes that may be applicable to an estate. These taxes can include income tax, estate tax, and inheritance tax.

Q: What should I do if I am named as an executor of an estate in Illinois?

A: If you are named as an executor of an estate, you should first contact an attorney to discuss your duties and responsibilities.

Conclusion: Estate Closing in Illinois

Closing an estate in Illinois can be a complex and challenging process, but by following the steps outlined in this comprehensive guide, executors and heirs can navigate the process effectively and efficiently. By understanding their rights and responsibilities, seeking professional guidance, and adhering to the legal requirements, they can ensure the proper administration of the estate and the fair distribution of assets to beneficiaries.