Consequences and Limitations of Transfer-on-Death Deeds in Illinois

Transfer-on-Death (TOD) deeds have become increasingly popular as a means of passing on property at death in Illinois. However, there are some important consequences and limitations to be aware of before using a TOD deed.

Transfer on Death Deeds in Kentucky | Brackney Law – Source brackneylaw.com

Consequences of TOD Deeds

TOD deeds are considered non-probate transfers, meaning they avoid the probate process. This can save time and money, but it also means that the transfer of property is not subject to the same safeguards as probate. As a result, there is a greater risk of fraud or abuse.

Transfer on Death Deeds: A Guide for Nonprofits | CCK Bequest – Source www.cckbequest.com

Limitations of TOD Deeds

TOD deeds can only be used to transfer real estate. They cannot be used to transfer other types of property, such as personal property or financial accounts. Additionally, TOD deeds must be executed in accordance with the Illinois law, or they will be considered invalid.

How to Maximize Your GAMSAT Preparation: A Comprehensive Guide – Source www.solutionhow.com

History and Myth of TOD Deeds

TOD deeds were first introduced in Illinois in 1985. They were originally intended to be a simple and convenient way to transfer property at death without the need for probate. However, there have been a number of cases where TOD deeds have been used to defraud or abuse the elderly or disabled. As a result, the law governing TOD deeds has been amended several times to make them more difficult to use for fraudulent purposes.

:max_bytes(150000):strip_icc()/Enhanced-Life-Estate-Deed-56aa10bb3df78cf772ac382f.jpg)

How to Use a Transfer-on-Death Deed to Avoid Probate – Source www.thebalancemoney.com

Hidden Secret of TOD Deeds

One of the most important consequences of TOD deeds is that they are irrevocable. Once a TOD deed is executed, it cannot be changed or revoked. This is because the transfer of property occurs at the time the deed is executed, not at the time of death. As a result, it is important to carefully consider the consequences of a TOD deed before signing it.

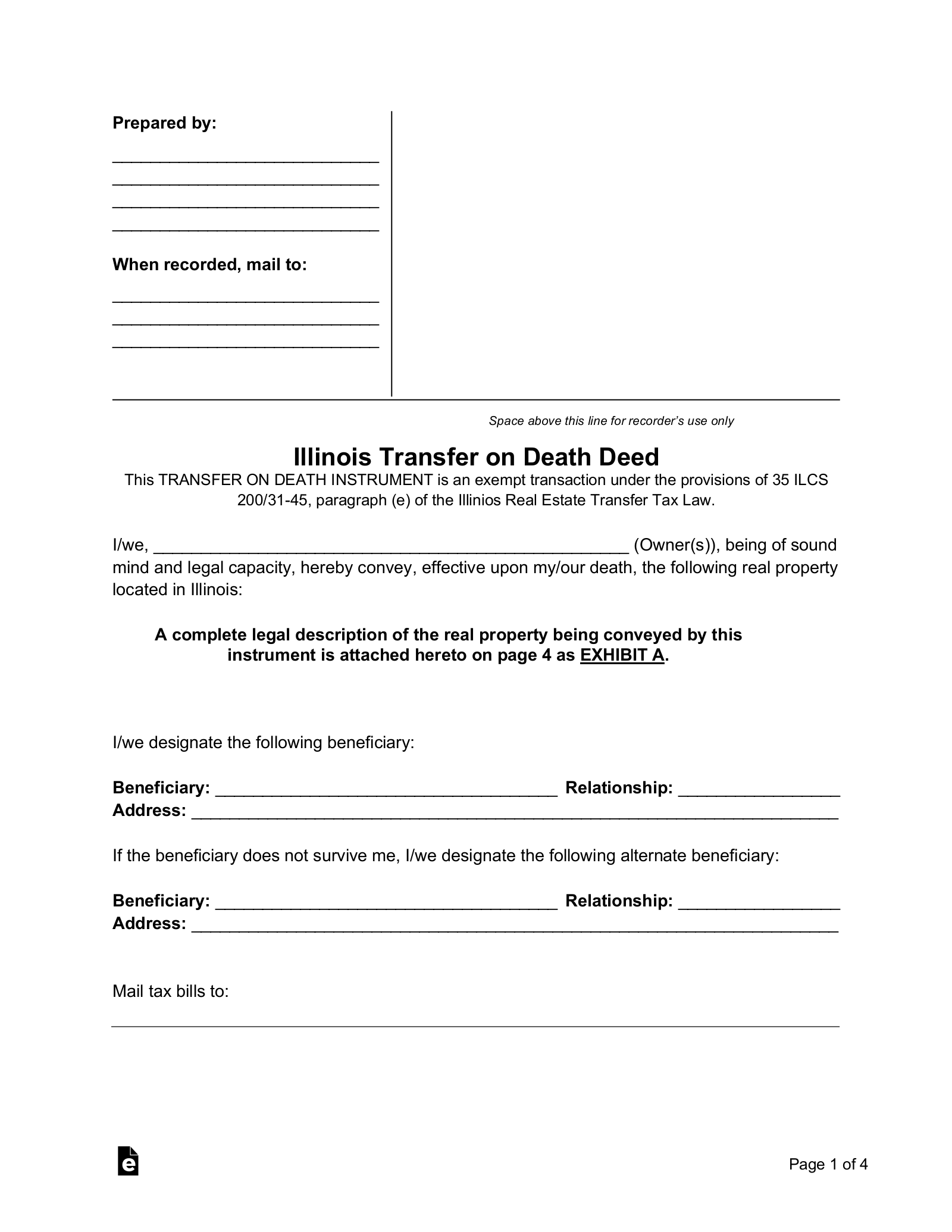

Free Illinois Transfer on Death Deed – PDF | Word – eForms – Source eforms.com

Recommendation of TOD Deeds

TOD deeds can be a useful estate planning tool, but it is important to be aware of the consequences and limitations before using one. If you are considering using a TOD deed, it is important to consult with an attorney to make sure it is the right choice for you.

Dupage County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

Similarities and Differences between TOD Deeds and Wills

TOD deeds and wills are both legal documents that can be used to transfer property at death. However, there are some important similarities and differences between the two. TOD deeds are non-probate transfers, while wills are probate transfers. This means that TOD deeds avoid the probate process, while wills do not. As a result, TOD deeds can save time and money, but they also mean that the transfer of property is not subject to the same safeguards as probate. Additionally, TOD deeds can only be used to transfer real estate, while wills can be used to transfer all types of property.

Quick Guide to California Transfer on Death Deeds | Snyder Law – Source www.snyderlawpc.com

Tips for Using TOD Deeds

If you are considering using a TOD deed, there are a few tips to keep in mind. First, make sure you understand the consequences and limitations of TOD deeds. Second, work with an attorney to make sure the deed is drafted correctly. Third, make sure the deed is properly executed. Finally, keep the deed in a safe place.

Transfer-On-Death Deeds: What Are They & How Do They Work? – Source www.gundersonlawgroup.com

What Happens if a TOD Deed is Challenged?

If a TOD deed is challenged, the court will determine whether the deed is valid. The court will consider factors such as whether the deed was executed in accordance with the Illinois law, whether the grantor had the capacity to execute the deed, and whether there was any fraud or undue influence. If the court finds that the deed is valid, it will be upheld.

Revocable Transfer-On-Death Deeds (aka Lady Bird Deed) New Since 2016 – Source www.attorneysecrets.com

Fun Facts about TOD Deeds

TOD deeds are relatively new to Illinois. They were first introduced in 1985. TOD deeds are one of the most common forms of non-probate transfers. TOD deeds can be used to transfer property to anyone, including family members, friends, or charities.

Electric Guitars: Exploring The Different Types – Source www.mellostudio.com

How to Change a TOD Deed

Once a TOD deed is executed, it cannot be changed or revoked. However, there are a few ways to change the effect of a TOD deed. One way is to sell or transfer the property before death. Another way is to have the grantees of the deed agree to hold the property in trust for a different person.

What if a TOD Deed is Invalid?

If a TOD deed is found to be invalid, the property will pass through the deceased person’s will or, if there is no will, according to the laws of intestacy.

Listicle of TOD Deeds

- TOD deeds are non-probate transfers.

- TOD deeds can only be used to transfer real estate.

- TOD deeds are irrevocable.

- TOD deeds can be challenged.

- TOD deeds are relatively new to Illinois.

Question and Answer about TOD Deeds

- What is a TOD deed? A Transfer-on-Death (TOD) deed is a legal document that allows the automatic transfer of ownership of real property upon the owner’s death without having to go through the probate process.

- What are the advantages of using a TOD deed? TOD deeds avoid probate, which can save time and money. They are also relatively easy to create and can be used to transfer property to anyone, including family members, friends, or charities.

- What are the disadvantages of using a TOD deed? TOD deeds are irrevocable, meaning that once they are created, they cannot be changed or revoked. They can also be challenged in court, and if they are found to be invalid, the property will pass through the deceased person’s will or, if there is no will, according to the laws of intestacy.

- How do I create a TOD deed? To create a TOD deed, you must complete a form that is available from the Illinois Secretary of State’s office. The form must be signed by the grantor and two witnesses and must be recorded in the county where the property is located.

Conclusion of Consequences And Limitations Of Transfer-on-Death Deeds In Illinois: A Comprehensive Guide

Transfer-on-Death (TOD) deeds can be useful estate planning tools. TOD deeds can be used to transfer property at death without going through the probate process, which can save time and money. However, it is important to be aware of the consequences and limitations of TOD deeds before using one. If you have any questions about TOD deeds, you should consult with an attorney.