Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

The death of a loved one is a difficult time, and it can be even more challenging if you are named as the executor of their will. One of the many tasks you will be responsible for is accessing their safety deposit box. This can be a daunting task, but it is important to do it correctly to protect the deceased’s assets.

If you are named as the executor of a will, it is important to understand your responsibilities. One of your main duties will be to gather the deceased’s assets and distribute them to their beneficiaries. This can include accessing their safety deposit box.

Safety deposit boxes are often used to store valuable items such as jewelry, heirlooms, and important documents. If the deceased had a safety deposit box, it is important to access it as soon as possible to prevent the contents from being lost or stolen.

To access a safety deposit box after someone has died, you will need to provide the bank with a copy of the death certificate and a letter of testamentary from the probate court. The bank will then allow you to access the box and remove its contents.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Fingerprint Safe Box Factory WELKO – The World’s No.1 Safe Box. – Source ketsatcaocap.vn

As an executor, you must be aware that accessing a safety deposit box after someone has died can be a sensitive and emotional experience. It is important to be respectful of the deceased’s wishes and to handle their belongings with care.

Before accessing the safety deposit box, it is important to gather all of the necessary documentation. This includes the death certificate, the letter of testamentary, and any other relevant documents.

Once you have gathered all of the necessary documentation, you can contact the bank to schedule an appointment to access the safety deposit box. The bank will require you to provide them with a copy of the death certificate and the letter of testamentary.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Jordan cropper Black and White Stock Photos & Images – Alamy – Source www.alamy.com

The history of safety deposit boxes dates back to the 19th century. The first safety deposit boxes were used to store valuables such as gold and silver. Over time, safety deposit boxes have become increasingly popular for storing a variety of items, including jewelry, heirlooms, and important documents.

Today, safety deposit boxes are offered by banks and credit unions. Safety deposit boxes are typically located in a secure area of the bank or credit union. Access to safety deposit boxes is restricted to the renter and authorized individuals.

Safety deposit boxes can provide peace of mind knowing that your valuables are safe and secure. However, it is important to remember that safety deposit boxes are not insured by the FDIC. This means that if the bank or credit union fails, your valuables may be lost.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Many Realistic Safety Deposit Boxes Vector Illustration. Banking – Source cartoondealer.com

There are many hidden secrets to safety deposit boxes. One of the most common secrets is that safety deposit boxes are not as secure as you might think. In fact, safety deposit boxes can be easily broken into by thieves.

Another hidden secret of safety deposit boxes is that banks and credit unions often have access to the contents of safety deposit boxes. This means that if the bank or credit union believes that you are not using the safety deposit box for legitimate purposes, they may open the box and inspect its contents.

If you are considering renting a safety deposit box, it is important to be aware of the hidden secrets of safety deposit boxes. By understanding the risks involved, you can make an informed decision about whether or not a safety deposit box is right for you.

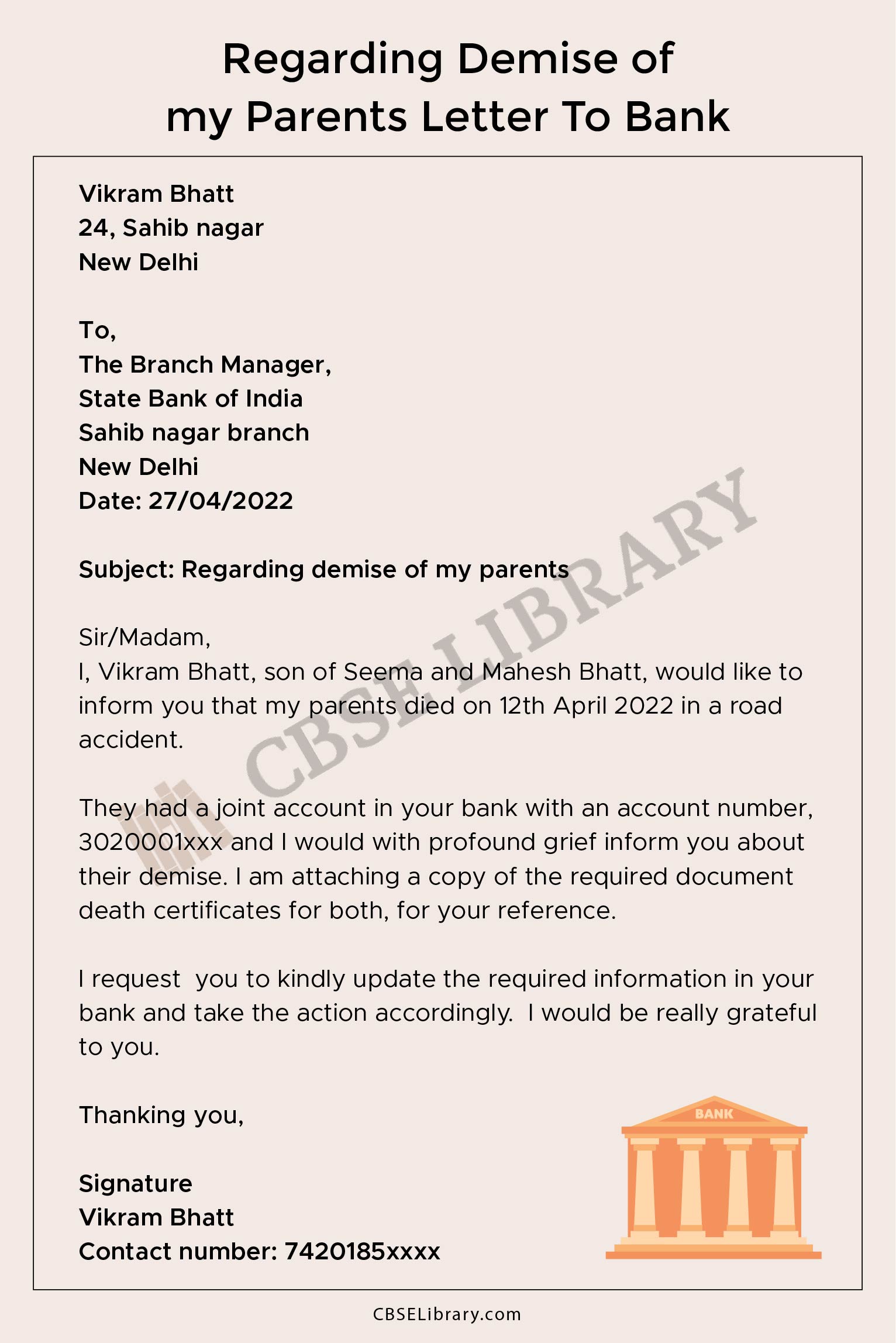

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Death Claim Letter Format For Bank Sample Letters And – vrogue.co – Source www.vrogue.co

If you are named as the executor of someone’s will, it is important to understand your responsibilities. One of your main duties will be to gather the deceased’s assets and distribute them to their beneficiaries. This can include accessing their safety deposit box.

To access a safety deposit box after someone has died, you will need to provide the bank with a copy of the death certificate and a letter of testamentary from the probate court. The bank will then allow you to access the box and remove its contents.

It is important to note that you may not be able to access the safety deposit box immediately after the person has died. The bank may need time to process the paperwork and to make sure that the box is properly sealed.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

DVD Reissue: $ (Dollars) *** – DenOfCinema – Source denofcinema.com

As an executor, you are responsible for ensuring that the deceased’s assets are distributed according to their wishes. This includes accessing their safety deposit box and removing its contents.

If you are unsure about how to access a safety deposit box after someone has died, you should contact an attorney for guidance. An attorney can help you understand your responsibilities as an executor and can assist you with the process of accessing the safety deposit box.

It is important to remember that you are not alone in this process. There are many resources available to help you, including attorneys, accountants, and financial advisors.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

In addition to accessing the safety deposit box, you may also be responsible for other tasks, such as:

- Notifying the bank of the death of the account holder

- Closing the account

- Distributing the funds to the beneficiaries

It is important to keep in mind that the laws governing safety deposit boxes vary from state to state. It is important to consult with an attorney in your state to ensure that you are following the proper procedures.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Stock Pictures: Pictures of Locks for sale on the streets – Source stockpicturesforeveryone.blogspot.com

Here are some tips for accessing a safety deposit box after someone has died:

- Contact the bank as soon as possible after the person has died.

- Gather all of the necessary documentation, including the death certificate and the letter of testamentary.

- Be respectful of the deceased’s wishes.

- Handle the deceased’s belongings with care.

By following these tips, you can help ensure that the process of accessing the safety deposit box is as smooth and stress-free as possible.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

If you have any questions about accessing a safety deposit box after someone has died, you should contact an attorney for guidance.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Object moved – Source www.royalmint.com

Fun Facts:

- The largest safety deposit box in the world is located in the Bank of England.

- Safety deposit boxes have been used to store a variety of items, including gold, silver, jewelry, and even human ashes.

- Some banks offer safety deposit boxes that are designed to withstand natural disasters, such as earthquakes and floods.

Safety deposit boxes can be a convenient and secure way to store your valuables. However, it is important to remember that safety deposit boxes are not insured by the FDIC. This means that if the bank or credit union fails, your valuables may be lost.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

What’s in your safety deposit box? – Christian Living – Hope Reflected – Source www.hopereflected.com

Here are some steps on how to access a safety deposit box after someone has died:

- Contact the bank or credit union where the safety deposit box is located.

- Provide the bank or credit union with a copy of the death certificate and a letter of testamentary from the probate court.

- The bank or credit union will then allow you to access the safety deposit box and remove its contents.

It is important to note that you may not be able to access the safety deposit box immediately after the person has died. The bank or credit union may need time to process the paperwork and to make sure that the box is properly sealed.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

Why Secure Vault Storage is better than Safety Deposit Boxes – Wealth – Source www.wsvs.com.au

What if you cannot find the key to the safety deposit box? If you cannot find the key to the safety deposit box, you will need to contact the bank or credit union. The bank or credit union may be able to provide you with a duplicate key or may be able to open the box for you.

It is important to note that if the bank or credit union is unable to open the box, you may need to hire a locksmith to do so. However, this can be a costly and time-consuming process.

Executor’s Responsibilities: Accessing Safety Deposit Boxes After Death

<