Are you a landlord worried about protecting yourself from liability in the event of an accident on your property? Understanding injury exclusion clauses in your insurance policy is crucial. Read on to learn more about this essential coverage and safeguard your investment.

Landlord’s Liability and Injury Exclusion Clauses

As a landlord, you have a legal duty to maintain a safe environment for your tenants. This duty extends to the common areas of your property, including hallways, stairs, and parking lots. If a tenant or guest is injured due to a hazardous condition on your property, such as a broken step or inadequate lighting, you could be held liable for their injuries.

To protect yourself from this liability, you need landlord’s insurance. This insurance typically includes coverage for bodily injury and property damage that occurs on your property. However, most landlord’s insurance policies also include injury exclusion clauses, which limit coverage for certain types of injuries.

Target of Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

The main target of exclusion clauses is to limit the coverage for injuries that are deemed to be not foreseeable or reasonable. By excluding these types of injuries, the insurance can limit its liability and ensure that it is not responsible for every possible accident that might occur on the property.

Exclusion Clauses in Landlord’s Liability Protection

There are many different types of injury exclusion clauses in landlord’s insurance policies. Some common examples include:

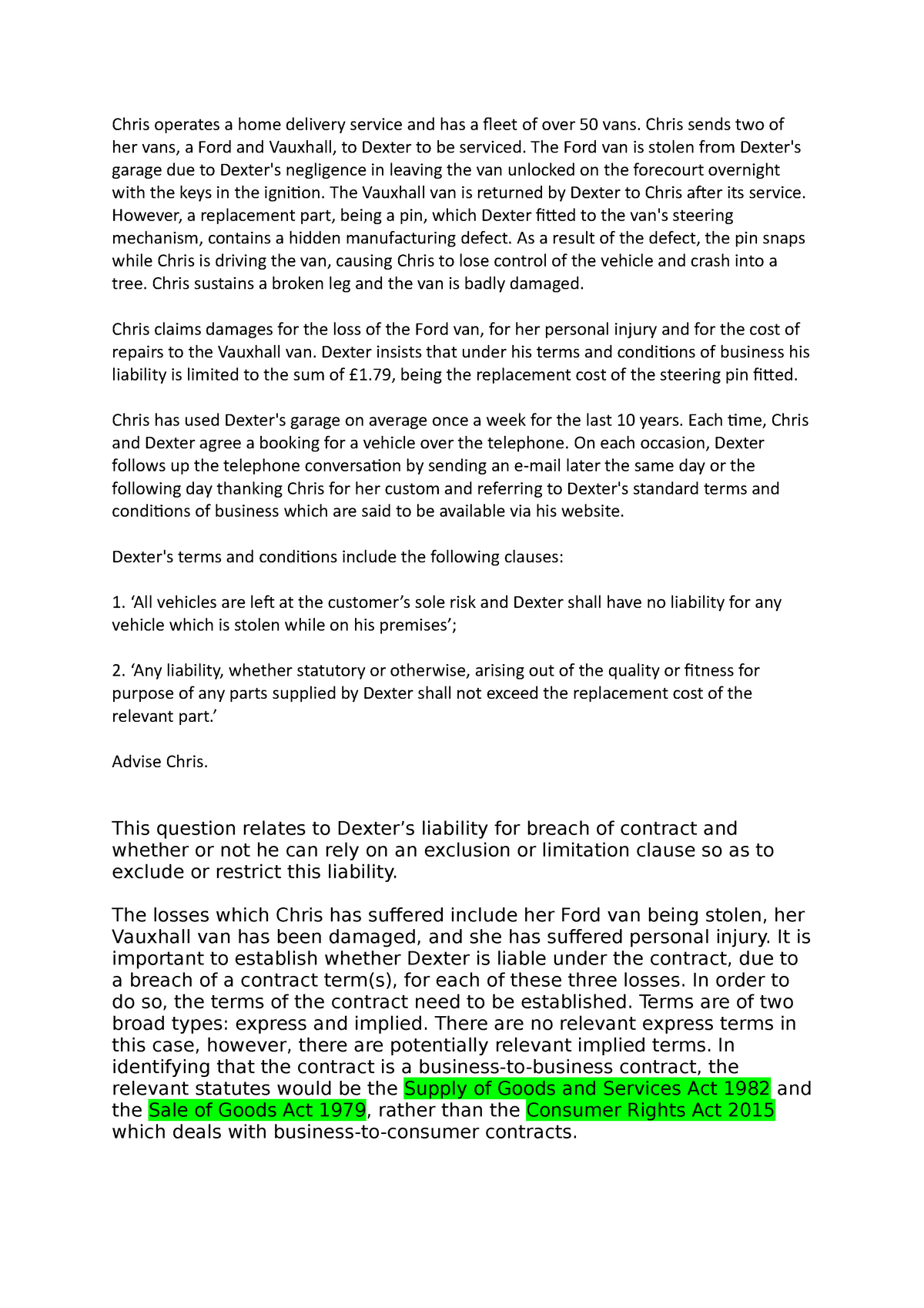

Exclusion clauses problem question – Chris operates a home delivery – Source www.studocu.com

- Intentional acts or criminal activity

- Injuries caused by third parties

- Injuries caused by the tenant’s own negligence

- Injuries caused by a latent defect

It is important to carefully review your landlord’s insurance policy to understand what types of injuries are excluded from coverage. You should also discuss your policy with your insurance agent to make sure that you have adequate coverage for your specific needs.

Personal Experience with Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

I once had a tenant who was injured when she slipped and fell on a wet floor in the common area of my building. Fortunately, she was not seriously injured, but she did file a claim with my insurance company.

My insurance company denied the claim because the injury was excluded under the policy’s injury exclusion clause. The policy excluded coverage for injuries caused by the tenant’s own negligence, and the insurance company argued that the tenant was negligent in not watching where she was walking.

I was disappointed that my insurance company denied the claim, but I understand why they did so. The injury exclusion clause is designed to protect insurance companies from having to pay for injuries that are caused by the negligence of the insured. I also understand that the exclusion clause is necessary to keep premiums low.

Recommendation for Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

I recommend that all landlords carefully review their landlord’s insurance policies to understand what types of injuries are excluded from coverage. You should also discuss your policy with your insurance agent to make sure that you have adequate coverage for your specific needs.

exclusion clause by helen simpson – Issuu – Source issuu.com

Additional Coverage for Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

In addition to landlord’s insurance, you may also want to consider purchasing additional coverage to protect yourself from liability. This coverage can include:

- Personal liability insurance

- Renter’s insurance

- Umbrella insurance

These additional coverages can provide you with peace of mind and help you to protect your assets in the event of an accident.

Landlord’s Liability Protection: Understanding Injury Exclusion Clauses in Summary

Landlord’s insurance is an essential part of protecting yourself from liability. However, it is important to understand the injury exclusion clauses in your policy. These clauses can limit coverage for certain types of injuries, such as intentional acts or criminal activity. By carefully reviewing your policy and discussing it with your insurance agent, you can make sure that you have adequate coverage for your specific needs.

Landlord’s Liability Protection: Understanding Injury Exclusion Clauses in Detail

There are many different factors that can affect the coverage of landlord’s insurance policies. These factors include the type of property, the number of units, and the location of the property. It is important to work with an insurance agent who understands these factors and can help you to find the right policy for your needs.

In addition to understanding the coverage of your policy, it is also essential to understand the exclusions. Exclusions are the specific types of losses that are not covered by your policy. Injury exclusion clauses are one of the most common types of exclusions.

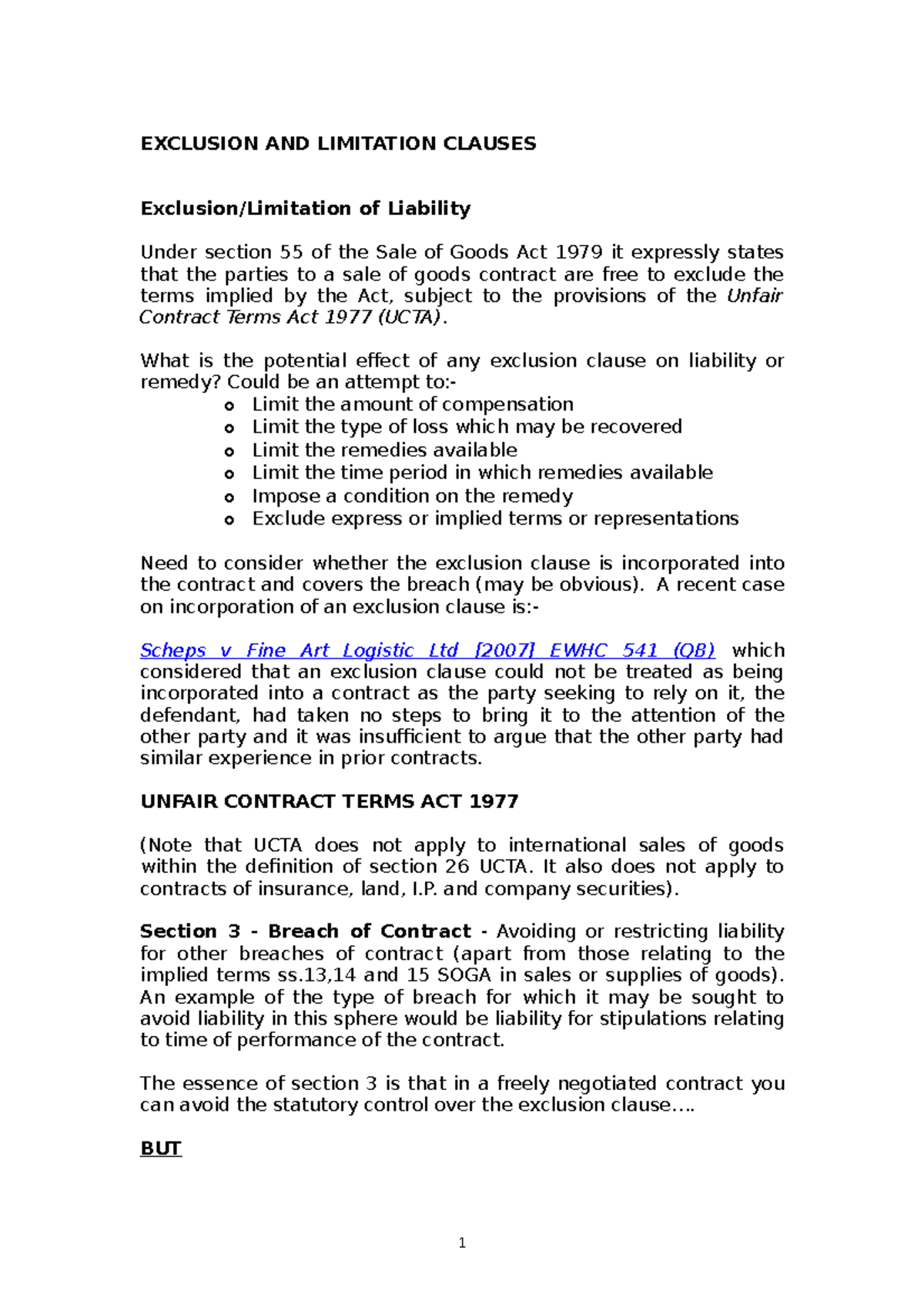

Exclusion & Limitation clauses – EXCLUSION AND LIMITATION CLAUSES – Source www.studocu.com

Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Injury exclusion clauses limit the coverage for injuries that are deemed to be not foreseeable or reasonable. By excluding these types of injuries, the insurance can limit its liability and ensure that it is not responsible for every possible accident that might occur on the property.

There are many different types of injury exclusion clauses in landlord’s insurance policies. Some common examples include:

- Intentional acts or criminal activity

- Injuries caused by third parties

- Injuries caused by the tenant’s own negligence

- Injuries caused by a latent defect

It is important to carefully review your landlord’s insurance policy to understand what types of injuries are excluded from coverage. You should also discuss your policy with your insurance agent to make sure that you have adequate coverage for your specific needs.

Tips for Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Here are some tips for understanding injury exclusion clauses in landlord’s insurance policies:

- Read your policy carefully and make sure that you understand the exclusions.

- Talk to your insurance agent about the exclusions and how they apply to your specific property.

- Consider purchasing additional coverage to protect yourself from liability.

- Be aware of the risks associated with renting your property and take steps to mitigate those risks.

By following these tips, you can help to protect yourself from liability and ensure that you have adequate coverage for your specific needs.

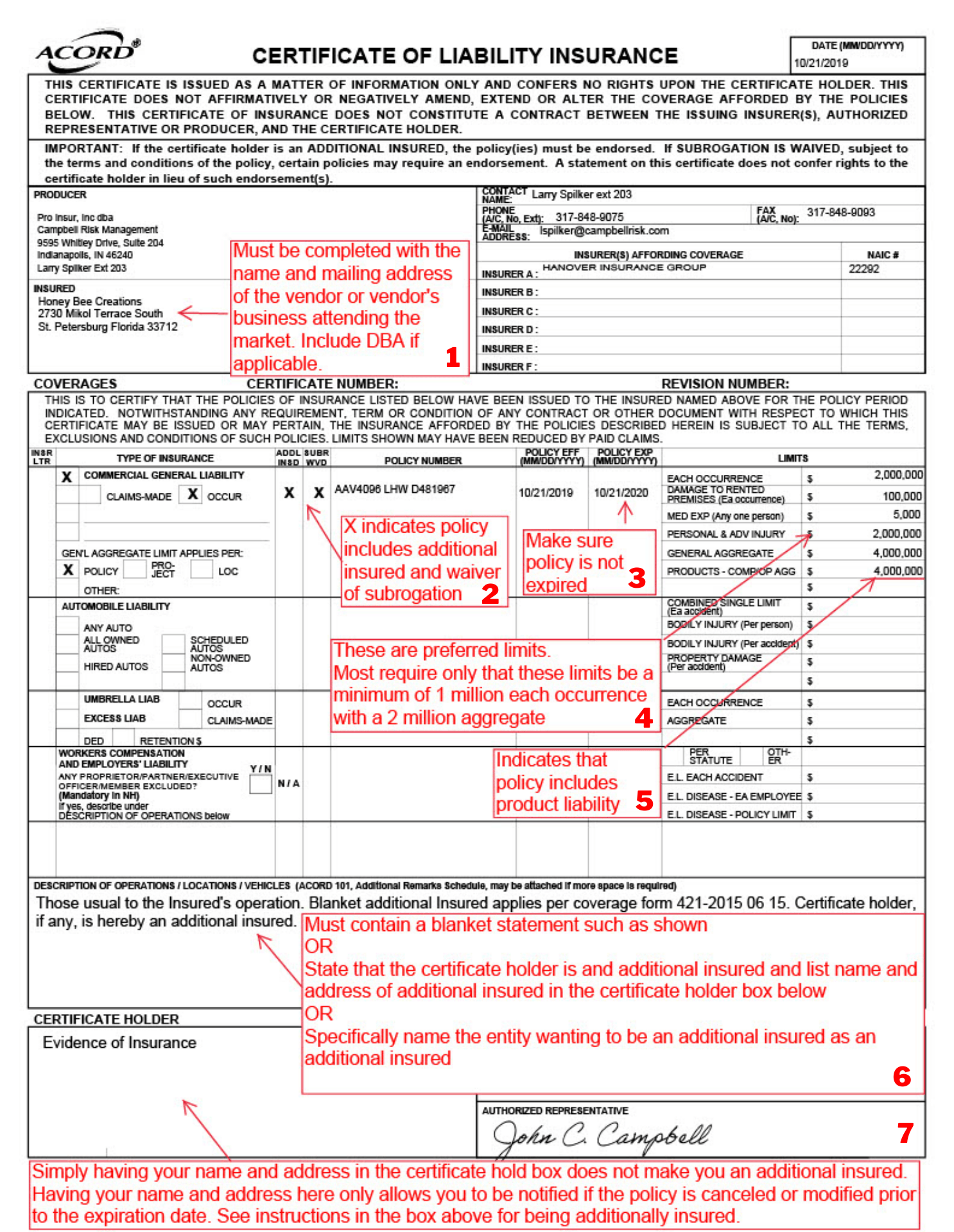

How to Read Your Certificate of Liability Insurance – Campbell Risk – Source www.campbellriskmanagement.com

Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Injury exclusion clauses are an important part of landlord’s insurance policies. By understanding these clauses, you can make sure that you have adequate coverage for your specific needs.

Fun Facts about Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Here are some fun facts about injury exclusion clauses in landlord’s insurance policies:

- Injury exclusion clauses are not required by law, but they are very common.

- The specific types of injuries that are excluded from coverage can vary from policy to policy.

- It is important to read your policy carefully to understand what types of injuries are excluded from coverage.

- You can purchase additional coverage to protect yourself from liability for injuries that are excluded from your policy.

How to Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

To ensure that you have adequate coverage for your specific needs, here are a few steps you can follow:

- Read your policy carefully and make sure that you understand the exclusions.

- Talk to your insurance agent about the exclusions and how they apply to your specific property.

- Consider purchasing additional coverage to protect yourself from liability.

- Be aware of the risks associated with renting your property and take steps to mitigate those risks.

What if Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

If you are not sure whether or not your landlord has insurance, you can ask them directly. If your landlord does not have insurance, you should consider getting renter’s insurance to protect yourself from liability in the event of an accident.

EU Standard Contractual Clauses: When and How to use them | Law – Source www.pinterest.co.uk

Listicle of Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Here is a listicle of important information about injury exclusion clauses in landlord’s insurance policies:

- Injury exclusion clauses are common in landlord’s insurance policies.

- The specific types of injuries that are excluded from coverage can vary from policy to policy.

- It is important to read your policy carefully to understand what types of injuries are excluded from coverage.

- You can purchase additional coverage to protect yourself from liability for injuries that are excluded from your policy.

- Be aware of the risks associated with renting your property and take steps to mitigate those risks.

Question and Answer about Landlord’s Liability Protection: Understanding Injury Exclusion Clauses

Here are some frequently asked questions about injury exclusion clauses in landlord’s insurance policies:

- What is an injury exclusion clause? An