Planning your estate can be a daunting task, but it’s essential to ensure that your wishes are carried out after you’re gone. A transfer-on-death deed can be a valuable tool in your estate plan, but it is important to understand how it works to make sure it meets your needs.

A transfer-on-death deed can help you avoid probate, which can be a lengthy and expensive process. Probate is the legal process of administering an estate after someone dies. If you have a will, probate is used to distribute your assets according to your wishes. If you die without a will, your assets will be distributed according to state law.

A transfer-on-death deed allows you to transfer ownership of your real property to a beneficiary upon your death. The beneficiary will not take ownership of the property until after you die. This can help you avoid probate, as the property will not be considered part of your estate.

Transfer-on-death deeds are relatively easy to create. You can create a transfer-on-death deed by filling out a form and having it notarized. You can also have an attorney prepare a transfer-on-death deed for you.

Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

A transfer-on-death deed is a legal document that allows you to transfer ownership of your real property to a beneficiary after your death. This can help you avoid probate, which can be a lengthy and expensive process.

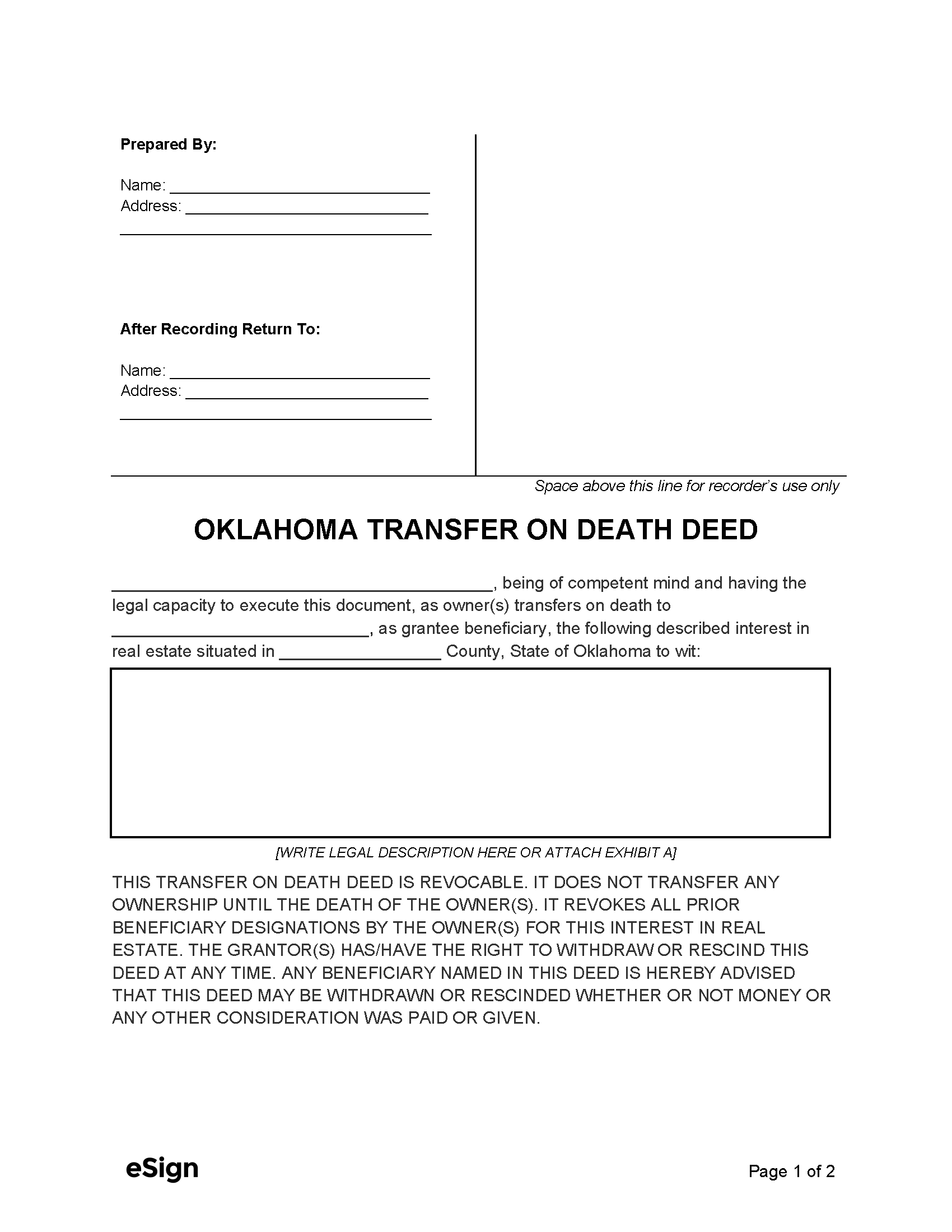

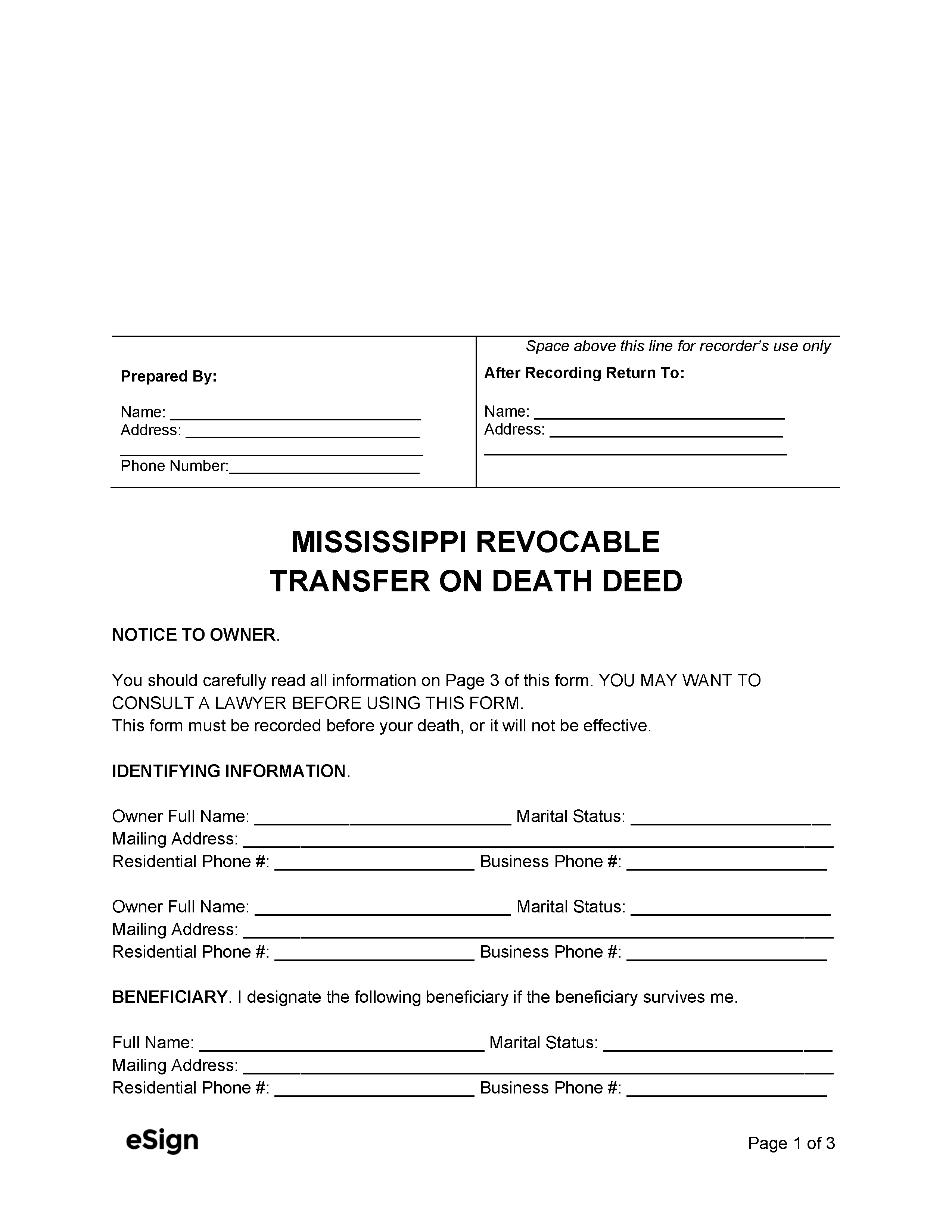

![Illinois Deed Forms & Templates (Free) [Word, PDF, ODT] Illinois Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Illinois-General-Warranty-Deed-Templates.Legal_.jpg)

Illinois Deed Forms & Templates (Free) [Word, PDF, ODT] – Source templates.legal

To create a transfer-on-death deed, you must fill out a form and have it notarized. You can also have an attorney prepare a transfer-on-death deed for you.

Once you have created a transfer-on-death deed, you should record it with the county recorder’s office in the county where the property is located. This will help to protect your beneficiary’s rights to the property.

History And Myth Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Transfer-on-death deeds have been around for centuries. The first known transfer-on-death deed was created in England in the 16th century.

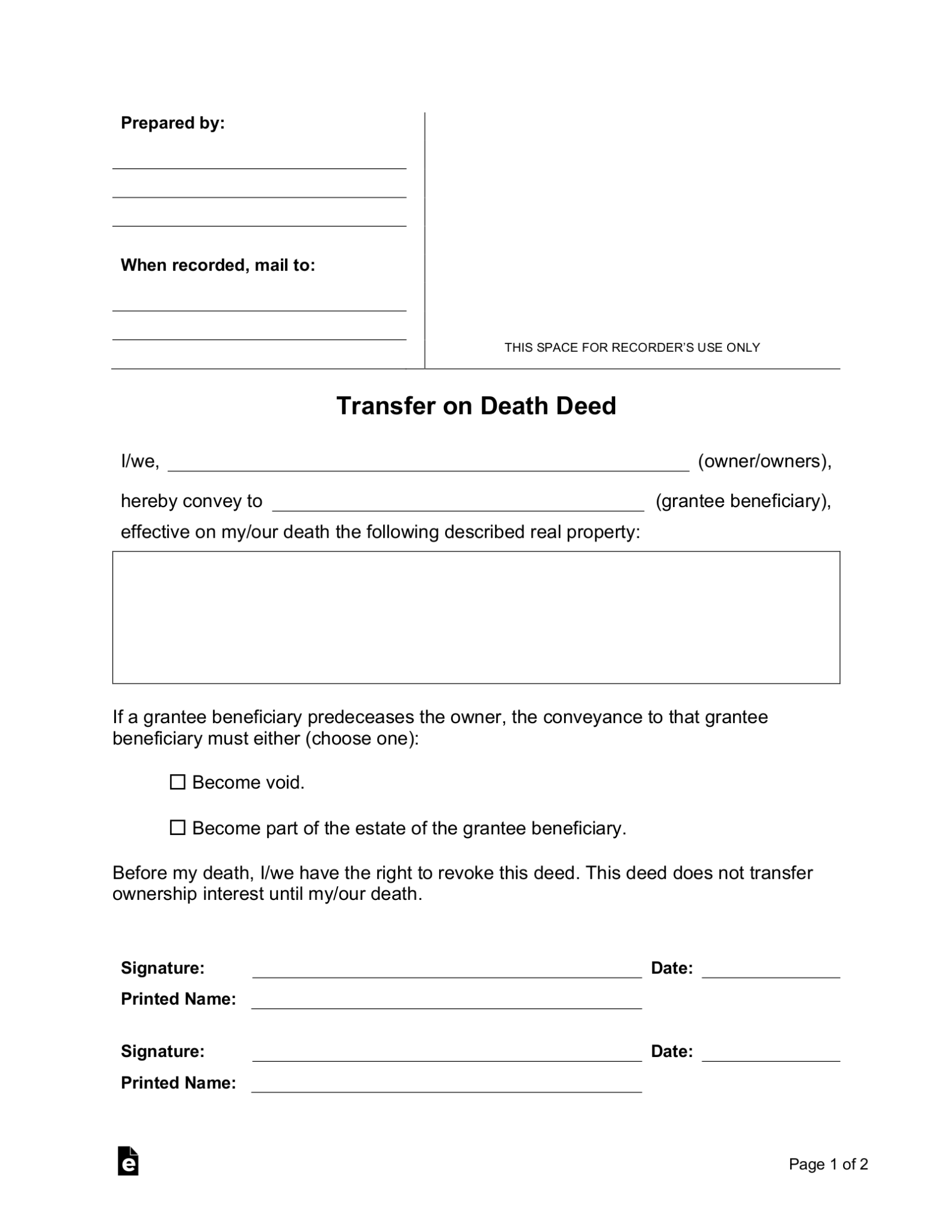

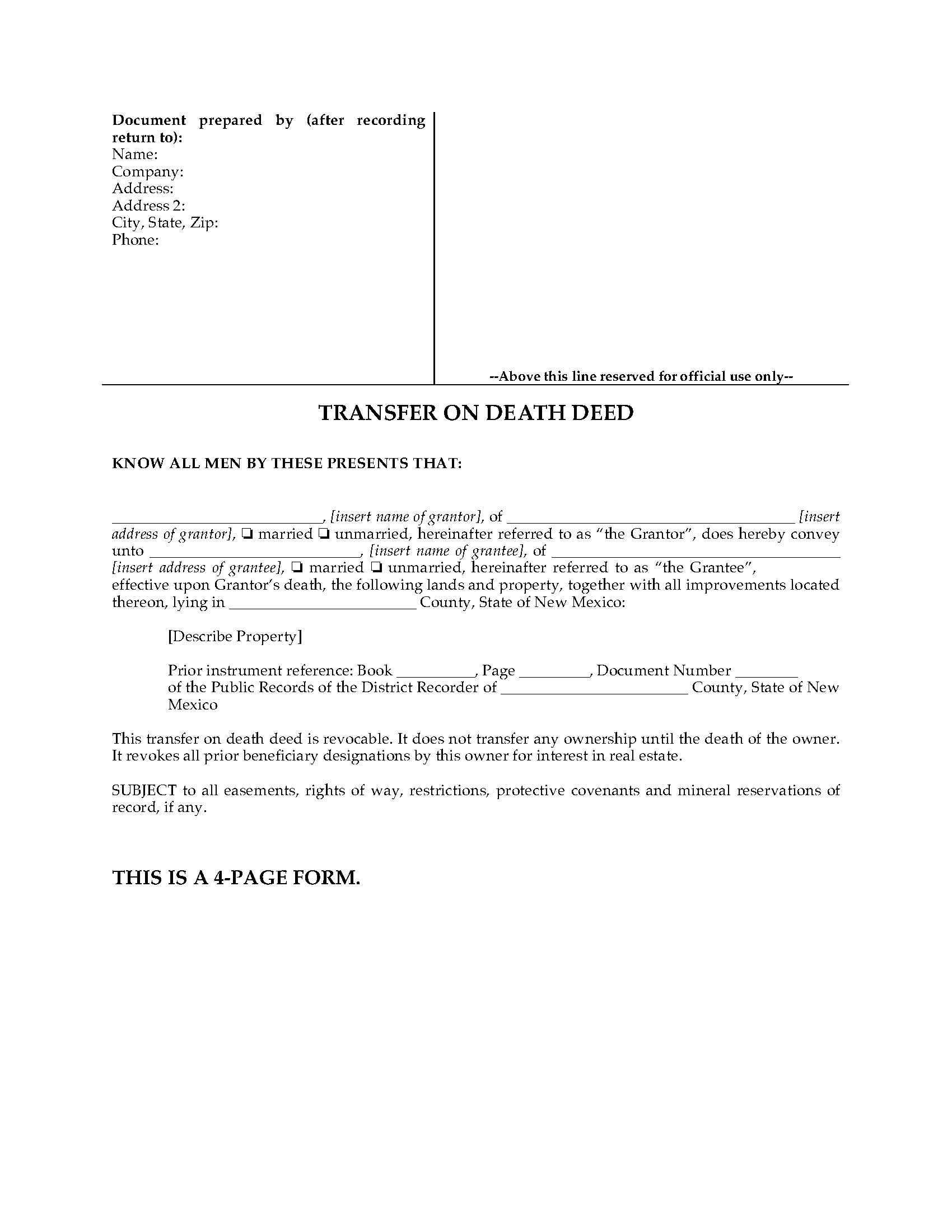

Montana Transfer On Death Deed Form Fill Out And Sign – vrogue.co – Source www.vrogue.co

Transfer-on-death deeds were originally used to transfer ownership of land to a beneficiary upon the death of the landowner. Over time, transfer-on-death deeds have been used to transfer ownership of other types of property, such as stocks, bonds, and bank accounts.

Hidden Secret Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

One of the hidden secrets of transfer-on-death deeds is that they can be used to avoid probate. Probate is the legal process of administering an estate after someone dies. Probate can be a lengthy and expensive process, so avoiding it can save your family time and money.

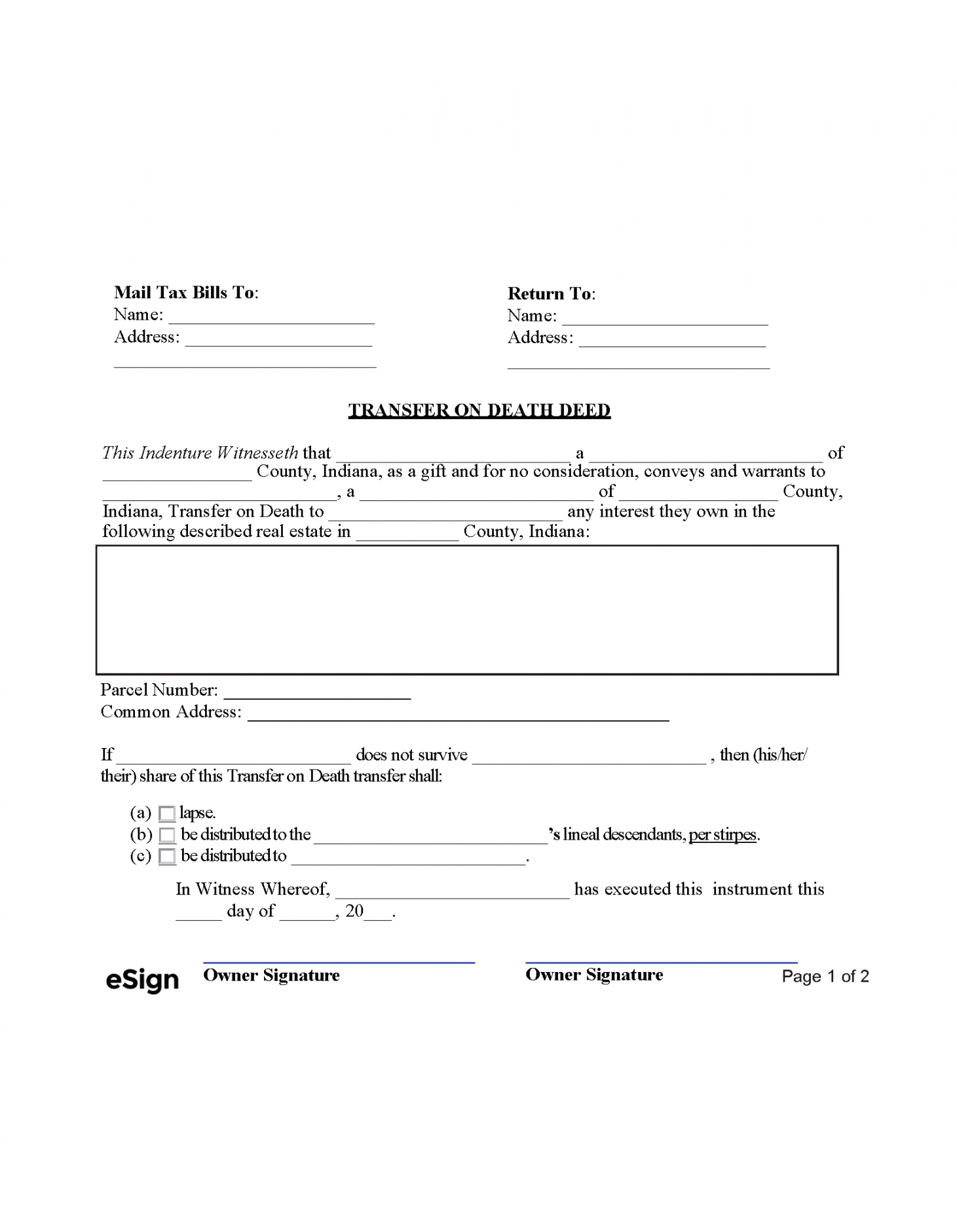

Free Transfer on Death Deed – PDF | Word – eForms – Source eforms.com

To avoid probate, you must create a transfer-on-death deed for all of your real property. You should also create a will to distribute your other assets, such as your personal property and bank accounts.

Recommendation Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

If you are considering creating a transfer-on-death deed, you should speak to an attorney. An attorney can help you understand the benefits and drawbacks of transfer-on-death deeds and can help you create a deed that meets your needs.

Free Printable Transfer On Death Deed Form Printable – vrogue.co – Source www.vrogue.co

Transfer-on-death deeds can be a valuable tool in your estate plan, but they are not right for everyone. If you are considering creating a transfer-on-death deed, you should speak to an attorney to learn more about your options.

Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Here are some additional tips for using transfer-on-death deeds:

- Make sure that you understand the terms of the deed.

- Keep the deed in a safe place.

- Tell your beneficiary about the deed.

- Review your deed regularly and make changes as needed.

Tips Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Here are some tips for using transfer-on-death deeds:

- Make sure that you understand the terms of the deed.

- Keep the deed in a safe place.

- Tell your beneficiary about the deed.

- Review your deed regularly and make changes as needed.

Transfer Death Tod Doc Template Pdffiller – vrogue.co – Source www.vrogue.co

By following these tips, you can use transfer-on-death deeds to help you avoid probate and protect your family.

Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Transfer-on-death deeds can be a powerful tool in your estate plan. By understanding the benefits and drawbacks of transfer-on-death deeds, you can make an informed decision about whether or not to use them.

Fun Facts Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Here are some fun facts about transfer-on-death deeds:

- Transfer-on-death deeds are not available in all states.

- The requirements for creating a transfer-on-death deed vary from state to state.

- Transfer-on-death deeds can be used to transfer ownership of real property, stocks, bonds, and bank accounts.

Printable Transfer On Death Deed Form Fill Out And Si – vrogue.co – Source www.vrogue.co

Transfer-on-death deeds can be a valuable tool in your estate plan. However, it is important to understand the benefits and drawbacks of transfer-on-death deeds before you decide whether or not to use them.

How To Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

To transfer a death deed in Illinois, you must follow these steps:

- Obtain a death certificate for the deceased.

- Complete the Transfer on Death Deed form.

- Have the deed notarized.

- File the deed with the recorder of deeds in the county where the property is located.

Transfer On Death Deed Template – Source old.sermitsiaq.ag

Once the deed is filed, the property will be transferred to the new owner.

What If Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

What if you want to change the beneficiary of your transfer-on-death deed? You can do so by creating a new deed and filing it with the recorder of deeds.

What if you want to sell the property that is subject to a transfer-on-death deed? You can do so, but you will need to get the consent of the beneficiary.

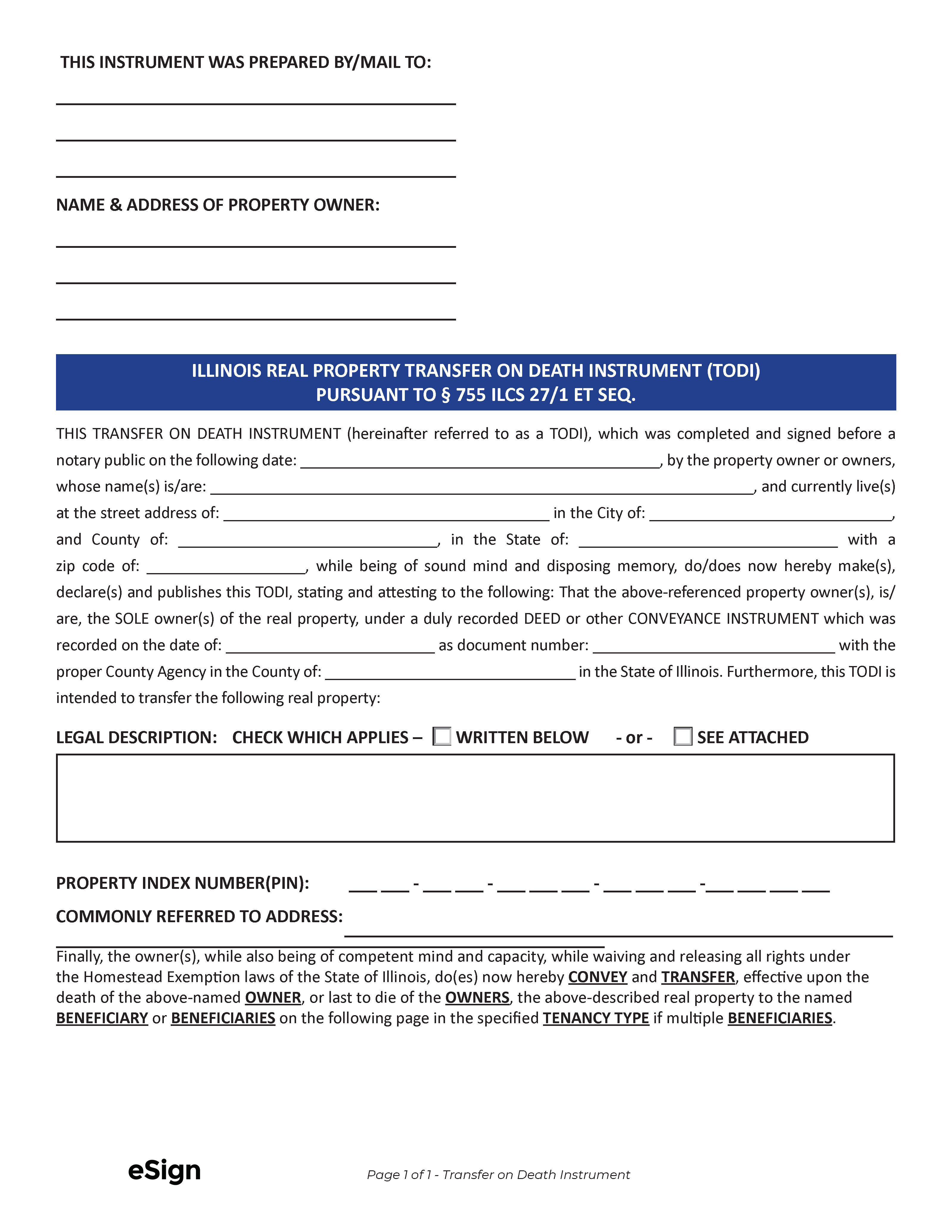

Dupage County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

What if the beneficiary of your transfer-on-death deed dies before you? The property will pass to the contingent beneficiary that you named in the deed.

Listicle Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

- Transfer-on-death deeds can be used to avoid probate.

- Transfer-on-death deeds are not available in all states.

- The requirements for creating a transfer-on-death deed vary from state to state.

- Transfer-on-death deeds can be used to transfer ownership of real property, stocks, bonds, and bank accounts.

- Transfer-on-death deeds can be a valuable tool in your estate plan.

- It is important to understand the benefits and drawbacks of transfer-on-death deeds before you decide whether or not to use them.

Colorado Quit Claim Deed Form – Source cocosign.com

Question And Answer

- What is a transfer-on-death deed?

- How do I create a transfer-on-death deed?

- What are the benefits of a transfer-on-death deed?

- What are the drawbacks of a transfer-on-death deed?

A transfer-on-death deed is a legal document that allows you to transfer ownership of your real property to a beneficiary after your death.

To create a transfer-on-death deed, you must fill out a form and have it notarized.

Transfer-on-death deeds can help you avoid probate, which can be a lengthy and expensive process.

One of the drawbacks of a transfer-on-death deed is that it can be difficult to change the beneficiary after the deed has been created.

Conclusion Of Transfer Of Death Deed Illinois: A Comprehensive Guide To Estate Planning

Transfer-on-death deeds can be a valuable tool in your estate plan. However, it is important to understand the benefits and drawbacks of transfer-on-death deeds before you decide whether or not to use them. If you have any questions about transfer-on-death