Looking to simplify your estate planning? Discover the Transfer On Death Instrument, a valuable tool for Cook County residents seeking a seamless transfer of assets.

Understanding the Challenges of Estate Planning

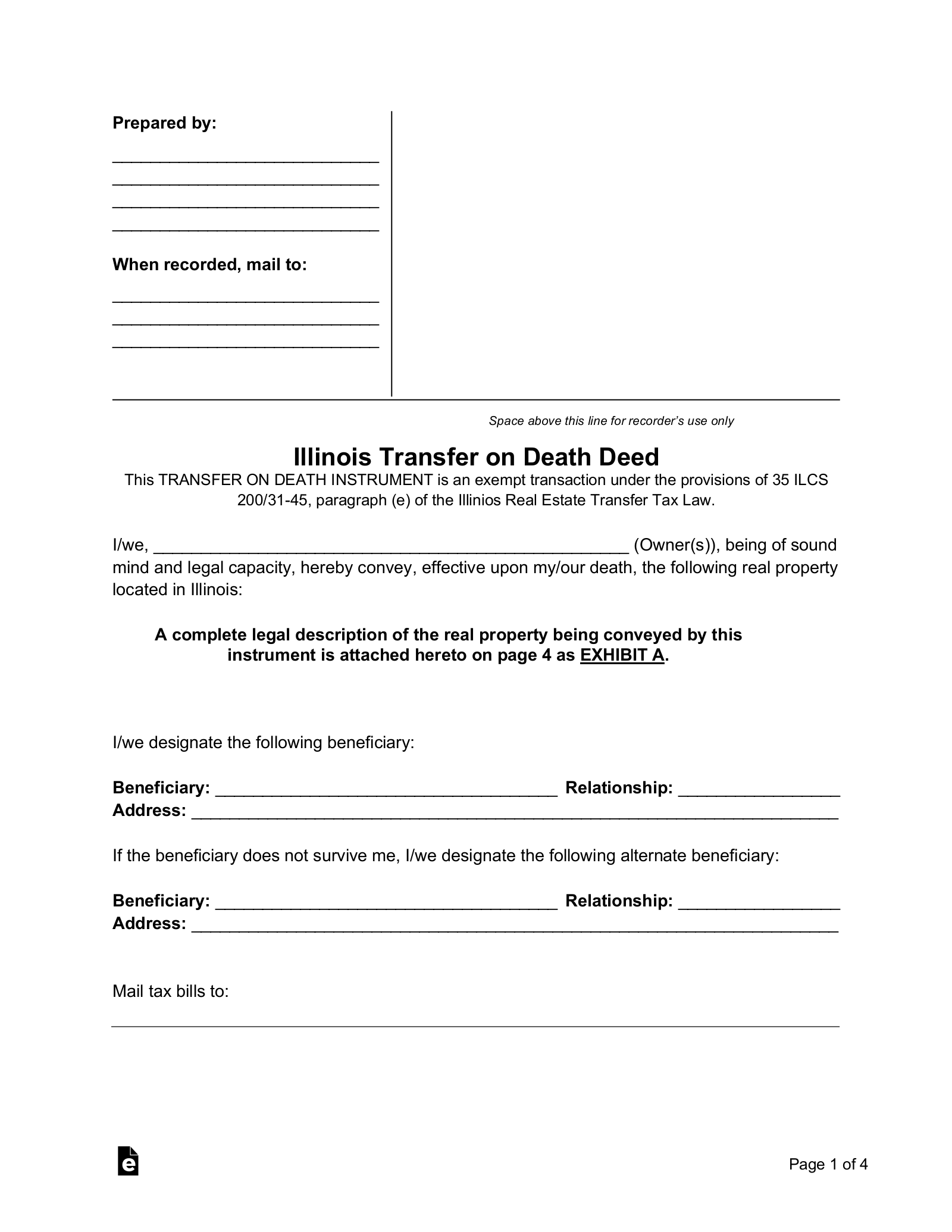

Free Illinois Transfer on Death Deed – PDF | Word – eForms – Source eforms.com

Estate planning can be a complex and daunting task. The traditional probate process can be time-consuming, costly, and often involves public disclosure of your assets. This can lead to delays, disputes, and unnecessary stress for your loved ones.

The Solution: Transfer On Death Instrument

Mckenzie County Transfer on Death Affidavit Form | North Dakota | Deeds.com – Source www.deeds.com

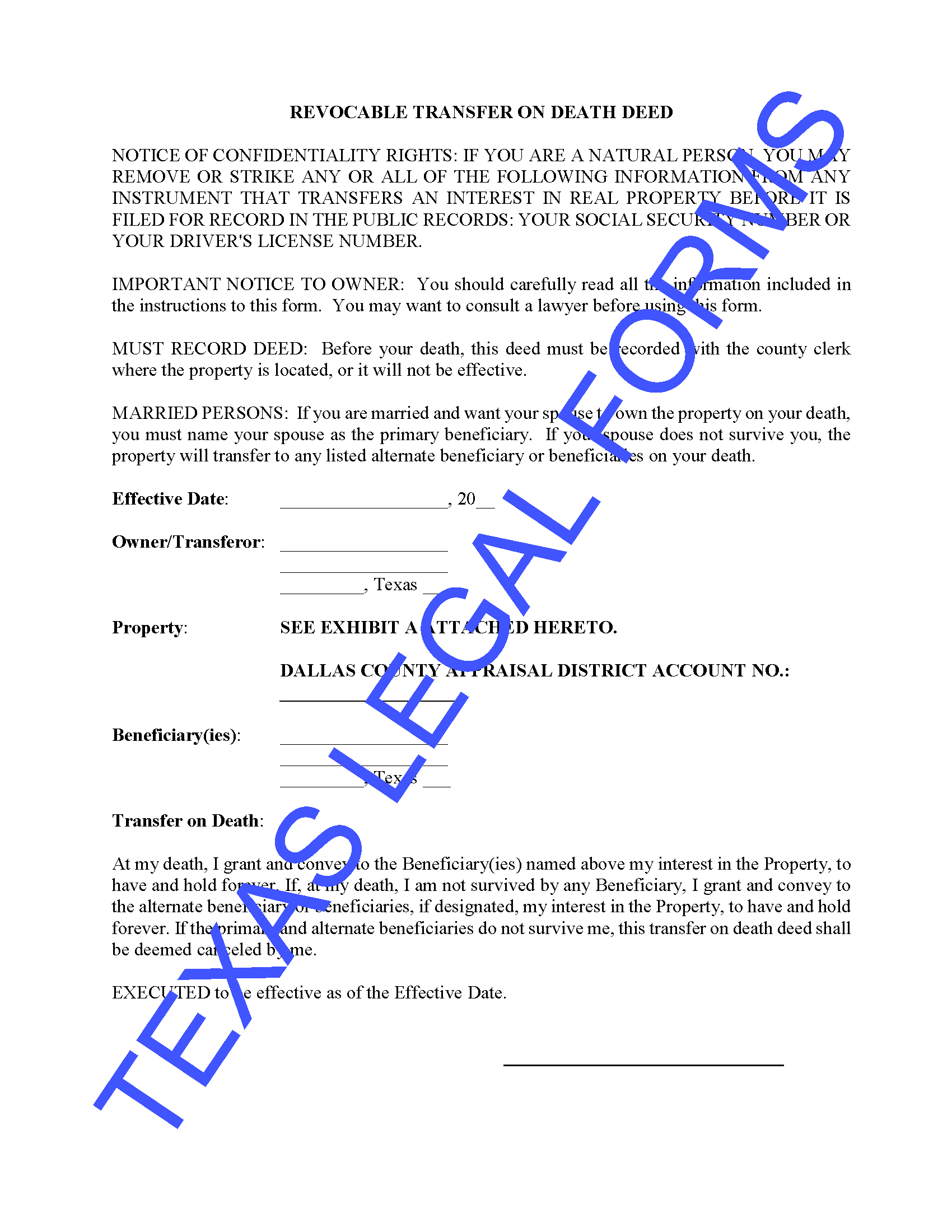

A Transfer On Death Instrument (TODI) offers an alternative to probate. It allows you to designate beneficiaries who will receive specific assets upon your death. This can include real estate, bank accounts, and other valuable possessions. By utilizing a TODI, you can streamline the transfer process, reduce probate fees, and maintain privacy.

Key Points About TODIs

Clark County Transfer on Death Deed Form | Nevada | Deeds.com – Source www.deeds.com

Personal Experience with TODIs

Cook County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

As a financial advisor, I have witnessed firsthand the benefits of TODIs. One client, Sarah, was facing a complex probate process after her father’s passing. The process was lengthy, expensive, and emotionally draining for her family. To avoid a similar situation, Sarah created a TODI designating her children as beneficiaries of her real estate. This ensured a smooth and seamless transfer of her assets upon her passing.

What is a Transfer On Death Instrument?

New Mexico Deed Transfer Form Free Printable – Printable Forms Free Online – Source printableformsfree.com

A TODI is a legal document that allows you to transfer ownership of certain assets to designated beneficiaries upon your death, without going through probate. This can be a valuable tool for managing the distribution of your property and avoiding unnecessary costs and delays.

History and Myths of TODIs

Cass County Transfer of Death Deed Form | North Dakota | Deeds.com – Source www.deeds.com

TODIs have been around for centuries, but there are still some common misconceptions surrounding them. One myth is that TODIs only apply to real estate. In reality, they can be used for various assets, including bank accounts, stocks, and bonds. Another misconception is that TODIs are only valid if you have a will. While a will can supplement a TODI, it is not required to create one.

Hidden Secrets of TODIs

Dupage County Transfer on Death Instrument Form | Illinois | Deeds.com – Source www.deeds.com

Beyond the basics, TODIs offer several hidden benefits. One advantage is that they allow you to maintain control over your assets during your lifetime. You can change or revoke a TODI at any time, giving you flexibility and peace of mind. Another benefit is that TODIs are not subject to claims from your creditors. This means that your assets will be distributed according to your wishes, even if you have outstanding debts.

Recommendation for Using TODIs

Campbell County Transfer on Death Affidavit Form | Wyoming | Deeds.com – Source www.deeds.com

If you are looking for a simple and effective way to plan your estate, TODIs are a valuable tool to consider. They can save you time, money, and stress, while ensuring that your assets are distributed according to your wishes. Consult with an experienced estate planning attorney to determine if a TODI is right for you.

Transfer On Death Instrument: A Guide For Cook County Residents

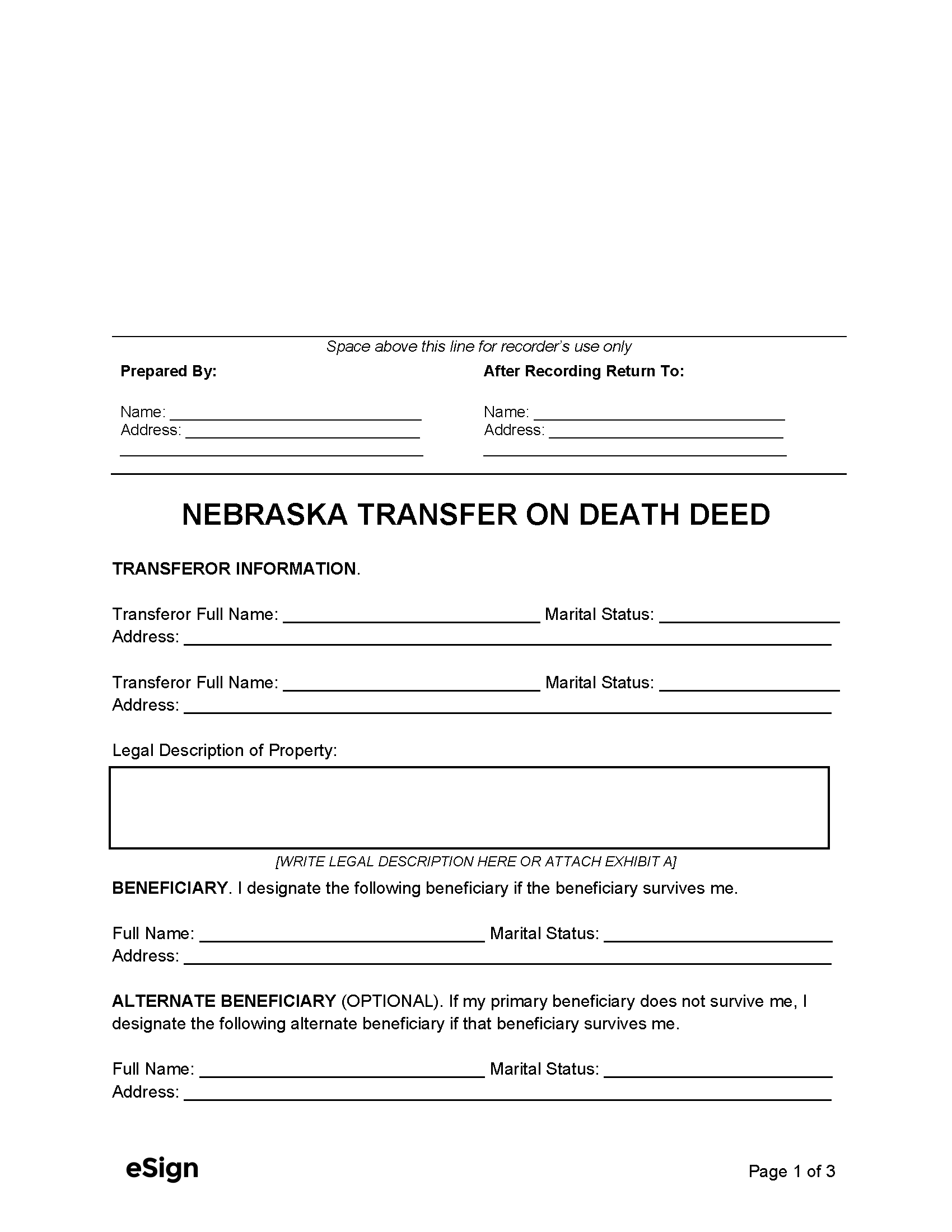

Free Nebraska Transfer on Death Deed Form | PDF | Word – Source esign.com

In Cook County, TODIs offer specific advantages. Illinois law allows for the creation of TODIs for real estate, vehicles, and certain types of financial accounts. By utilizing TODIs, Cook County residents can avoid the probate process and its associated costs. Furthermore, TODIs can provide peace of mind, knowing that their wishes will be respected after their passing.

Tips for Using TODIs Effectively

Oconto County Transfer on Death Deed Form | Wisconsin | Deeds.com – Source www.deeds.com

To ensure that your TODI is effective, follow these tips:

Cook County Resources for TODIs

The Cook County Recorder of Deeds provides information and resources on TODIs. You can obtain official TODI forms and find additional guidance on the Recorder’s website.

Fun Facts About TODIs

Did you know?

How to Create a Transfer On Death Instrument

Creating a TODI is relatively simple. It involves completing a form and having it notarized. You can obtain a TODI form from your financial institution or an estate planning attorney. Be sure to carefully review the form and provide accurate information.

What if You Change Your Mind About a TODI?

If you decide you no longer want a TODI, you can revoke it at any time. To do so, you must destroy the original document or create a new document that revokes the previous TODI.

Listicle of Benefits of TODIs

Question and Answer

1. Can I create a TODI for all my assets?

No, TODIs are only available for certain types of assets, such as real estate, vehicles, and financial accounts.

2. Do I need a lawyer to create a TODI?

While you can create a TODI without an attorney, it is advisable to consult with one to ensure that the document is properly executed and meets your needs.

3. What happens if I die without a TODI?

Your assets will be distributed according to the laws of intestacy in your state. This may not reflect your wishes or intentions.

4. Can I change a TODI after it has been created?

Yes, you can change or revoke a TODI at any time. Simply destroy the original document or create a new document that revokes the previous TODI.

Conclusion of Transfer On Death Instrument: A Guide For Cook County Residents

A Transfer On Death Instrument (TODI) is a valuable tool for Cook County residents seeking to simplify their estate planning and avoid the complexities of probate. By designating specific beneficiaries to receive your assets upon your death, you can streamline the transfer process, reduce costs, and maintain privacy. If you are considering using a TODI, consult with an experienced estate planning attorney to determine if it is the right choice for you.