Are you a homeowner in Illinois looking for ways to protect your most valuable asset?

Owning a home is a significant investment, and it’s important to understand the legal protections available to safeguard your property. One valuable tool that homeowners in Illinois can utilize is the Homestead Exemption.

Homestead Exemption provides a layer of protection for your home from creditors and other legal actions. By understanding and utilizing this exemption, you can secure your property and ensure its value for years to come. Here’s a comprehensive guide to unlocking homestead rights in Illinois and safeguarding your property effectively.

Unlocking Homestead Rights In Illinois: A Comprehensive Guide To Protecting Your Property

Homestead Exemption is a legal provision that protects a specified portion of your home’s equity from creditors and certain legal claims. In Illinois, the Homestead Exemption allows homeowners to exempt up to $15,000 of their home’s equity from forced sale to satisfy debts or judgments.

Unlocking homestead rights in Illinois is a relatively straightforward process. The first step is to file a Declaration of Homestead with the county recorder’s office in the county where your property is located. You can obtain the necessary forms from the recorder’s office or download them online.

Access Control Systems – Mustang Locksmith Inc – Source mustanglocks.com

Once you have completed the Declaration of Homestead, you must file it with the county recorder’s office. There is usually a small filing fee associated with this process. Once the Declaration of Homestead is filed, it will be recorded in the county’s land records and become effective immediately.

It’s essential to note that Homestead Exemption only applies to your primary residence. You can only have one Homestead Exemption at a time. If you move, you will need to file a new Declaration of Homestead for your new property.

Fire door safety to protect your property and save lives – Source rjswastemanagement.co.uk

Homestead Exemption provides several benefits to homeowners in Illinois. First, it can protect your home from creditors. If you have outstanding debts or judgments against you, your creditors cannot force the sale of your home to satisfy those debts. This can provide peace of mind and ensure that you have a place to live, even if you experience financial difficulties.

Second, Homestead Exemption can protect your home from property taxes. In Illinois, homeowners who qualify for the Homestead Exemption receive a reduction in their property taxes. This can save you money on your annual property tax bill and make it more affordable to own a home.

10 Modern Fence Ideas – Source www.msn.com

There are some limitations to Homestead Exemption. For example, Homestead Exemption does not protect your home from liens that were placed on your property before you filed the Declaration of Homestead. Additionally, Homestead Exemption does not protect your home from foreclosure if you fail to make your mortgage payments.

Overall, Homestead Exemption is a valuable tool that can protect your home from creditors and legal actions. By understanding and utilizing this exemption, you can safeguard your property and ensure its value for years to come.

Dealing with Termites: Protecting Your Property » Sundarban Pest – Source sundarbanpestcontrol.com

Unlocking Homestead Rights In Illinois: A Personal Experience

I recently went through the process of unlocking homestead rights in Illinois. I was initially hesitant because I didn’t know much about the process. However, I’m glad I did it because it was relatively easy and has already provided me with peace of mind.

I downloaded the Declaration of Homestead form from the county recorder’s office website. Once I completed the form, I took it to the recorder’s office and filed it. The entire process took less than 30 minutes.

I’m now confident that my home is protected from creditors and legal actions. If you’re a homeowner in Illinois, I encourage you to consider unlocking your homestead rights. It’s a simple process that can provide you with valuable peace of mind.

Unlocking Real Estate Property Appraisals A Guide – Source nolvamedblog.com

Unlocking Homestead Rights In Illinois: History And Myths

The Homestead Exemption has a long history in Illinois. It was first enacted in 1870 to protect family farms from creditors. Over the years, the exemption has been expanded to include all homeowners in Illinois.

There are many myths about Homestead Exemption. One common myth is that you can only file for Homestead Exemption if you are over a certain age or income level. This is not true. Any homeowner in Illinois can file for Homestead Exemption, regardless of their age or income.

Another common myth is that Homestead Exemption protects your home from all debts. This is also not true. Homestead Exemption only protects your home from debts that are not secured by your home. For example, Homestead Exemption will not protect your home from foreclosure if you fail to make your mortgage payments.

Intruder Alarms: Effectively protecting your business – Security Group – Source www.securitygroupltd.co.uk

Unlocking Homestead Rights In Illinois: A Hidden Secret

Homestead Exemption is a valuable tool that can protect your home from creditors and legal actions. However, many homeowners in Illinois are unaware of this exemption. As a result, they are not taking advantage of this valuable protection.

If you’re a homeowner in Illinois, I encourage you to learn more about Homestead Exemption. It’s a simple process that can provide you with valuable peace of mind.

To learn more about Homestead Exemption, you can visit the website of the Illinois State Bar Association or contact your local county recorder’s office.

Christmas Decorations From Your Garden – Greet Kris – Source greetkris.blogspot.com

Unlocking Homestead Rights In Illinois: Recommendations

Here are a few recommendations for unlocking homestead rights in Illinois:

- File a Declaration of Homestead as soon as possible after you purchase your home.

- Keep a copy of your Declaration of Homestead in a safe place.

- Review your Declaration of Homestead every few years to make sure it is still accurate.

- If you move, you will need to file a new Declaration of Homestead for your new property.

By following these recommendations, you can ensure that your home is protected from creditors and legal actions.

Our Pro Guarantee – Get the Best Service from TradiePro – Source tradie.pro

Unlocking Homestead Rights In Illinois: How It Works

To unlock homestead rights in Illinois, you must file a Declaration of Homestead with the county recorder’s office in the county where your property is located. The Declaration of Homestead must include the following information:

- Your name and address

- The legal description of your property

- A statement that you are the owner of the property and that you reside there as your primary residence

Once you have filed the Declaration of Homestead, it will be recorded in the county’s land records and become effective immediately.

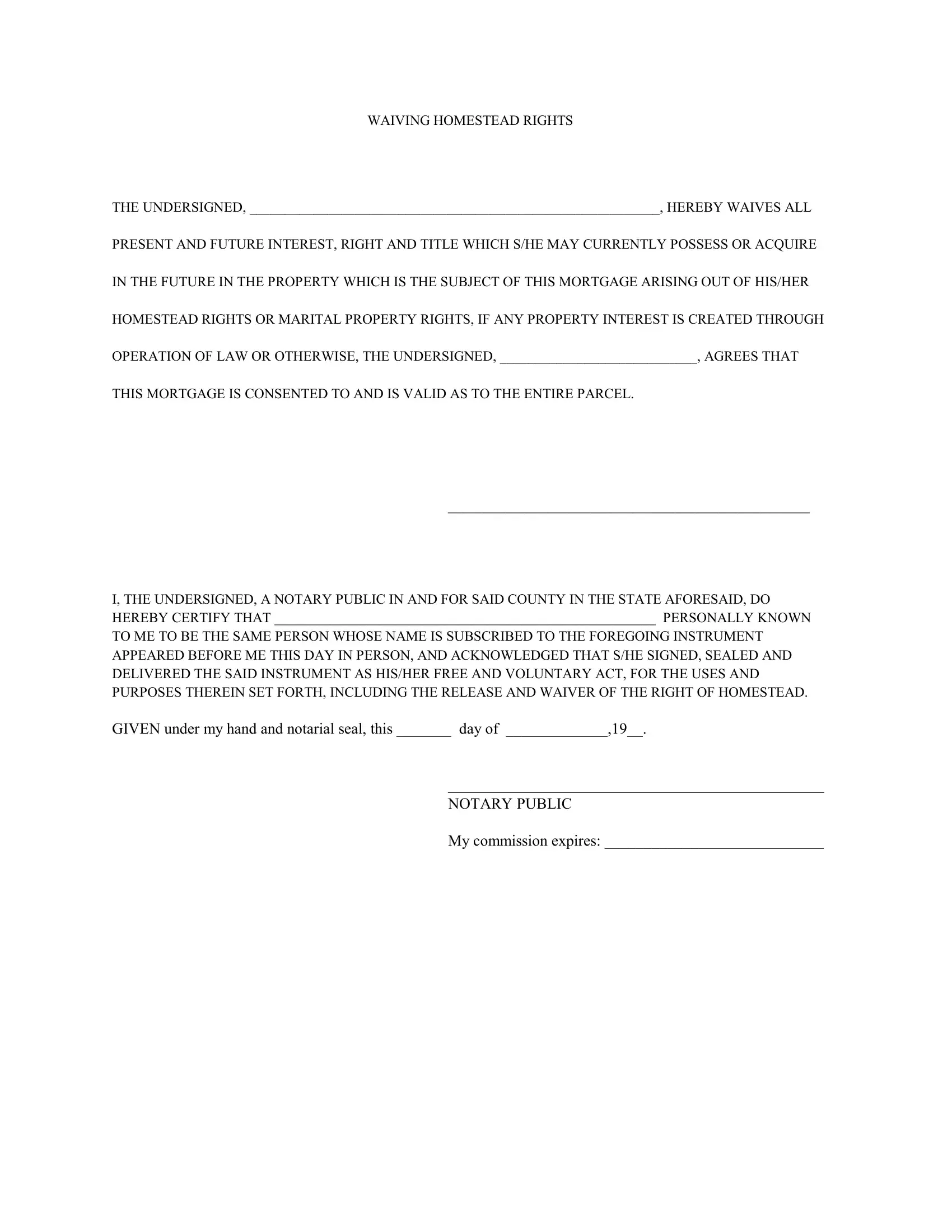

Waiving Homestead Form ≡ Fill Out Printable PDF Forms Online – Source formspal.com

Unlocking Homestead Rights In Illinois: Tips

Here are a few tips for unlocking homestead rights in Illinois:

- File your Declaration of Homestead as soon as possible after you purchase your home.

- Keep a copy of your Declaration of Homestead in a safe place.

- Review your Declaration of Homestead every few years to make sure it is still accurate.

- If you move, you will need to file a new Declaration of Homestead for your new property.

- If you have any questions about Homestead Exemption, you can contact your local county recorder’s office or an attorney.

By following these tips, you can ensure that your home is protected from creditors and legal actions.

Protect Your Property with These 4 Business Security Solutions | Kfoury – Source kfouryeng.com

Unlocking Homestead Rights In Illinois: Fun Facts

Here are a few fun facts about Homestead Exemption in Illinois:

- The Homestead Exemption was first enacted in Illinois in 1870.

- The Homestead Exemption is available to all homeowners in Illinois, regardless of their age or income.

- The Homestead Exemption protects up to $15,000 of your home’s equity from creditors and legal actions.

- The Homestead Exemption does not protect your home from liens that were placed on your property before you filed the Declaration of Homestead.

- The Homestead Exemption does not protect your home from foreclosure if you fail to make your mortgage payments.

These are just a few fun facts about Homestead Exemption in Illinois. By understanding and utilizing this exemption, you can safeguard your home and ensure its value for years to come.

Unlocking Homestead Rights In Illinois: What If

What if I don’t file a Declaration of Homestead? If you do not file a Declaration of Homestead, you will not be able to take advantage of the Homestead Exemption. This means that your home will not be protected from creditors and legal actions. If you have any debts or judgments against you, your creditors could force the sale of your home to satisfy those debts.

What if I move? If you move, you will need to file a new Declaration of Homestead for your new property. The Homestead Exemption only applies to your primary residence. You can only have one Homestead Exemption at a time.