Estate Settlement: Navigating The Process Without Legal Representation

Navigating the process of estate settlement, especially without legal representation, can be overwhelming. It’s essential to understand the complexities involved, manage potential pitfalls, and navigate the legal framework to ensure a smooth and compliant settlement.

Should This Agreement be Enforced? – Davis & Mendelson Law Should This – Source www.camdencountydivorcelawyer.com

Understanding Estate Settlement

Estate settlement involves managing the distribution of a deceased individual’s assets and liabilities. It encompasses tasks such as locating assets, managing debts, preparing tax returns, and distributing assets to beneficiaries. The process can be time-consuming and requires attention to detail.

Seeking legal representation can add significant costs to the settlement process. However, there are options for navigating estate settlement without legal assistance. Self-representation can be feasible for smaller, less complex estates, where the deceased had a simple will and minimal assets.

Navigating Electronic Signatures (“E-Signatures”) in Real Estate – Source www.laughlinlawfirm.com

Sorting Personal Experience and Estate Settlement

Dealing with the emotional aspects of losing a loved one while navigating estate settlement can be challenging. It’s crucial to separate personal feelings from the tasks at hand. Focus on understanding the legal process, gathering necessary documentation, and making informed decisions.

The process of estate settlement can unearth unexpected complexities. Understanding the legal framework and documentation involved is key. Probate, the legal process for administering an estate, can vary depending on the state. Research and consult resources to stay informed and avoid costly mistakes.

.jpg)

Chicago Freedom School | Co-empowering with Youth. Honoring The Past – Source www.chicagofreedomschool.org

Filing Essential Paperwork

One of the crucial steps in estate settlement is filing the deceased’s Last Will and Testament with the appropriate court. This document outlines the deceased’s final wishes regarding the distribution of their assets. If there is no will, the process becomes more complex and may require the appointment of an administrator.

Estate executors and administrators have specific responsibilities in managing the estate. They must gather and value assets, pay debts and taxes, and distribute assets to beneficiaries. Understanding their roles and responsibilities is essential for a smooth settlement process.

Immigrant Rights Champions Introduce Bill to Create Statewide Universal – Source www.rmian.org

Tax Implications in Estate Settlement

Estate settlement involves navigating complex tax implications. Federal and state laws govern estate taxes and income taxes on estate assets. Executors and administrators must be aware of these laws to ensure timely and accurate tax filings. Failure to address tax obligations can result in penalties and additional costs.

Estate executors and administrators must manage estate finances responsibly. This includes paying outstanding debts, managing estate income and expenses, and preparing and filing tax returns. Careful financial management ensures that the estate’s assets are used appropriately and that taxes are paid on time.

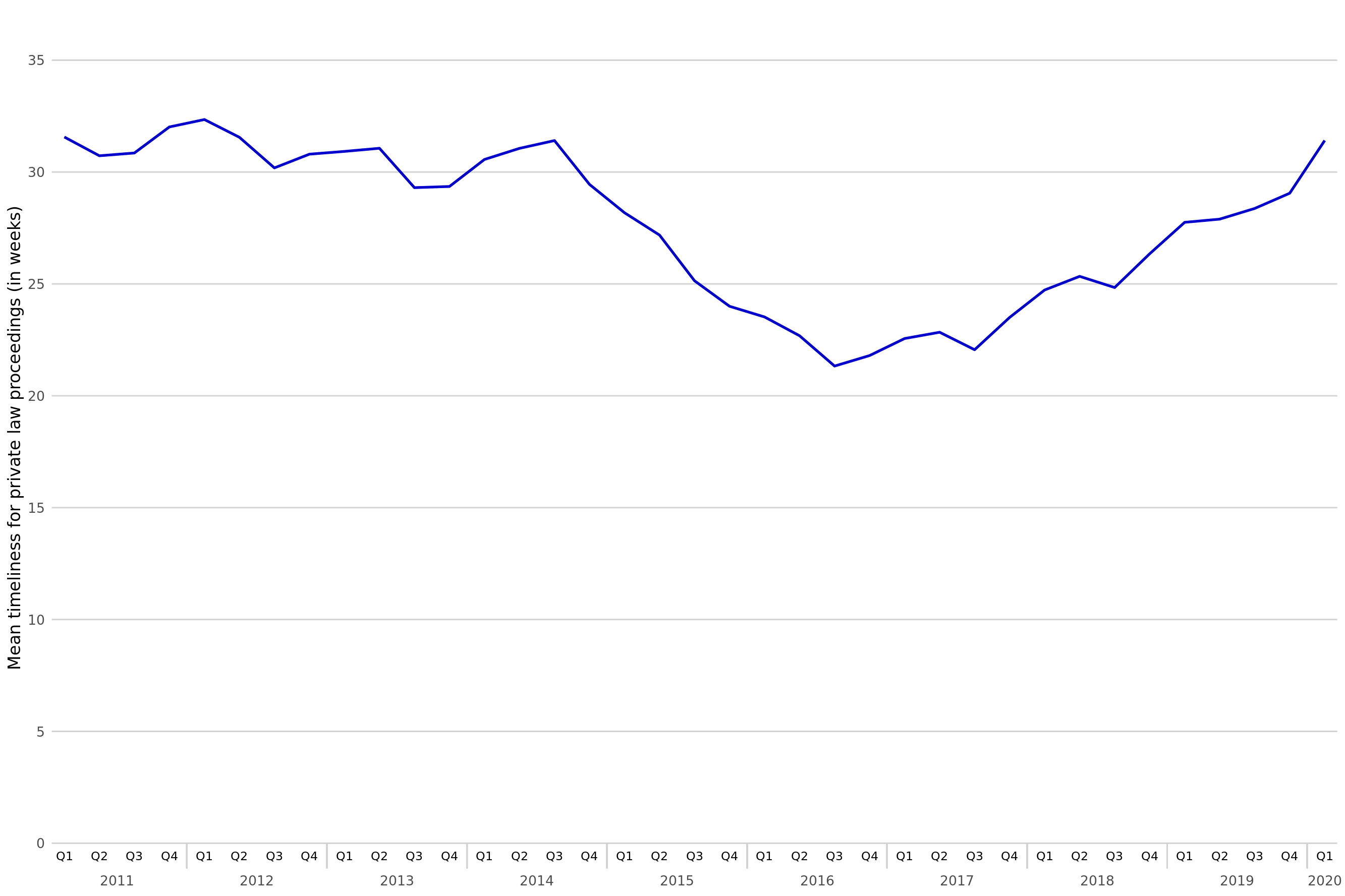

Family Court Statistics Quarterly: January to March 2020 – GOV.UK – Source www.gov.uk

Communication with Beneficiaries

Effective communication with beneficiaries is essential throughout the estate settlement process. Executors and administrators must provide regular updates on the progress of the settlement, address their concerns, and ensure transparency. Clear communication fosters trust and prevents misunderstandings or disputes among beneficiaries.

Legal Representation: Why Should I Hire an Attorney? – ADR Times – Source www.adrtimes.com

Conclusion of Estate Settlement: Navigating The Process Without Legal Representation

Navigating estate settlement without legal representation requires careful planning, research, and attention to detail. By understanding the legal framework, managing emotions, and seeking guidance from trusted sources, individuals can navigate the process efficiently and effectively. While legal representation can provide support and expertise, self-representation is a viable option for smaller, less complex estates.