## Small Estate Affidavit: A Simplified Guide To Administering Estates In Illinois

Do you need help administering a small estate in Illinois? If so, you may be able to avoid the probate process by filing a small estate affidavit. This simplified procedure can save you time and money.

A small estate affidavit is a legal document that allows you to transfer property from a deceased person’s estate to their heirs without going through probate. In Illinois, you can file a small estate affidavit if the total value of the estate is less than $120,000.

In Illinois, the following people can file a small estate affidavit:

The surviving spouse of the deceased person

The children of the deceased person

The parents of the deceased person

The siblings of the deceased person

Any other person who is entitled to inherit from the deceased person

To file a small estate affidavit, you will need to gather the following documents:

A certified copy of the death certificate

A list of the deceased person’s assets and debts

A list of the deceased person’s heirs

A small estate affidavit form

You can get a small estate affidavit form from the circuit clerk’s office in the county where the deceased person lived. Once you have gathered the necessary documents, you can file the small estate affidavit with the circuit clerk’s office.

Filing a small estate affidavit can save you time and money. The probate process can be lengthy and expensive, so avoiding it can be a big benefit. In addition, filing a small estate affidavit is a relatively simple process. You do not need to hire an attorney to file a small estate affidavit, but you may want to consult with an attorney if you have any questions about the process.

Filing a small estate affidavit can be a great way to avoid the probate process and save time and money. If you are the surviving spouse, child, parent, sibling, or other heir of a deceased person, you may be able to file a small estate affidavit to transfer property from the deceased person’s estate to your heirs.

A: $120,000

A: The surviving spouse, children, parents, siblings, or other heirs of the deceased person

A: A certified copy of the death certificate, a list of the deceased person’s assets and debts, a list of the deceased person’s heirs, and a small estate affidavit form

A: From the circuit clerk’s office in the county where the deceased person lived

Wisconsin Small Estate Affidavit 1 – Source cocosign.com

## Small Estate Affidavit: A Simplified Guide To Administering Estates In Illinois

When a loved one passes away, the last thing you want to deal with is the hassle of probate. Probate is the legal process of administering a deceased person’s estate. It can be a lengthy and expensive process, especially if the estate is complex.

Fortunately, there is a simplified probate process available in Illinois for small estates. If the total value of the estate is less than $120,000, you may be able to file a small estate affidavit. This affidavit allows you to transfer the deceased person’s property to their heirs without going through the full probate process.

To file a small estate affidavit, the following requirements must be met:

The total value of the estate must be less than $120,000.

There is no real estate in the estate.

There is no will.

The heirs are all adults.

If all of these requirements are met, you can file a small estate affidavit.

To file a small estate affidavit, you will need to gather the following documents:

A certified copy of the death certificate

A list of the deceased person’s assets and debts

A list of the deceased person’s heirs

A small estate affidavit form

You can get a small estate affidavit form from the circuit clerk’s office in the county where the deceased person lived. Once you have gathered the necessary documents, you can file the small estate affidavit with the circuit clerk’s office.

Filing a small estate affidavit can save you time and money. The probate process can be lengthy and expensive, so avoiding it can be a big benefit. In addition, filing a small estate affidavit is a relatively simple process. You do not need to hire an attorney to file a small estate affidavit, but you may want to consult with an attorney if you have any questions about the process.

Filing a small estate affidavit can be a great way to avoid the probate process and save time and money. If you are the surviving spouse, child, parent, sibling, or other heir of a deceased person, you may be able to file a small estate affidavit to transfer property from the deceased person’s estate to your heirs.

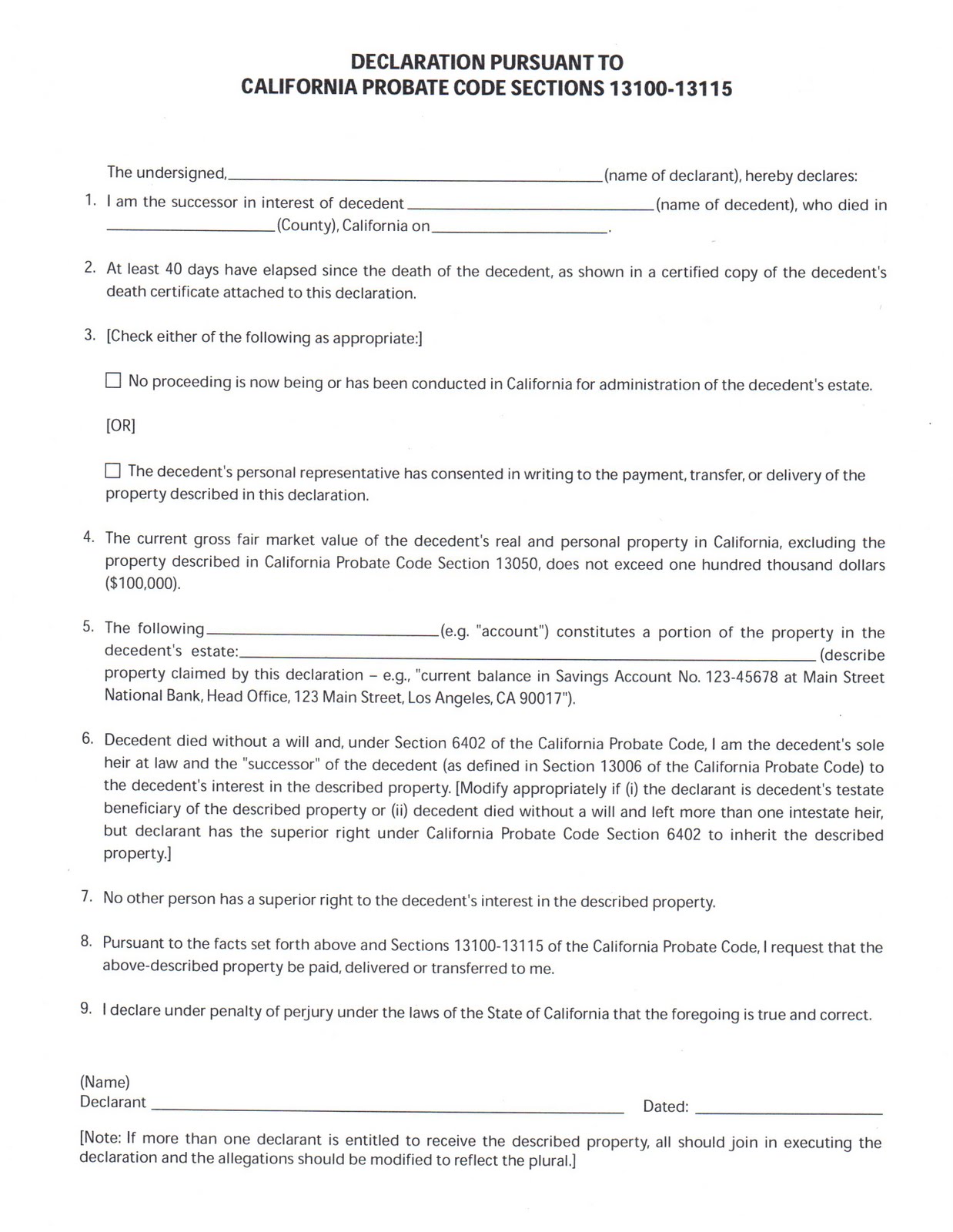

Estate Planning in California: Small Estate Affidavit – Source calestateplanning.blogspot.com

## Small Estate Affidavit: A Simplified Guide To Administering Estates In Illinois

The death of a loved one is always a difficult time. Dealing with the legal and financial matters that come after a death can be overwhelming. If the deceased person had a small estate, you may be able to avoid the probate process by filing a small estate affidavit.

A small estate affidavit is a legal document that allows you to transfer property from a deceased person’s estate to their heirs without going through probate. In Illinois, you can file a small estate affidavit if the total value of the estate is less than $120,000.

In Illinois, the following people can file a small estate affidavit:

The surviving spouse of the deceased person

The children of the deceased person

The parents of the deceased person

The siblings of the deceased person

Any other person who is entitled to inherit from the deceased person

To file a small estate affidavit, you will need to gather the following documents:

A certified copy of the death certificate

A list of the deceased person’s assets and debts

A list of the deceased person’s heirs

A small estate affidavit form

You can get a small estate affidavit form from the circuit clerk’s office in the county where the deceased person lived. Once you have gathered the necessary documents, you can file the small estate affidavit with the circuit clerk’s office.

Filing a small estate affidavit can save you time and money. The probate process can be lengthy and expensive, so avoiding it can be a big benefit. In addition, filing a small estate affidavit is a relatively simple process. You do not need to hire an attorney to file a small estate affidavit, but you may want to consult with an attorney if you have any questions about the process.

Filing a small estate affidavit can be a great way to avoid the probate process and save time and money. If you are the surviving spouse, child, parent, sibling, or other heir of a deceased person, you may be able to file a small estate affidavit to transfer property from the deceased person’s estate to your heirs.

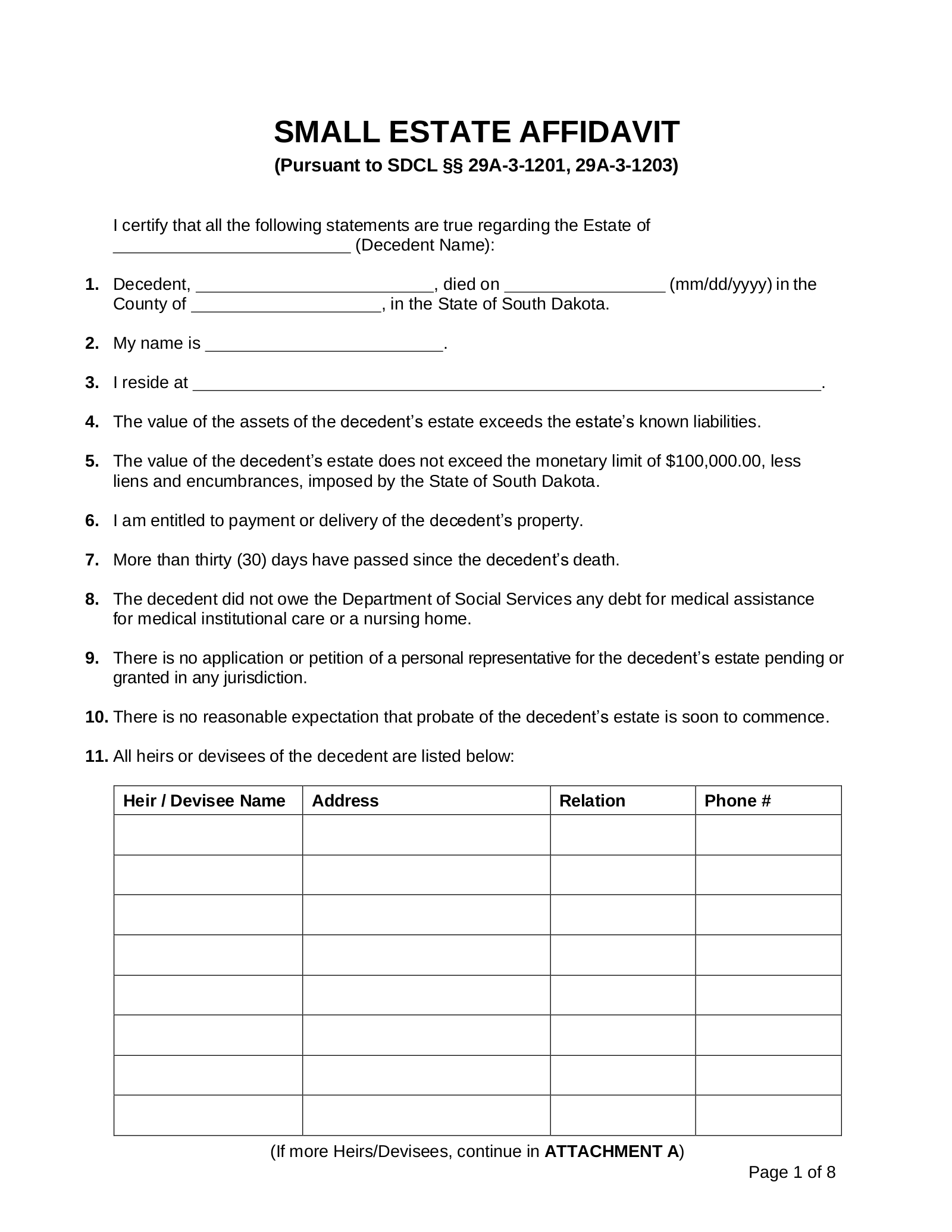

Free South Dakota Small Estate Affidavit | Collection of Personal – Source eforms.com

## Small Estate Affidavit: A Simplified Guide To Administering Estates In Illinois

When someone dies, their estate must go through probate, which is the legal process of distributing their assets. This process can be complex and expensive, especially if the estate is large. Fortunately, there is a simplified probate process available for small estates in Illinois.

A small estate affidavit is a legal document that allows you to transfer property from a deceased person’s estate to their heirs without going through probate. In Illinois, you can file a small estate affidavit if the total value of the estate is less than $120,000.

In Illinois, the following people can file a small estate affidavit:

– The surviving spouse of the deceased person

– The children of the deceased person

– The parents of the deceased person

– The siblings of the deceased person

– Any other person who is entitled to inherit from the deceased person

To file a small estate affidavit, you will need to gather the following documents:

– A certified copy of the death certificate

– A list of the deceased person’s assets and debts

– A list of the deceased person’s heirs

– A small estate affidavit form

You can get a small estate affidavit form from the circuit clerk’s office in the county where the deceased person lived. Once you have gathered the necessary documents, you can file the small estate affidavit with the circuit clerk’s office.

Filing a small estate affidavit can save you time and money. The probate process can be lengthy and expensive, so avoiding it can be a big benefit. In addition, filing a small estate affidavit is a relatively simple process. You do not need to hire an attorney to file a small estate affidavit, but