Have you ever wondered what happens when someone dies and leaves behind a will? Who ensures that the deceased’s wishes are carried out and their assets are distributed according to their instructions? The answer lies in the intricate world of estate administration, and understanding the need for a surety bond plays a crucial role in this process.

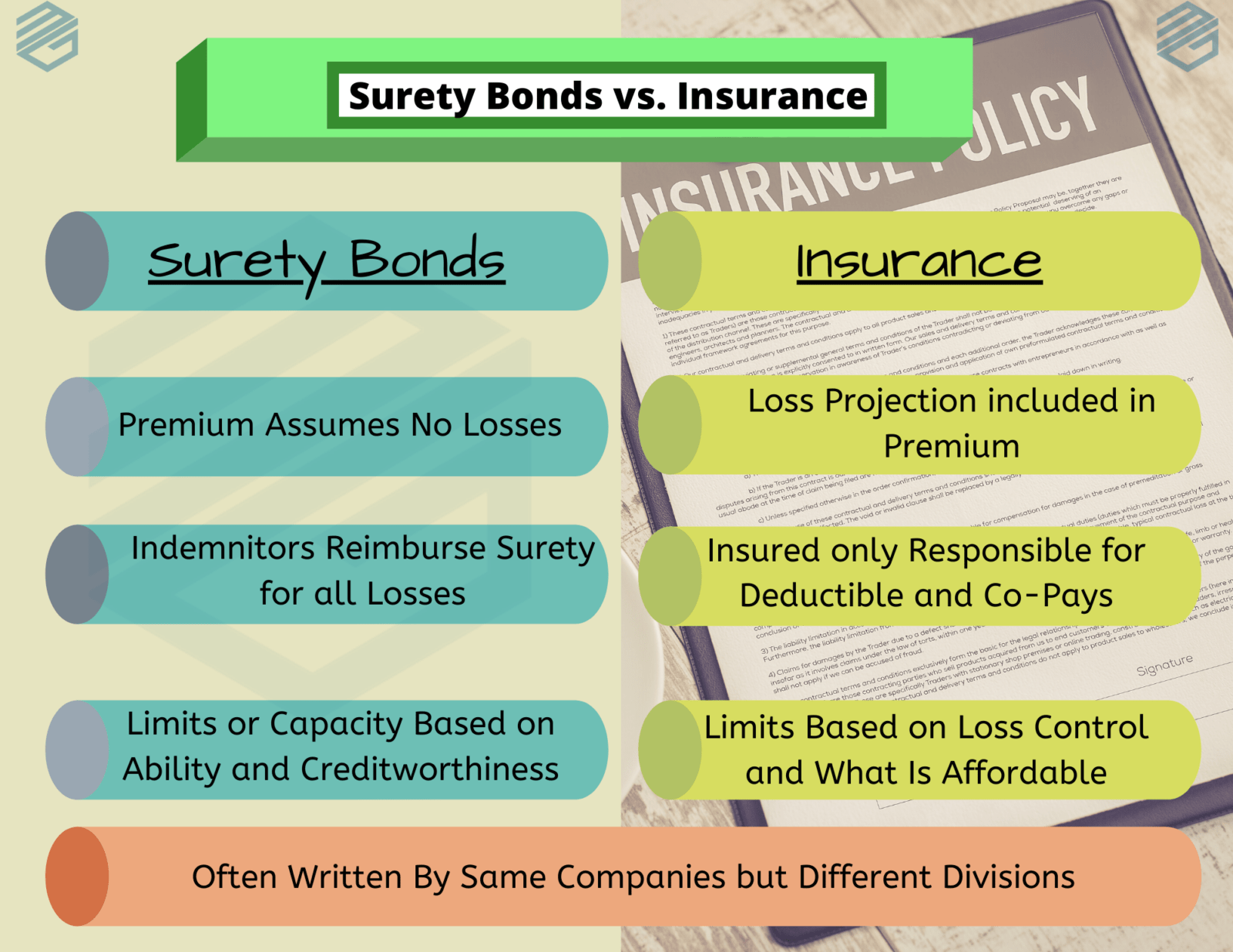

Estate administration can be a complex and time-consuming process, often involving legal, financial, and emotional challenges. One of the key elements in ensuring the integrity and accountability of this process is the requirement for a surety bond. A surety bond is a legal contract that guarantees the faithful performance of a fiduciary, typically the executor or administrator of an estate. By obtaining a surety bond, the fiduciary assumes responsibility for managing the estate’s assets properly, fulfilling the deceased’s wishes, and accounting for all transactions.

Understanding the need for a surety bond in estate administration

The primary purpose of a surety bond in estate administration is to protect the beneficiaries of the estate from potential financial losses due to the fiduciary’s mismanagement or misconduct. In the event that the fiduciary breaches their duties, the surety company that issued the bond is legally obligated to compensate the estate for any damages or losses incurred. This level of protection ensures that the deceased’s wishes are upheld and their assets are distributed fairly among their intended beneficiaries.

In addition to protecting the beneficiaries, a surety bond also provides the probate court with assurance that the fiduciary will fulfill their responsibilities diligently. The bond serves as a form of insurance, giving the court confidence that the estate’s assets will be managed responsibly and in accordance with the law. Without a surety bond, the probate court may hesitate to appoint a fiduciary, potentially delaying the estate administration process.

Why Contractors Need Surety Bond Insurance Companies | Bond insurance – Source www.pinterest.com

The target of a surety bond in estate administration

The target of a surety bond in estate administration is the fiduciary, who is typically the executor or administrator of the estate. The executor is responsible for carrying out the deceased’s wishes as expressed in their will, while the administrator is appointed by the court if the deceased died without leaving a will. Both the executor and the administrator have a legal obligation to act in the best interests of the estate and its beneficiaries.

The surety bond serves as a guarantee that the fiduciary will fulfill their duties honestly and competently. It provides a level of financial protection for the beneficiaries in case the fiduciary mismanages the estate’s assets, breaches their fiduciary duties, or fails to properly account for all transactions. By obtaining a surety bond, the fiduciary demonstrates their commitment to upholding the deceased’s wishes and protecting the interests of the estate.

History and myth of a surety bond in estate administration

The history of surety bonds in estate administration dates back to ancient times when people relied on personal guarantees to ensure the trustworthiness of individuals handling financial matters. Over the centuries, the concept of surety bonds evolved into a formal legal mechanism used to protect the interests of those involved in estate administration.

One common myth associated with surety bonds is that they are only necessary for large or complex estates. However, even small estates can benefit from the protection provided by a surety bond. In fact, some probate courts require a surety bond for all estates, regardless of their size.

What Is a Surety Bond? Everything You Need to Know About This Financial – Source okcinsurancebrokers.com

Hidden secrets of a surety bond in estate administration

One hidden secret of surety bonds in estate administration is that they can help to expedite the probate process. By providing the probate court with assurance that the fiduciary is financially responsible, a surety bond can reduce the need for extensive oversight and supervision, which can save time and money for the estate.

Another hidden secret is that surety bonds can protect the fiduciary from personal liability. In the event that the fiduciary makes a mistake or incurs losses due to circumstances beyond their control, the surety company will be responsible for compensating the estate, not the fiduciary personally.

Recommendation of a surety bond in estate administration

When selecting a surety company to issue a bond for estate administration, it is important to consider the company’s financial strength, reputation, and experience in handling estate matters. It is also essential to compare the premiums charged by different companies to ensure you are getting the best value for your money.

Once you have selected a surety company, the process of obtaining a bond is relatively straightforward. You will need to provide the company with information about the estate, the fiduciary, and the amount of coverage required. The surety company will then conduct an underwriting review to assess the risk associated with the bond.

Surety Bonds vs. Letters of Credit: The Ultimate Guide – Source www.bondexchange.com

Understanding the need for a surety bond in estate administration

A surety bond is a type of insurance that protects the beneficiaries of an estate from financial losses due to the fiduciary’s mismanagement or misconduct. The bond serves as a guarantee that the fiduciary will fulfill their duties honestly and competently, providing peace of mind to the beneficiaries and the probate court.

Tips for understanding the need for a surety bond in estate administration

Here are a few tips to help you understand the need for a surety bond in estate administration:

- Talk to an estate planning attorney. An attorney can help you understand the legal requirements for estate administration and can advise you on whether or not a surety bond is necessary for your estate.

- Shop around for surety bonds. There are many different surety companies that offer estate administration bonds. Be sure to compare the premiums and coverage offered by different companies before making a decision.

- Read the bond carefully before you sign it. Make sure you understand the terms and conditions of the bond, including the amount of coverage provided and the circumstances under which the bond can be forfeited.

Understanding the need for a surety bond in estate administration

A surety bond is a type of insurance that protects the beneficiaries of an estate from financial losses due to the fiduciary’s mismanagement or misconduct. The bond serves as a guarantee that the fiduciary will fulfill their duties honestly and competently, providing peace of mind to the beneficiaries and the probate court.

Fun facts of a surety bond in estate administration

Here are a few fun facts about surety bonds in estate administration:

- Surety bonds have been used in estate administration for centuries.

- The amount of coverage required for a surety bond is typically based on the value of the estate’s assets.

- Surety bonds can protect the fiduciary from personal liability in the event that they make a mistake or incur losses due to circumstances beyond their control.

How to understand the need for a surety bond in estate administration

To understand the need for a surety bond in estate administration, it is important to first understand the role of the fiduciary. The fiduciary is the person who is responsible for managing the estate’s assets and distributing them to the beneficiaries according to the deceased’s wishes. The fiduciary has a legal obligation to act in the best interests of the estate and its beneficiaries.

Surety Bond Frequently Asked Questions – MG Surety Bonds – Source mgsuretybonds.com

What if a surety bond in estate administration

What if a surety bond in estate administration is not obtained? If a surety bond is not obtained, the fiduciary may be required to post a personal bond. A personal bond is a type of security that is backed by the fiduciary’s personal assets. If the fiduciary breaches their duties, the beneficiaries may be able to recover damages from the fiduciary’s personal assets.

Listicle of a surety bond in estate administration

Here is a listicle of the benefits of obtaining a surety bond in estate administration:

- Protects the beneficiaries from financial losses due to the fiduciary’s mismanagement or misconduct.

- Provides the probate court with assurance that the fiduciary will fulfill their duties honestly and competently.

- Can help to expedite the probate process.

- Protects the fiduciary from personal liability.