Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

As a tenant, it’s important to understand your rights when it comes to your security deposit. One of the most common questions is whether or not your landlord can deduct unpaid rent from your security deposit. The answer to this question depends on a number of factors, including the laws in your state or country, the terms of your lease agreement, and the circumstances surrounding the unpaid rent.

Can the Landlord Deduct Painting Fees From My Rental Security Deposit? – Source www.weekand.com

There are a number of reasons why a tenant may fall behind on rent. They may have lost their job, had an unexpected medical expense, or simply made a mistake. Whatever the reason, it’s important to communicate with your landlord as soon as possible if you’re unable to pay your rent on time. Most landlords are willing to work with tenants who are experiencing financial difficulties, and may be willing to create a payment plan or offer other assistance.

Free Security Deposit Receipt Template – PDF | Word – eForms – Source eforms.com

However, if you’ve repeatedly failed to pay your rent on time, or if you’ve broken other terms of your lease agreement, your landlord may have the right to deduct the unpaid rent from your security deposit. In most states, landlords are required to provide tenants with a written notice before they can deduct any money from the security deposit.

What Can a Landlord Deduct From a Security Deposit? – Source www.verandahproperties.com

The notice should state the amount of the deduction, the reason for the deduction, and the date by which the deduction will be made. If you disagree with the deduction, you can file a dispute with your landlord. The landlord will then have the opportunity to provide you with a written explanation of the deduction. If you’re still not satisfied, you can file a complaint with your local housing authority or tenant’s rights organization.

Sample Printable security deposit agreement Form Real Estate Forms – Source www.pinterest.ph

## What is Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained is a legal issue that can arise when a tenant fails to pay their rent and the landlord attempts to deduct the unpaid rent from the tenant’s security deposit. The law governing this issue varies from state to state, but generally speaking, landlords are not permitted to deduct unpaid rent from a security deposit unless the lease agreement specifically authorizes such a deduction.

Even if the lease agreement does authorize the deduction of unpaid rent from the security deposit, the landlord must still follow certain procedures in order to do so. For example, the landlord must provide the tenant with a written notice of the deduction, which must state the amount of the deduction and the reason for the deduction. The landlord must also give the tenant an opportunity to contest the deduction before it is made. If the tenant disagrees with the deduction, they can file a dispute with the landlord. The landlord will then have the opportunity to provide the tenant with a written explanation of the deduction. If the tenant is still not satisfied, they can file a complaint with their local housing authority or tenant’s rights organization.

## History and Myth of Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

The history of Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained is a long and complex one. However, the basic principles governing this issue have remained relatively unchanged over time. In most states, landlords are not permitted to deduct unpaid rent from a security deposit unless the lease agreement specifically authorizes such a deduction. This is because a security deposit is intended to protect the landlord from damages to the property, not to cover unpaid rent.

There are a number of myths surrounding Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained. One common myth is that landlords can deduct unpaid rent from a security deposit even if the lease agreement does not authorize such a deduction. This is not true. Another common myth is that landlords can deduct unpaid rent from a security deposit without providing the tenant with a written notice. This is also not true. Landlords must provide tenants with a written notice of any deductions from the security deposit, which must state the amount of the deduction and the reason for the deduction.

Security Deposit Invoice Template | Invoice Maker – Source invoicemaker.com

## Hidden Secret of Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

One of the most important things to remember about Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained is that it is a legal issue that can vary from state to state. As such, it is important to consult with an attorney if you have any questions about your rights and obligations under the law. An attorney can help you understand your rights and ensure that your landlord is not violating them.

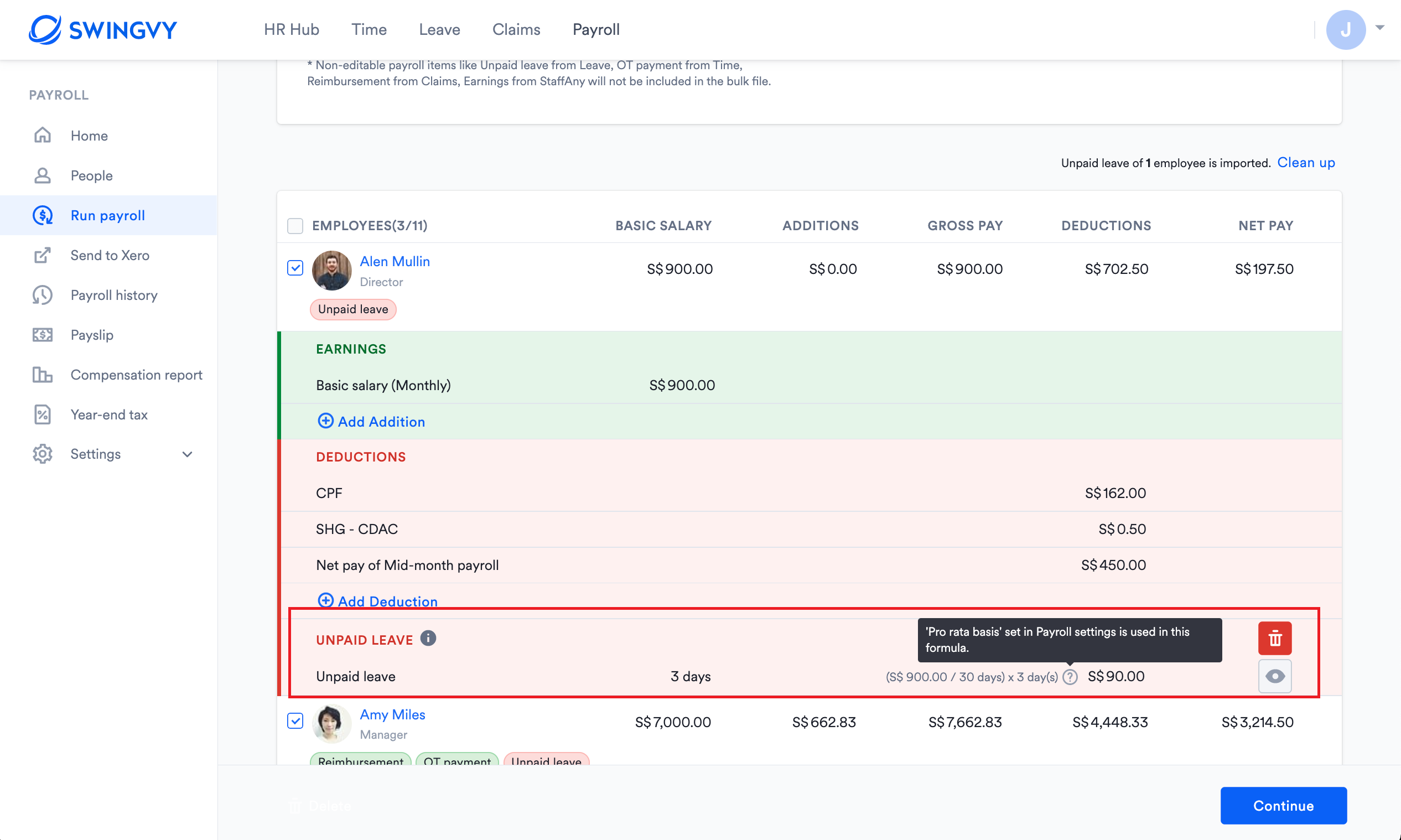

Deduct unpaid leave through Swingvy payroll – Source help.swingvy.com

## Tips of Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

Here are a few tips to help you avoid disputes over security deposits:

– Make sure that you understand the terms of your lease agreement before you sign it.

– Pay your rent on time, every time.

– Keep your rental unit clean and in good condition.

– Communicate with your landlord if you are having difficulty paying your rent.

– If you have a dispute with your landlord over your security deposit, file a complaint with your local housing authority or tenant’s rights organization.

### Conclusion of Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained

Can A Landlord Deduct Unpaid Rent From Security Deposit? Your Rights Explained is a complex issue that can vary from state to state. However, the basic principles governing this issue have remained relatively unchanged over time. In most states, landlords are not permitted to deduct unpaid rent from a security deposit unless the lease agreement specifically authorizes such a deduction. This is because a security deposit is intended to protect the landlord from damages to the property, not to cover unpaid rent.