Understanding Illinois Inheritance Laws When There’s No Will can be complex and overwhelming. Without a will, the state will determine how your assets are distributed, which may not align with your wishes. This article will guide you through the intricacies of inheritance laws in Illinois when there’s no will, helping you navigate this challenging situation.

When a person dies without a will, their estate is said to be “intestate.” Intestate succession laws vary by state, and in Illinois, the distribution of assets follows a specific order of priority.

Understanding Illinois Inheritance Laws When There’s No Will

The Illinois Probate Act outlines the distribution of assets for intestate estates. The surviving spouse inherits the first $25,000, plus half of the remaining estate. If there is no surviving spouse, the children inherit the entire estate. If there is no surviving spouse or children, the estate passes to the parents, then to the siblings, and so on.

What is the Legal Length of a Knife to Carry in Illinois? – Source knifewave.com

It’s crucial to understand that these laws may not reflect your desired distribution of assets. Without a will, you have no control over who inherits your property, which could lead to unexpected and potentially unwanted outcomes.

Personal Experience with Understanding Illinois Inheritance Laws When There’s No Will

My grandfather passed away recently without leaving a will. As his only heir, I was responsible for navigating the probate process. It was a complex and time-consuming experience, and I often wished there had been a will to guide the distribution of his assets.

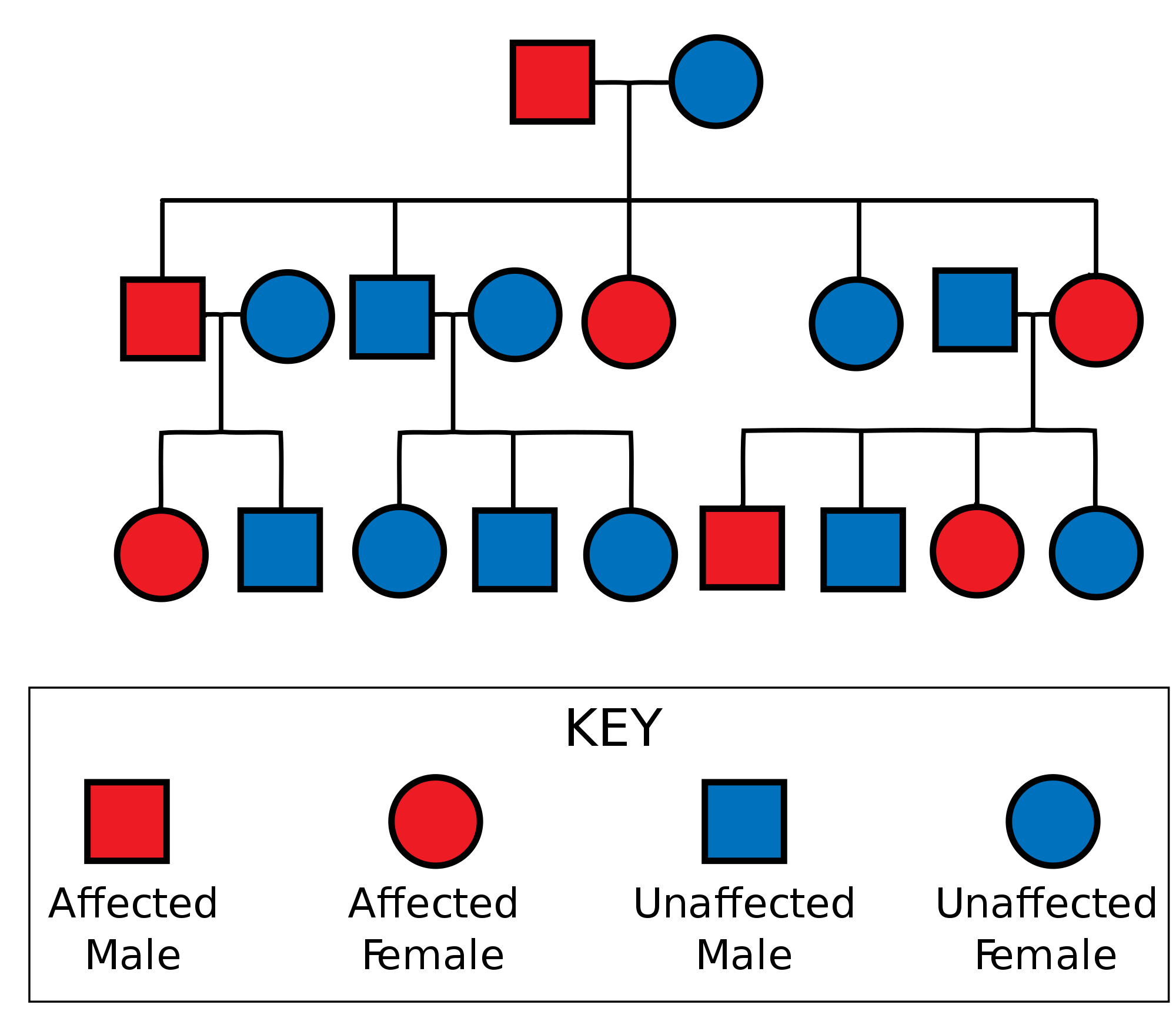

5.13 Mendelian Inheritance – Human Biology – Source humanbiology.pressbooks.tru.ca

I learned firsthand the importance of having a will. It allows you to specify your wishes regarding the distribution of your assets and ensures that your legacy is honored according to your intentions. Understanding Illinois inheritance laws when there’s no will is essential for avoiding potential disputes and ensuring a smooth transition of assets.

History and Myth of Understanding Illinois Inheritance Laws When There’s No Will

Intestate succession laws have a long history, dating back to ancient times. In the absence of a will, these laws were designed to ensure a fair distribution of assets among the deceased person’s family members.

A Guide to Understanding Inheritance Tax Laws in Florida – Source www.floridataxlawyers.com

One common myth is that the government takes all the assets if there is no will. This is not true. In Illinois, the state only takes assets if there are no living heirs. However, without a will, the state’s laws will determine who inherits your assets, which may not align with your wishes.

Hidden Secret of Understanding Illinois Inheritance Laws When There’s No Will

A hidden secret of Illinois inheritance laws when there’s no will is that you can still have a say in how your assets are distributed. By creating a trust, you can effectively bypass the intestate succession laws and ensure that your assets are distributed according to your wishes.

Understanding Illinois Marriage Laws – The Bridal Tip – Source thebridaltip.com

Trusts are legal entities that hold your assets and distribute them to your beneficiaries according to your instructions. By creating a trust, you can avoid probate, minimize taxes, and ensure that your assets are protected from creditors.

Recommendation for Understanding Illinois Inheritance Laws When There’s No Will

The best way to ensure that your wishes are honored after your death is to create a will. A will allows you to specify your beneficiaries, choose an executor to administer your estate, and make other important decisions regarding the distribution of your assets.

Illinois Labor Laws – Buddy Punch – Source buddypunch.com

Creating a will is relatively simple and inexpensive. You can use an online will-writing service or consult with an attorney to create a will that meets your specific needs. By taking this important step, you can avoid the potential pitfalls of intestate succession and ensure that your legacy is honored according to your intentions.

Understanding Illinois Inheritance Laws When There’s No Will and Related Keywords

Understanding Illinois inheritance laws when there’s no will is essential for ensuring that your assets are distributed according to your wishes. Here are some related keywords to help you navigate this complex legal landscape:

Understanding Estate & Inheritance Taxes in Illinois and Missouri – Source www.sivialaw.com

- Illinois Inheritance Laws

- Intestate Succession

- Probate

- Will

- Trust

Tips for Understanding Illinois Inheritance Laws When There’s No Will

Here are some tips for understanding Illinois inheritance laws when there’s no will:

Free of Charge Creative Commons inheritance law Image – Legal 1 – Source pix4free.org

- Educate yourself about the intestate succession laws in Illinois.

- Consider creating a will to ensure that your assets are distributed according to your wishes.

- Talk to an attorney if you have any questions about inheritance laws or estate planning.

Understanding Illinois Inheritance Laws When There’s No Will and Related Keywords

Here are some additional resources and related keywords to help you understand Illinois inheritance laws when there’s no will:

Muslim mother Inheritance share | Islamic Inheritance law – Source www.islamicinheritancelaw.com

- Illinois Probate Act

- Illinois Bar Association

- Estate Planning

- Asset Distribution

- Beneficiaries

- Executor

Fun Facts of Understanding Illinois Inheritance Laws When There’s No Will

Here are some fun facts about inheritance laws in Illinois when there’s no will:

Illinois Inheritance Tax Calculator – Accurate & Free Calculator – Source inheritancetaxcalc.com

- If you die without a will, your spouse will inherit the first $25,000 of your estate.

- If you have no surviving spouse or children, your parents will inherit your estate.

- If you have no surviving spouse, children, or parents, your siblings will inherit your estate.

How to Understanding Illinois Inheritance Laws When There’s No Will

If you want to learn more about understanding Illinois inheritance laws when there’s no will, here are some resources:

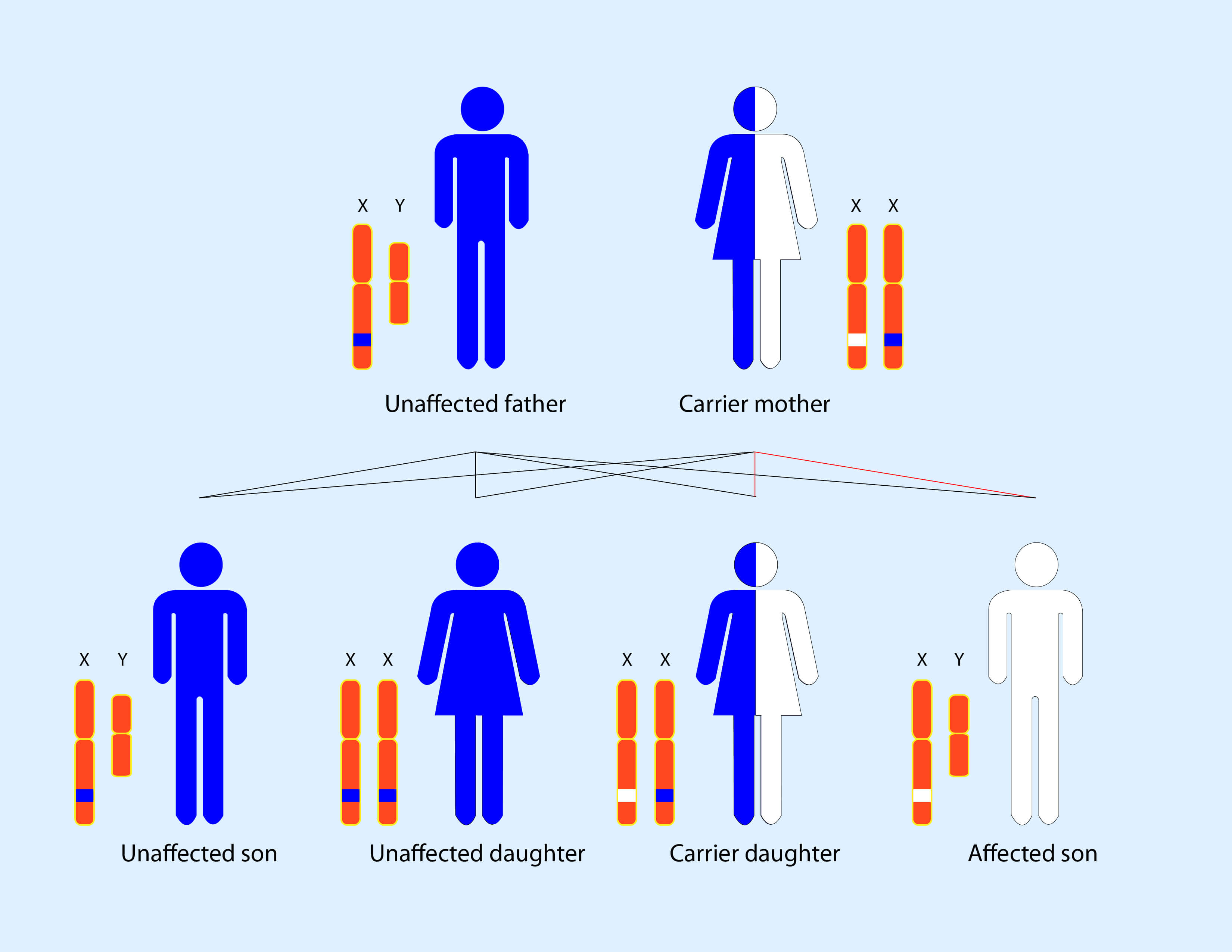

Summarize the role of a genetic counselor – runwest – Source runwest.weebly.com

- Illinois Probate Act

- Illinois Bar Association

- Estate Planning

- Asset Distribution

- Beneficiaries

- Executor

What if Understanding Illinois Inheritance Laws When There’s No Will

If you’re not sure what to do if you don’t have a will, here are some steps you can take:

- Talk to an attorney.

- Create a will.

- Consider creating a trust.

- Educate yourself about inheritance laws.

Listicle of Understanding Illinois Inheritance Laws When There’s No Will

Here’s a listicle of understanding Illinois inheritance laws when there’s no will:

- If you die without a will, your spouse will inherit the first $25,000 of your estate.

- If you have no surviving spouse or children, your parents will inherit your estate.

- If you have no surviving spouse, children, or parents, your siblings will inherit your estate.

- You can create a will to ensure that your assets are distributed according to your wishes.

- You can consider creating a trust to avoid probate and minimize taxes.

Questions and Answers

- What happens if I die without a will in Illinois?

If you die without a will in Illinois, your estate will be distributed according to the intestate succession laws. This means that your spouse, children, parents, and siblings will inherit your assets in a specific order of priority.

- Can I create a will if I don’t have any assets?

Yes, you can create a will