Are you looking for a way to protect your wealth from inflation and economic uncertainty? Look no further than VanEck Merk Gold Trust: Safeguarding Value In Precious Metal. This exchange-traded fund (ETF) offers a convenient and cost-effective way to invest in physical gold, providing you with peace of mind knowing that your assets are backed by a tangible, valuable commodity.

Understanding the Different Types of Gold That Exist Today – Finding Farina – Source findingfarina.com

Unlocking Peace of Mind in Precious Metal Investments

In today’s volatile financial landscape, traditional investments may not always provide the stability you seek. VanEck Merk Gold Trust: Safeguarding Value In Precious Metal addresses this concern by offering a hedge against inflation and economic downturns. Gold has historically served as a safe haven asset, retaining its value even during periods of market turmoil.

6 2 22 9 00 am vaneck merk gold trust ounz fees https www merkgold com – Source www.sec.gov

Your Gateway to Gold Investment

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal makes investing in gold accessible to everyday investors. Unlike physical gold bullion, which can be expensive and difficult to store securely, this ETF offers a convenient and affordable alternative. You can buy and sell shares of the ETF just like any other stock, providing you with instant exposure to the gold market.

OUNZ: VanEck Merk Gold Trust – Source moneyguynow.com

The Story Behind VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

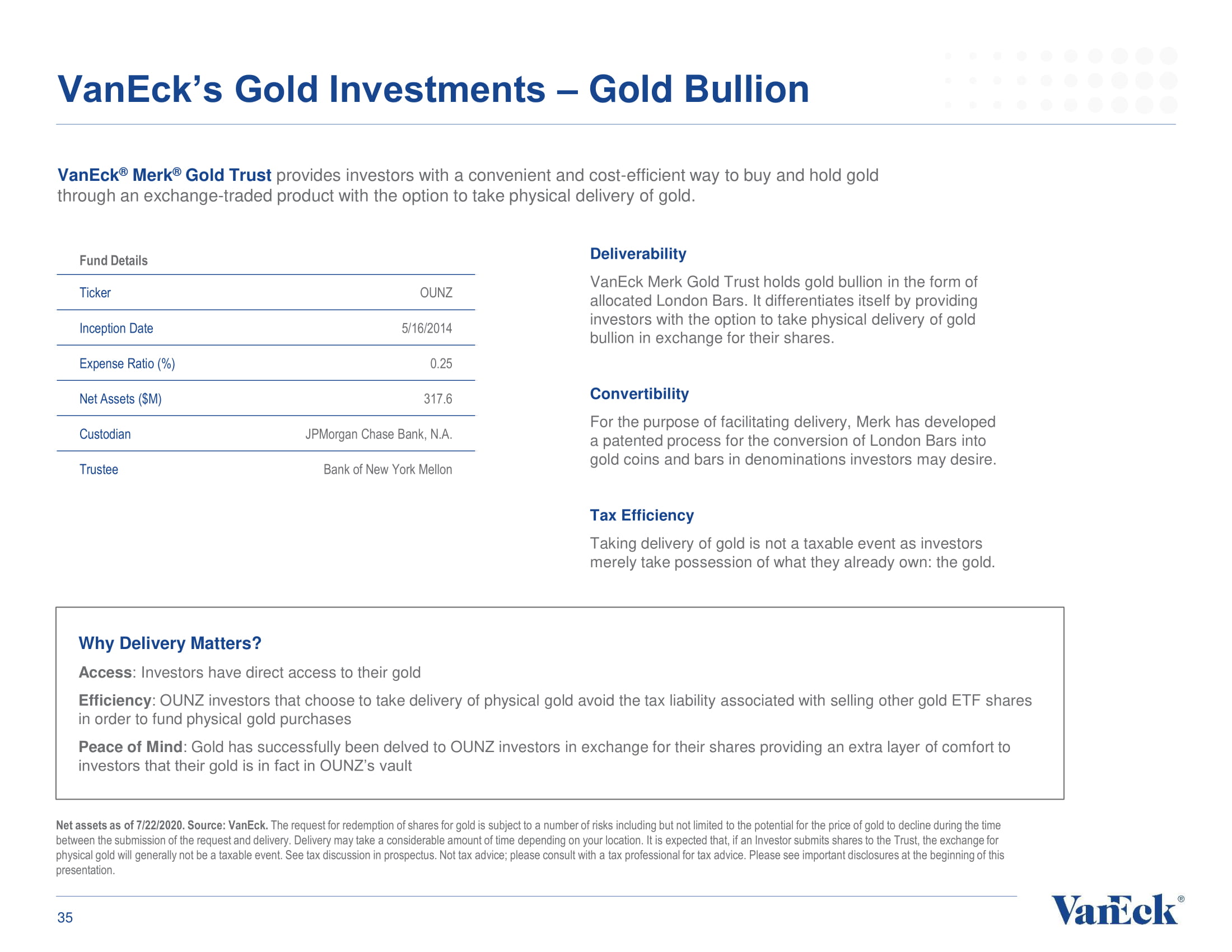

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal is a physically-backed gold exchange-traded fund (ETF) that offers investors exposure to the price of gold without the need to purchase and store physical gold. The fund is managed by VanEck, a global investment management firm, and Merk Investments, a leading expert in precious metals.

VanEck Merk Gold Trust – FWP – Free Writing Prospectus – August 06, 2020 – Source fintel.io

What is VanEck Merk Gold Trust: Safeguarding Value In Precious Metal?

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal aims to provide investors with a convenient and cost-effective way to access the gold market. The fund invests in physical gold bullion, which is stored in a secure vault. Investors can purchase shares of the ETF on the New York Stock Exchange Arca, Inc. under the ticker symbol “OUNZ”.

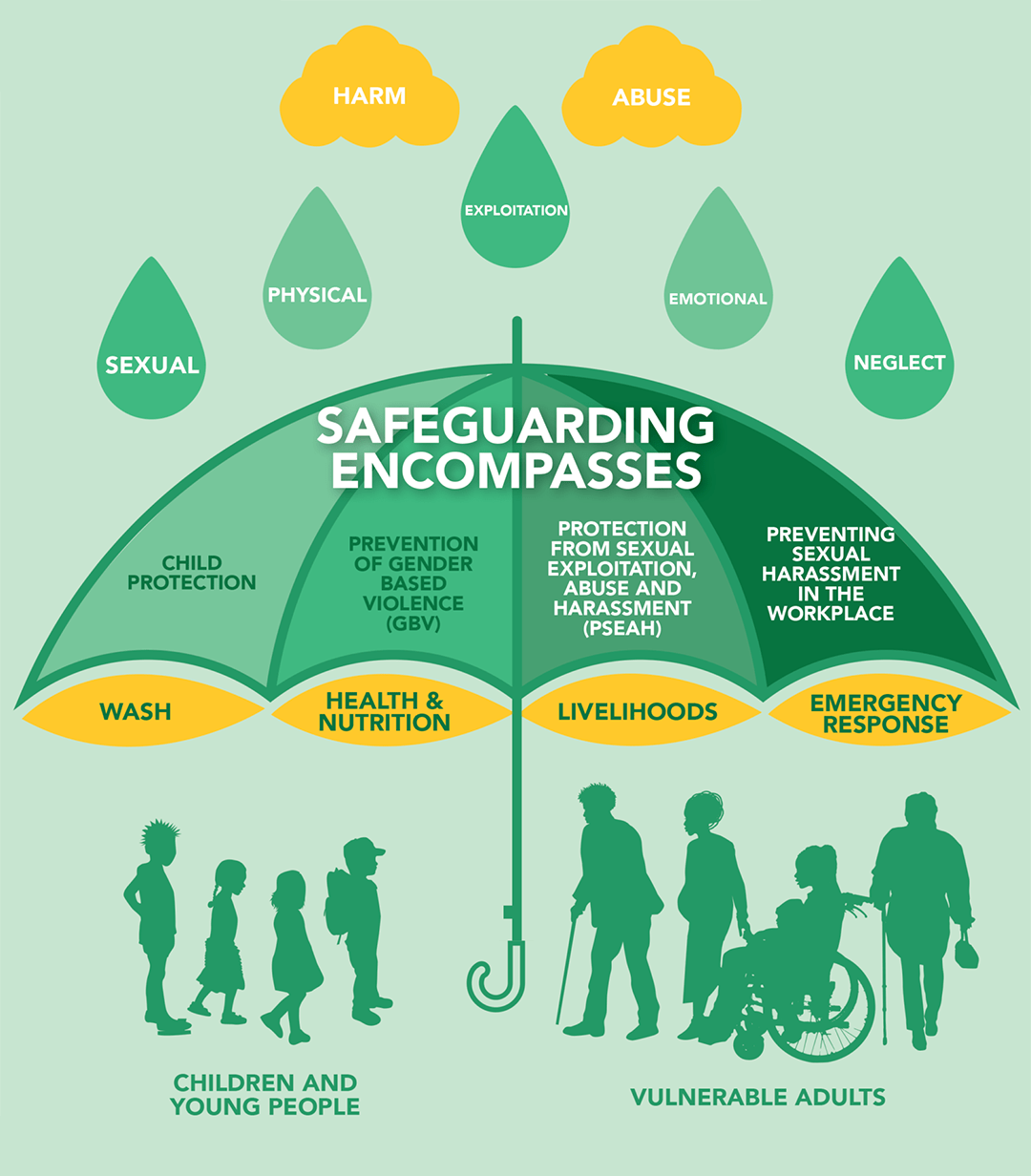

Safeguarding – GOAL Global – Source www.goalglobal.org

History and Myth of VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal was launched in 2006 and has since become one of the most popular gold ETFs on the market. The fund has a long history of providing investors with consistent returns, even during periods of market volatility.

Jewelry Guides | Types of wedding rings, Tiffany wedding rings – Source www.pinterest.com

Hidden Secrets of VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal offers a number of advantages over other gold investment options. First, the fund is physically-backed, which means that it is backed by actual gold bullion. This provides investors with peace of mind knowing that their investment is backed by a tangible asset.

VanEck Merk Gold Trust (OUNZ) – Overview – Source merkgold.com

Recommendations for VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal is a suitable investment for a variety of investors. The fund is a good option for investors who are looking for a way to diversify their portfolio and reduce their overall risk. It is also a good choice for investors who are looking for a long-term investment that will protect their wealth from inflation.

VanEck Merk Gold Trust – Free Writing Prospectus Prospectus – August 06 – Source fintel.io

Why Invest in VanEck Merk Gold Trust: Safeguarding Value In Precious Metal?

Investing in VanEck Merk Gold Trust offers several key benefits:

- Protection against inflation: Gold has historically served as a hedge against inflation, as its value tends to rise when the cost of living increases.

- Diversification: Gold is a distinct asset class that can help diversify your portfolio and reduce overall risk.

- Convenience: VanEck Merk Gold Trust eliminates the need for physical gold storage and provides easy access to the gold market.

- Transparency: The ETF’s holdings are regularly audited, ensuring transparency and accountability.

VanEck’s Gold Investments 32 – Source content-archive.fast-edgar.com

Tips for Investing in VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

Consider these tips when investing in VanEck Merk Gold Trust:

- Set clear investment goals: Determine why you are investing in gold and how it aligns with your overall financial strategy.

- Diversify your investments: Gold should be considered one part of a diversified portfolio that includes other asset classes.

- Monitor the gold market: Stay informed about economic and geopolitical factors that can impact gold prices.

Free Writing Prospectus – VanEck Merk Gold Trust – FWP – August 06, 2020 – Source fintel.io

Understanding the Value of VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal provides several advantages:

- Direct exposure to gold: The ETF allows investors to participate directly in the gold market without the challenges of storing physical gold.

- Liquidity: The ETF can be bought and sold on the stock exchange, providing flexibility and ease of access.

- Transparency: The fund’s daily holdings are reported, ensuring transparency and allowing investors to monitor their investment.

- Cost-effective: Investing in gold through the ETF can be more cost-effective than purchasing physical gold.

Fun Facts About VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

Here are some intriguing facts about VanEck Merk Gold Trust:

- Physical backing: Each share of the ETF represents ownership of a specific amount of physical gold stored in vaults.

- Global reach: The ETF has a global presence, with investors from various countries accessing the gold market through it.

- Long-term track record: VanEck Merk Gold Trust has been operational for over a decade, providing a reliable investment option for investors.

How to Invest in VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

Investing in VanEck Merk Gold Trust is straightforward:

- Open a brokerage account: Choose a reputable brokerage firm that offers access to ETFs.

- Research and decide: Determine how much you want to invest and place a buy order for the ETF using its ticker symbol, “OUNZ”.

- Monitor and adjust: Keep an eye on the gold market and make adjustments to your investment as needed.

What if VanEck Merk Gold Trust: Safeguarding Value In Precious Metal is Not Right for You?

Consider these alternatives if VanEck Merk Gold Trust does not meet your investment needs:

- Physical gold: Invest directly in physical gold bars or coins for complete control over your holdings.

- Gold mining stocks: Gain exposure to gold through companies involved in gold mining and exploration.

- Gold futures and options: Engage in sophisticated trading strategies involving gold futures and options.

Listicle: Benefits of VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

- Tangible asset backing

- Protection against inflation

- Diversification

- Convenience and liquidity

- Transparency and accountability

Frequently Asked Questions about VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

- How is the ETF’s gold stored? Physical gold bullion is held in secure vaults, audited regularly for transparency.

- What are the fees associated with the ETF? The expense ratio is 0.40%, covering management fees and operating expenses.

- Can I invest in the ETF from outside the US? Yes, VanEck Merk Gold Trust is available to international investors through specific brokerage firms.

- How can I learn more about the ETF? Visit VanEck’s website or consult with a financial advisor for in-depth information.

Conclusion of VanEck Merk Gold Trust: Safeguarding Value In Precious Metal

VanEck Merk Gold Trust: Safeguarding Value In Precious Metal offers a valuable way to diversify your portfolio, protect against inflation, and safeguard your wealth. Its physical backing, convenience, transparency, and cost-effectiveness make it a compelling investment option for those seeking exposure to gold. By investing in this ETF, you can harness the power of precious metal to enhance your financial well-being.