Have you ever lost an important document, such as a stock certificate or a bond? If so, you know how stressful it can be. You may worry that someone will find the document and use it to steal your identity or your money. Fortunately, there is a way to protect yourself from this type of fraud: an indemnity bond for lost instrument.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

If you lose an important document, you should report it to the issuer immediately. The issuer will then typically require you to obtain an indemnity bond before they will issue a replacement document. An indemnity bond is a type of insurance policy that protects the issuer from financial loss in the event that the lost document is found and used fraudulently.

The cost of an indemnity bond will vary depending on the value of the lost document and the length of time for which the bond is required.

In most cases, the issuer will require you to obtain an indemnity bond from a reputable insurance company.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

Lost Instrument Surety Bonds – Lexington National Insurance Corporation – Source lexingtonnational.com

I once lost a stock certificate that was worth a significant amount of money. I was very worried that someone would find the certificate and use it to steal my money. I immediately reported the loss to the issuer and obtained an indemnity bond. This gave me peace of mind knowing that I was protected from financial loss if the certificate was found and used fraudulently.

An indemnity bond is a valuable tool that can protect you from financial loss if you lose an important document. If you ever lose an important document, be sure to report it to the issuer immediately and obtain an indemnity bond.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

An indemnity bond for lost instrument is a type of surety bond that protects the issuer of a lost document from financial loss in the event that the document is found and used fraudulently.

State of North Carolina Motor Vehicle Certificate of Title Indemnity – Source www.ezsuretybonds.com

Indemnity bonds are typically required by issuers of stocks, bonds, and other financial instruments. They can also be required by banks and other financial institutions in the event that a customer loses a check or other negotiable instrument.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

The history of indemnity bonds for lost instruments dates back to the early days of banking. In the early 1800s, banks began issuing notes that could be used as currency. However, these notes were often lost or stolen, which led to financial losses for the banks.

Celebrating the 50th Anniversary of Title IX – New Jersey Education – Source www.njea.org

In order to protect themselves from these losses, banks began to require customers to obtain indemnity bonds before issuing replacement notes. This practice has continued to the present day.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

There are many hidden secrets to indemnity bonds for lost instruments. One of the most important secrets is that the bond does not expire. This means that the issuer of the lost document is protected from financial loss even if the document is found and used fraudulently years later.

Printable Lost Indemnity Time Certificate – Source mavink.com

Another hidden secret is that the bond can be used to recover damages in addition to the value of the lost document. For example, if the lost document is a stock certificate, the issuer may be able to recover the lost profits if the stock price increases after the certificate is found.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

If you lose an important document, it is important to obtain an indemnity bond as soon as possible. This will protect you from financial loss in the event that the document is found and used fraudulently.

There are many different types of indemnity bonds available. The type of bond that you need will depend on the type of document that you have lost.

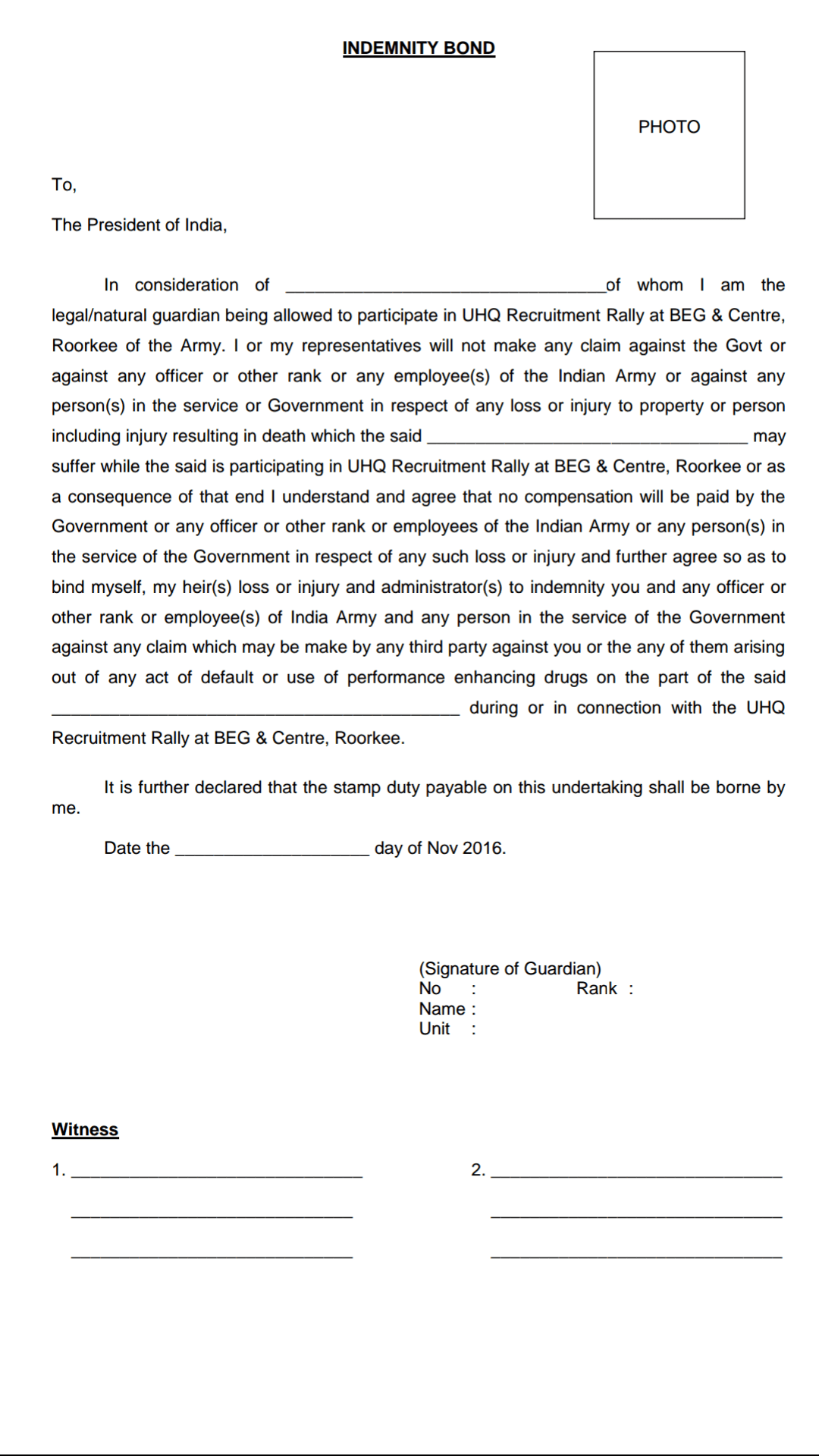

Format for Indemnity Bond for Army Open and Relation Bharti – Source kikali.in

To obtain an indemnity bond, you will need to contact an insurance company. The insurance company will ask you to provide information about the lost document, such as the date it was lost, the value of the document, and the circumstances surrounding the loss.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

Indemnity bonds for lost instruments are a valuable tool that can protect you from financial loss. If you ever lose an important document, be sure to obtain an indemnity bond as soon as possible.

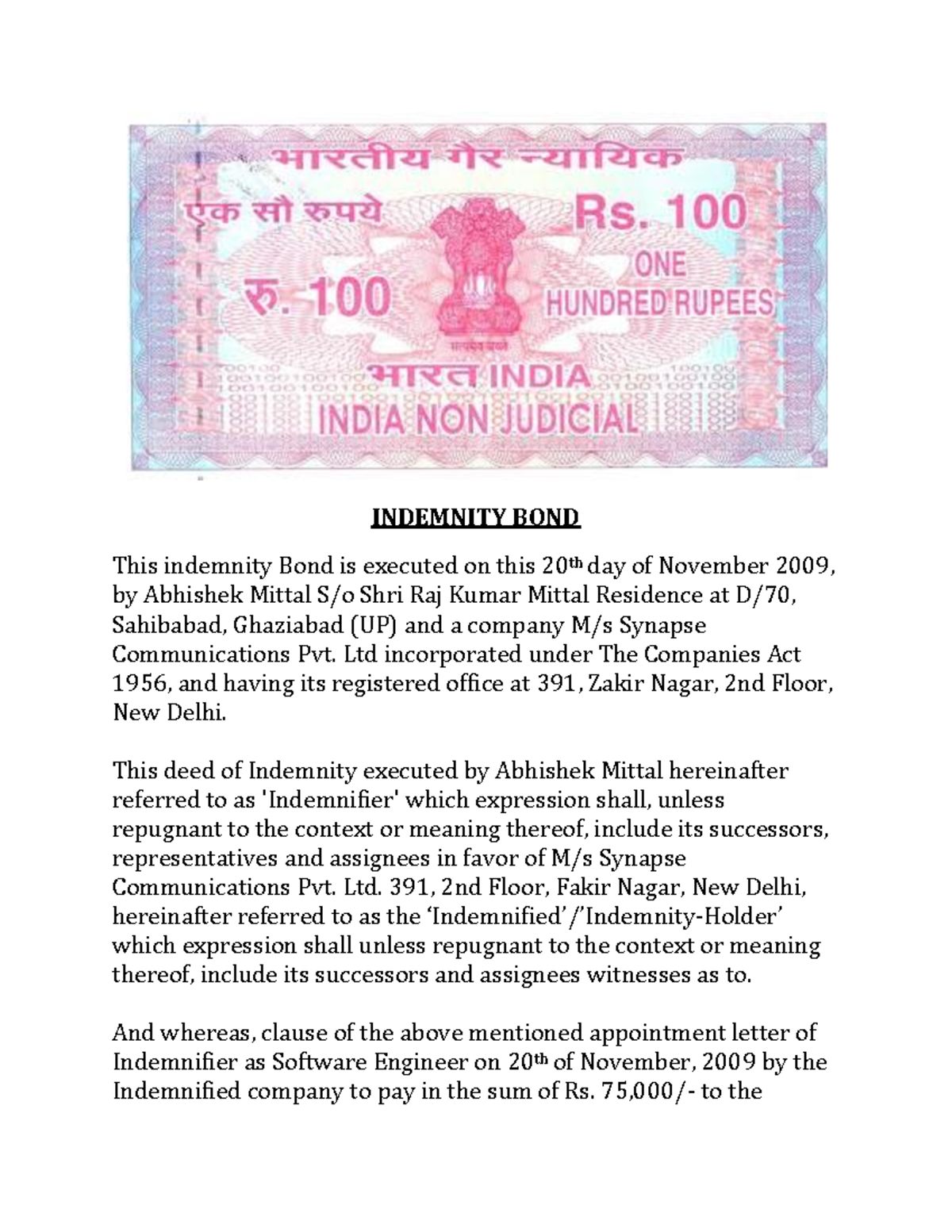

Indemnity BOND -converted – Warning: TT: undefined function: 32 – Source www.studocu.com

Here are some tips for obtaining an indemnity bond:

- Contact an insurance company as soon as possible after you lose the document.

- Provide the insurance company with as much information as possible about the lost document.

- Be prepared to pay a premium for the bond.

- Keep a copy of the bond in a safe place.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

Indemnity bonds for lost instruments are a complex topic. If you have any questions about indemnity bonds, be sure to consult with an insurance professional.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

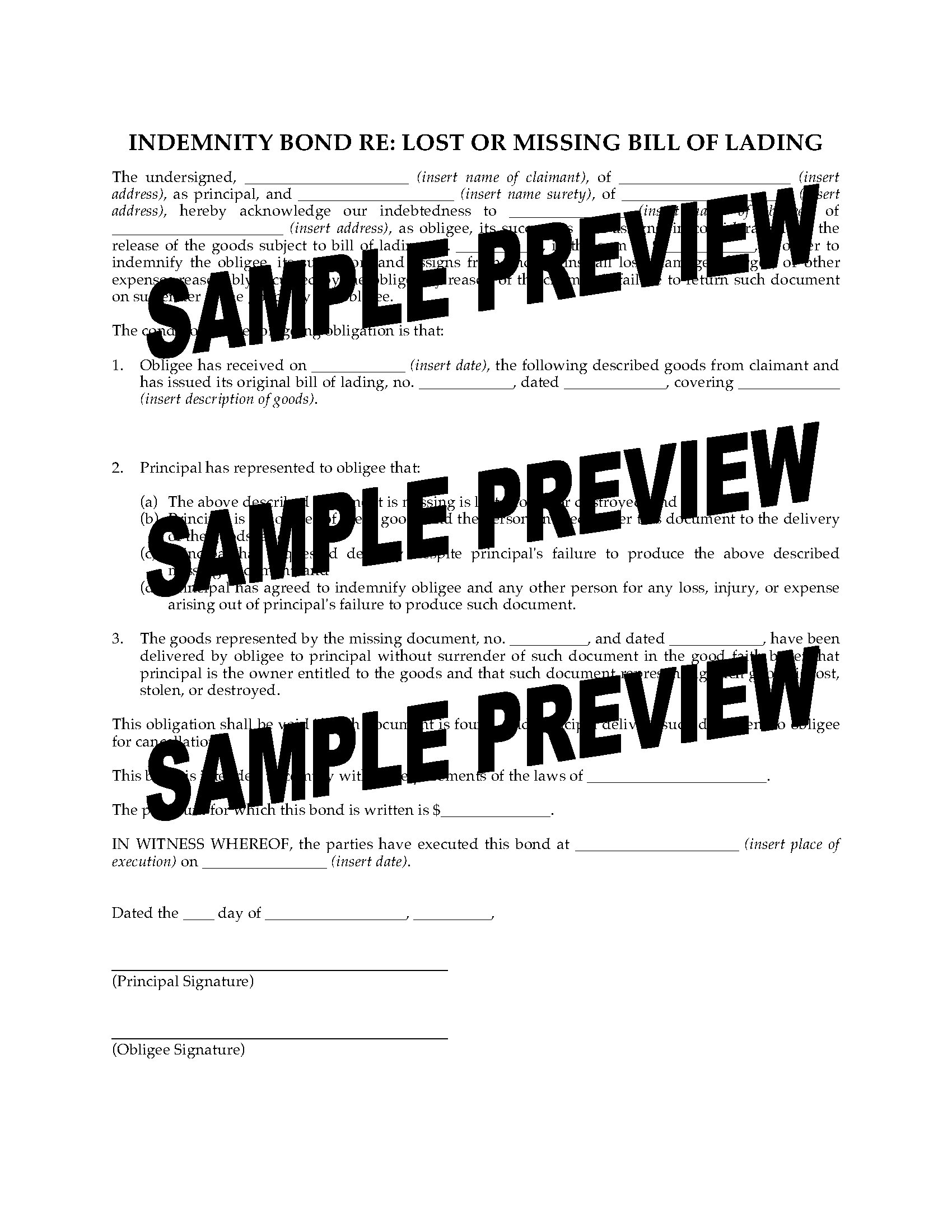

Indemnity Bond re Lost or Missing Bill of Lading | Legal Forms and – Source www.megadox.com

Here are some fun facts about indemnity bonds for lost instruments:

- Indemnity bonds have been used for centuries to protect people from financial loss.

- Indemnity bonds are not only used for lost documents. They can also be used to protect people from financial loss in the event of a breach of contract or a wrongful death.

- Indemnity bonds are a relatively inexpensive way to protect yourself from financial loss.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

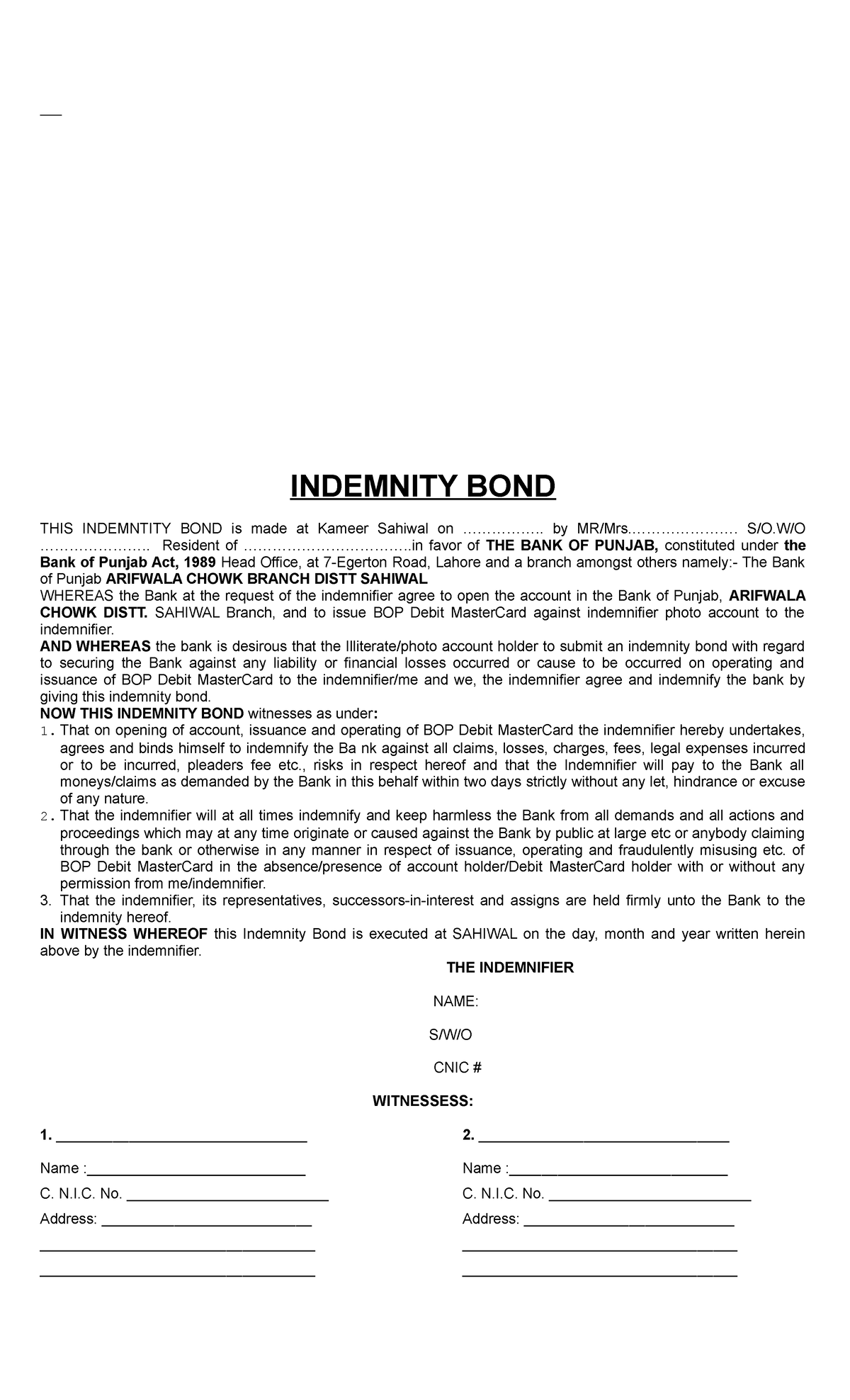

ATM Indemnity Bond Illiterate account holder per – INDEMNITY BOND THIS – Source www.studocu.com

To obtain an indemnity bond for a lost instrument, you will need to:

- Contact an insurance company.

- Provide the insurance company with information about the lost instrument.

- Pay a premium for the bond.

The insurance company will then issue you an indemnity bond. You should keep a copy of the bond in a safe place.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

what is a lost instrument bond – steggeman-roscoe – Source steggeman-roscoe.blogspot.com

What if you lose an indemnity bond? If you lose an indemnity bond, you should contact the insurance company that issued the bond immediately. The insurance company will be able to issue you a replacement bond.

Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

Here is a listicle of the benefits of indemnity bonds for lost instruments:

- Indemnity bonds protect you from financial loss in the event that a lost document is found and used fraudulently.

- Indemnity bonds are relatively inexpensive.

- Indemnity bonds are easy to obtain.

- Indemnity bonds can be used to recover damages in addition to the value of the lost document.

Question and Answer

Q: What is an indemnity bond for lost instrument?

A: An indemnity bond for lost instrument is a type of surety bond that protects the issuer of a lost document from financial loss in the event that the document is found and used fraudulently.

Q: Why do I need an indemnity bond for lost instrument?

A: You need an indemnity bond for lost instrument if you have lost an important document, such as a stock certificate or a bond. The bond will protect you from financial loss in the event that the document is found and used fraudulently.

Q: How do I obtain an indemnity bond for lost instrument?

A: To obtain an indemnity bond for lost instrument, you will need to contact an insurance company. The insurance company will ask you to provide information about the lost document, such as the date it was lost, the value of the document, and the circumstances surrounding the loss.

Q: What are the benefits of an indemnity bond for lost instrument?

A: The benefits of an indemnity bond for lost instrument include:

- Protection from financial loss in the event that the lost document is found and used fraudulently

- Relatively inexpensive

- Easy to obtain

- Can be used to recover damages in addition to the value of the lost document

Conclusion of Indemnity Bond For Lost Instrument: Protect Your Rights And Secure Compensation

Indemnity bonds for lost instruments are a valuable tool that can protect you from financial loss. If you ever lose an important document, be sure to obtain an indemnity bond as soon as possible.