In the ever-evolving landscape of the energy industry, the proposed merger between Diamondback Energy and Endeavor Energy has sparked widespread interest and raised questions. This comprehensive analysis aims to provide insights into the intricacies of this transaction, examining its implications and potential impact on the sector.

Challenges Facing the Energy Industry

Acquisition Analysis | Diamondback Energy and Endeavor Energy merger – Source novilabs.com

The energy industry is constantly grappling with challenges such as fluctuating oil prices, geopolitical uncertainties, and increasing environmental regulations. These factors have put pressure on companies to optimize operations and explore strategic partnerships.

Objectives of the Diamondback-Endeavor Merger

Diamondback Energy to donate M to Midland’s Bush Tennis Center – Source www.mrt.com

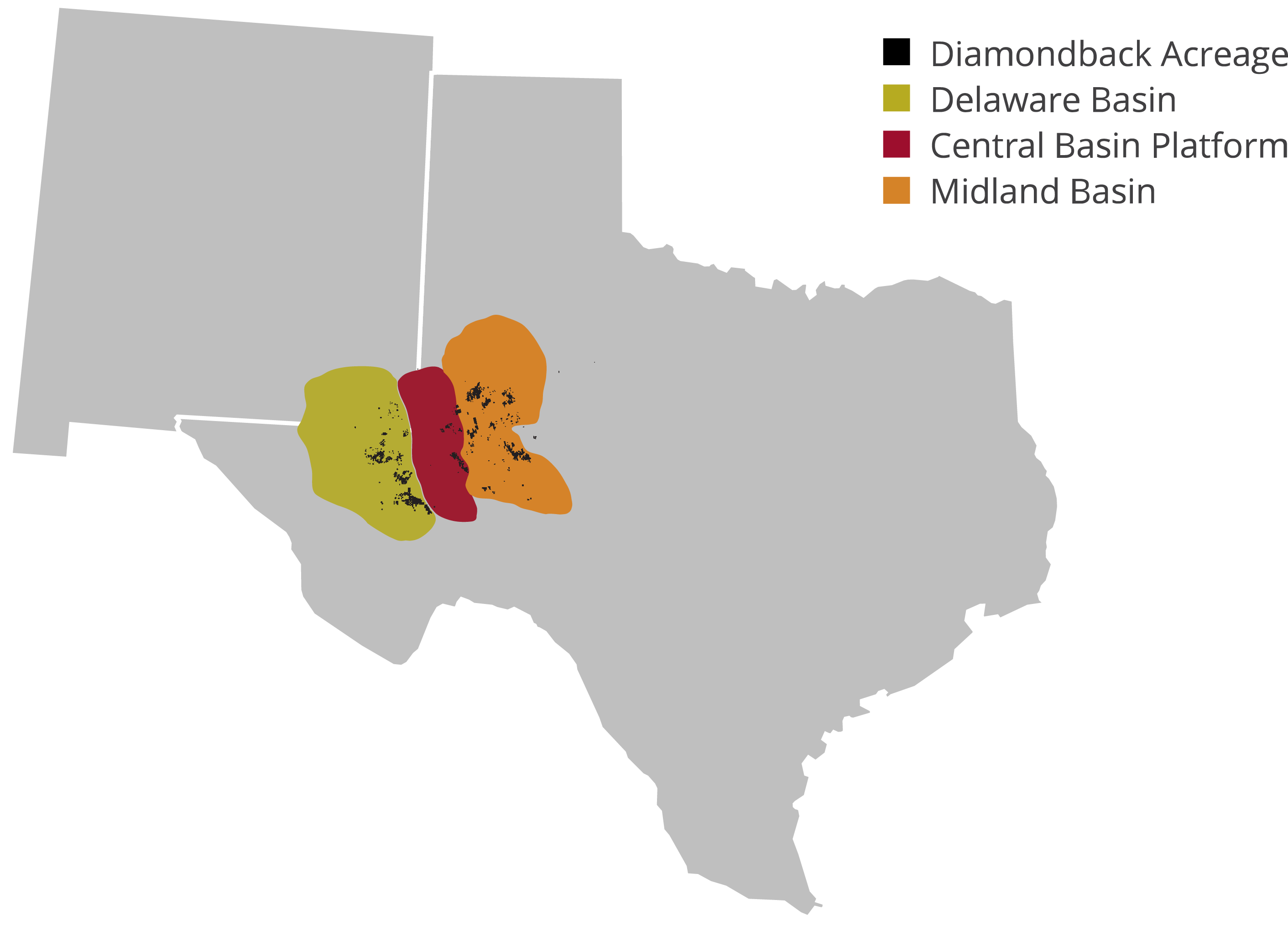

The primary objective of the Diamondback-Endeavor merger is to create a consolidated entity that combines the strengths of both companies. This includes leveraging Diamondback’s production capabilities in the Permian Basin and Endeavor’s expertise in the Eagle Ford and Bakken regions.

Summary of Key Findings

Diamondback Energy, Inc. and Endeavor Energy Resources, L.P. to Merge – Source www.diamondbackenergy.com

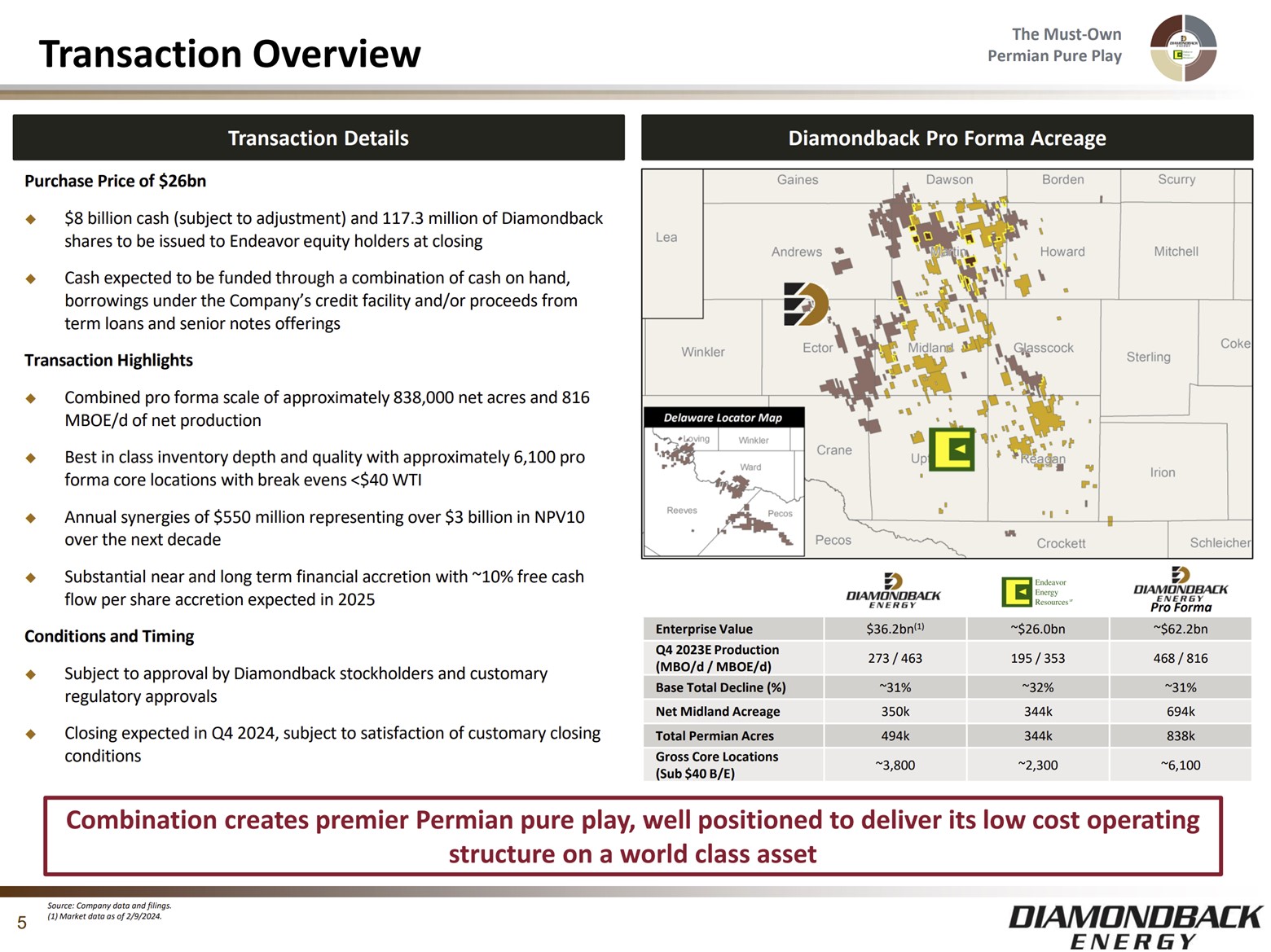

The proposed merger is expected to result in increased production, reduced operating costs, and improved financial flexibility. The combined entity will have a stronger presence in key oil-producing regions, providing greater scale and diversification.

Diamondback Energy’s Proposed Merger With Endeavor Energy: A Comprehensive Analysis

Personal Experience and Insights

Diamondback Energy 2023 GUIDANCE HIGHLIGHTS – Oil Gas Leads – Source oilgasleads.com

As an energy analyst, I have closely followed the developments in the Diamondback-Endeavor merger. My personal observation is that the merger aligns with the industry’s need for consolidation and efficiency. It has the potential to create a formidable player in the market.

Understanding Diamondback Energy’s Proposed Merger With Endeavor Energy

Diamondback Energy Follows ExxonMobil and Occidental Petroleum with a – Source www.theglobeandmail.com

The merger is expected to create a company with a combined production of over 300,000 barrels of oil equivalent per day. This will make it one of the largest independent oil producers in the United States. The combined entity will have access to a diverse portfolio of assets, including oil-rich properties in the Permian Basin, Eagle Ford, and Bakken regions.

History and Evolution of Diamondback Energy’s Proposed Merger With Endeavor Energy

Diamondback Energy is exploring sale of Permian Basin assets – Source www.mrt.com

The merger is the culmination of several years of discussion and planning between the two companies. Both Diamondback and Endeavor have a history of successful acquisitions and integration. This experience should provide a solid foundation for a smooth transition.

Unveiling the Hidden Truths of Diamondback Energy’s Proposed Merger With Endeavor Energy

Here’s How Much You Would Have Made Owning Diamondback Energy Stock In – Source www.benzinga.com

Beyond the financial and operational aspects, the merger also has implications for the energy industry as a whole. It could lead to increased competition, consolidation, and a shift in the balance of power among producers.

Recommendations for Approaching Diamondback Energy’s Proposed Merger With Endeavor Energy

Diamondback Energy – Oil Gas Leads – Source oilgasleads.com

Investors should carefully consider the potential risks and rewards of the merger. It is important to assess the company’s financial health, operational capabilities, and management team. A comprehensive analysis of the merger’s impact on the industry is also recommended.

Related Keywords for Diamondback Energy’s Proposed Merger With Endeavor Energy

Diamondback Energy of Midland reports second-quarter earnings – Source www.mrt.com

Independent oil producers, Permian Basin, Eagle Ford, Bakken, consolidation, efficiency, market dominance, investment analysis.

Tips for Navigating Diamondback Energy’s Proposed Merger With Endeavor Energy

Diamondback Energy Intrinsic Value – Diamondback Energy Pioneers – Source stock.goodwhale.com

Stay informed about the latest developments related to the merger. Read industry news, consult with analysts, and attend investor briefings. Diversify your investment portfolio to mitigate risk. Consider investing in both Diamondback and Endeavor to benefit from the potential synergies.

Diamondback Energy’s Proposed Merger With Endeavor Energy: A Comprehensive Analysis

This merger has the potential to create a leading player in the oil industry. It is important to understand the rationale behind the merger and its potential implications for the sector and investors.

Fun Facts About Diamondback Energy’s Proposed Merger With Endeavor Energy

The combined company will be headquartered in the Permian Basin, which is the largest oil-producing region in the United States. The merger will create the second-largest independent oil producer in the Permian Basin. Diamondback and Endeavor have a combined workforce of over 1,500 employees.

How to Get Involved in Diamondback Energy’s Proposed Merger With Endeavor Energy

Investors can purchase shares of Diamondback Energy or Endeavor Energy to participate in the merger. Analysts and industry experts can provide valuable insights and guidance throughout the merger process. Stay updated on regulatory approvals and other developments that may affect the merger.

What If Diamondback Energy’s Proposed Merger With Endeavor Energy Falls Through?

If the merger does not proceed as planned, it could have negative implications for both companies. Investors may experience a loss in value of their shares. The companies may face challenges in achieving their strategic objectives independently.

Listicle of Diamondback Energy’s Proposed Merger With Endeavor Energy

Benefits of the merger: Increased production, reduced costs, improved financial flexibility, enhanced market position. Challenges to consider: Regulatory approvals, integration risks, market volatility, geopolitical uncertainties.

Question and Answer

Q1. What is the primary objective of the Diamondback-Endeavor merger?

A1. To create a consolidated entity with increased production and financial flexibility.

Q2. What is the expected production of the combined company?

A2. Over 300,000 barrels of oil equivalent per day.

Q3. How will the merger impact the industry?

A3. It could lead to increased competition and consolidation.

Q4. What should investors consider before investing in the merger?

A4. Financial health, operational capabilities, and management team.

Conclusion of Diamondback Energy’s Proposed Merger With Endeavor Energy: A Comprehensive Analysis

The Diamondback-Endeavor merger is a significant event in the energy industry. It has the potential to create a leading player with substantial production, operational efficiency, and financial strength. Investors, analysts, and stakeholders should carefully assess the merger’s implications and make informed decisions based on their individual risk-return profiles and industry outlook.