If you’re looking for a reliable way to assess the financial health of a company, analyzing its free cash flow (FCF) is a key metric to consider. FCF measures the amount of cash a company generates from its operations, after accounting for capital expenditures and other non-cash expenses. It provides insights into a company’s ability to meet its financial obligations, invest in growth, and return cash to shareholders.

Many investors and analysts use FCF to evaluate a company’s financial stability and long-term growth potential. Positive FCF indicates that a company is generating sufficient cash flow to cover its expenses and invest in new projects, which can be a sign of financial strength. Alternatively, negative FCF can raise concerns about a company’s ability to meet its obligations and fund its growth.

Analyzing Microsoft’s Free Cash Flow: A Key Metric For Financial Stability

Microsoft Corporation is a global technology leader with a diverse portfolio of products and services. The company’s FCF has been steadily increasing in recent years, indicating its strong financial health and ability to generate significant cash from its operations. In 2023, Microsoft reported an FCF of $79.3 billion, up from $65.3 billion in 2022. This growth reflects the company’s continued success in its core businesses, including software, cloud computing, and gaming.

Importance of Microsoft’s Free Cash Flow

Microsoft’s FCF plays a crucial role in supporting the company’s strategic initiatives. It provides the company with the financial flexibility to invest in research and development, expand its product offerings, and make acquisitions. In addition, Microsoft’s strong FCF enables it to return cash to shareholders through dividends and share buybacks.

Understanding Free Cash Flow: A Key Metric for Financial Analysis – Source bojanfin.com

Microsoft’s FCF: Historical Perspective

Microsoft’s FCF has grown significantly over the past decade, driven by the success of its flagship products and services. In 2013, the company’s FCF was $24.1 billion, which has increased by more than threefold since then. This growth reflects Microsoft’s ability to consistently generate high levels of cash flow, even during periods of economic uncertainty.

Nvidia stock has 42% upside in 2024 as the AI-chip company targets 0 – Source www.msn.com

Unveiling the Secret of Microsoft’s FCF

Microsoft’s strong FCF can be attributed to several factors, including its dominant position in the software market, its diversified revenue streams, and its efficient cost structure. The company’s long-term contracts with enterprise customers provide a stable source of recurring revenue, while its cloud-based services offer high margins and scalability.

Amazon Is a Free-Cash Rocket Ship. Time to Jump on Board. – Barron’s – Source www.barrons.com

Recommendations for Analyzing FCF

Investors and analysts can use FCF to make informed investment decisions. When evaluating a company’s FCF, it is important to consider the following factors:

- Consistency: A company with consistently positive FCF is generally considered to be more financially stable than a company with volatile FCF.

- Growth: A company that is growing its FCF over time is often a sign of financial strength and long-term growth potential.

- Margin: FCF margin, which is calculated by dividing FCF by revenue, provides insights into a company’s efficiency in generating cash.

Global Cash Flow Analysis Template – SampleTemplatess – SampleTemplatess – Source www.sampletemplatess.com

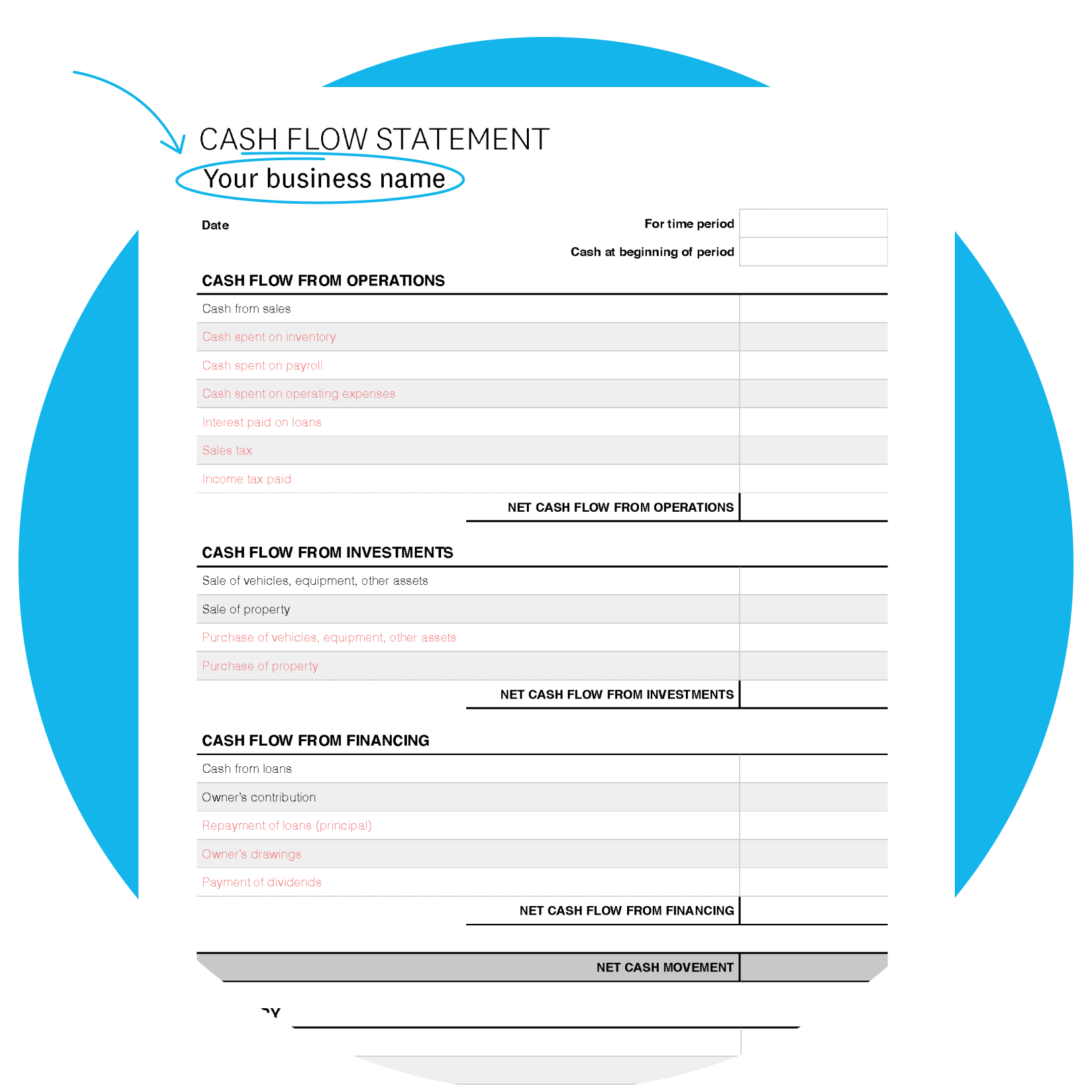

FCF in Microsoft’s Financial Statements

Microsoft’s FCF is reported in the company’s financial statements, specifically in the cash flow statement. The cash flow statement provides a detailed breakdown of the company’s cash inflows and outflows, including its operating, investing, and financing activities.

Understanding Free Cash Flow Per Share: A Key Metric for Investors – Source marketmilestone.in

Tips for Analyzing Microsoft’s FCF

Here are some additional tips for analyzing Microsoft’s FCF:

- Compare Microsoft’s FCF to its peers: Benchmarking Microsoft’s FCF against its competitors can provide insights into the company’s relative financial performance.

- Consider Microsoft’s capital expenditure plans: Microsoft’s capital expenditure plans can impact its FCF in the short term. It is important to understand the company’s investment strategy.

- Read Microsoft’s investor presentations and earnings calls: Microsoft provides valuable information about its FCF and financial performance in its investor presentations and earnings calls.

Cash Flow Statement Template | Xero AU – Source www.xero.com

Impact of Microsoft’s FCF on Share Price

Microsoft’s strong FCF has a positive impact on its share price. A company with consistently positive FCF is often seen as a more attractive investment than a company with negative or volatile FCF. This is because FCF is a key indicator of a company’s ability to generate shareholder value through dividends, share buybacks, and acquisitions.

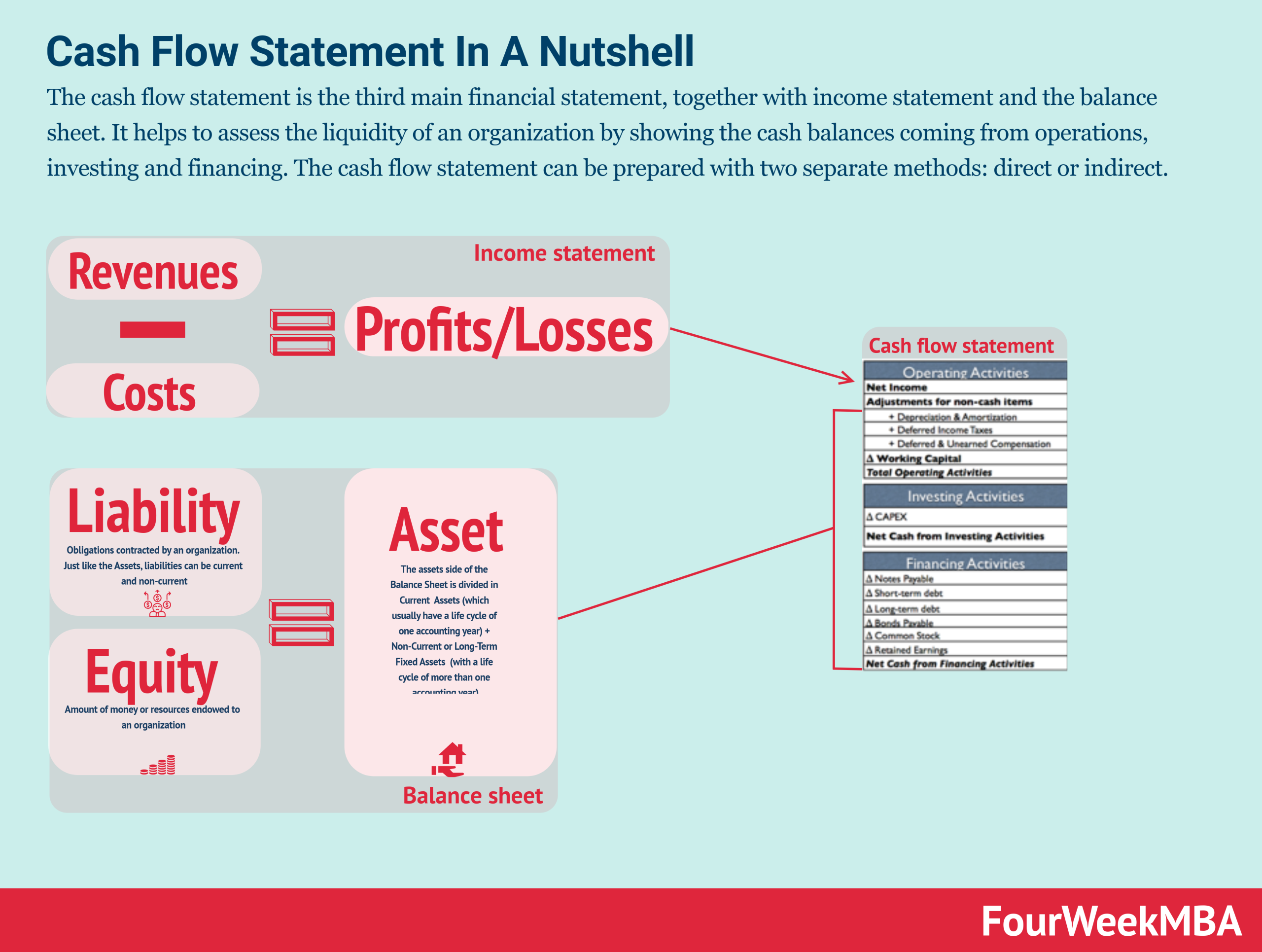

Nestlé Free Cash Flow – FourWeekMBA – Source fourweekmba.com

Fun Facts about Microsoft’s FCF

Here are some fun facts about Microsoft’s FCF:

- Microsoft’s FCF has grown by more than 10% in each of the past five years.

- Microsoft’s FCF margin is consistently above 20%, which is considered to be a high level of efficiency.

- Microsoft has used its FCF to fund a number of strategic acquisitions, including the recent acquisition of Activision Blizzard.

What is free cash flow? | Investing Definitions | Morningstar – Source www.morningstar.com

How to Use Microsoft’s FCF in Investment Decisions

Microsoft’s FCF can be used to make informed investment decisions. Investors can use FCF to assess the company’s financial stability, growth potential, and shareholder value creation potential.

What Is A Cash Flow Statement Enkel Back Office Solut – vrogue.co – Source www.vrogue.co

What If Microsoft’s FCF Declines?

While Microsoft’s FCF has been consistently positive in recent years, it is possible that it could decline in the future. A decline in FCF could be caused by a number of factors, including a downturn in the economy, increased competition, or changes in the company’s business strategy. If Microsoft’s FCF declines, it could impact the company’s ability to invest in growth, return cash to shareholders, and meet its financial obligations.

Donated Fixed Assets On Cash Flow Statement Financial | Alayneabrahams – Source alayneabrahams.com

Listicle: 5 Benefits of Analyzing Microsoft’s FCF

- Assess financial stability

- Evaluate growth potential

- Make informed investment decisions

- Identify potential risks

- Compare Microsoft to its peers

Question and Answer: Analyzing Microsoft’s FCF

- What is Microsoft’s FCF?

Microsoft’s FCF is the amount of cash the company generates from its operations, after accounting for capital expenditures and other non-cash expenses. - How has Microsoft’s FCF performed in recent years?

Microsoft’s FCF has grown significantly over the past decade, driven by the success of its flagship products and services. - What are some factors that contribute to Microsoft’s strong FCF?

Microsoft’s dominant position in the software market, its diversified revenue streams, and its efficient cost structure all contribute to its strong FCF. - How can investors use Microsoft’s FCF to make informed investment decisions?

Investors can use Microsoft’s FCF to assess the company’s financial stability, growth potential, and shareholder value creation potential.

Conclusion of Analyzing Microsoft’s Free Cash Flow: A Key Metric For Financial Stability

Analyzing Microsoft’s FCF can provide valuable insights into the company’s financial health and long-term growth potential. Microsoft’s consistently positive FCF is a testament to its strong financial position and ability to generate significant cash from its operations. By understanding the importance of FCF and how to analyze it, investors and analysts can make more informed investment decisions about Microsoft and other companies.