Deductibles are a crucial aspect of insurance policies that determine how much you pay out-of-pocket before your insurance coverage kicks in. However, understanding the different types of deductibles, such as aggregate vs. embedded deductibles, can be confusing.

Navigating the complexities of insurance policies can be challenging, especially when it comes to understanding the nuances between different types of deductibles. This guide aims to provide a comprehensive understanding of aggregate vs. embedded deductibles, empowering you to make informed decisions about your insurance coverage.

Aggregate Deductible: A Comprehensive Overview

An aggregate deductible is a set amount that you must pay out-of-pocket for all covered expenses within a specific period, typically a year. Once you reach the aggregate deductible limit, your insurance policy will start covering the remaining eligible expenses.

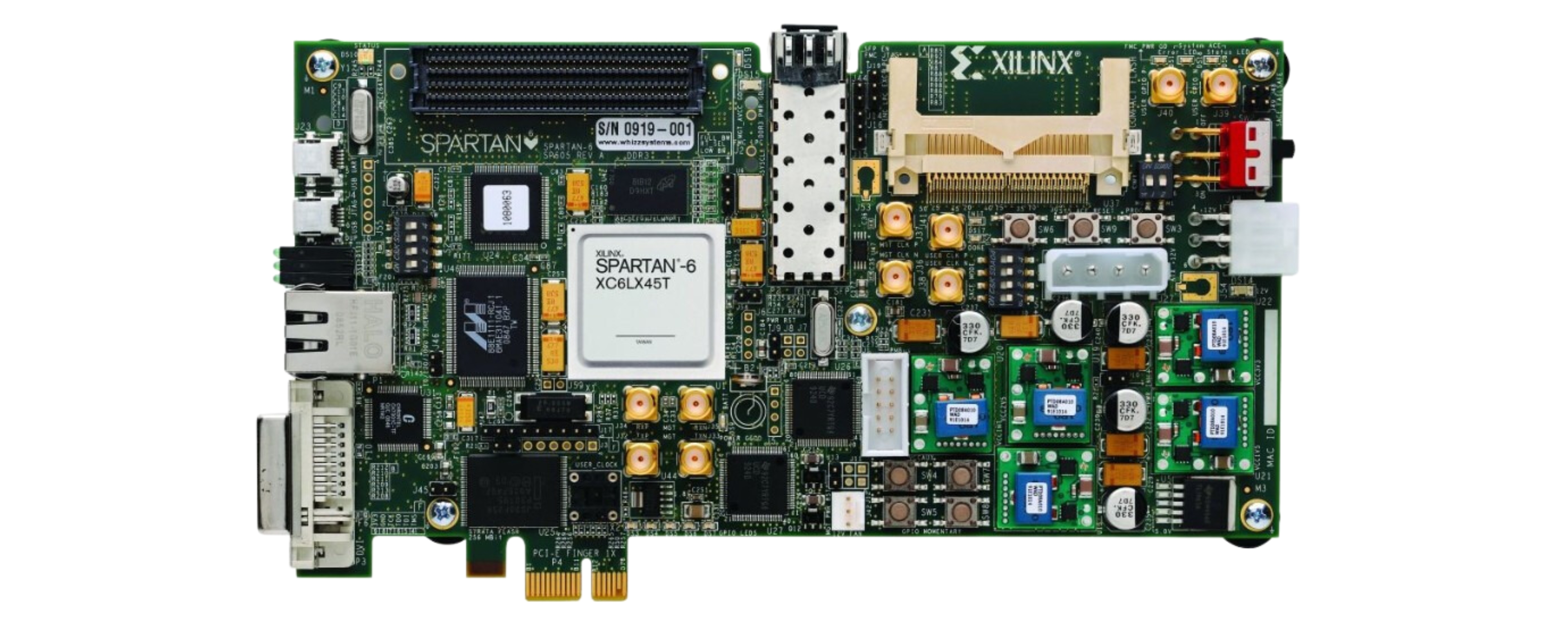

FPGA Design: A Comprehensive Guide to Mastering Field-Programmable Gate – Source www.wevolver.com

Embedded Deductible: A Deeper Explanation

An embedded deductible is a specific portion of the aggregate deductible that applies to a particular category of covered expenses. For instance, you may have an aggregate deductible of $1,000 and an embedded deductible of $250 for prescription drugs. This means you must pay the first $250 of prescription drug expenses before your insurance coverage begins for that category.

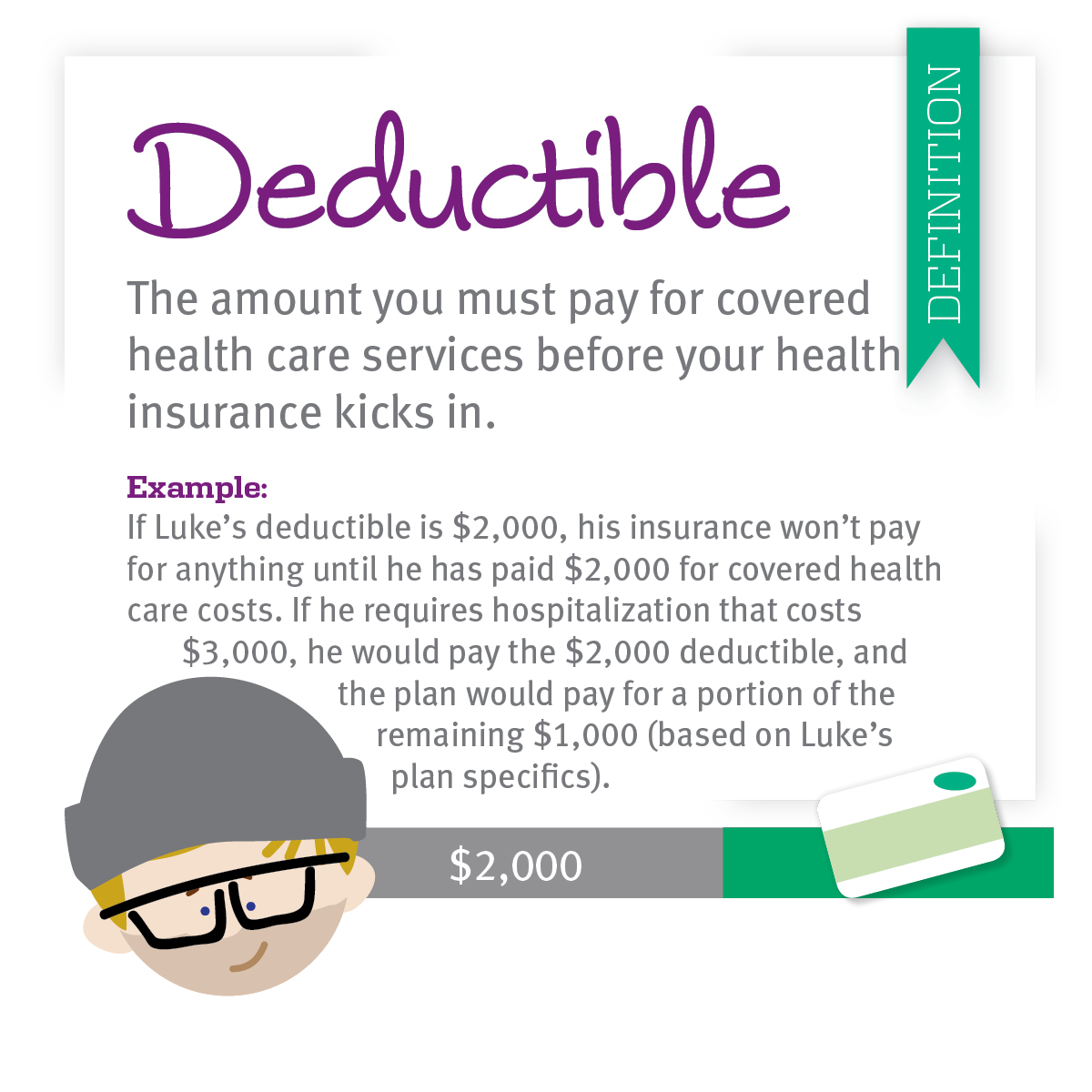

Understanding Insurance Terminology: Premium, Deductible, Policy Limit – Source talkaaj.com

Historical Evolution and Common Myths

The concept of deductibles has evolved over time, leading to various myths and misconceptions. One common myth is that higher deductibles always result in lower premiums. While this may be true in some cases, it’s not always the case. It’s essential to consider your individual circumstances and risk tolerance when selecting a deductible.

Healthcare Benefits – Santander eGuide- SHUSA/NEW HIRE – Source businessolver.foleon.com

Unveiling the Hidden Secrets

Understanding the hidden implications of deductibles is crucial. For example, if you have multiple policies with aggregate deductibles, the deductibles may not be combined. This means you could end up paying multiple deductibles for the same incident.

Hurricane vs. Named Storm vs. Wind Deductible: Complete Understanding – Source www.atoallinks.com

Expert Recommendations for Informed Decisions

When choosing between aggregate and embedded deductibles, consider your financial situation, risk tolerance, and coverage needs. If you anticipate frequent small expenses, an embedded deductible may be more suitable. However, if you prefer to pay a higher deductible upfront to lower your premiums, an aggregate deductible may be a better option.

What is a Good Home Insurance Deductible-Comprehensive Guide – Source myinsuranceplanet.com

Delving into the Details

Aggregate deductibles are calculated based on all covered expenses within the specified period. Embedded deductibles, on the other hand, are specific to a particular category of expenses. Understanding these distinctions is essential for making informed decisions about your insurance coverage.

Understanding 0 Deductible Health Insurance: A Comprehensive Guide – Source newhealthinsurance.com

Essential Tips for Navigating Deductibles

To ensure you fully understand your insurance policy, consider the following tips: Carefully review your policy documents to identify the types of deductibles and their specific terms. Consult with your insurance agent or a financial advisor to discuss your individual needs and the best deductible options for you.

Definitions and Meanings of Health Care and Health Insurance Terms – Source blog.cdphp.com

Gaining a Deeper Understanding

Aggregate deductibles can be beneficial if you have infrequent but potentially high expenses. Embedded deductibles, on the other hand, can be advantageous if you have predictable expenses within specific categories.

Your Guide to Understanding Health Insurance – Wellness – Source blogs.winona.edu

Fun Facts and Surprising Insights

Did you know that some insurance policies may have both aggregate and embedded deductibles? This can create a complex deductible structure that requires careful consideration. Understanding the interactions between different types of deductibles is crucial for managing your insurance costs effectively.

Embedded Deductible vs Umbrella Deductible – Health Benefits Associates – Source healthbenefits.net

Empowering You with Knowledge

To effectively navigate the world of deductibles, arm yourself with knowledge. Research different types of deductibles and their implications. Seek professional guidance if necessary to ensure you have the right coverage for your situation.

How Do Embedded Deductibles Impact Your Health Insurance? – Source www.agilerates.com

What If Scenarios: Exploring the Possibilities

Consider hypothetical scenarios to understand how deductibles work in practice. For instance, if you have an aggregate deductible of $1,000 and incur medical expenses of $1,500, you would be responsible for paying the first $1,000 out-of-pocket.

A Comprehensive Listicle for Clarity

Here’s a concise listicle summarizing key points about aggregate vs. embedded deductibles:

- Aggregate deductibles apply to all covered expenses within a specified period.

- Embedded deductibles apply to specific categories of expenses.

- Understanding the interactions between different types of deductibles is crucial.

- Consider your financial situation, risk tolerance, and coverage needs when choosing a deductible.

- Consult with an insurance professional or financial advisor for personalized guidance.

Question and Answer Corner

To enhance your understanding, here are some frequently asked questions and answers:

- Q: Can I change my deductible after purchasing an insurance policy?

- A: Yes, in most cases, you can change your deductible, but it may result in a change in your premium.

- Q: What happens if I don’t reach my deductible in a given period?

- A: If you don’t reach your deductible, you will be responsible for paying all covered expenses out-of-pocket.

- Q: How do I calculate my out-of-pocket expenses?

- A: To calculate your out-of-pocket expenses, add up all the deductibles and copayments you have paid for covered services.

Conclusion of Aggregate Vs. Embedded Deductible: A Comprehensive Guide For Understanding Insurance Policies

Understanding aggregate vs. embedded deductibles is essential for making informed insurance decisions. By carefully considering the implications of each type of deductible and consulting with experts if needed, you can optimize your coverage and minimize out-of-pocket expenses. Remember, the best insurance policy is the one that meets your individual needs and provides you with peace of mind.