In today’s uncertain world, self-employed individuals face the constant threat of losing income due to unexpected events that prevent them from working. Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is a lifeline for the self-employed, providing them with a financial safety net to protect against income loss resulting from disability, illness, or injury.

Self-employment can be a risky endeavor. Unexpected events, such as accidents or illnesses, can severely impact income. Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance offers a solution to this challenge, ensuring self-employed individuals have access to income replacement when they need it most.

Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is a state-mandated program designed specifically for self-employed individuals in California. It provides income replacement benefits to those unable to work due to a disability, illness, or injury.

Edd Disability Weekly Benefit Chart 2024 – Bonny Christy – Source chrissywashley.pages.dev

To summarize, Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance offers self-employed individuals peace of mind, knowing they have a financial safety net to rely on in the event of an unexpected event that prevents them from working.

Target Audience of Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance

Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is specifically tailored to self-employed individuals in California. These individuals typically do not have access to employer-provided disability insurance, making this program a crucial source of income protection.

To be eligible for Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance, individuals must meet the following criteria:

- Self-employed

- Reside in California

- Earn at least $400 a quarter from self-employment

By meeting these criteria, self-employed individuals can protect themselves from financial hardship in the event of a disability that prevents them from working.

As a self-employed individual, it is essential to understand the importance of protecting your income in the event of unexpected events that can impact your ability to work. Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance offers a comprehensive solution to this challenge, providing self-employed individuals with peace of mind and financial security.

ISO certification Archives – iso certification in kuwait – Source gulf-iso.com

History and Misconceptions about Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance

The concept of self-employment disability insurance has been around for decades, but Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is a relatively new program. Established in 2023, it aims to address the unique income security needs of self-employed individuals in California.

One common misconception is that self-employment disability insurance is only available to those with high incomes. However, this is not true. Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is open to all self-employed individuals who meet the eligibility criteria, regardless of income level.

Another misconception is that self-employment disability insurance is a costly expense. While there are premiums involved, they are typically affordable and can vary based on factors such as age, occupation, and income. The benefits provided by Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance far outweigh the costs, especially during times of need.

Ouch! Handling a Dental Emergency While On Vacation | Ivy Lane Dentistry – Source wordpress-973507-4369749.cloudwaysapps.com

It is important to note that Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is a state-mandated program. This means that self-employed individuals in California are legally required to participate in the program and pay premiums. Failure to do so may result in penalties and additional expenses.

Tips for Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance

To ensure you get the most out of Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance, here are some valuable tips:

- Enroll as soon as possible to avoid coverage gaps.

- Pay your premiums on time to maintain eligibility.

- Keep accurate records of your income and expenses.

- File your claim promptly if you become disabled.

Understanding the ins and outs of Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance will help you navigate the process smoothly and ensure you receive the benefits you are entitled to.

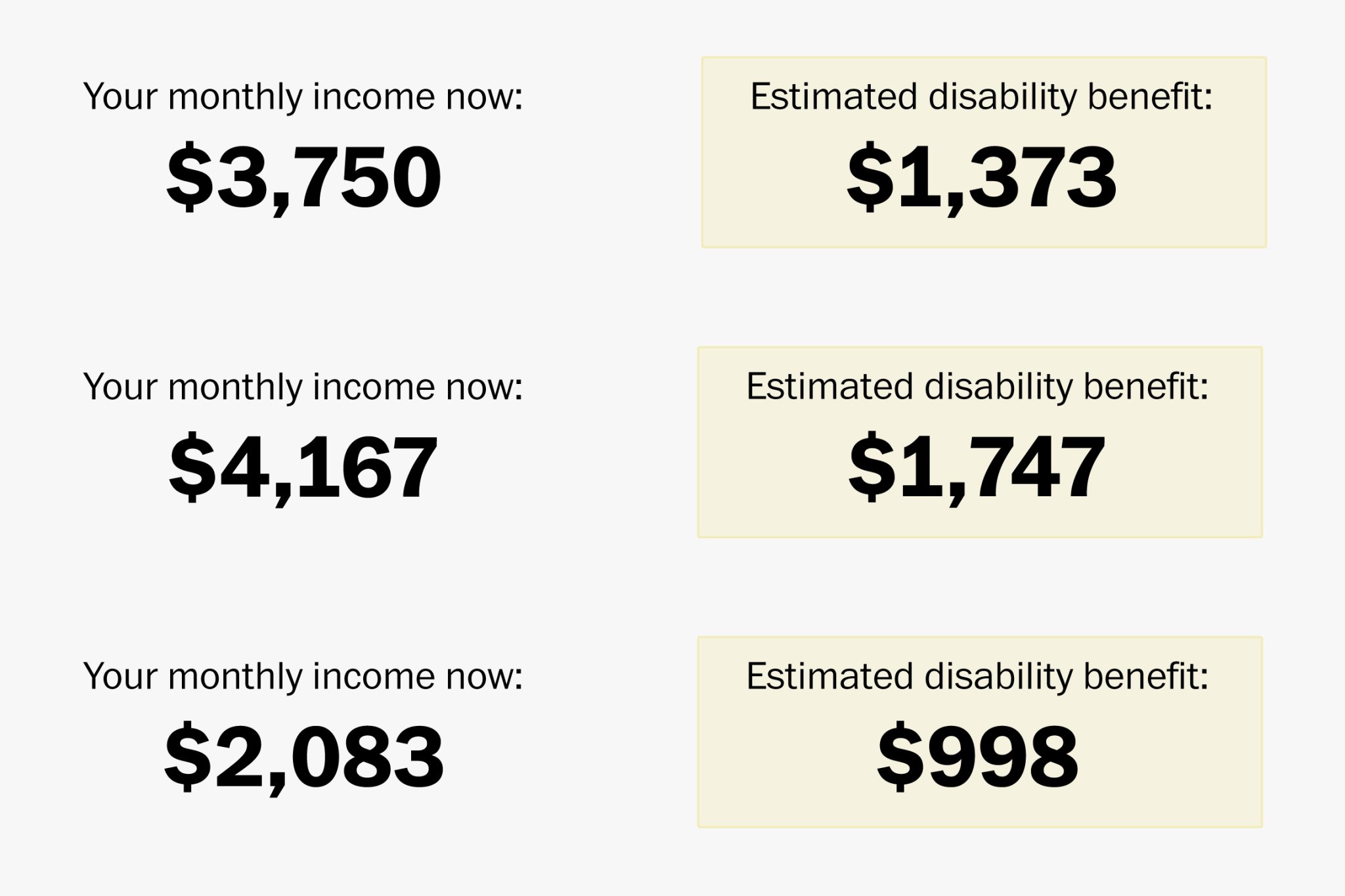

Ca Disability Rates 2024 – Cammi Corinna – Source wandiswjanice.pages.dev

Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance – Questions and Answers

To provide further clarity on Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance, here are some commonly asked questions and answers:

- Q: How much does Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance cost?

- A: Premiums for Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance vary depending on factors such as age, occupation, and income. The California Employment Development Department (EDD) provides a premium calculator to estimate your costs.

- Q: What benefits are provided by Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance?

- A: Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance provides income replacement benefits of up to $1,330 per week (as of 2023) for eligible self-employed individuals who are unable to work due to a disability, illness, or injury.

- Q: How long can I receive benefits from Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance?

- A: Benefits from Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance can be received for up to 52 weeks for each disability claim.

- Q: What are the eligibility requirements for Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance?

- A: To be eligible for Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance, you must be self-employed, a resident of California, and earn at least $400 per quarter from self-employment.

Conclusion of Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance

As a self-employed individual, protecting your income against unforeseen events is essential. Max Ca Sdi Tax 2023: Comprehensive Guide To Self-Employment Disability Insurance is a valuable resource that provides self-employed individuals in California with peace of mind and financial security. By understanding the program’s benefits and requirements, you can ensure you have the coverage you need to safeguard your income in the event of a disability.