Unlock Financial Security With Liberty Mutual’s Comprehensive Short-Term Disability Insurance

Do you have a plan in place to protect your income if you’re unable to work due to a disability? If not, Liberty Mutual’s Comprehensive Short-Term Disability Insurance can help you safeguard your financial future.

The Difference Between the Main Types of Individual Disability – Source semplesolutionsllc.com

What is Short-Term Disability Insurance?

Short-term disability insurance provides income replacement if you’re unable to work due to a disability for a period of time, typically up to two years. This coverage can help you pay for essential expenses, such as mortgage or rent, car payments, and groceries, while you’re recovering.

Group Disability Terms to Know – Source mysecurecare.com

Why Choose Liberty Mutual’s Short-Term Disability Insurance?

Liberty Mutual is a leading provider of short-term disability insurance, with over 100 years of experience. We offer a range of plans to meet your specific needs and budget, and our claims process is fast and easy.

Types of Private Short Term Disability Insurance – Insurance Passion – Source www.insurancepassion.com

Benefits of Liberty Mutual’s Short-Term Disability Insurance

There are many benefits to choosing Liberty Mutual’s Short-Term Disability Insurance, including:

- Income replacement if you’re unable to work due to a disability

- Coverage for up to two years

- Fast and easy claims process

- Choice of plans to meet your specific needs and budget

Disability Insurance is the Ultimate Safeguard – Source waltonfinancial.ca

My Journey with Disability Insurance

I’ve been working as a freelance writer for over 10 years. I love my job, but I know that anything can happen. A few years ago, I was in a car accident and was unable to work for several months. I was so grateful that I had short-term disability insurance through Liberty Mutual. The benefits helped me cover my essential expenses while I was recovering.

I’m not the only one who has benefited from Liberty Mutual’s short-term disability insurance. I’ve heard from many other people who have been able to get back on their feet after a disability thanks to this coverage.

What Do Disability Insurance Policies Usually Cover? | KBI – Source www.kbibenefits.com

Understanding the Policy

Liberty Mutual’s short-term disability insurance policy is designed to provide you with income replacement if you’re unable to work due to a disability. The policy covers a wide range of disabilities, including:

- Illness

- Injury

- Pregnancy

- Mental health conditions

The policy also includes a number of benefits that can help you get back on your feet, such as:

- Vocational rehabilitation

- Job placement assistance

- Financial counseling

How Supplemental Disability Insurance Works for Doctors – Source www.sdtplanning.com

History and Myths of Disability Insurance

Disability insurance has been around for over a century. However, there are still many myths and misconceptions about this type of coverage.

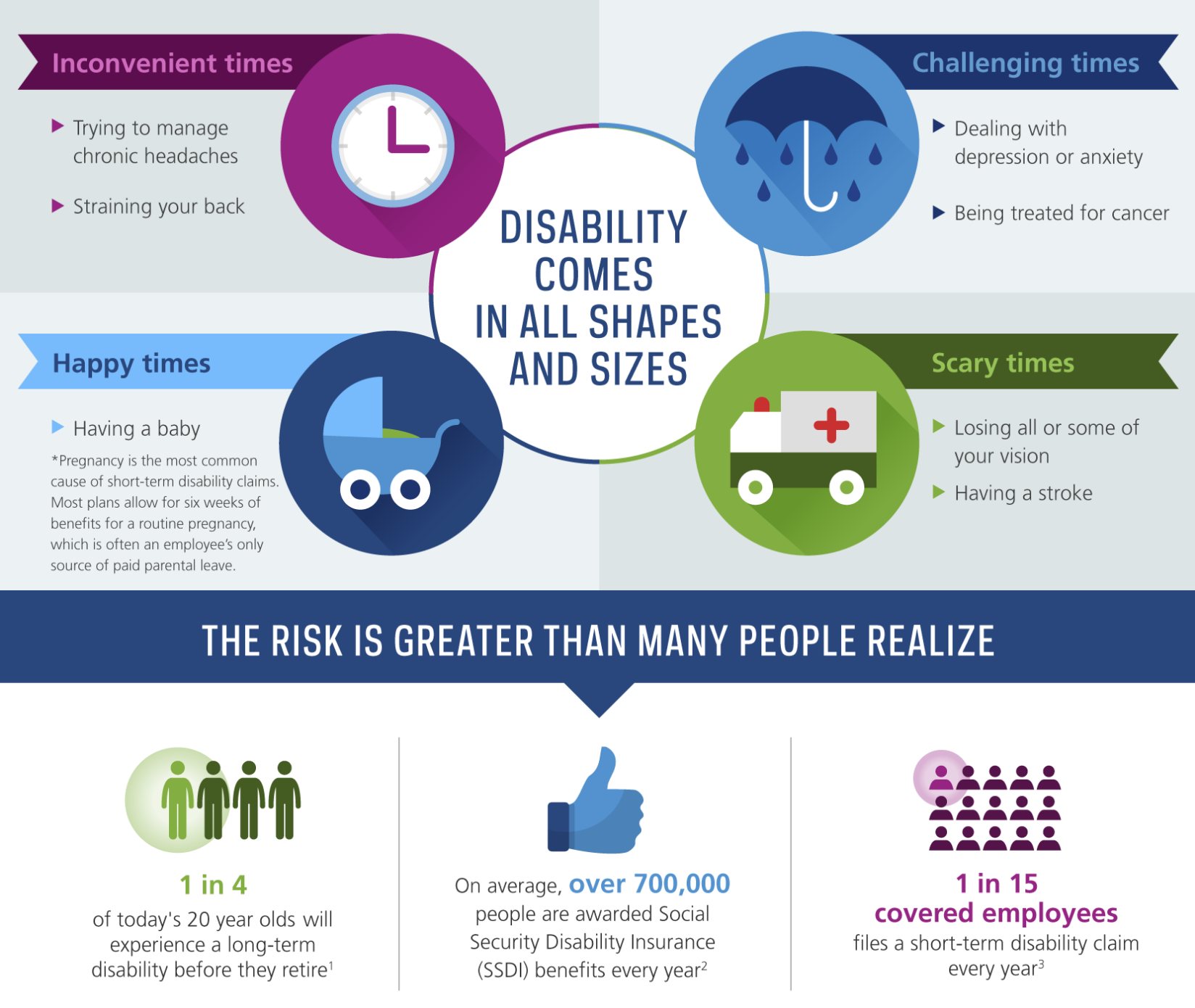

One common myth is that disability insurance is only for people who work in high-risk occupations. However, the truth is that anyone can become disabled, regardless of their occupation. In fact, the Social Security Administration reports that over 25% of Americans will experience a disability that lasts for at least three months at some point in their lives.

Disability Insurance During a Pandemic – Small Business Health – Source abbotbenefits.com

Hidden Secrets of Disability Insurance

There are a few hidden secrets about disability insurance that you should know.

First, you don’t have to wait until you’re disabled to purchase disability insurance. You can actually purchase coverage while you’re still healthy and working.

Second, disability insurance can be tailored to your specific needs. You can choose the amount of coverage you want, the length of time you want the coverage to last, and the type of disability you want to be covered for.

A Quick Guide to The Different Types of Disability Insurance – Source www.actionlifemedia.com

Recommendations for Choosing Disability Insurance

If you’re considering purchasing disability insurance, there are a few things you should keep in mind.

First, you should make sure that you understand the policy and the coverage it provides. You should also make sure that you can afford the premiums.

Second, you should compare policies from different insurance companies. This will help you find the best coverage at the best price.

Short Term Disability Insurance: How Do You Qualify? | WalletGenius – Source walletgenius.com

Benefits of Short-Term Disability Insurance

Short-term disability insurance can provide you with a number of benefits, including:

- Income replacement

- Peace of mind

- Financial security

If you’re unable to work due to a disability, short-term disability insurance can help you pay your bills and maintain your lifestyle.

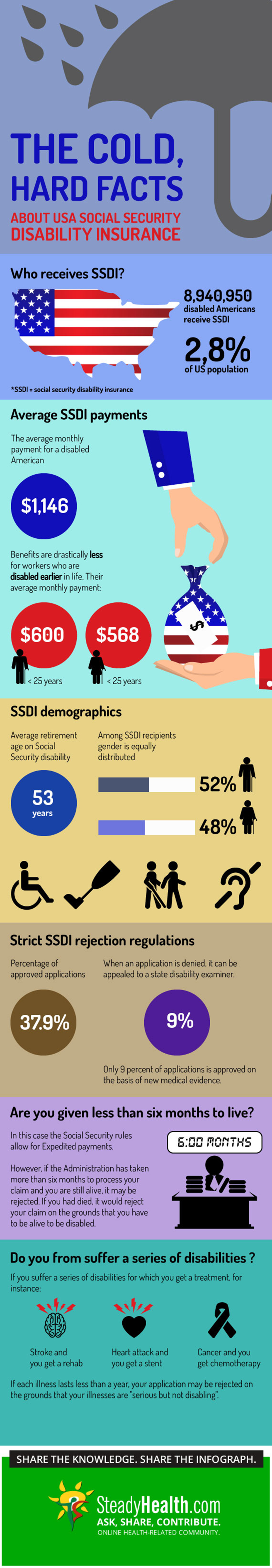

How Not To Get Rejected For Disability Retirement In The USA | Healthy – Source www.steadyhealth.com

Tips for Getting the Most Out of Your Disability Insurance Policy

Here are a few tips for getting the most out of your disability insurance policy:

- Make sure you understand the policy and the coverage it provides.

- Pay your premiums on time.

- File a claim as soon as you become disabled.

- Keep a record of your medical records.

- Be prepared to provide documentation to support your claim.

Importance of Disability Insurance

Disability insurance is an important part of any financial plan. It can provide you with income replacement if you’re unable to work due to a disability. If you don’t have disability insurance, you could be at risk of losing your income and your financial security.

Fun Facts About Disability Insurance

Here are a few fun facts about disability insurance:

- The first disability insurance policy was issued in 1850.

- Over 60% of Americans have some form of disability insurance.

- The average monthly benefit for short-term disability insurance is $1,000.

How to Apply for Disability Insurance

Applying for disability insurance is a simple process. You can apply online, over the phone, or through a licensed insurance agent.

When you apply for disability insurance, you will need to provide information about your health, your income, and your occupation.

What if I’m Denied Disability Insurance?

If you’re denied disability insurance, you can appeal the decision. You will need to submit a written appeal to the insurance company. In your appeal, you should explain why you believe you should be approved for benefits.

If your appeal is denied, you may be able to file a lawsuit against the insurance company.

Listicle of Disability Insurance Benefits

Here is a listicle of the benefits of disability insurance:

1. Income replacement

2. Peace of mind

3. Financial security

4. Coverage for a wide range of disabilities

5. Fast and easy claims process

6. Choice of plans to meet your specific needs and budget

Questions and Answers About Disability Insurance

- What is disability insurance?Disability insurance is a type of insurance that provides income replacement if you’re unable to work due to a disability.

- Who needs disability insurance?Everyone needs disability insurance, regardless of their occupation or health status.

- How much disability insurance do I need?The amount of disability insurance you need will vary depending on your income, your expenses, and your financial goals.

- How do I apply for disability insurance?You can apply for disability insurance online, over the phone, or through a licensed insurance agent.

Conclusion of Unlock Financial Security With Liberty Mutual’s Comprehensive Short-Term Disability Insurance

Disability insurance is an important part of any financial plan. It can provide you with income replacement if you’re unable to work due to a disability. If you don’t have disability insurance, you could be at risk of losing your income and your financial security.

Liberty Mutual’s Comprehensive Short-Term Disability Insurance is a great option for anyone who wants to protect their income and their financial future. The policy provides a wide range of benefits, including income replacement, vocational rehabilitation, and job placement assistance.