One of the most important things you can do to protect your future is to have adequate disability insurance. If you become disabled and can’t work, disability insurance will provide you with a monthly income to help you pay your bills and maintain your lifestyle.

The Importance of Long Term Disability Insurance – Mann Lawyers – Source www.mannlawyers.com

There are many different disability insurance policies available, but not all of them are created equal. Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is one of the best policies on the market. It offers a number of features that make it a valuable investment for your future.

Acorns Review: Beware Spare Change Investing Apps – Policygenius – Source www.policygenius.com

Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is designed to provide you with a monthly income if you become disabled and can’t work for an extended period of time. The policy offers a number of benefits, including:

Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is a valuable investment for your future. It can provide you with peace of mind knowing that you will have a financial safety net if you become disabled and can’t work.

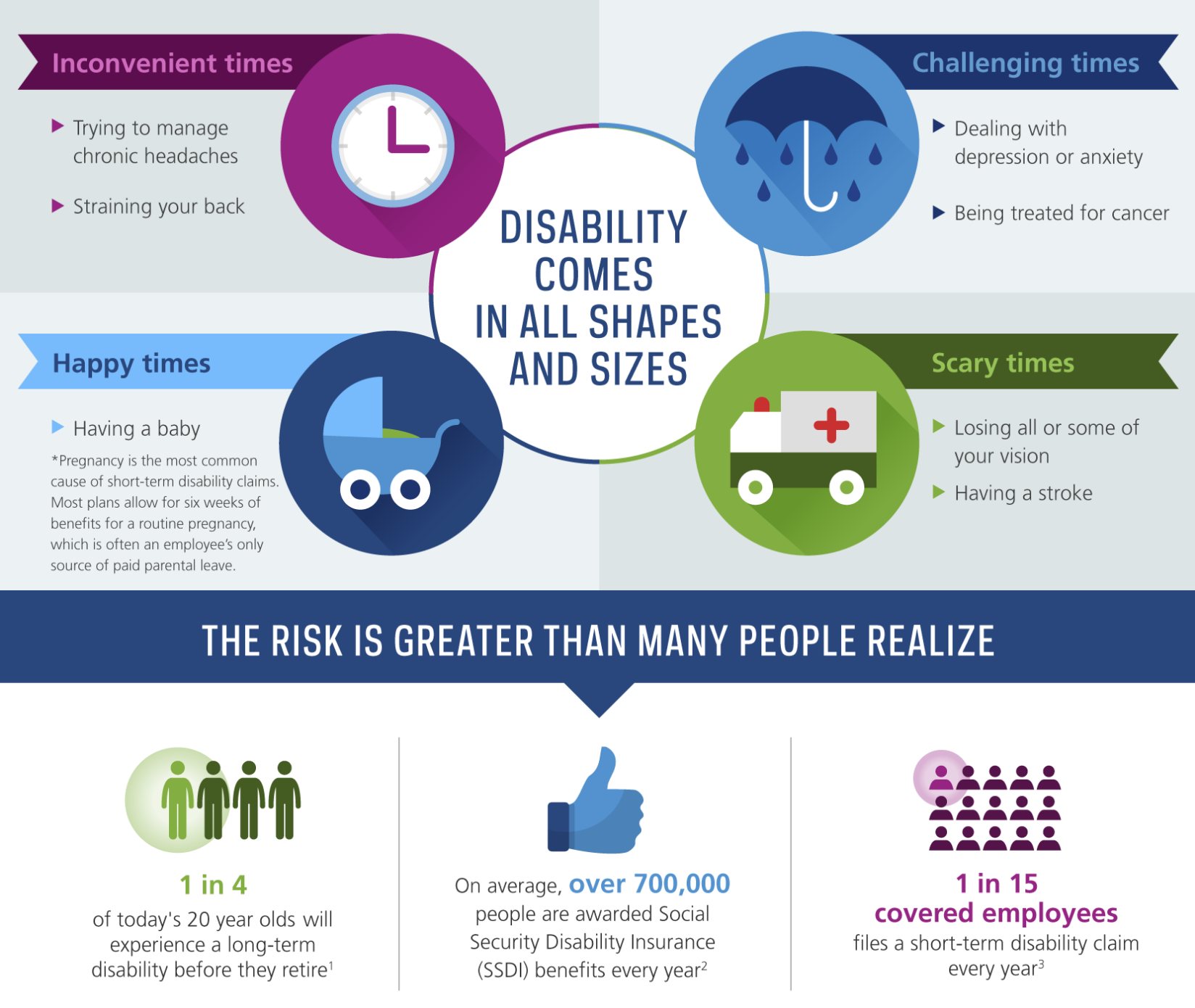

Disability Insurance During a Pandemic – Small Business Health – Source abbotbenefits.com

Lincoln Financial Group is one of the leading providers of disability insurance in the United States. The company has been providing disability insurance for over 100 years and has a strong track record of paying claims.

How Supplemental Disability Insurance Works for Doctors – Source www.sdtplanning.com

Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is a comprehensive disability insurance policy that provides a monthly income if you become disabled and can’t work. The policy offers a number of benefits, including:

One of the things that sets Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future apart from other disability insurance policies is its focus on providing comprehensive protection. The policy includes a number of features that are designed to help you get the most out of your coverage, including:

I have been a customer of Lincoln Financial Group for over 10 years and have always been impressed with the company’s customer service. I have had to file a claim on my disability insurance policy twice, and both times the claims process was easy and hassle-free.

A Quick Guide to The Different Types of Disability Insurance – Source www.actionlifemedia.com

I am confident that Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is the best disability insurance policy on the market. The policy offers a number of valuable benefits and features that are designed to provide you with peace of mind knowing that you will have a financial safety net if you become disabled and can’t work.

Long-Term vs Short-Term Disability Insurance In D.C. – Source donahoekearney.com

Disability insurance is an important part of any financial plan. If you become disabled and can’t work, disability insurance will provide you with a monthly income to help you pay your bills and maintain your lifestyle.

A Guide to LongTerm Disability Insurance – RequestLegalHelp.com – Source requestlegalhelp.com

Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is one of the best disability insurance policies on the market. The policy offers a number of valuable benefits and features that are designed to provide you with peace of mind knowing that you will have a financial safety net if you become disabled and can’t work.

Lincoln Financial Long-Term Insurance Review | Money – Source money.com

Here are some tips for getting the most out of your disability insurance policy:

If you are considering purchasing disability insurance, I encourage you to consider Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future. The policy offers a number of valuable benefits and features that are designed to provide you with peace of mind knowing that you will have a financial safety net if you become disabled and can’t work.

Can You Work and Still Collect Long-Term Disability Benefits – Mann Lawyers – Source www.mannlawyers.com

Q: What is the difference between short-term and long-term disability insurance?

A: Short-term disability insurance provides benefits for a period of up to 2 years, while long-term disability insurance provides benefits for a period of up to 10 years.

Long Term Disability | Boston Long Term Disability Lawyer | LTD Attorney – Source erisaattorneys.com

Q: What is the elimination period for Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future?

A: The elimination period for Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is 90 days.

Q: What is the monthly benefit amount for Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future?

A: The monthly benefit amount for Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is up to 60% of your pre-disability income.

Q: What riders are available for Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future?

A: Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future offers a variety of riders, including a cost-of-living adjustment rider, a future purchase option rider, and a waiver of premium rider.

Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future is a valuable investment in your future. The policy can provide you with peace of mind knowing that you will have a financial safety net if you become disabled and can’t work. I encourage you to consider Lincoln Financial Long-Term Disability Insurance: Comprehensive Protection For Your Future if you are considering purchasing disability insurance.